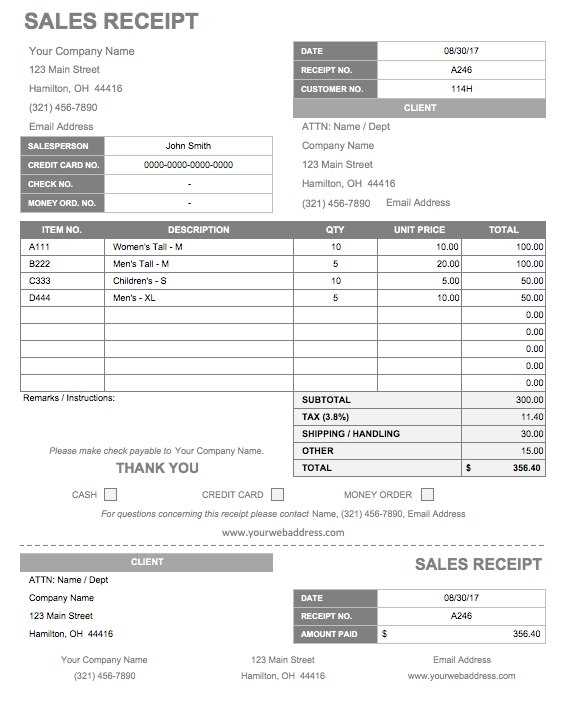

Use a clear and structured format to ensure your receipt looks professional and meets business requirements. Include key details like the seller’s name, contact information, date, and a breakdown of purchased items. A well-designed template enhances credibility and simplifies record-keeping.

Include essential transaction details such as the total amount, payment method, and tax calculations. Adding a unique receipt number helps with tracking and organization. If sending digital receipts, ensure they are in a widely accepted format like PDF.

Customize your template to match your branding by adding a logo, business colors, or specific terms. Many apps and software options allow quick adjustments to create receipts that align with your business identity.

Use automation for efficiency. Tools like Apple Notes, invoice apps, or built-in templates on platforms like Microsoft Word and Google Docs speed up the process. Preformatted templates help maintain consistency and reduce errors.

Ensure compliance with local regulations by checking tax requirements and legal standards. Providing accurate and complete receipts builds trust with customers and simplifies accounting.

Here’s the revised version with fewer word repetitions while keeping the meaning:

