If you’re looking for streamlined and accurate receipt templates for IRA (Individual Retirement Account) transactions, you’ve come to the right place. These templates are designed to help you document contributions, rollovers, distributions, and other financial activities associated with your IRA in 2019. Utilizing a clear, consistent format will make tracking your retirement account much simpler and ensure compliance with IRS regulations.

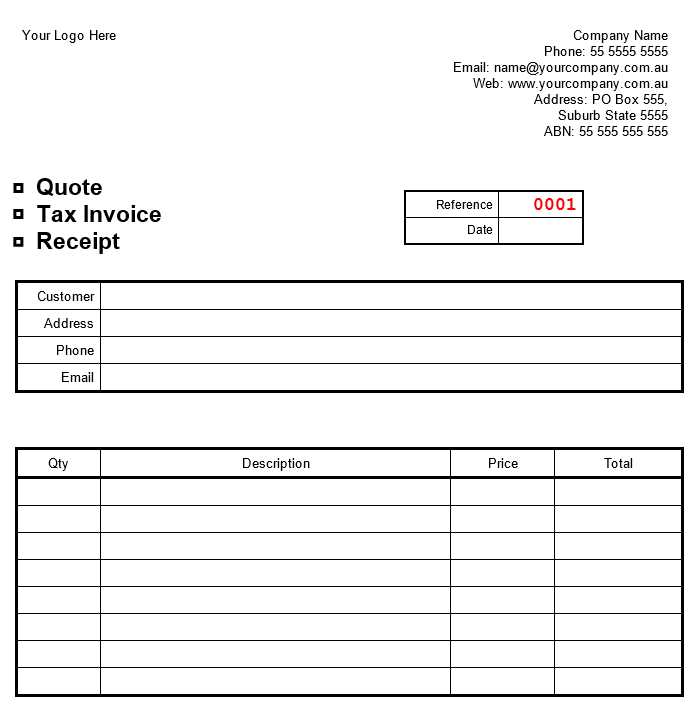

When choosing a template, focus on one that captures all necessary data such as transaction type, amounts, dates, and account numbers. A well-structured receipt will not only keep your records organized but will also make tax filing easier. Remember, the IRS requires precise documentation, so opt for templates that include space for detailed information like custodian names, account numbers, and the nature of each transaction.

For those using IRA receipt templates in 2019, it’s important to ensure they align with current tax rules. While the template itself can be simple, the key is in the accuracy of the details you input. Double-check that your contribution limits, rollover amounts, and any distribution details match IRS guidelines to avoid errors down the line.

Here’s the corrected version:

Update your receipt templates for 2019 with the following adjustments to ensure accuracy and compliance with IRS guidelines.

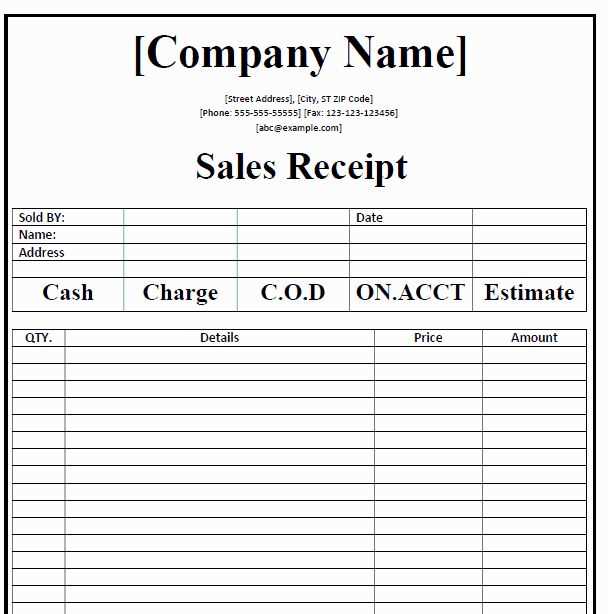

Firstly, ensure that your receipts clearly display the full name and contact information of your business. This should include the address, phone number, and email, which are mandatory for documentation purposes.

Secondly, adjust the date format to MM/DD/YYYY to match the IRS standard. If you’re working with online receipts, confirm that the timestamp is accurate and corresponds with the transaction time.

