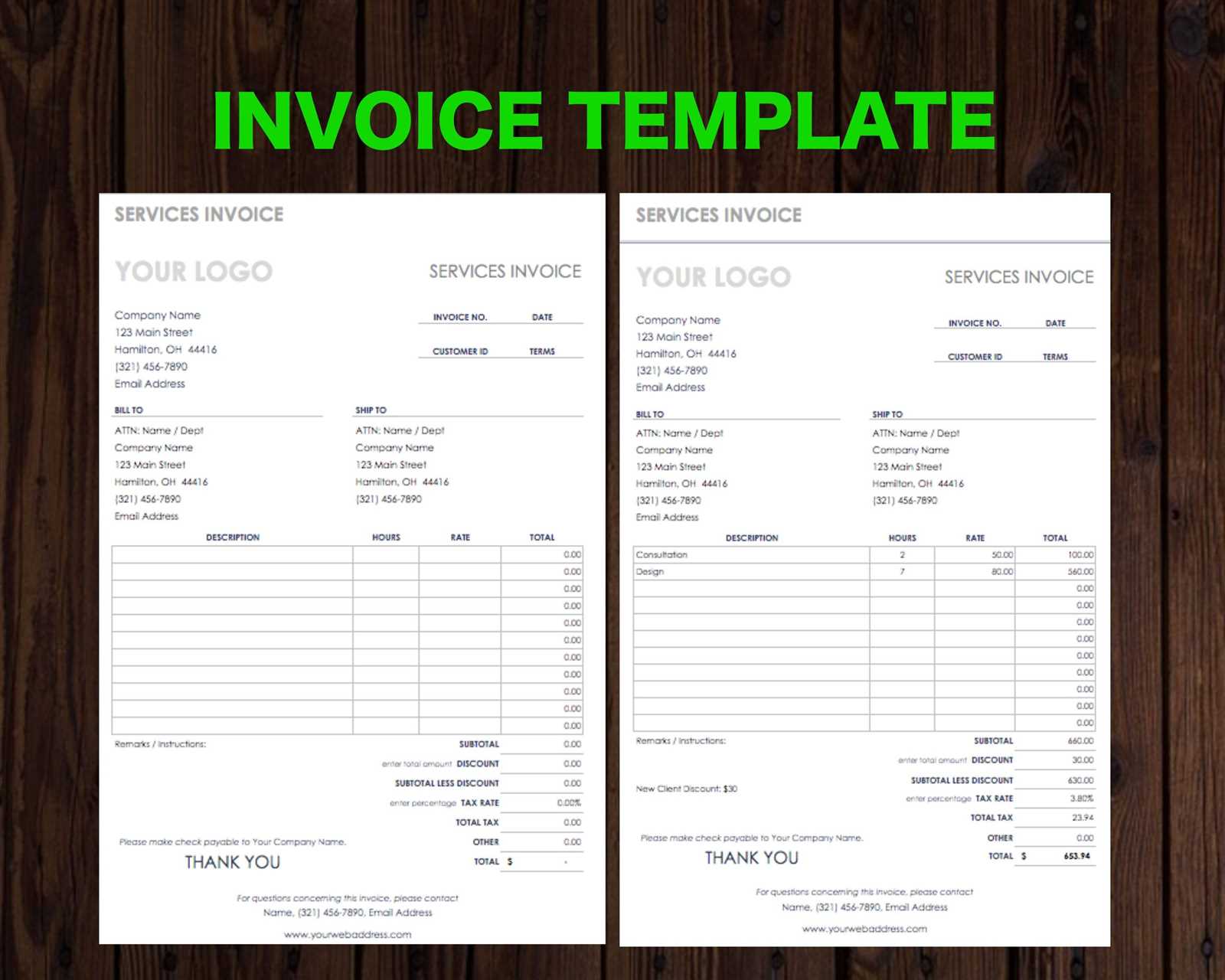

To create a professional and accurate receipt for your jewelry business, using a template designed specifically for jewelers is highly recommended. This will help ensure that all necessary details, such as item descriptions, prices, and customer information, are clearly presented. You can easily modify these templates to match your brand’s style while keeping important legal requirements in check.

