To create an investment receipt that meets your needs, make sure it includes specific details such as the amount invested, the date, the type of investment, and the name of the investor. These elements ensure clarity and legality in documenting the transaction. A well-structured template can help simplify the process for both the investor and the recipient.

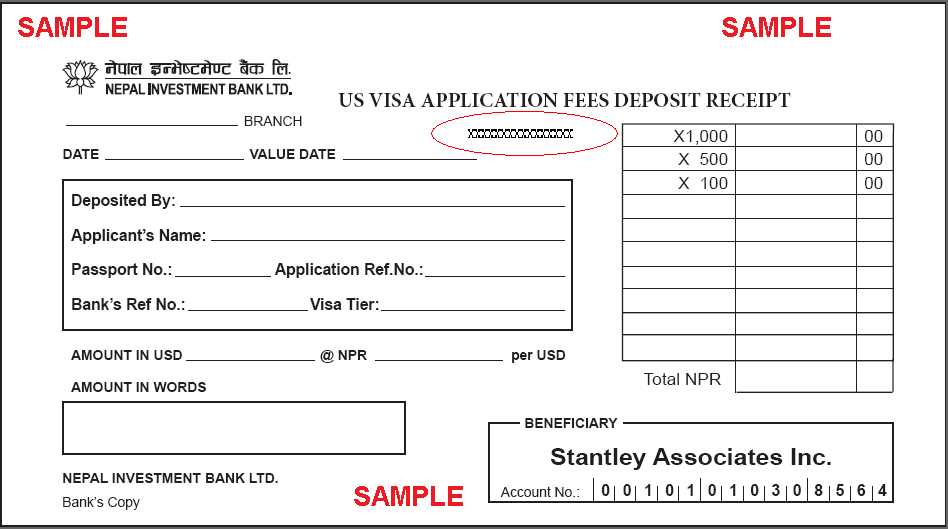

Details to Include: The template should clearly indicate the full name and contact information of both parties. The investment amount should be expressed in the relevant currency, along with the payment method used. If the investment is part of a larger fund or project, be sure to include the project or fund’s name and description.

Another key aspect is specifying the return on investment (ROI) expectations. If applicable, include information about dividends, interest, or other benefits the investor is entitled to. This helps establish transparency and a mutual understanding of the terms between both parties.