Include a breakdown of the purchased items or services, with itemized costs. This not only helps with transparency but also facilitates tax deductions when applicable.

Don’t forget to add the tax rate applied, the total tax charged, and the total amount paid. This is critical for both the taxpayer and tax authority records.

Finally, add a unique receipt number to each document. This provides a reference point for both customers and your business for future inquiries or audits.

IRA Receipt Templates 2019: A Practical Guide

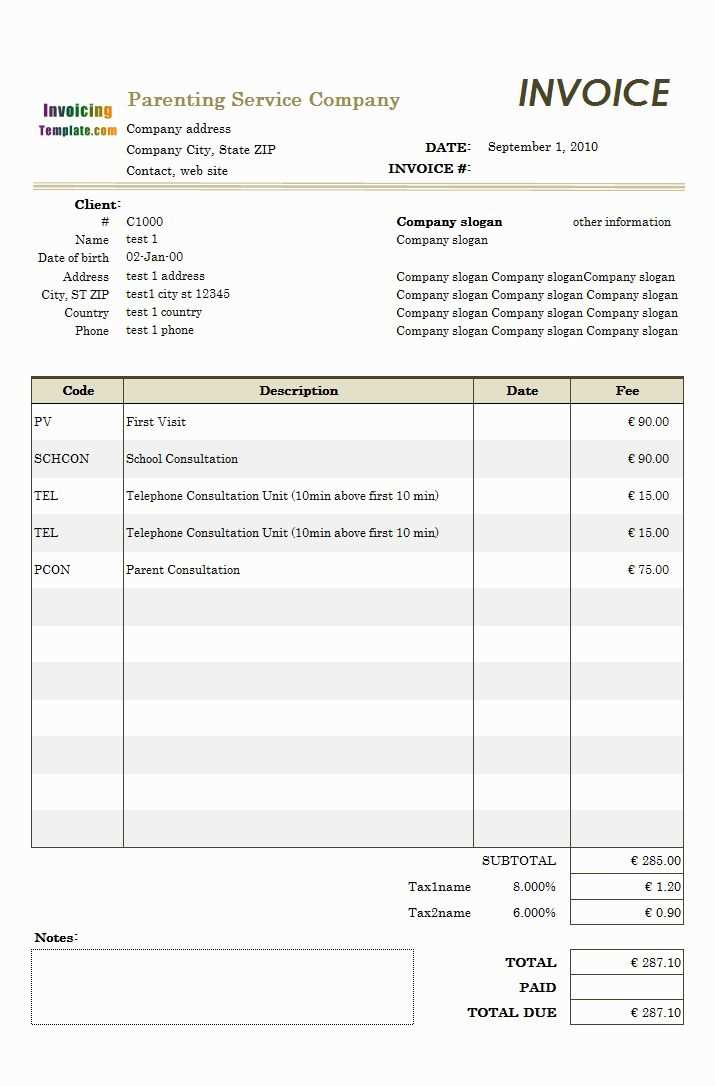

Creating an accurate IRA receipt template for 2019 tax reporting is straightforward if you focus on including the key details required by the IRS. The receipt should clearly outline the contributions made to your IRA account, whether it is traditional or Roth. Start with the basic information like the donor’s name, address, and Social Security number (or taxpayer identification number) to ensure proper identification in the tax records.

How to Create an IRA Receipt Template for 2019 Tax Reporting

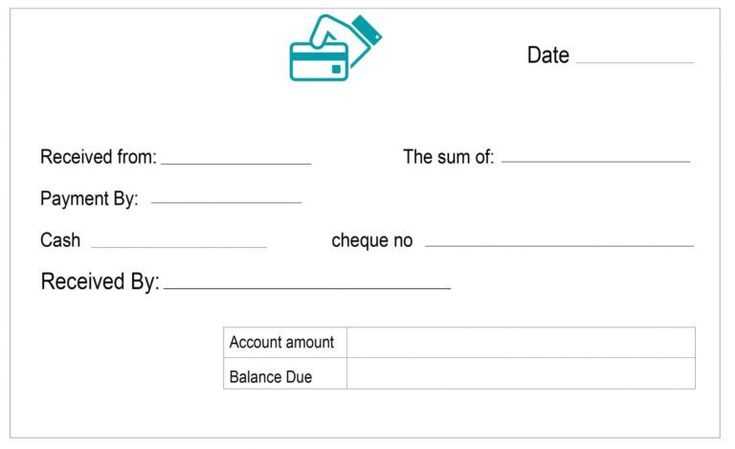

Your IRA receipt template should be designed to document each contribution clearly. Include the following elements:

- Contributor’s Information: Full name, address, and taxpayer identification number (TIN).

