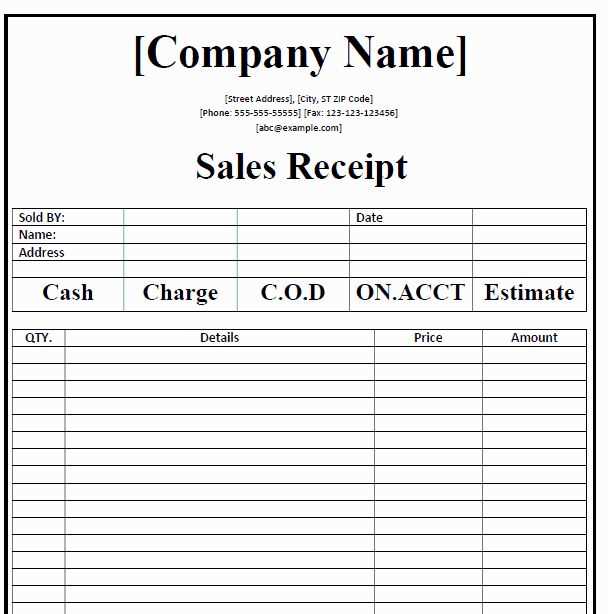

Use a structured format when creating an insurance receipt to ensure clarity and accuracy. Start with the policyholder’s name, policy number, and coverage details. Include a breakdown of the services provided and the corresponding charges. This makes the receipt easier to review for both the customer and the insurer.

Ensure clear itemization of all costs involved. List each service or item separately along with the date of service, the cost for each, and any applicable taxes or discounts. This prevents misunderstandings or disputes over the charges.

Always include contact information for both the insurance company and the policyholder. This enables quick resolution of any issues that may arise after the receipt is issued. Additionally, make sure the receipt includes the payment method and the total amount paid, providing transparency to both parties.

Here are the corrected lines:

Ensure that the template includes the date of service. This should be placed near the top for quick reference. Specify the amount charged and any applicable taxes separately. If discounts were applied, list them clearly to avoid confusion. Ensure that the insurance provider’s name and policy number are included for validation purposes. The recipient’s name and contact information should be positioned near the bottom for easy identification. Double-check the format to avoid errors in numeric entries.

- Insurance Receipt Template

For an accurate and professional insurance receipt, follow these guidelines:

- Receipt Title: Include “Insurance Receipt” as the title for easy identification.

- Recipient Information: Clearly state the name of the insurance company and policyholder. Provide the address and contact information as well.

- Date of Payment: Record the date the payment was made.

- Amount Paid: Specify the total amount paid, including any taxes or fees. Use a currency symbol for clarity.

- Payment Method: Indicate whether the payment was made via credit card, bank transfer, check, or another method.

- Policy Number: Include the relevant policy number to match the payment with the correct insurance coverage.

- Transaction ID: If applicable, provide the unique transaction ID for reference.

- Service Description: A brief explanation of the coverage or service the payment is related to.

- Signature/Authorization: Add a space for signatures or an electronic authorization, if required.

How to Format the Receipt

- Use clear, legible fonts such as Arial or Times New Roman.

- Ensure proper spacing between sections for readability.

- Use bold for headers and important sections to distinguish them from the rest of the content.

Final Steps

- Double-check all details for accuracy, especially amounts and dates.

- Provide a copy of the receipt to the policyholder for their records.

- Keep a copy for your own documentation, either digitally or in paper form.

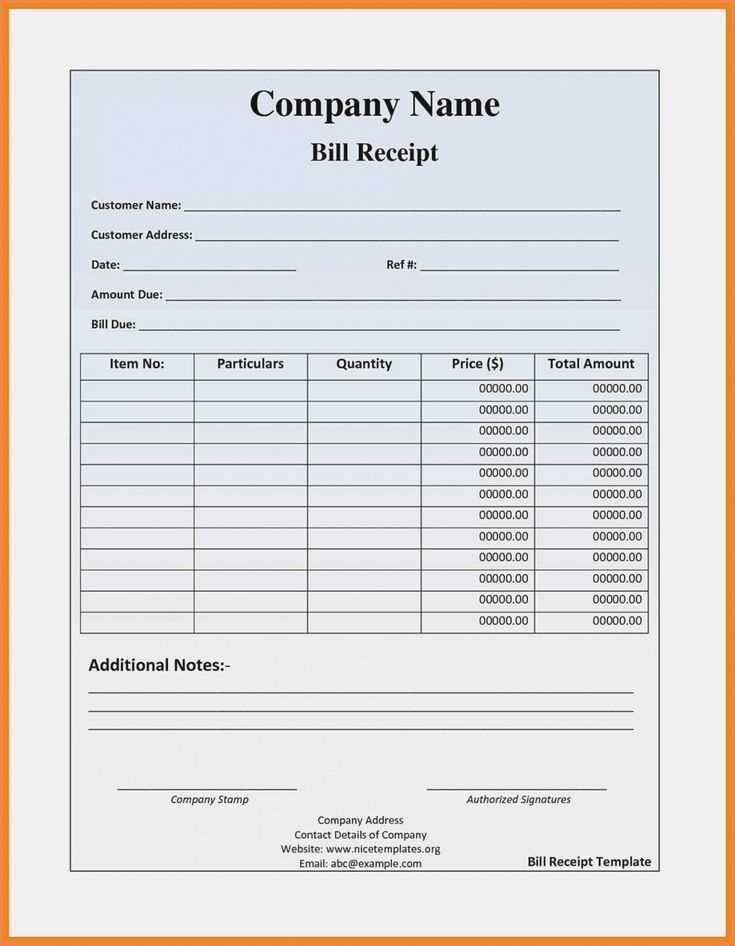

To create a straightforward insurance receipt, focus on clarity and necessary details. Include the recipient’s name, the insurance provider’s name, policy number, and the date of payment. Clearly state the amount paid and the method of payment (e.g., credit card, check). Provide a brief description of the coverage or service the payment relates to, ensuring it is easy to match with the policy terms.

