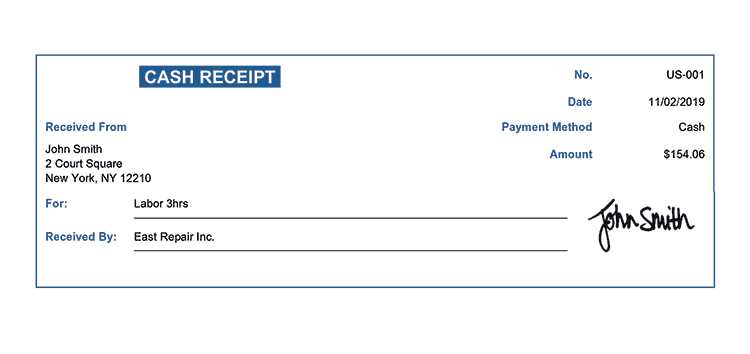

For an investor receipt, clarity and accuracy are key. Include the investor’s full name, the investment amount, and the date of the transaction. Clearly state the purpose of the investment, specifying whether it’s for equity or debt. A detailed breakdown of the investment terms, such as interest rates, repayment schedules, or any rights granted, should follow. This ensures that both parties are aligned on expectations and legal agreements.

Key elements to include are the investor’s contact information, the funding method (e.g., bank transfer or check), and any additional clauses or conditions, like security or collateral requirements. These details help safeguard both the investor and the recipient, establishing a transparent record for future reference.

It’s also beneficial to add a section for signatures, confirming mutual agreement and the completion of the transaction. Be sure to keep a copy of the signed receipt for your records, as it can serve as a vital reference for any future discussions or legal needs.

Lastly, ensure that your template is customizable to suit different types of investment scenarios, as this can streamline future transactions.

Here are the corrected lines:

Ensure all investor details are filled accurately, with correct spelling and formatting. It’s essential to list the exact amount invested and the agreed-upon terms. Double-check the transaction date and the nature of the investment, as this information should reflect precisely the terms outlined in your agreement.

Investor Information

| Field | Correction |

|---|---|

| Investor Name | Correct spelling and full legal name |

| Investment Amount | Ensure the correct figure, no extra digits |

| Transaction Date | Ensure the exact date as per agreement |

| Investment Type | Clarify the type of investment (e.g., equity, loan) |

Additional Tips

Ensure consistency in formatting for clarity. Always use precise figures and terms, and avoid any ambiguity. Provide space for investor signatures and official date stamps to validate the receipt. These small details guarantee clarity and accuracy, which can prevent issues later.