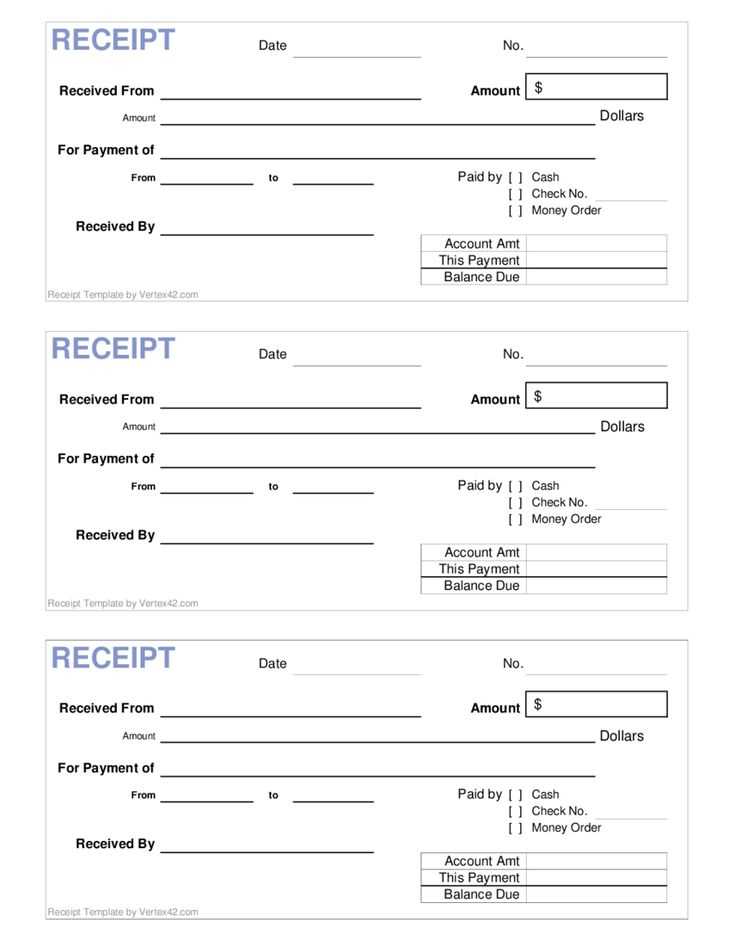

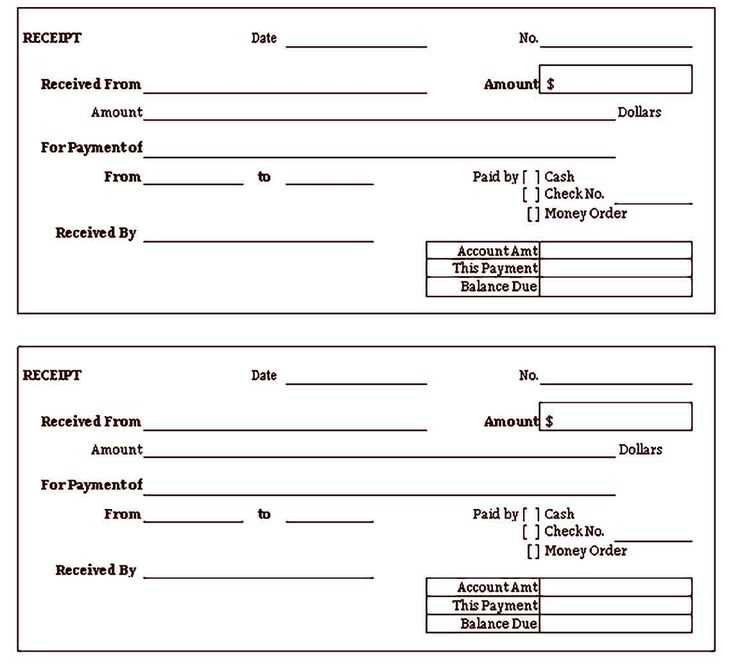

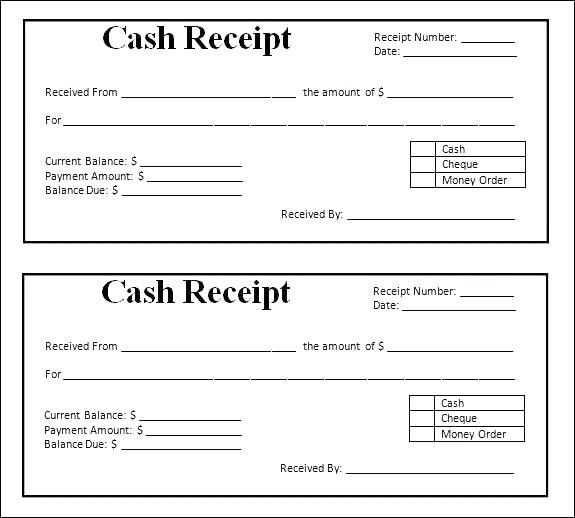

Structure and Format: Use a clean, easy-to-read format. Start with the header “Investment Receipt” and follow with a breakdown of transaction details. The receipt should also feature space for signatures to confirm the authenticity of the agreement. Keep the language clear, avoiding jargon, to ensure that both parties understand the agreement without confusion.

Here’s the adjusted version with reduced repetition:

For a streamlined investment receipt template, keep it clear and concise. Focus on essential details only. Include the transaction date, investor details, investment amount, and payment method. Avoid redundancy by ensuring no repeated data throughout the document.

Use consistent formatting to maintain clarity. For example, align monetary values, dates, and descriptions properly to enhance readability. Clearly label each section to guide the reader through the document.

| Investor Name | Investment Amount | Date of Transaction | Payment Method |

|---|---|---|---|

| John Doe | $10,000 | February 5, 2025 | Bank Transfer |

| Jane Smith | $5,000 | February 5, 2025 | Credit Card |

Incorporate a clear section for signatures to confirm both parties’ agreement. Simplify language wherever possible and remove unnecessary jargon. This approach ensures a smooth and professional document that communicates all the necessary information without overloading the reader.

- Investment Receipt Template Guide

Ensure your investment receipt template includes key details for clarity and accuracy. Start by including the investor’s name, the investment amount, and the date of the transaction. The receipt should also state the type of investment made, whether it’s stocks, bonds, or real estate. For transparency, include the investment’s maturity date or any relevant timelines if applicable.

Provide a clear breakdown of any fees or charges associated with the investment. It’s also helpful to reference any agreements or contracts related to the transaction. A section for both parties to sign and date adds a layer of authenticity to the document. If possible, include contact information for both the investor and the entity receiving the investment.

To ensure consistency, use a standardized format with headings and bullet points. Keep language simple and direct, avoiding ambiguity. A well-structured investment receipt template enhances communication and prevents future disputes.

Ensure your investment receipt includes these key elements to make it clear and legally binding. Start with the investor’s name and contact details. This establishes who is making the investment. The investment amount follows–specifying the currency and the exact sum. Then, include the investment’s purpose and description of the asset or opportunity, ensuring there is no ambiguity.

Investment Terms and Conditions

Clearly outline the terms, including the rate of return, duration of the investment, and any associated risks. This gives the investor clarity about expectations. Include payment terms–how and when the funds will be used or distributed. Specify any rights attached to the investment, such as voting rights or dividend eligibility.

Signatures and Date

End with the signature of both parties and the date of agreement. This validates the document and ensures both parties are committed to the terms outlined. A well-organized receipt will avoid misunderstandings and protect all parties involved.

Begin by clearly labeling the document as an “Investment Receipt.” This will immediately establish its purpose and importance.

- Header Information: Include the date, transaction number, and both parties’ names and contact details. This ensures easy reference in case of disputes or questions.