Ensure that the receipt has a unique identifier, like a receipt number, for reference purposes. This will make it easier to track and verify payments in case of future inquiries or disputes. It’s also a good practice to add a section for both the issuer’s and recipient’s contact information in case of follow-up questions or concerns.

Be concise but thorough–each detail should be legible and unambiguous. Avoid including excessive terms or legal language that may confuse the recipient. Use a clean and simple layout with enough space between sections to make it visually accessible. By following these steps, you can create a receipt format that meets both practical needs and regulatory requirements.

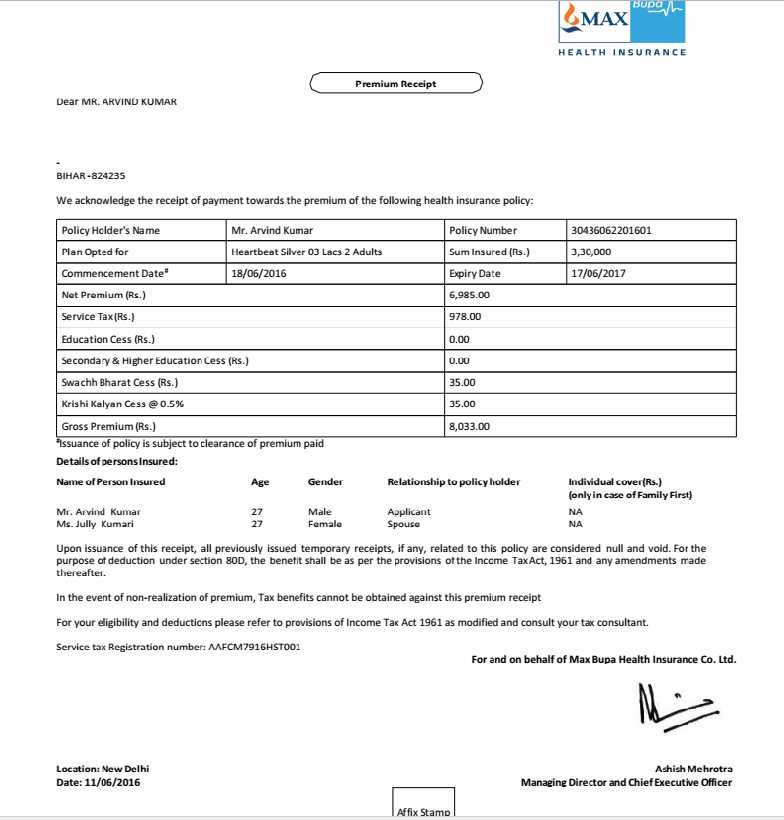

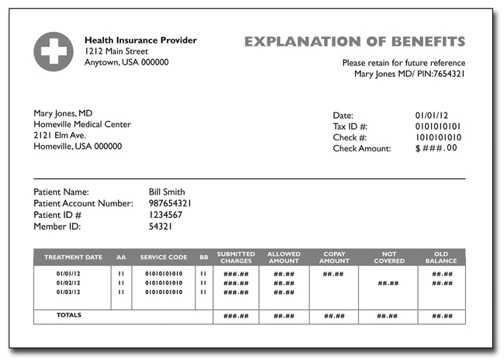

Adjust the structure of your insurance receipt template to suit the unique requirements of different insurance types. Begin by incorporating specific fields such as policy numbers, coverage details, and the type of claim involved. For health insurance receipts, include medical codes, provider details, and treatment descriptions. For auto insurance, focus on accident details, repair estimates, and vehicle identification numbers (VIN).

Health Insurance

For health insurance receipts, integrate sections that display patient information, diagnosis codes, service provider names, and detailed treatment records. It’s also helpful to have spaces for insurance provider references, co-payment details, and any applicable deductibles. Ensure these fields are easy to fill out and clearly labeled to streamline the processing of claims.

Auto Insurance

In auto insurance, emphasize sections for accident reports, vehicle damage assessments, and repair shop details. Include specific areas for the claimant’s personal information, as well as the insurance policy number and the claim reference. A section for authorized repairs, towing services, and parts costs will make the template more adaptable for automotive claims.

By customizing the receipt template to these distinct needs, you increase the clarity and efficiency of claims processing, minimizing confusion for both insurers and claimants.

Ensure the accuracy of all information on receipt templates to comply with local laws. Each template should include clear details such as the policyholder’s name, policy number, service rendered, and the amount paid. This prevents any disputes over claims or payments and ensures the template meets legal standards for documentation.

Data Privacy and Confidentiality

Receipt templates must handle sensitive customer data responsibly. Include only necessary information and comply with data protection regulations, such as GDPR in the EU or CCPA in California. Ensure that all data is stored securely and accessible only to authorized individuals to prevent data breaches.

Dispute Resolution Information

Including information about how disputes or misunderstandings regarding payments will be handled can help prevent legal issues. This can be a short section that outlines the procedure for filing complaints or resolving issues through mediation or arbitration, offering transparency and a clear course of action for policyholders.

Use a clear and concise format for your insurance receipt to ensure all key information is included. Start with the insured person’s details, such as their name and policy number, followed by the date of the insurance event. Include the type of coverage, any claim numbers, and a breakdown of the amounts covered and paid. Make sure to include the provider’s contact information, including their phone number and address. Finish with a reference to the transaction method or confirmation number, if applicable.

Keep the receipt organized and easy to read, with each section clearly labeled. This will help the insured person track their coverage and payments accurately.