- Investor Receipt Template

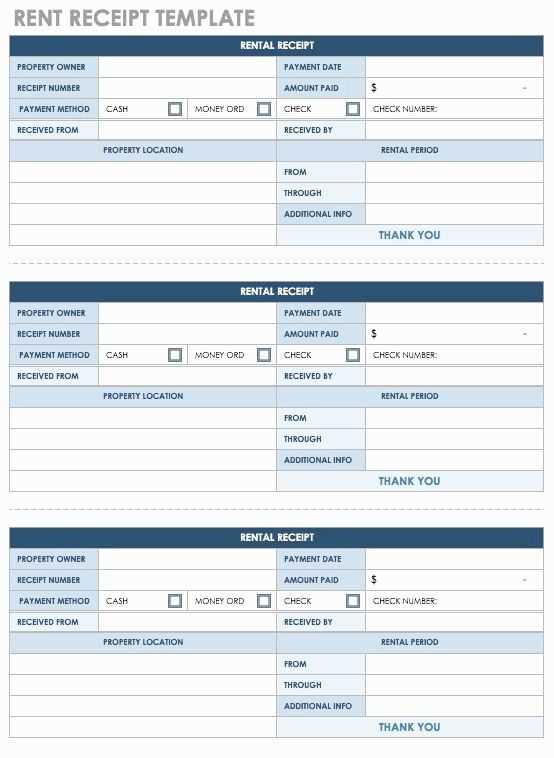

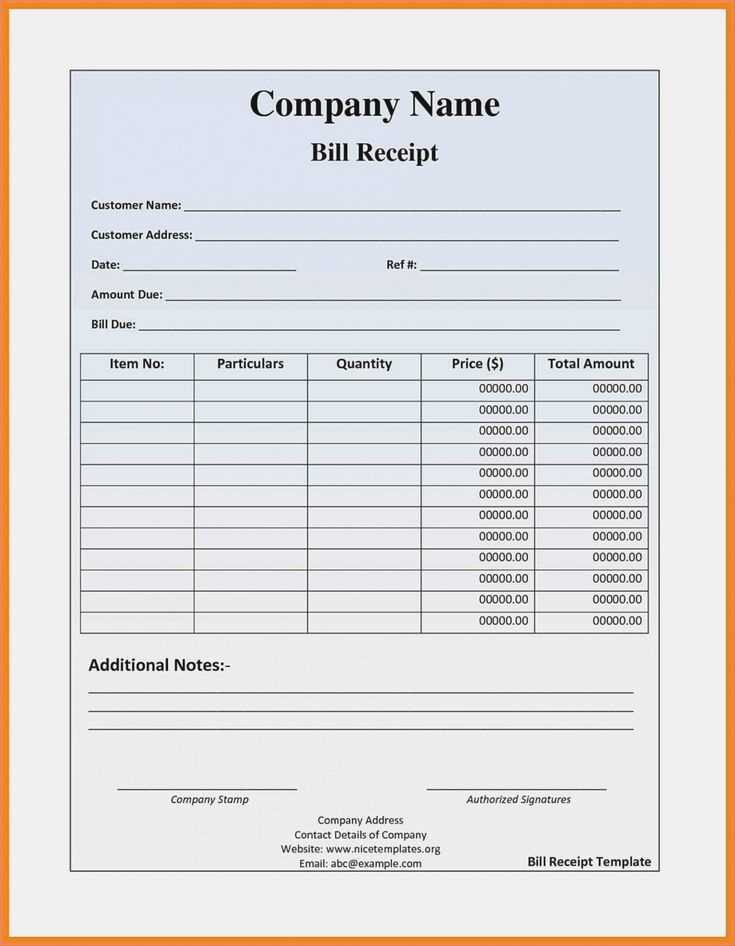

Ensure clarity and transparency in your investment transactions with a clear and concise investor receipt template. Start by including the investor’s full name, contact information, and the specific amount invested. Mention the date of investment and a brief description of the investment opportunity, such as equity shares or loan agreements. A unique reference number for each transaction will help keep your records organized and easily traceable.

In addition, outline the payment method used, whether it’s bank transfer, check, or another form of payment. A section for the signature of both the investor and a representative of the company can help validate the document. Providing an official company logo and legal disclaimers, if applicable, will further enhance the document’s professionalism.

Key details to include:

- Investor’s name and contact details

- Amount of investment

- Date of transaction

- Payment method used

- Reference number

- Investment description (e.g., shares, bonds, loan)

- Signatures of investor and company representative

By keeping the template simple yet comprehensive, you maintain a clear record and prevent misunderstandings between parties involved.

