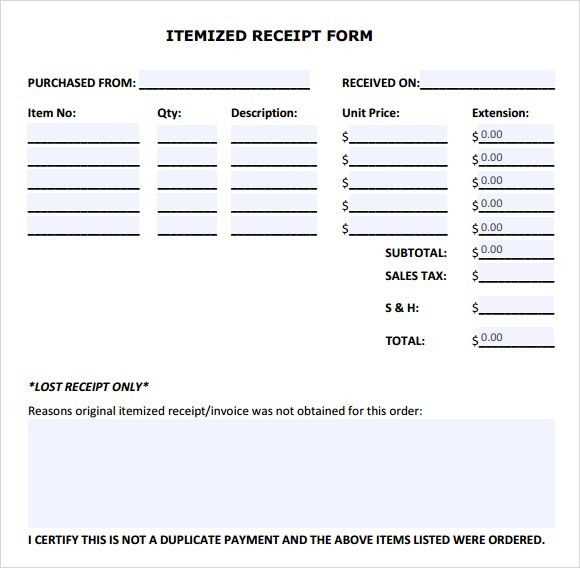

Use this template to create clear, detailed, and accurate itemised receipts for your transactions. It helps break down the cost of each item, taxes, and discounts for full transparency.

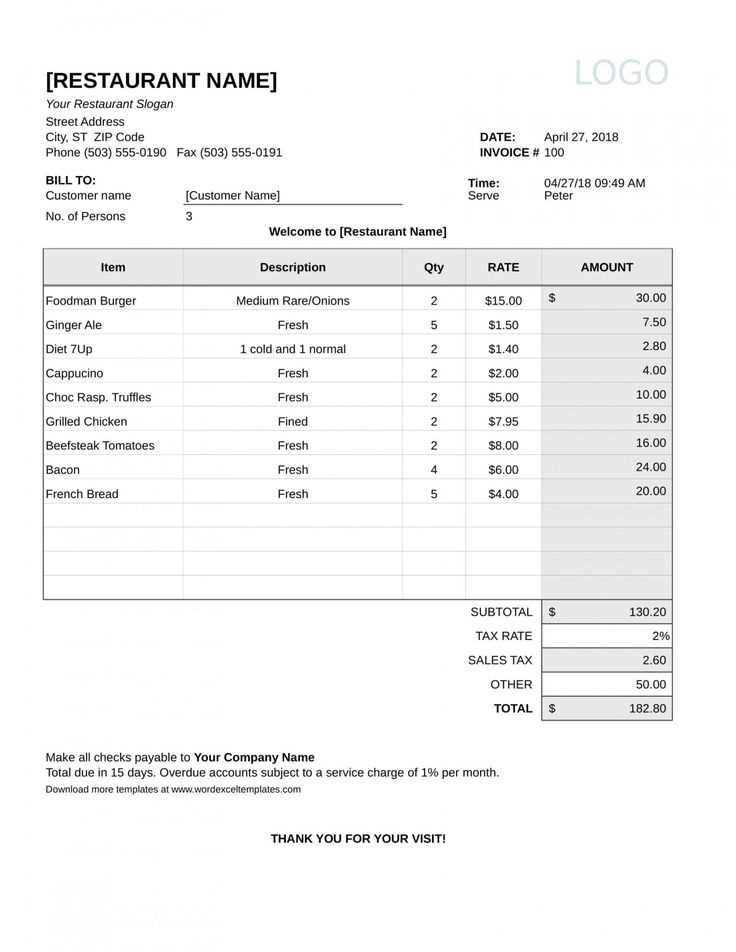

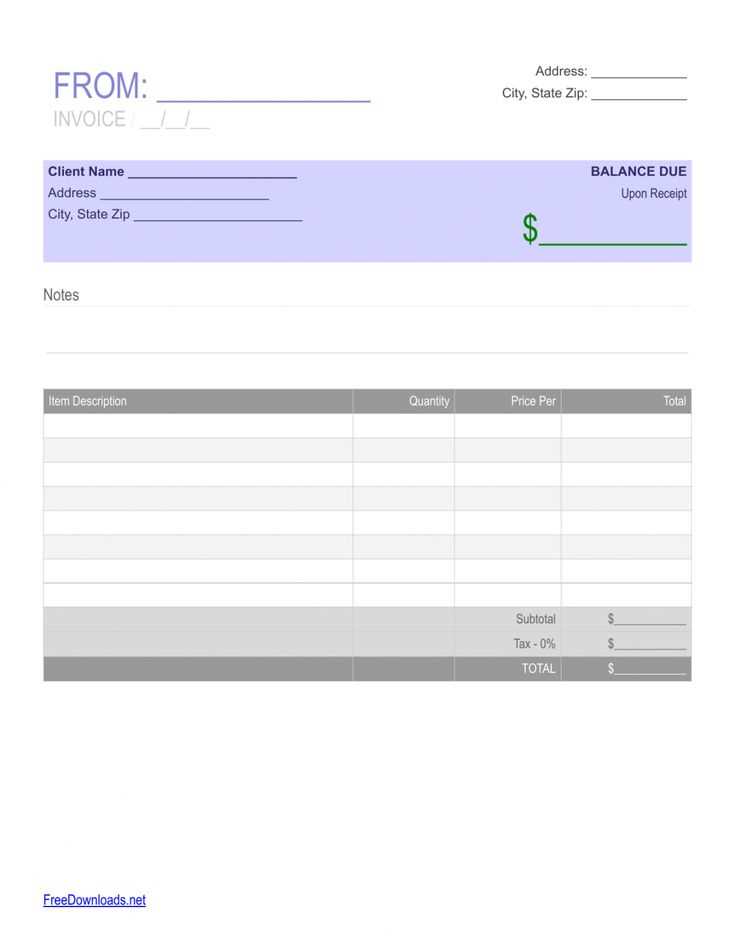

Include the transaction date, business details, and unique identifiers like receipt number. Then, list each item or service purchased along with the quantity, price per unit, and total cost. Make sure to display the subtotal, taxes, and any additional charges, followed by the final amount due.

For added clarity, consider grouping related items or services together. This format improves readability and simplifies understanding of the purchase breakdown.

Using an itemised receipt template saves time, reduces errors, and keeps records organised for both customers and businesses alike.

