Use a precise investor receipt template from the Chamber of Commerce to ensure accurate documentation of investments. This template helps formalize transactions, ensuring compliance with legal and financial standards. Incorporating key details such as investor name, investment amount, and transaction date reduces the risk of errors and misunderstandings.

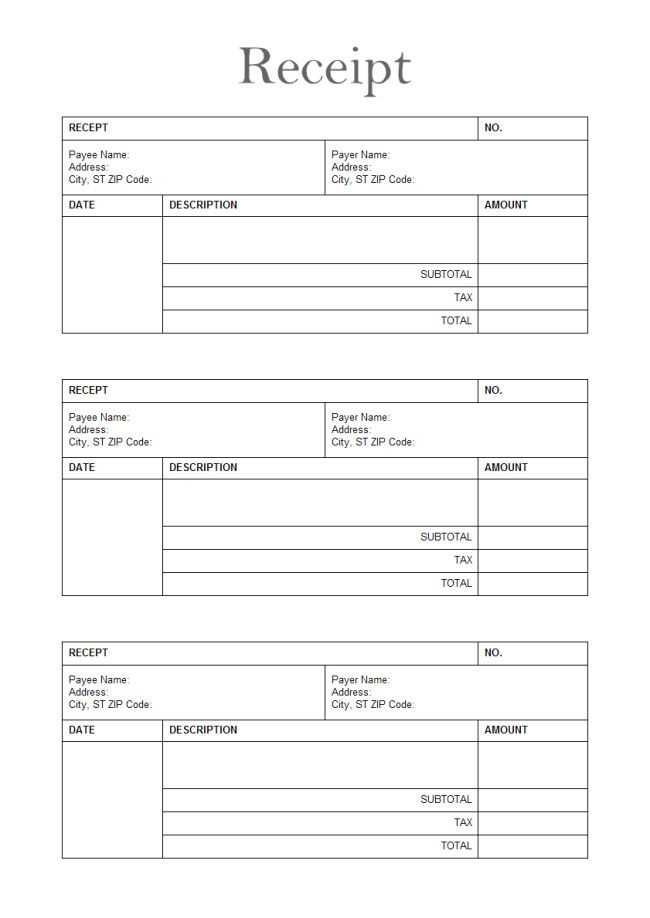

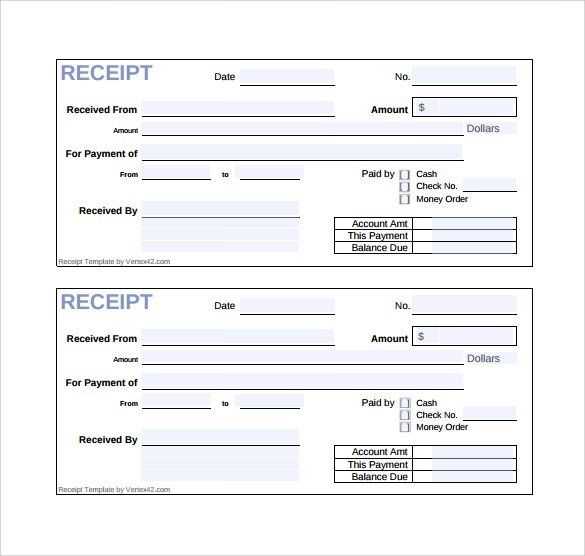

A well-structured receipt simplifies tracking financial contributions, which is critical for both investors and businesses. Include the transaction reference number and any relevant details related to the investment’s purpose. This transparency not only builds trust but also creates a solid foundation for future business dealings.

Ensure the template is easy to read and tailored to your specific needs. Use clear headings for each section, such as “Investor Information,” “Amount,” and “Transaction Date.” By doing so, you streamline the documentation process and keep records organized for future reference.

Here is an improved version where words repeat no more than 2-3 times:

