For individuals and businesses looking to simplify tax filing, using accurate and consistent receipt templates is a must. IRS receipt templates for 2019 are designed to help you track your expenses properly, ensuring you’re fully compliant with tax laws. These templates streamline the process of documenting your purchases, making them easier to reference during tax season.

To ensure your receipts are IRS-compliant, focus on including all necessary details: the date of purchase, vendor name, itemized list of goods or services, amounts, and payment method. Templates for 2019 specifically include sections for categorizing business-related expenses, a requirement for many types of tax deductions.

Once you’ve chosen a template, always double-check that it reflects the IRS guidelines. Many free and paid templates available online already include the proper structure, but it’s wise to confirm they align with the latest IRS forms. This can save time and reduce the chances of errors when filing taxes.

Here’s an Improved Version of the Text:

To efficiently create and manage your IRS receipt templates for 2019, it’s vital to follow a few key guidelines. Start by ensuring all necessary fields are included, such as the date of the transaction, the total amount, the payer’s details, and the purpose of the payment. These elements will make the receipt valid and useful for tax documentation.

Next, ensure the format is clean and easy to read. A well-organized table is an excellent way to display transaction details. Here’s an example of how you can structure your receipt data:

| Field | Details |

|---|---|

| Date | MM/DD/YYYY |

| Transaction Amount | $XXX.XX |

| Payer | Name or Business Name |

| Purpose | Payment for goods/services |

It’s also a good idea to include any IRS-specific identifiers such as an Employer Identification Number (EIN) or a taxpayer identification number (TIN), if applicable. These identifiers enhance the credibility and traceability of your receipts for both personal and business tax filings.

Lastly, regularly check the IRS guidelines for any changes or updates to receipt requirements, ensuring compliance for future tax periods.

Here’s a detailed plan for an article on “IRS Receipt Templates 2019” in HTML format, with each section focused on specific practical aspects:

For IRS receipt templates in 2019, ensure you have the correct structure, including all required data points. Begin by collecting information such as the date of transaction, seller’s information, amount paid, and a detailed description of the item or service. Your template should be clear and easy to read, with a consistent format that can be reused for future transactions.

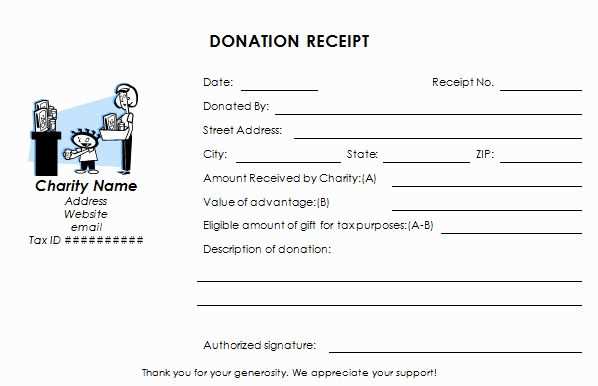

First, define the purpose of the receipt: whether it’s for charitable donations, business expenses, or personal transactions. Tailor the template to the type of transaction for maximum clarity and compliance. Each receipt should feature an itemized list of purchases or services provided, with space for the buyer and seller’s contact details, including tax identification numbers if applicable.

Next, include sections for both a signature and a date stamp. This adds validity to the document and provides a timestamp of when the transaction occurred. Double-check your template for any missing fields that could raise questions during an audit.

When designing the template layout, prioritize simplicity. A clean design with clear headings such as “Transaction Details,” “Total Amount,” and “Description” ensures no critical information is overlooked. Make sure the font is legible and the formatting allows for easy printing or digital storage.

For digital receipts, integrate fields that allow for automatic calculations of totals and taxes. If you’re creating templates for multiple types of transactions, consider creating separate versions to accommodate different fields for each scenario. For example, a business receipt might need more fields than a charitable donation receipt.

After creating your template, test it. Generate several example receipts to confirm everything is working correctly. Ensure the formatting aligns properly when printed or saved digitally. Once finalized, save the template in a file format that can be accessed and edited easily, such as Word or PDF, depending on your needs.

- How to Customize Receipt Templates for Your Business Needs

Customize your receipt templates by including your business logo, name, and contact details at the top for instant brand recognition. Adjust the layout to clearly highlight transaction details, such as the date, item description, quantity, and price. Make sure the receipt includes a section for applicable taxes and any discounts applied. Use a consistent font style that is easy to read and aligns with your brand identity.