Start by including the date of purchase, which ensures both you and the customer have a record of the transaction. Make sure to list the items sold with a clear breakdown of their prices. For each item, include its weight, metal type, gemstone, and any other important features. This provides transparency and helps to prevent any misunderstandings in the future.

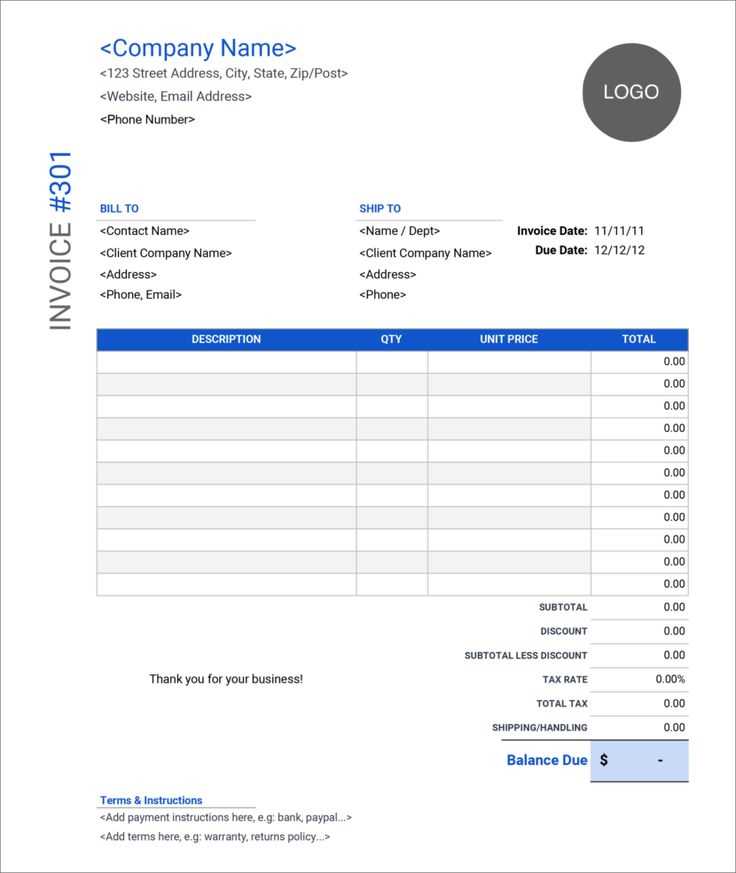

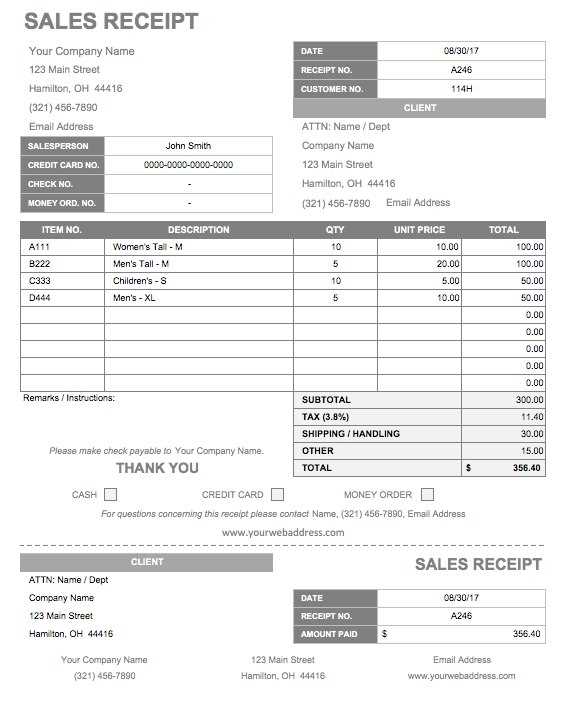

Incorporate your business name and contact information at the top of the receipt. This makes it easier for customers to reach out in case they have questions or need further assistance. You should also add a section for taxes, discounts, and any other relevant charges. This section allows for clarity on the total amount due and reassures customers of the accuracy of the pricing.