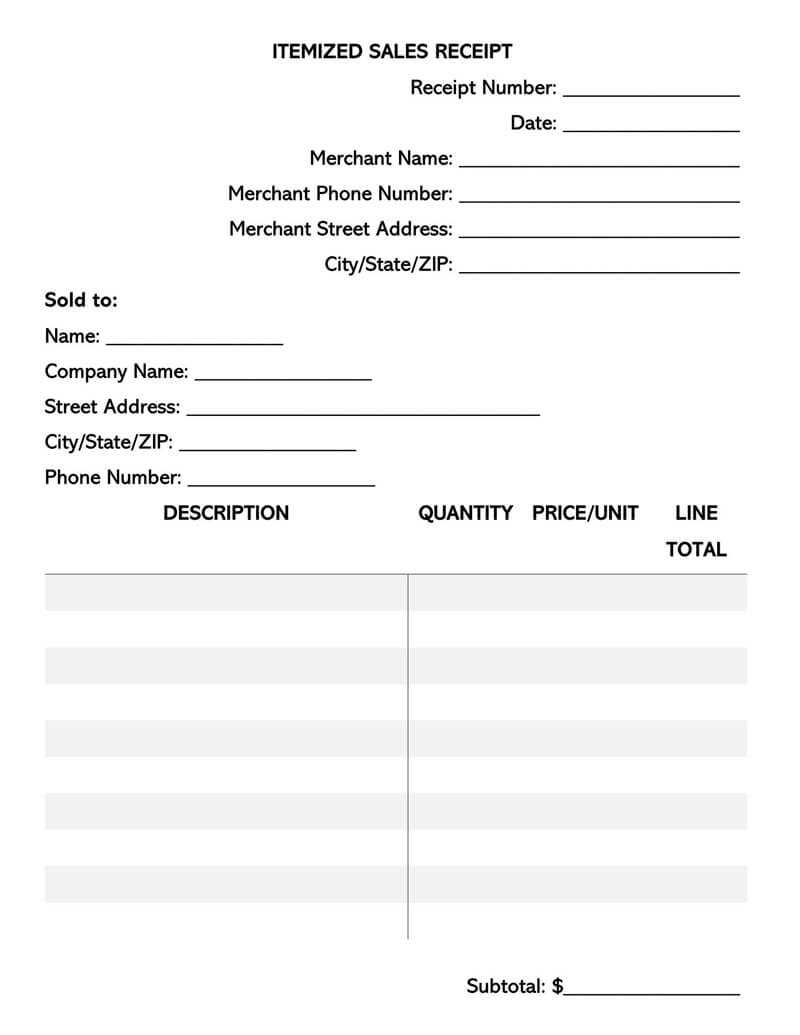

Use a clear layout to ensure readability. Keep sections structured with distinct headings for details like date, amount, and payment method.

Avoid redundant labels. Instead of “Receipt for Purchase,” simply use “Receipt.” Similarly, remove unnecessary words in descriptions to maintain brevity.

Ensure all required information is included–business name, contact details, itemized list, and tax breakdown. A well-organized template improves usability and speeds up processing.

For customization, use an editable format like PDF or Word. This allows quick adjustments without redesigning the entire receipt.

- iPhone Purchase Receipt Template

Use a structured layout: Include the store name, date of purchase, buyer details, product description, price breakdown, and payment method. A clean, well-organized receipt ensures clarity.

Ensure compatibility: Save the receipt in a widely accepted format like PDF or DOCX. This prevents formatting issues and makes sharing easier.

Key Elements to Include

Header: Display the seller’s logo, name, and contact details.

Itemized List: Specify the iPhone model, storage capacity, color, and any included accessories.

Taxes & Discounts: Clearly show tax amounts, applied discounts, and the total cost.

Digital & Print Options

For digital use: Add a unique invoice number and QR code for quick verification.

For printed copies: Use high-quality paper and legible fonts for a professional appearance.