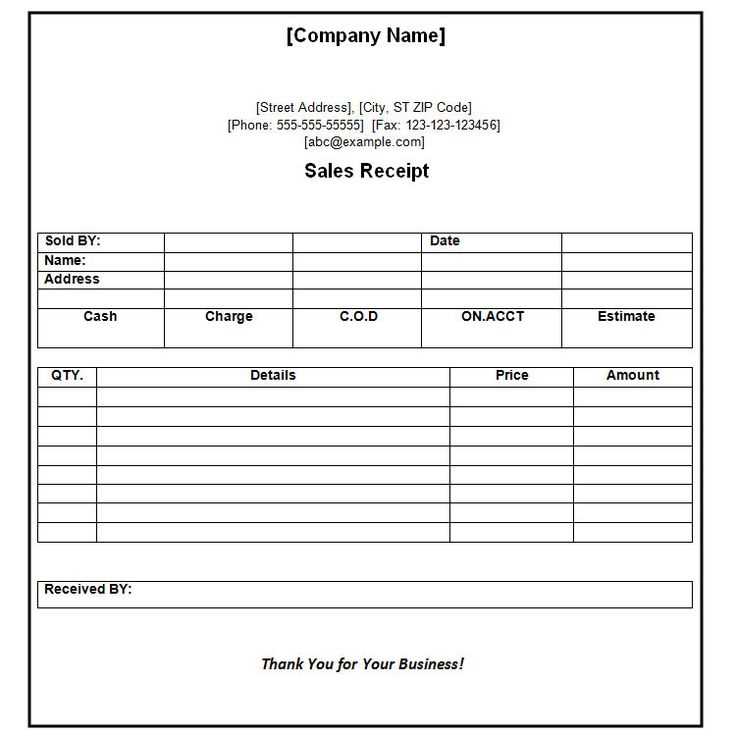

Use a clear and structured format when creating an investor receipt. Avoid cluttering the document with redundant information. Focus on the most relevant details such as transaction date, amount, and investor details.

- Transaction Date: Clearly state the date of the transaction to avoid confusion.

- Amount Received: Include the exact amount received in both numerical and written form.

- Investor Details: List the investor’s full name and contact information.

- Payment Method: Specify the payment method used, whether by check, bank transfer, or other methods.

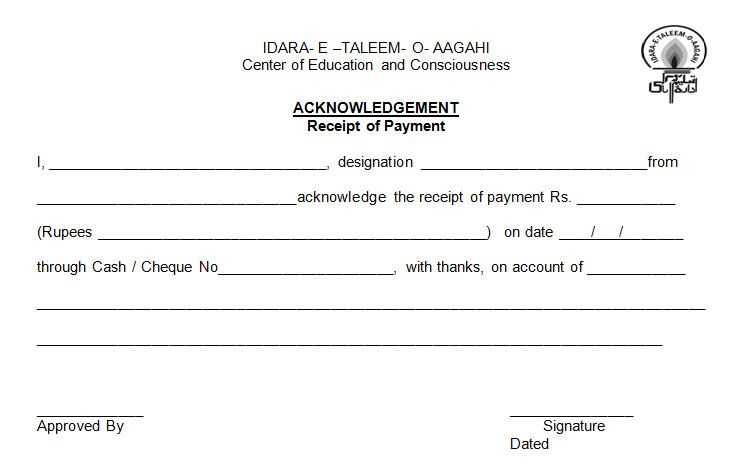

- Signature: Provide space for both the investor and receiver to sign, ensuring accountability.

Ensure the document is signed and dated to confirm its authenticity. Keep the language straightforward and free from jargon. This ensures clarity and avoids potential misunderstandings.

- Investor Receipt Template for Chamber of Commerce

An Investor Receipt for the Chamber of Commerce should contain specific details to ensure clarity and compliance. The document must confirm the transaction, list the investor’s contribution, and serve as an official acknowledgment of receipt. Here’s how to structure it:

| Field | Description |

|---|---|

| Receipt Number | A unique identifier for tracking the receipt. |

| Date | The exact date when the transaction occurred. |

| Investor Name | The full legal name of the investor. |

| Amount Invested | The precise sum of money or asset invested. |

| Investment Type | Specify whether the investment is monetary, in-kind, or another type. |

| Chamber of Commerce Details | Name and contact information of the Chamber of Commerce. |

| Authorized Signature | A signature from a Chamber representative confirming receipt. |

| Remarks | Additional information or special conditions related to the investment. |

Ensure that all fields are filled out accurately to prevent any future disputes or confusion. Keep a copy of the receipt for both the investor and the Chamber’s records.

For clear documentation, select a format that is both simple and comprehensive. Use a professional template that includes all necessary details: investor name, amount, date, and the specific purpose of the investment. The format should allow for quick validation by the Chamber of Commerce or other authorities if needed.

Key Elements of the Receipt Format

Focus on clarity and accuracy. The receipt should be easy to read, structured logically, and contain the following sections:

| Section | Description |

|---|---|

| Investor Details | Name, contact information, and investor ID (if applicable). |

| Investment Amount | Clearly state the amount invested, currency, and payment method. |

| Date | Indicate the exact date the investment was made. |

| Investment Purpose | Specify the project or initiative receiving the funds. |

| Signature | Include signatures of both parties, if required, for authentication. |

Digital vs. Paper Formats

If submitting digitally, use a PDF or another universally accessible format. A digital receipt ensures easy storage and retrieval, and it can be shared quickly when necessary. For paper receipts, ensure they are printed on quality paper with clear, legible fonts. Whether digital or paper, keep a backup for record-keeping.

