Use the Kindful receipt template to quickly generate clear and concise transaction receipts for donors. By incorporating all necessary fields, such as donor details, donation amount, and date, you create a professional and organized document.

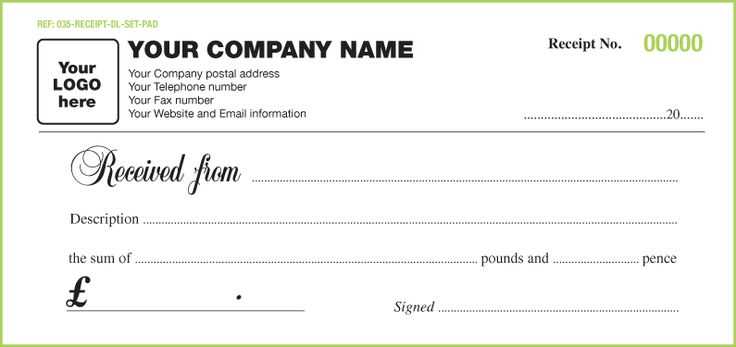

Customize the template to suit your organization’s needs, ensuring it includes your logo and any required legal disclaimers. This keeps your receipts both functional and aligned with your branding. The template is straightforward to modify, making it ideal for various donation events or campaigns.

Ensure accurate record-keeping with the ability to track all donations and generate receipts with ease. This will help in simplifying tax-related documentation for both donors and your organization.

Efficiency and accuracy are key when handling donor information. This template eliminates the guesswork and allows you to focus on your organization’s core mission while maintaining proper documentation practices.

Sure! Here’s a revised version with minimal repetition:

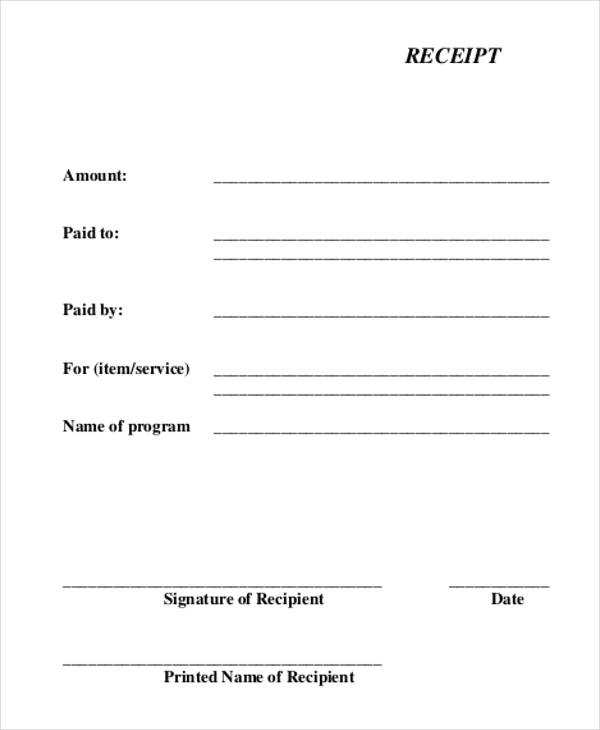

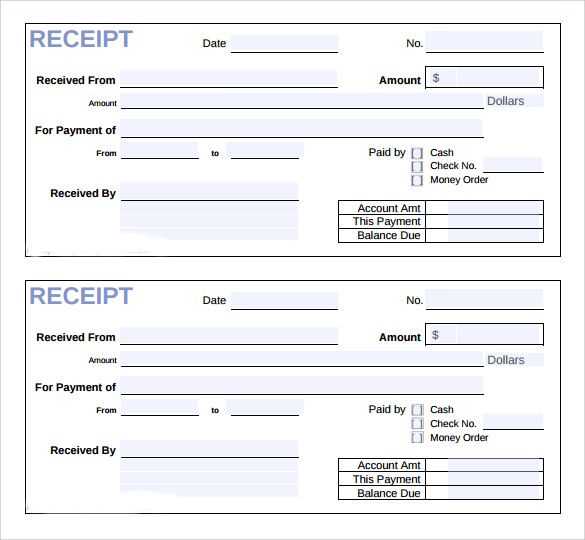

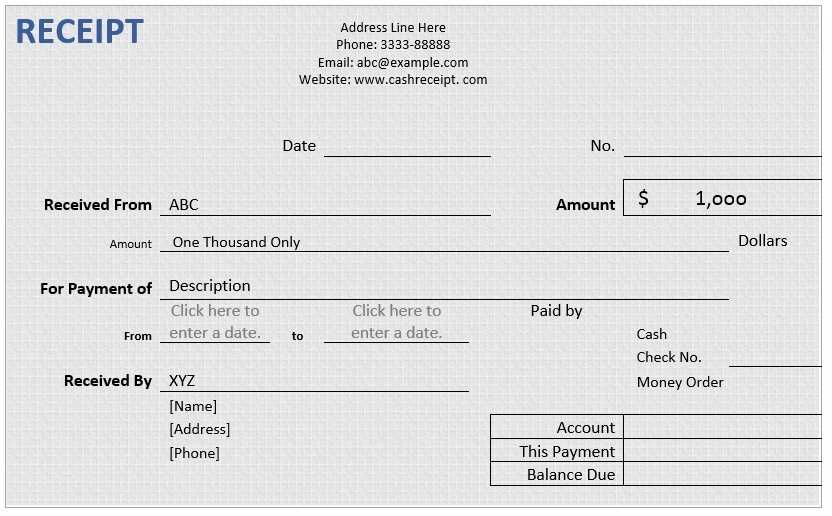

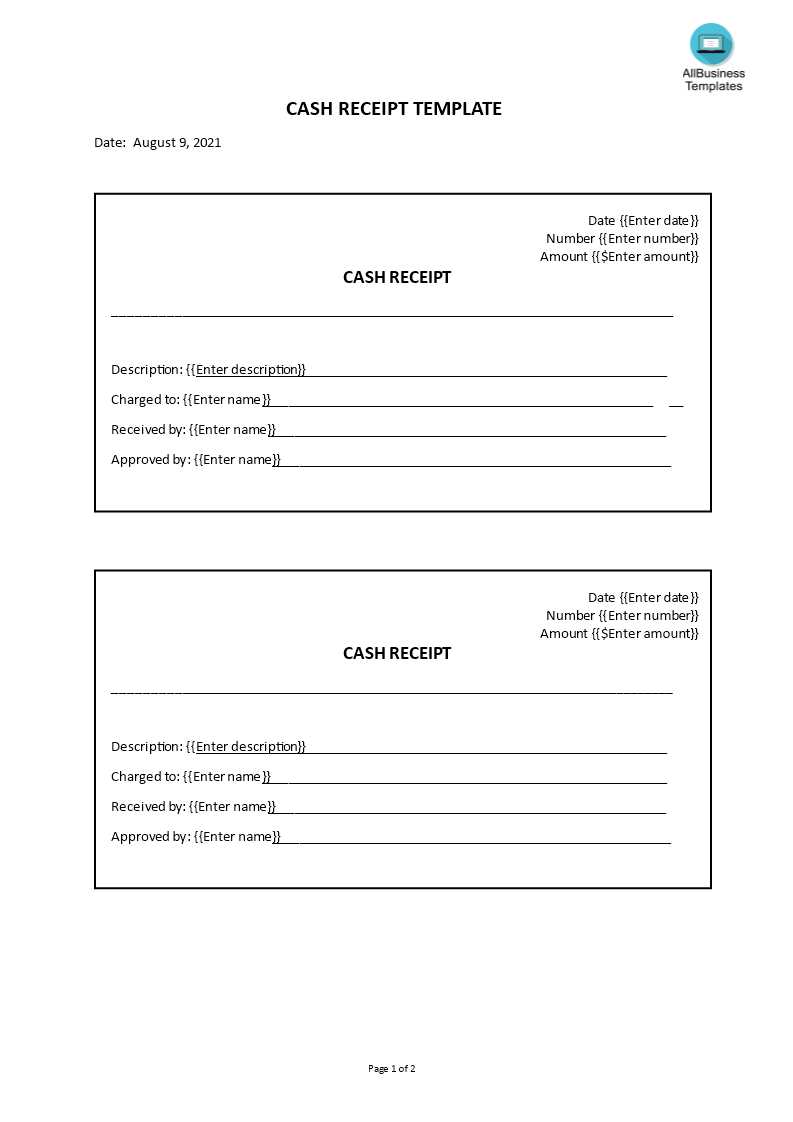

To create a clean and concise receipt, include only the necessary details. Begin by clearly stating the company name, followed by the transaction date and unique receipt number. Next, list the items purchased along with their prices, including any applicable taxes or discounts. Finally, provide the total amount due and specify payment method for transparency.