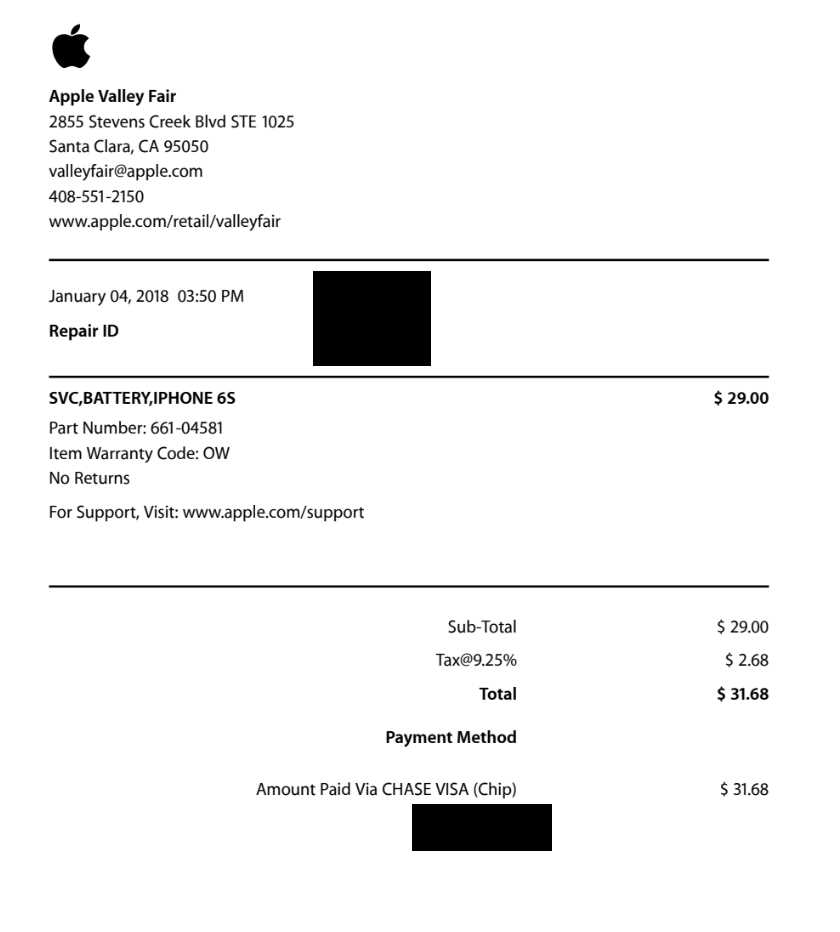

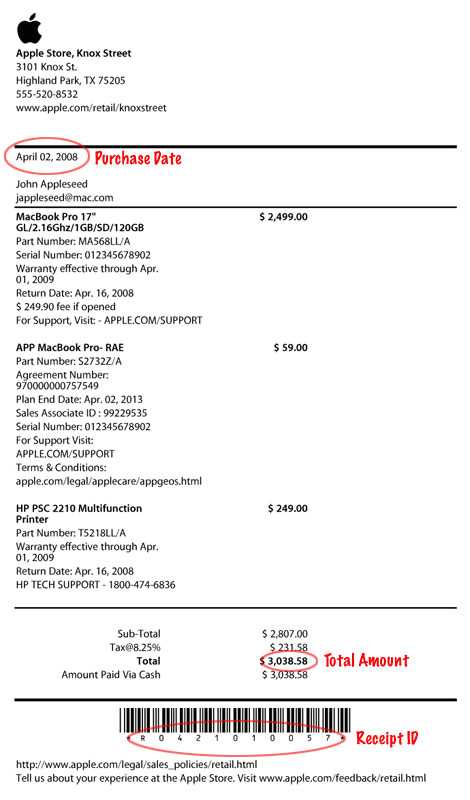

Order Details: Every Apple receipt includes a unique order number, purchase date, and payment method. These details help track transactions and resolve disputes.

Purchased Items: Each item appears with its name, quantity, and price. If applicable, subscription details or renewal dates are also listed.

Billing Information: The receipt specifies the buyer’s name, billing address, and payment summary, including taxes and discounts.

Support and Refund Policy: A link or instructions for requesting refunds and managing purchases ensure easy access to customer support.

Company Identification: Apple’s contact details, legal disclaimers, and tax registration numbers authenticate the document and provide compliance information.

Modify an iPhone receipt template to match your branding and transaction details. Adjust key elements for clarity and professionalism.

Key Adjustments

- Logo and Brand Colors: Replace the default logo with your own. Use consistent brand colors for a cohesive look.

- Customer Information: Ensure fields for name, email, and purchase details are clearly structured.

- Date and Order Number: Format these elements for quick reference. Use YYYY-MM-DD for consistency.

- Itemized List: Display product names, quantities, and prices. Highlight discounts or taxes separately.

- Payment Details: Indicate the payment method, last four digits of the card, and transaction status.

Enhancing Readability

- Font and Spacing: Use legible fonts with proper spacing to avoid clutter.

- Digital Accessibility: Optimize for mobile viewing by keeping text concise and structured.

- Download Options: Include a PDF or email option for easy storage.

Save the customized template as a reusable format to streamline future receipts while maintaining a professional presentation.

PDF ensures a consistent layout across devices and is ideal for professional invoices. It preserves formatting and can be easily shared or archived.

HTML works best for online receipts, adapting to different screen sizes and allowing interactive elements like clickable links and dynamic data fields.

Structured Data Formats

CSV simplifies bulk data processing and works well for importing transaction records into accounting software.

JSON is efficient for API integrations, allowing seamless data exchange between platforms without manual input.

Optimized for Printing

Thermal Printing uses compact, text-based formats for clear, ink-free receipts, reducing printing costs.

A4 or Letter Templates suit business documentation, ensuring all details fit neatly on a standard page for easy filing.