Lastly, don’t forget to include your return and exchange policy. Clearly outlining your terms lets customers know what they can expect if they need to return or exchange an item, building trust and reducing potential disputes.

Here’s the revised version with minimized repetitions:

To create an efficient Indian jeweler receipt template, ensure clarity in design and structure. Start by including the basic information: customer name, date of purchase, and description of the items sold. The receipt should also specify the total price, taxes applied, and any discounts or offers provided. This clarity prevents confusion and ensures both the customer and jeweler have a clear understanding of the transaction.

Layout and Organization

Place the itemized list of products or services near the top of the receipt, followed by a summary section. The summary should highlight the total cost, tax breakdown, and any adjustments made, such as discounts or additional charges. Be sure to use straightforward language to describe the items, avoiding overly technical terms that could confuse the customer.

Additional Details

Incorporate space for the jeweler’s contact information and business logo at the bottom. This helps reinforce brand identity and provides customers with a quick way to reach out for follow-up questions or future purchases. The template should be adaptable, allowing for different types of jewelry or services, while maintaining consistency in format for each transaction.

- Detailed Guide on Indian Jeweler Invoice Template

Ensure your invoice contains clear details of the transaction, focusing on accuracy. Begin by listing the buyer’s information, including name, address, and contact details. Next, include the seller’s business name, GST registration number (if applicable), and address. It’s crucial to detail the item sold, specifying weight, purity, design, and any additional services such as customizations or repairs.

The pricing section should clearly state the base price, taxes, and any discounts applied. When applying GST, mention the percentage and amount separately for transparency. Include a breakdown of charges such as packaging and shipping fees, if relevant.

Offer payment terms, such as due dates and accepted payment methods. Clearly outline any return or refund policies for the customer’s reference. Finally, a unique invoice number and the date of the transaction help keep the records organized. Maintain consistency with your template to streamline the invoicing process and meet regulatory standards.