Key Details to Include

Make sure to include the business contact information, such as address and phone number. If applicable, a return policy or warranty statement can be added at the bottom of the receipt. This keeps the document professional and informative, without unnecessary fluff.

Design Tips

For readability, keep the layout simple with clear, distinguishable sections. Use bold for headings and ensure that the font size is legible. Keep the amount information prominent and easily identifiable. Avoid cluttering the receipt with excessive branding or unrelated content.

- Kindful Receipt Template Overview

The Kindful receipt template provides a structured format for generating donation receipts. It includes the donor’s name, donation amount, and any applicable tax information. This template ensures compliance with tax reporting requirements while offering a clean, professional layout.

Each receipt template can be customized to include your organization’s logo, contact information, and specific donation details, such as the campaign or fund the donation supports. This flexibility allows for a personalized touch while maintaining clarity in the presented information.

Ensure the template includes a unique receipt number for easy tracking and reference. This simple feature helps with organization and provides a way to quickly resolve any potential issues with donors or tax authorities.

For donors, the template should clearly list the donation date and specify whether the contribution was monetary or in-kind. This detail will make it easier for them to report their donations on their taxes.

Lastly, consider offering an option for donors to receive their receipt via email or print. Providing both options accommodates different preferences and ensures your organization remains accessible and responsive.

Choose a clean and simple layout. Prioritize clarity and ease of reading. Use a standard paper size like A4 or 80mm thermal for consistency. Start by organizing the most important details at the top, such as the business name, address, and contact information. This ensures that customers can quickly access essential info.

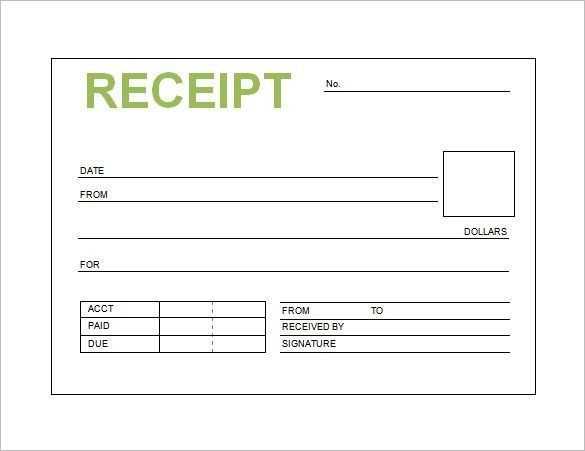

Layout Structure

Divide the receipt into clear sections: header, transaction details, and footer. The header should include the business logo, name, and contact info. In the transaction section, list items, prices, and totals in a neat table or aligned format. Keep text legible by using a readable font size like 10-12pt.

Use of Space

Balance the white space between sections. This enhances readability and prevents a cluttered appearance. Avoid overcrowding by limiting the amount of text and focusing on relevant information, such as item descriptions, quantities, prices, and discounts.

The footer can include a thank you message, return policy, or social media links. Keep it short and unobtrusive, making sure it complements the overall design without overwhelming the customer.

Consider using contrasting colors for headings and totals to make key information stand out. Keep the design minimalist; unnecessary graphics can distract from the receipt’s core purpose.

Adjust the receipt template to suit different types of donations. When tailoring for gifts like cash, tangible items, or services, ensure the layout reflects the donation type accurately.

Cash Gifts

- Include the donation amount clearly in a bold, easy-to-read font.

- For anonymity, offer a check box for “anonymous donation,” keeping it discreet but documented.

- Add a note to specify whether the donation is tax-deductible, if applicable.

Physical Gifts

- List the item description, quantity, and approximate value.

- Offer a space for the donor to include any additional messages or instructions for the gift.

Service Donations

- Specify the service provided, including the date and hours worked.

- Make sure to mention the value of the service based on the going rate in your area.

These adjustments will make the receipt more relevant and detailed, ensuring the donor receives accurate documentation of their contribution.

Ensure you clearly highlight tax-deductible elements on your receipt to make the process of claiming deductions smooth for your donors. This helps both parties avoid confusion during tax season.