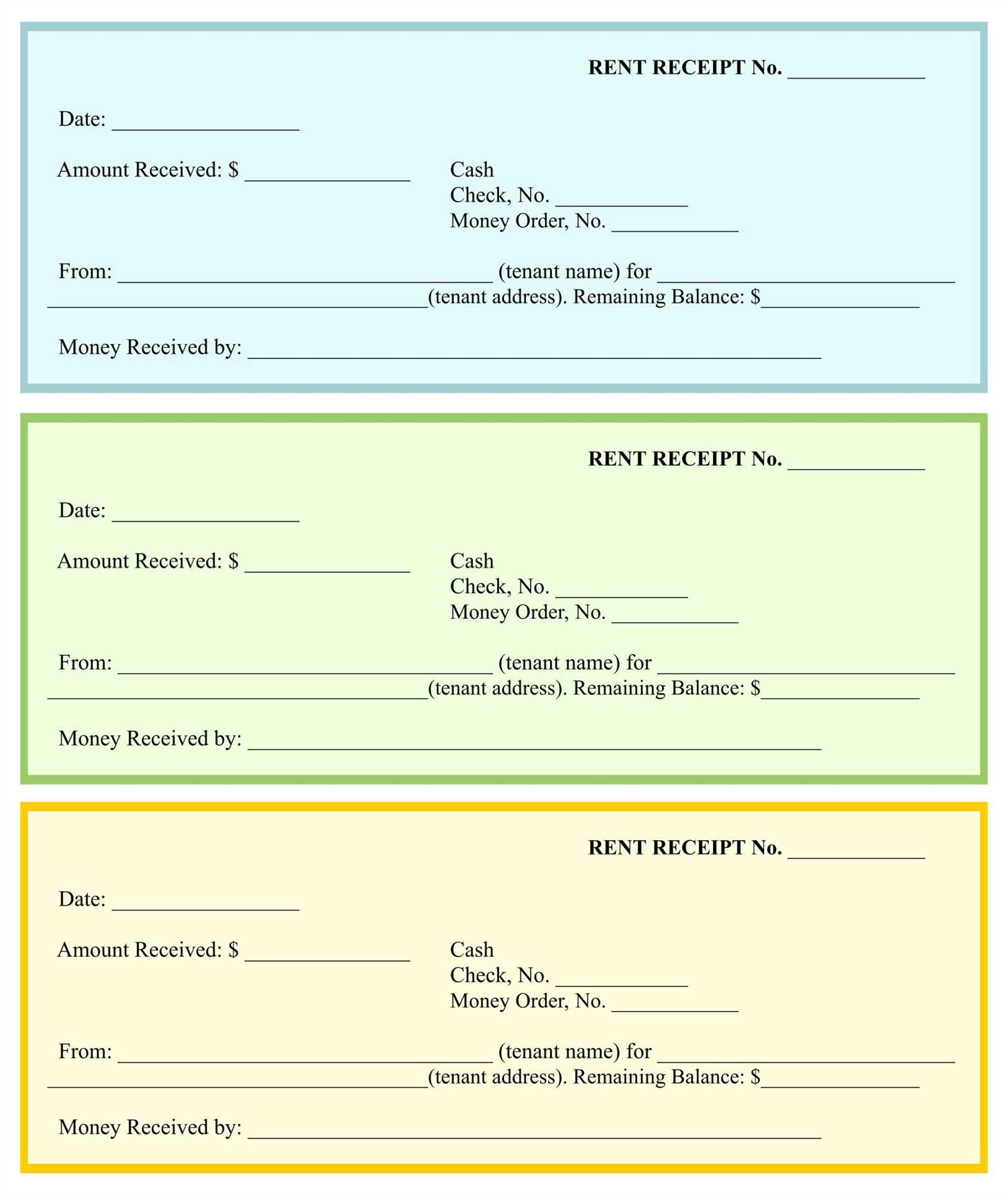

Begin by ensuring the receipt includes the investor’s name, the date of the transaction, and the amount invested. Clearly label each section to avoid confusion. Include a unique transaction ID for tracking purposes. This allows both parties to reference the transaction easily in the future.

Add a brief description of the investment or project to give context. For example, specify whether the investment is for equity, debt, or another type of funding. This helps clarify the nature of the agreement and prevents misunderstandings down the line.

Incorporate payment methods, whether it’s a wire transfer, cheque, or other means. Including this detail ensures transparency and helps reconcile financial records accurately. Be sure to note any applicable fees or charges tied to the transaction.

If applicable, add fields for payment terms, such as repayment schedule or dividend information. Customizing the template to reflect the specific terms of your agreement provides a professional and organized approach to managing investments.

Lastly, consider adding a section for signatures. Even if this is a digital transaction, a designated spot for signatures or approval adds credibility and confirms that both parties agree to the terms of the investment.

Ensure your investor receipt clearly states the amount of investment, the purpose of the funds, and any rights or obligations tied to the investment. Accurate documentation can prevent misunderstandings in the future.

- Tax Implications: Any investment can carry tax consequences. Both the investor and the issuer need to assess whether the receipt is considered taxable income or if deductions are applicable. For example, capital gains taxes might apply depending on the terms of the investment.

- Legal Framework: Specify the governing law for any disputes that may arise. Clarify whether the receipt falls under local or international regulations and which jurisdiction will govern legal actions.

- Transferability: The receipt should mention if the investment can be transferred or sold to third parties. If restrictions apply, they should be outlined clearly to avoid any future disputes.

- Return on Investment (ROI): Define how and when the investor will receive returns, including the type of return (e.g., interest, dividends, profit share) and the frequency of payments. Be explicit about any potential risks or uncertainties regarding ROI.

Familiarize yourself with the specifics of your local tax laws and seek professional guidance if needed. The investor receipt should be a legally sound document that protects both parties and supports clear tax reporting.

Store receipts in a secure, organized system, either digitally or physically. For digital storage, use cloud-based services that offer encryption, allowing for safe access from anywhere. Ensure the system you choose is reliable and includes backup features to prevent data loss. For physical storage, use fireproof and waterproof file cabinets, and organize receipts by date and type of investment to ensure easy retrieval.

Distribute receipts to investors promptly after transactions. Emailing PDF copies ensures that investors receive their records in a timely manner. Include clear, detailed information on each receipt, such as the date of the transaction, amount, investment type, and any relevant terms. Provide an option for investors to request physical copies, but avoid making it the default method.

Establish a standardized format for receipts to make tracking and comparison easier. This can be achieved by using a template with consistent fields, ensuring that every receipt includes the same key data. Include any necessary disclaimers or notes regarding tax implications, where relevant.

Set up regular checks to ensure receipts are correctly stored and easily accessible. For digital records, this may include regular audits to ensure data integrity, while for physical records, it may involve periodic reviews of filing systems and inventory control to prevent loss or damage.

To create a well-structured investor receipt, begin by clearly outlining the date of the transaction, the investor’s name, and the amount invested. Make sure all fields are legible and concise.

Basic Information

The receipt must include the transaction date, which serves as a key reference. Add the investor’s full name, along with their contact details for clarity. Include the investment amount, specifying the currency used to avoid ambiguity.

Investment Details

Include a brief description of the investment made. Specify the type of investment–whether it’s equity, debt, or another form. Mention the project or company involved, including relevant identifiers such as project names or registration numbers to further clarify the nature of the transaction.

End the receipt with a simple confirmation statement of the received funds and a signature field for both the investor and the receiver, ensuring all legal aspects are covered.