- IRA Account Details: Specify whether the contribution is for a Traditional or Roth IRA and include the account number if available.

- Contribution Amount: Clearly state the dollar amount of the contribution. Be specific about the tax year for which the contribution is being made (e.g., 2019).

- Contribution Date: Indicate the exact date when the contribution was made. This is crucial for determining eligibility and limits.

- Signature of Custodian: The receipt should be signed by the financial institution or IRA custodian acknowledging the deposit.

- Custodian’s Information: Include the name and contact information of the financial institution managing the IRA.

Key Information to Include in Your 2019 Receipt Template for IRA Reporting

Along with the basic data points, you must include the following additional details to comply with IRS guidelines:

- Contribution Type: Clarify whether the contribution is pre-tax (Traditional IRA) or after-tax (Roth IRA), as this impacts tax calculations.

- Annual Limits: Acknowledge the contribution limits for 2019 ($6,000 for individuals under 50 and $7,000 for those 50 or older). If the contribution exceeds the limit, it must be reported separately to avoid penalties.

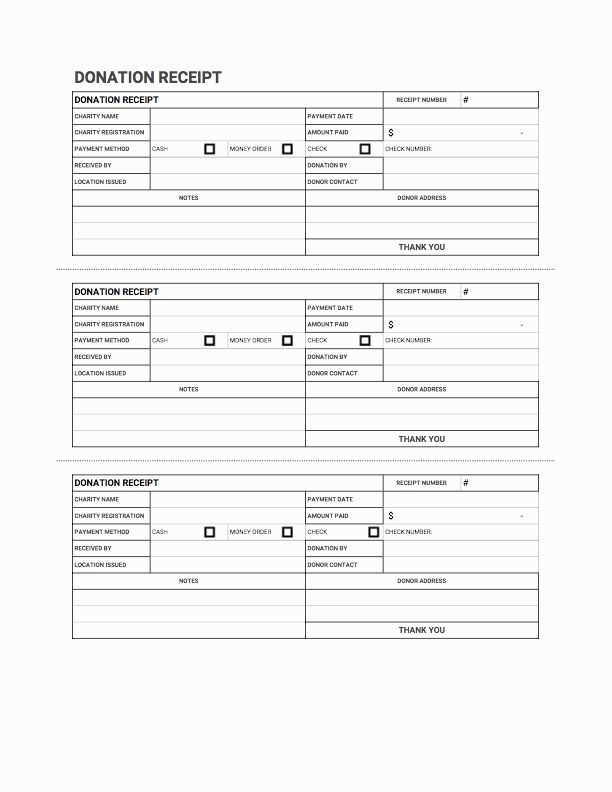

- Rollovers: If the contribution is part of a rollover from another account, make sure to indicate this and provide details of the original account.

These details will ensure that your IRA contributions are correctly documented and match the information filed with the IRS.

It is also recommended to keep a copy of the receipt for your personal records. If the IRS requests documentation for your contribution, the receipt will serve as proof of the deposit.

Common Mistakes to Avoid When Using IRA Templates in 2019

Avoid these common mistakes to ensure your IRA receipt template is valid for tax reporting:

- Incorrect Contribution Dates: Ensure the date on the receipt matches the transaction date. This can prevent any issues with reporting contributions in the wrong tax year.

- Missing Custodian Information: Always include the financial institution’s details, including contact info and signatures, to make the receipt verifiable.

- Exceeding Contribution Limits: Double-check the contribution amount to avoid exceeding the IRS limits. Contributions beyond the annual limit may incur penalties.

- Omitting the Contribution Type: Be clear about whether the contribution is pre-tax or after-tax. This distinction affects your tax filings.

By following these guidelines, your IRA receipt template will be ready for tax reporting and compliant with IRS requirements.