Itemised Receipt Template

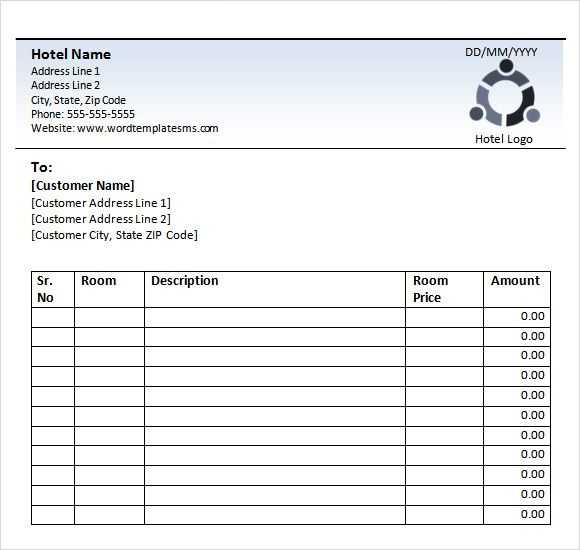

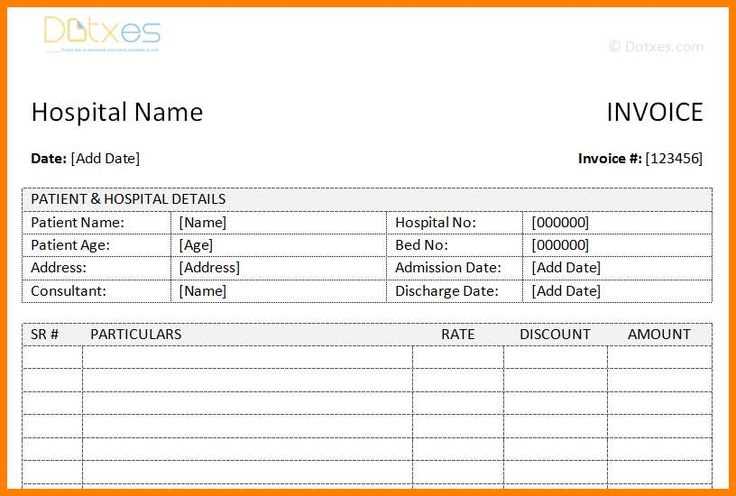

To create a detailed itemised receipt, include these key components: the business name, address, contact information, and date of the transaction. This sets the stage for clarity and transparency.

Key Elements of the Template

Begin with a clear header that includes your business name and any relevant identifiers, such as a tax number. Below, list the purchased items, ensuring each entry includes:

- Item Name: Provide a brief, clear description.

- Quantity: Specify the number of units purchased.

- Unit Price: Clearly state the price per unit.

- Total Price: The total for each item (quantity x unit price).

Finalizing the Template

After listing the items, include a summary section that adds up the subtotal, any applicable taxes, and the final total. Make sure these totals are clear and easy to read. Add payment details, like the method used, to complete the receipt.

With this structure, your itemised receipt will be precise and professional, ensuring all necessary information is conveyed in a user-friendly format.

How to Structure Key Components of an Itemised Receipt

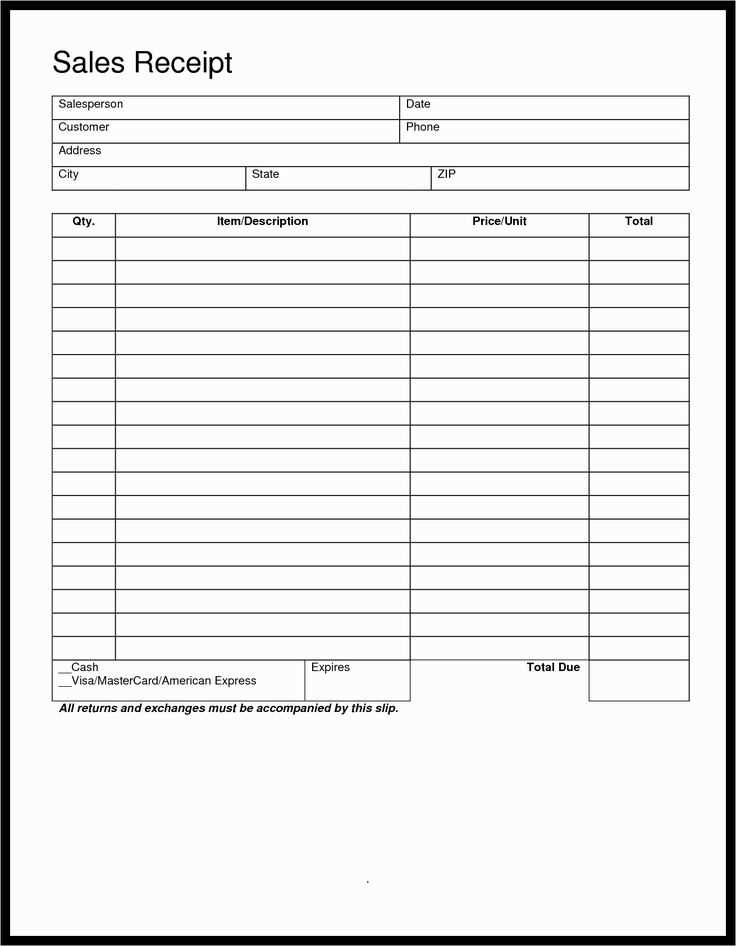

Begin by organizing the receipt into distinct sections to ensure clarity and readability. Each section should serve a specific purpose and provide relevant information in a logical order.