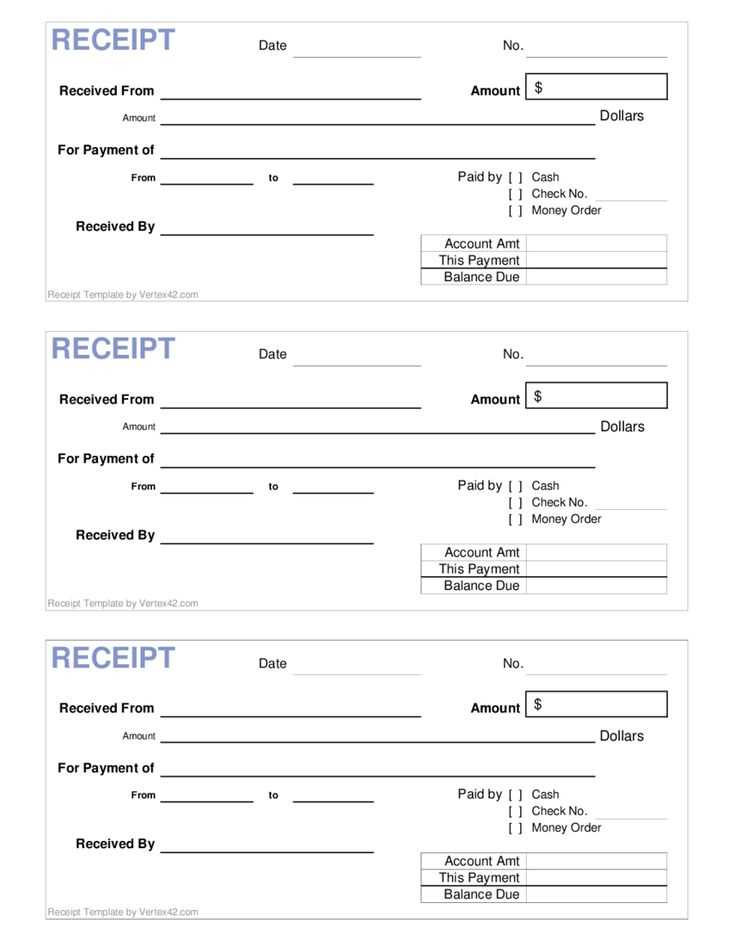

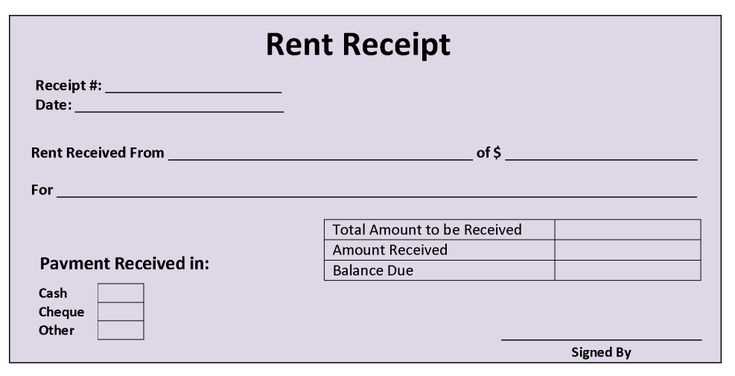

Choose a receipt format that reflects your store’s branding and provides all necessary details to your customers. This ensures clear communication and enhances trust. A well-structured receipt should include the following:

- Store Details: Display your business name, address, and contact information clearly. This allows customers to reach you if needed.

- Transaction Information: Include the transaction date, time, and unique receipt number for easy reference.

- Itemized List: Break down purchased items with clear descriptions, quantities, and individual prices. This prevents confusion and adds transparency.

- Taxes and Discounts: Specify any applied taxes, discounts, or promotions. This helps customers understand the final amount paid.

- Payment Method: Note the method used (cash, card, etc.), ensuring customers have a complete record of their purchase.

Opt for a format that fits your store’s layout and size of transactions. A compact design is ideal for quick purchases, while larger formats may be suitable for complex sales with multiple items. Regularly review and update your format to meet evolving customer expectations and legal requirements.

Include your GSTIN (Goods and Services Tax Identification Number) in a prominent place on the receipt. This is a mandatory legal requirement for businesses that are registered under GST. Be sure to specify the GST rate for each item separately, along with the tax amount to ensure transparency and compliance.

Along with the GST details, add the name of your business, address, and contact information. This information is vital for customer reference and for legal purposes. Clearly mention any terms such as return policies, warranties, or other important conditions that may apply to the transaction.

Ensure the receipt structure clearly outlines the following:

| Field | Details |

|---|---|

| GSTIN | Ensure your GST Identification Number is visible on the receipt for legal compliance. |

| GST Rate | Specify the GST rate applicable to each item or service. |

| GST Amount | Display the GST amount separately from the item price. |

| Business Information | Include your business name, address, and contact details. |

| Legal Terms | Clearly state return/exchange policies or warranties, if applicable. |

Regularly review your receipt template to stay compliant with changes in tax laws and regulations. Make sure the format is easy to read and includes all required details to avoid any confusion or issues with your customers or authorities.

Design your receipt template to reflect your brand identity. Incorporate your logo, business colors, and fonts to create a cohesive look that aligns with your jewelry store’s atmosphere. This makes the receipt more than just a transaction record–it becomes a subtle branding tool that reinforces your store’s style and professionalism.

Adding Personal Touches

Consider including a personalized message on the receipt. A simple “Thank you for your purchase!” or “We appreciate your trust in us” goes a long way in creating a welcoming environment. Customers feel more valued, and this small gesture enhances their overall experience. You can also include loyalty program details or a special offer for their next visit.

Optimizing Information Layout

Ensure that key details such as the item description, price, and purchase date are easy to find and read. Organize the layout logically–grouping the itemized list at the top, followed by payment methods and transaction details. A clean, uncluttered design improves customer satisfaction and makes the receipt more useful as a reference.

Ensure your receipt template includes clear sections for transaction details. Start with the customer’s name and contact information at the top. Follow this with a list of items purchased, including a brief description, weight or quantity, and price for each item. Add taxes and any applicable discounts below this list. Display the total amount due at the end, making it easy to understand. Include space for the date and transaction number for record-keeping. Consider adding a section for payment methods, specifying whether the transaction was made by cash, card, or another method. Keep the layout clean and structured to avoid confusion and ensure accuracy.