Using a mobile app to create a receipt can simplify your record-keeping. Many apps can help generate receipts in seconds, making it easy to track payments, expenses, and purchases. Here’s how to generate a mobile receipt using some popular apps:

1. Use a Receipt Maker App

Receipt Maker apps are designed to create receipts quickly. Follow these steps:

- Download a receipt-making app such as “Receipt Maker” or “Invoice Maker” from your app store.

- Open the app and select the option to create a new receipt.

- Fill in details such as the date, items, total amount, and payment method.

- Customize the receipt with your logo or personal information if necessary.

- Save or send the receipt directly to your customer via email or message.

2. Use Accounting Apps with Receipt Functions

Accounting apps like QuickBooks or FreshBooks offer receipt creation features as part of their service. Here’s what to do:

- Download and install the accounting app.

- Create a new invoice or receipt by entering the transaction details.

- Choose from pre-built receipt templates to match the style you prefer.

- Generate the receipt and email it directly from the app or save it to your device for later use.

Using mobile apps for receipts streamlines the process and helps you keep organized records with minimal effort.

Ensure that all invoices and sales records comply with local tax regulations. Each record must include key details such as the business name, address, date of transaction, list of goods or services sold, the price, and applicable taxes. Retain these documents for the required duration according to your jurisdiction’s laws, usually between 3 to 7 years, to avoid penalties during audits.

Record Retention Requirements

It’s critical to maintain accurate records of all sales transactions. Businesses must securely store invoices and sales receipts in case of a future audit. Digital records are valid, but ensure that they are easily accessible and backed up regularly to prevent loss. Consult local laws to confirm the retention period and storage conditions for digital versus paper records.

Tax Implications

Failure to provide accurate invoices could lead to tax compliance issues. Each sale needs to be documented for tax purposes, and businesses must apply the correct sales tax rate. Incorrect or missing information may result in fines or difficulties during tax reporting. Keep track of any tax changes and adjust your invoicing system accordingly.

| Invoice Element | Legal Requirement |

|---|---|

| Business Details | Full business name and address |

| Date of Transaction | Must be clearly listed |

| Itemized List | Detailed description of goods/services sold |

| Tax Information | Applicable tax rate and total tax amount |

| Payment Terms | Specify payment due date or terms if applicable |

Several online platforms offer ready-made Apple receipt templates that are easy to download and customize. Websites like Template.net and Etsy provide professionally designed options suitable for various business needs. These templates are typically available in popular formats such as PDF and Word, making them convenient to use and modify.

Another great option is using free templates on Google Docs. Simply search for “Apple receipt template” in the template gallery, and you’ll find several pre-designed formats that can be easily adjusted to suit your requirements. Alternatively, Microsoft Office also offers a variety of templates through Word, which are customizable and user-friendly.

If you prefer templates that align specifically with Apple’s brand aesthetics, consider exploring dedicated design sites like Canva or Adobe Express. Both platforms offer customizable receipt templates where you can adjust fonts, colors, and logos to meet your needs. Many of these templates are free or come with affordable premium versions.

Lastly, you can check Apple’s own support or community forums for user-shared templates. These may not always be as polished as the ones found on professional sites, but they can offer a more personalized touch depending on your needs.

For those creating an iPhone receipt template, be sure to include key elements that reflect a professional transaction. Start by clearly indicating the seller’s name, address, and contact details. This helps the recipient quickly identify the source of the purchase.

Itemized list: Include a detailed list of the products purchased, including item names, quantities, individual prices, and any applicable taxes. This ensures clarity on what was bought and how much was paid for each item.

Date and time: Add the exact date and time of the purchase. This is particularly useful for returns or warranty claims. If possible, use a timestamp format to help avoid confusion.

Total amount: Clearly display the total amount due, including taxes, discounts, and any other relevant fees. The total should be easily visible to prevent any errors in payment.

Payment method: Specify how the payment was made (e.g., credit card, cash, or mobile payment). This adds transparency to the transaction and can be important for both the customer and the seller.

Ensure the receipt is well-structured and visually organized. This makes it easier for both parties to review the transaction details and keeps the receipt looking neat and professional.