For specific business needs, tailor the template with additional fields. For example, if you’re in the service industry, you might want to add a “service description” section. Include a unique transaction or order number for easy reference. You can also add payment methods accepted to provide clarity for your customers.

Integrate custom fields like customer notes or terms and conditions if applicable. You can also modify the footer to include thank-you messages, return policies, or a customer feedback survey link. Adjust these elements based on the nature of your transactions and what information is most valuable to your customers.

Lastly, ensure your template complies with local tax regulations by incorporating mandatory details such as tax identification numbers or business registration details. Regularly update the template to reflect any changes in business operations or tax laws.

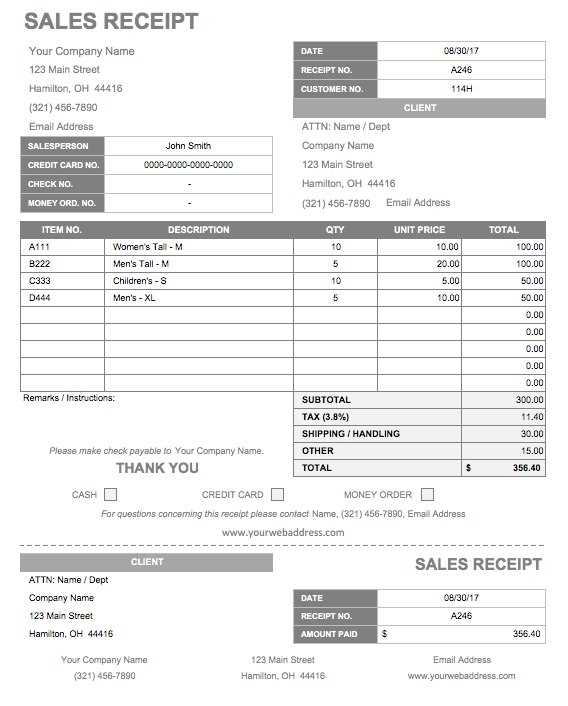

Include the following elements in your 2019 IRS receipt template for compliance and accuracy:

Transaction Information

Clearly display the transaction date, description of goods or services, quantity, unit price, and the total amount. Include sales tax, if applicable. These details ensure transparency and help the IRS verify the amounts reported.

Business Information

Provide your business name, address, and tax identification number (TIN or EIN). This makes the receipt traceable and provides the IRS with necessary details for identification.

Ensure the receipt number is unique to track individual transactions, and always provide your business contact information for any follow-up inquiries.

Accuracy in filling out receipt templates can make a big difference. Ensure all required fields are completed correctly, especially names, dates, amounts, and payment methods. Missing or incorrect information can lead to misunderstandings or delays in processing.

- Double-check for typos in names, amounts, and dates. Simple errors can cause confusion and may result in returns or disputes.

- Don’t forget to include the transaction details such as the type of service or product purchased, along with any relevant tax or discount information. Lack of detail makes the receipt less useful and harder to understand.

- Ensure the correct tax rates are applied. Use up-to-date tax rates for the specific jurisdiction of the transaction.

- Be cautious about not keeping a copy of the receipt. Retaining a duplicate ensures you can verify the transaction if needed in the future.

- Avoid leaving unnecessary blank fields. This can make the receipt appear incomplete or unprofessional.

Follow these tips to avoid mistakes that could compromise the validity or clarity of your receipt templates.

Make sure the IRS receipt template you use in 2019 includes accurate information to avoid any issues. Stick to the format approved by the IRS, which ensures your data matches their requirements.

- Header Information: Ensure the receipt includes the full name of the organization or person receiving the payment. Include their address and contact details.

- Payment Amount: Clearly state the payment amount, both numerically and in words. Include the exact date of the transaction.

- Description of Services: Provide a brief but specific description of the services or goods provided. This should align with the purpose of the payment.

- Tax Identification Number (TIN): Including the correct TIN is crucial for tax reporting purposes.

- Signature: Ensure a signature from an authorized representative of the receiving party is included, verifying the transaction.

Why Accuracy Matters

Small errors or missing details could delay processing or lead to issues when submitting the receipt for tax purposes. Double-check every section before finalizing the template.

Customizing the Template

If you’re using software or a template provider, confirm it allows for customization. You may need to add extra fields based on specific transaction types or personal preferences.