- Investment Details: Provide a breakdown of the investment amount, including the principal and any interest or fees. Be transparent about the financial breakdown to avoid confusion.

- Method of Payment: Specify how the investment was made, whether via wire transfer, check, or other methods. This helps verify the transaction’s legitimacy.

- Signature Section: Leave space for signatures from both parties to confirm the transaction. This adds a layer of trust and formality.

Use Clear Formatting for Readability

Ensure that the receipt is well-organized and easy to read. Use headings and bullet points to break up large chunks of text. This allows both parties to quickly locate important information.

Avoid Ambiguity

Each section should be precise, with no room for interpretation. Double-check the numbers, percentages, and dates to ensure everything is accurate. Small mistakes can lead to larger issues later.

Ensure the investment receipt clearly identifies both the investor and the recipient, including full names, addresses, and any relevant legal entities involved. Proper documentation should reflect the transaction date, amount, and investment purpose. Always specify the terms of the agreement to prevent future disputes. A well-drafted receipt may include disclaimers about potential risks, making sure both parties acknowledge the investment’s nature.

Make sure the receipt adheres to local tax laws and regulations. Some jurisdictions require specific language or forms for tax reporting purposes. Include provisions regarding returns, dividends, or other profits to ensure that expectations are legally documented.

Keep records of the receipt along with the corresponding contract. This ensures that you can easily refer back to the terms if necessary. If creating a digital receipt, ensure it is signed and protected by encryption or similar means to maintain its authenticity and prevent alterations.

Adjust the layout to suit your branding and operational needs. Add your company logo at the top for immediate recognition. Customize the header with your business name, contact information, and any legal disclaimers that apply to your transactions.

Tailor the Content for Specific Transactions

- Include fields for investment amounts, transaction dates, and the name of the investor.

- Provide a detailed breakdown of each investment, such as interest rates, terms, and payment schedules.

- Leave space for additional notes or special conditions that pertain to the agreement.

Ensure Consistency with Your Other Documents

- Align the font and color scheme with other forms, contracts, and receipts to create a unified look.

- Check that your template complies with any industry standards or regulatory requirements.

By customizing these details, you ensure that your receipt template reflects your company’s professionalism and makes the investment process clear for your clients.

Double-check the dates. Ensure that the receipt includes the accurate transaction date to avoid discrepancies with your financial records. A common mistake is listing the wrong date, which can lead to confusion during audits or when tracking investments over time.

Include clear investment details. Failing to specify the type of investment can cause complications down the line. Be sure to describe the asset or fund involved–whether it’s stocks, bonds, or a real estate investment–to prevent any ambiguity.

Avoid leaving out tax-related information. Incomplete or missing tax identification details, such as the investor’s tax ID number or the investment’s tax status, can create issues when preparing tax returns or claiming deductions.

Ensure the amounts are accurate. Double-check the investment amounts, including any commissions or fees. Errors in these figures can affect financial planning and reporting.

Clarify the payment method. When recording a receipt, specify the payment method used–whether through wire transfer, check, or digital platforms. This eliminates confusion in case of payment disputes.

Include the correct investor information. Missing or incorrect names, addresses, or contact details can lead to complications when verifying ownership or for future communication regarding the investment.

QuickBooks offers a streamlined solution for generating investment receipts. Its automation capabilities ensure that receipts are generated accurately, incorporating transaction details directly from your investment records. You can customize templates to fit your needs and quickly create professional-looking receipts with minimal effort.

For a more basic approach, Excel or Google Sheets allows you to design your own investment receipt templates. You can include formulas for automatic calculations and easily format your receipts to match your preferences. Both tools provide the flexibility to adjust the template as your needs evolve.

FreshBooks provides another excellent option, with an intuitive interface for creating receipts. It integrates with your accounting system, automatically filling in relevant data, making it quicker to generate receipts without needing to input information manually each time.

Expensify offers a cloud-based solution for tracking and generating receipts. It automatically scans and logs investment-related receipts, saving them for future reference, and enabling you to quickly create new ones when needed. This tool also provides an easy way to track expenses and investments in one place.

All these tools are designed to save you time while ensuring that your investment receipts are accurate, consistent, and easy to manage. Choose the one that best fits your workflow and requirements.

Investment Receipt Template: A Clear Approach

Creating an investment receipt requires clarity and attention to detail. Ensure that all necessary data is included to maintain accuracy without redundancy.

Key Components of an Investment Receipt

The receipt should clearly outline the investment amount, the date of transaction, the purpose of the investment, and the investor’s details. Avoid unnecessary repetition in these fields. Focus on providing only relevant information.

| Field | Details |

|---|---|

| Investment Amount | The exact amount invested, expressed clearly in currency. |

| Transaction Date | Include the exact date of the investment to track timing. |

| Purpose | A brief description of what the investment is for (e.g., equity, bonds, etc.). |

| Investor Details | Name, contact info, and other relevant data of the investor. |

Avoid Redundancy

It is essential to keep the format simple and direct. Use concise language and avoid repeating details unnecessarily. Each section should serve a clear purpose without overlapping with other parts of the document.