1. Header Information

- Store Name and Contact Details: Include the business name, address, phone number, and email for easy communication.

- Receipt Date and Time: Clearly list the date and time of the transaction.

- Transaction ID: A unique number to identify the specific purchase.

2. Item Breakdown

- Item Description: Include clear, concise names for each item or service.

- Quantity: Indicate the number of units purchased.

- Unit Price: List the cost per unit of each item.

- Total Price: Show the total cost for each item, including taxes or discounts where applicable.

3. Payment Summary

- Subtotal: The sum of all items before tax or discount.

- Tax: Clearly show the tax rate and total tax amount.

- Discount: If applicable, indicate any discounts applied to the transaction.

- Total Amount: The final amount due, after adding tax and subtracting discounts.

4. Footer Information

- Payment Method: Note the method used (cash, credit card, etc.).

- Return Policy: Provide a brief statement or link to return/exchange guidelines.

- Customer Service Information: Offer support details for post-purchase inquiries.

Formatting and Customisation Options for Clarity and Professionalism

Use clean, legible fonts such as Arial or Calibri to enhance readability. Avoid decorative fonts that might distract from the important details. Opt for a standard font size of 10-12 pt to maintain balance between clarity and space.

Organisation of Information

Structure the receipt clearly by categorising items, taxes, and totals. Group similar entries together and leave space between sections to make the receipt easy to scan. Align the text consistently to the left or right, depending on your preference, but avoid mixing both alignments within a section.

Customisation of Branding Elements

Include your company logo or name at the top to reinforce your brand. Ensure the logo is appropriately sized–not too large to dominate the page, but visible enough to create a professional appearance. Choose a colour scheme that reflects your brand’s identity, but keep it subtle to avoid overwhelming the content.

Consider offering clients a clear breakdown of taxes and fees. Label each section with simple headings like “Subtotal,” “Tax,” and “Total” to reduce confusion. Highlight the final amount with bold text or a larger font size for emphasis.

Incorporate a footer with your contact information, payment methods accepted, or return policy, but ensure it doesn’t clutter the rest of the content. Keep the footer concise and to the point.

Practical Applications of an Itemised Receipt in Business Transactions

An itemised receipt helps businesses maintain clear records and ensure accuracy in financial transactions. These receipts break down the total amount into individual line items, which aids both business owners and customers in tracking purchases. They are particularly beneficial for reconciling sales and verifying the accuracy of charges.

Improved Inventory Management

By providing detailed information on each item purchased, itemised receipts assist businesses in tracking their inventory levels. This data helps to identify sales trends, optimize stock orders, and prevent stockouts or overstocking issues. Regular analysis of receipt data ensures a smoother inventory management process.

Tax and Compliance Accuracy

Itemised receipts play a key role in maintaining compliance with tax regulations. Businesses can separate taxable items from non-taxable ones, which simplifies the tax calculation process. They also help businesses provide clear documentation in case of an audit.

Customer Transparency and Dispute Resolution

Itemised receipts provide customers with transparency regarding the cost breakdown. In case of disputes, they offer clear evidence of the transaction, which can help resolve issues related to overcharging or incorrect items. This transparency builds trust with customers and enhances the overall customer experience.

Expense Reporting

For businesses that require employees to submit expenses, itemised receipts simplify the reimbursement process. Detailed receipts make it easier for accounting departments to validate the expenses, ensuring that only authorized and necessary purchases are reimbursed.

Analysis of Pricing Strategy

Itemised receipts allow businesses to monitor individual pricing strategies. By reviewing the breakdown of costs, businesses can assess their pricing structure and adjust to market demands, ensuring they stay competitive and maximize profits.

| Item Description | Quantity | Unit Price | Total Price |

|---|---|---|---|

| Product A | 2 | $10 | $20 |

| Product B | 1 | $15 | $15 |

| Shipping | 1 | $5 | $5 |

| Total | $40 |