Itemize Deductible Contributions

List each contribution separately, specifying the amount that is tax-deductible. If there are any non-deductible portions, make it clear to avoid any misunderstanding. For example, if a donor receives goods or services in exchange for their donation, deduct the fair market value from the total contribution and list the remaining deductible amount.

Include Official Tax Exemption Information

Provide your organization’s tax-exempt number and IRS status. This ensures that the donor understands the validity of the deduction. A brief statement like, “Our organization is a 501(c)(3) non-profit,” helps clarify the deductibility of the contribution.

By following these steps, you’ll make it easier for your donors to claim deductions while ensuring your receipts meet legal standards.

Include the donor’s full name and the specific donation amount in the receipt. This ensures accuracy and personal connection. Make sure to clearly state the date of the contribution and a brief description of the purpose or project supported by the donation.

Use a warm, appreciative tone in the message to acknowledge the donor’s contribution. A simple sentence like “Your support makes a difference in [cause]” helps reinforce the impact of their donation.

- Incorporate the donor’s preferred communication style, whether it’s formal or casual, to create a more personalized experience.

- Customize the receipt with your organization’s branding elements, such as logos or colors, to align with your identity.

- Consider adding a thank you note from key team members or the organization’s leadership, reinforcing the importance of the donor’s support.

For recurring donors, acknowledge their ongoing support by including phrases like “Thank you for being a continued supporter of [organization].” This highlights their loyalty and deepens their engagement with your cause.

Lastly, offer additional ways to stay connected. Include information on upcoming events, newsletters, or opportunities for further involvement, ensuring the donor feels valued long after the donation is made.

Ensure that your receipt is clear and easy to read in both print and digital formats by following these guidelines:

Layout and Structure

Start with a clean and consistent layout. For both versions, prioritize a hierarchical structure: begin with the merchant’s name and contact details, followed by the transaction details, and end with the payment summary. In digital versions, ensure the text scales properly for different screen sizes. For printed receipts, check that the font size is large enough for easy reading without sacrificing space.

Design Adjustments for Digital and Print

For digital receipts, use a responsive design to ensure readability on both mobile devices and desktops. Incorporate links for additional information, such as return policies or customer support, while keeping them minimal to avoid clutter. In print receipts, avoid long URLs or excessive text that may get cut off. Use a fixed-width font to guarantee proper alignment and legibility.

Make sure your digital receipt is downloadable in a format that’s easy for your customers to save, like PDF or JPEG. For printed versions, use a standard paper size and ensure the printer settings are configured to match the layout.

By following these guidelines, you can create receipts that work seamlessly across both platforms, providing customers with a positive experience whether they’re reviewing their purchase on a screen or holding a printed copy.

Integrating a donation receipt template with tracking tools simplifies data management. Use compatible platforms that can automatically sync donor information, ensuring accurate record-keeping. Platforms like Kindful, DonorPerfect, and Bloomerang support seamless integration for real-time updates.

Step-by-Step Integration

To connect the template to your chosen tracking tool, follow these steps:

- Log into your donation tracking platform.

- Navigate to the settings section and select “Integrations” or “API Settings”.

- Choose your receipt template provider from the list or manually input the template’s API key.

- Enable automatic syncing, which allows receipt data to update donor profiles instantly.

- Test the integration by completing a dummy donation, ensuring the receipt generates correctly in both the template and the tracking tool.

Key Benefits

| Benefit | Impact |

|---|---|

| Real-time Sync | Donor records are updated immediately after each donation. |

| Time-Saving | Reduces manual entry errors and eliminates double work. |

| Improved Accuracy | Automatic data matching ensures correct donation details on receipts. |

Connecting the template to tracking tools streamlines your workflow, reduces errors, and enhances the donor experience. Regularly check for updates to both systems to ensure smooth operation.

Ensure your receipt template is clear and functional. Focus on a clean layout with legible fonts and sufficient space between sections. Use distinct headings to separate payment details, such as items, amounts, and totals.

Accuracy is key. Double-check that all information aligns correctly. Include transaction dates, payment methods, and a unique receipt number. Provide clear item descriptions and quantities, with individual prices visible.

Incorporate a thank you message at the bottom to show appreciation. Keep it concise yet personal, adding a touch of warmth without overwhelming the reader.

Test your template for compatibility across different devices to ensure a seamless experience for customers accessing receipts online or through print.