Include the following details to ensure the investor receipt is valid:

- Investor’s Full Name – Clearly state the investor’s legal name.

- Investment Amount – Specify the exact sum invested, including the currency.

- Date of Investment – Indicate the precise date the investment was made.

- Transaction Reference – Provide a unique transaction ID or reference number.

- Company Information – Include the business name, registration number, and contact details.

- Receipt Number – Assign a unique identifier to the receipt for tracking purposes.

- Payment Method – State how the investment was made (e.g., bank transfer, cheque, etc.).

- Signature – Ensure a signature from the authorized company representative is included.

Confirm that all the required information is provided to validate the receipt and prevent any disputes in the future.

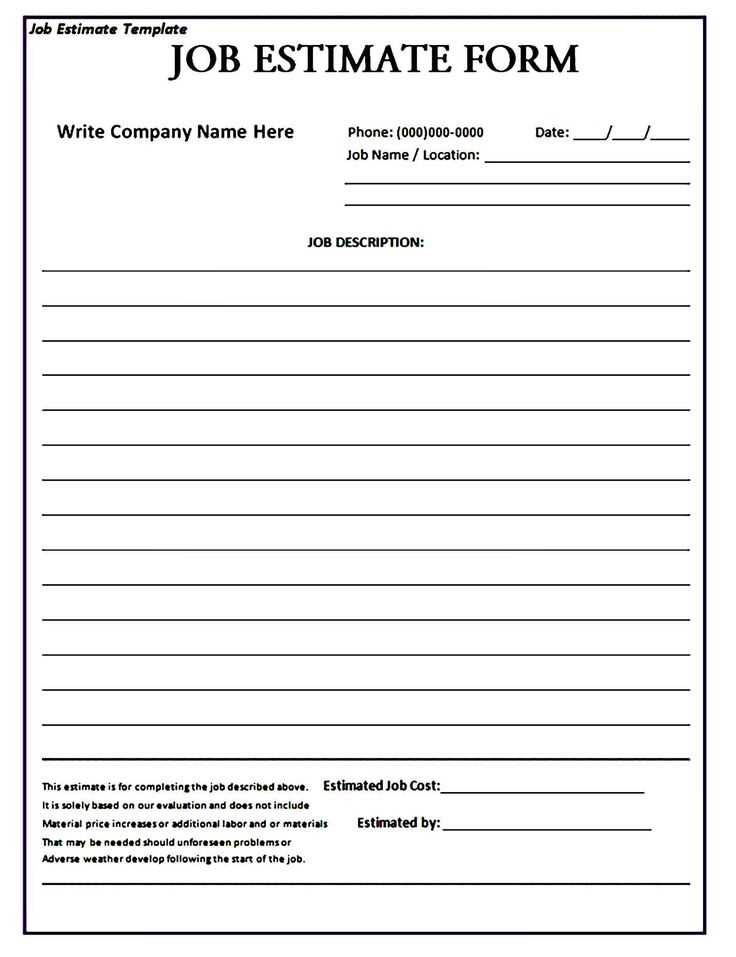

Tailor your investor receipt template to meet both your business’s and your investors’ needs. Start by adjusting the layout to match your branding. Use your company logo, colors, and fonts to make the document visually aligned with your corporate identity. This reinforces professionalism and makes your receipts instantly recognizable.

Include Necessary Fields

Ensure all key details are included, such as the investor’s name, the amount invested, the investment date, and any relevant project or equity details. You may also want to add a unique receipt number for tracking purposes. Make sure to clearly display your contact information, including your business address, phone number, and email.

Incorporate Terms and Conditions

If applicable, include any terms and conditions related to the investment. These may include payment schedules, refund policies, or other agreements that both you and the investor have mutually agreed upon. Be concise and clear to avoid ambiguity.

Customize the template to reflect the nature of your business and the specific investment. This adds clarity and reduces confusion for both parties involved.

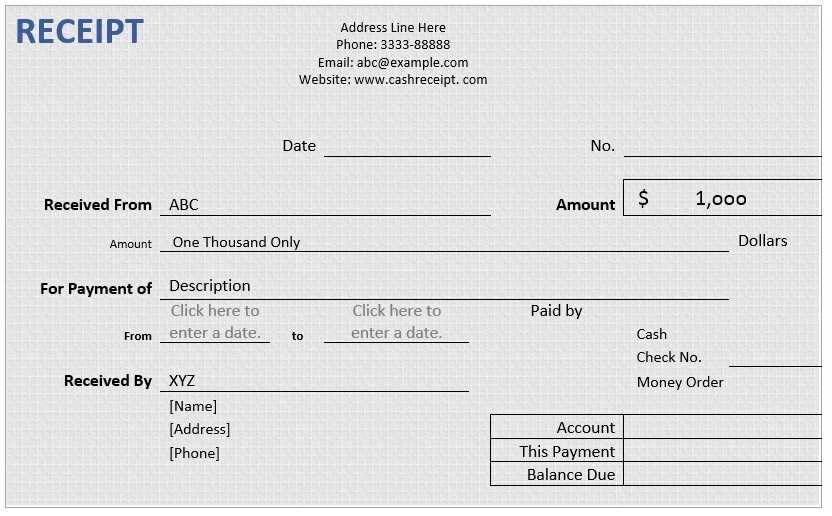

Begin by verifying the investor’s identity and confirming the transaction details. Ensure the amount received and the investment type match the agreement made between the parties.

Prepare the receipt, including the investor’s full name, address, contact details, and the date of the transaction. Include the precise amount received, the currency used, and the investment’s purpose.

Ensure the receipt includes a clear statement that the funds are being used in compliance with relevant Chamber of Commerce regulations. This statement serves as proof that the transaction is legitimate.

Sign the receipt with an authorized representative’s name and title, confirming the receipt’s validity. Add any required Chamber of Commerce seals or stamps for authentication.

Provide the investor with a copy of the signed receipt, either electronically or physically, as per the preference specified during the transaction.

Store a copy of the receipt in your records for future reference and ensure that it is accessible for audits or regulatory reviews.

Ensure the accuracy of all details on the receipt to avoid mistakes that could lead to legal or financial issues.

1. Missing or Incorrect Contact Information

Always verify that both the investor’s and your company’s contact information are accurate. Double-check email addresses, phone numbers, and business addresses to avoid delays in communication or disputes over receipt validity.

2. Inaccurate Investment Amount

Confirm the amount of investment is correct. Errors in the amount listed can lead to confusion and affect tax reporting. Ensure the total corresponds to what was agreed upon.

3. Lack of Signature or Authorization

Include a signature or proper authorization from both parties. This validates the receipt and prevents future challenges to its authenticity.

4. Incomplete or Unclear Terms

Detail the terms of the investment in clear language. Avoid vague terms that can cause misinterpretations or legal problems. Specify the investment type, return expectations, and duration if applicable.

5. Missing or Incorrect Date

Always include the correct date on the receipt. The date indicates when the investment transaction occurred and is important for both record-keeping and tax reporting purposes.

6. Incorrect or Missing Transaction ID

Include a unique transaction ID for easy reference. This helps keep track of investments and provides a point of contact for future inquiries.

7. Failure to Adhere to Legal Requirements

Ensure your receipt follows the legal guidelines set by the chamber of commerce or other relevant authorities. Research the specific requirements for receipts in your jurisdiction to avoid penalties.

8. Ignoring Record Keeping

Keep copies of all receipts. These records are necessary for auditing purposes, future investment transactions, and tax filings. Make sure your documentation is complete and organized.

Organize investor receipts by creating a dedicated folder or digital storage system. For paper receipts, store them in a labeled binder with clear sections for different categories, such as investment types or dates. For digital receipts, use cloud storage with folders that mirror the physical system, ensuring easy access and retrieval.

Use software or apps designed for tracking financial documents. These tools allow you to scan receipts, add metadata, and sort them according to categories, making it easier to track expenses and investments. Regularly back up your digital records to prevent loss.

For long-term storage, keep records for the minimum required time according to local regulations, often between 3-7 years. Label each receipt with relevant details, such as investment date, amount, and investor name. If needed, create a spreadsheet with a summary of the receipts for quick reference.

Investor Receipt Template Chamber of Commerce

Use a clear, concise template for issuing receipts to investors. This should include the chamber of commerce’s name, contact details, and registration number for transparency. Additionally, include the investor’s name, the amount invested, and the purpose of the investment. Clearly state the date of the transaction and reference any related agreements.

Template Structure

Ensure the receipt structure is simple and easy to follow. Start with the chamber of commerce’s information, followed by the investor’s details. Then, list the transaction amount, currency, and any applicable taxes or fees. Conclude with a thank-you note and instructions for any follow-up action.

Key Considerations

Be specific when listing the investment amount and avoid vague terms. If the transaction involves multiple parties or conditions, include those details. Keep records organized for future reference and verification. A receipt should serve as a formal acknowledgment of the transaction and comply with local legal requirements.