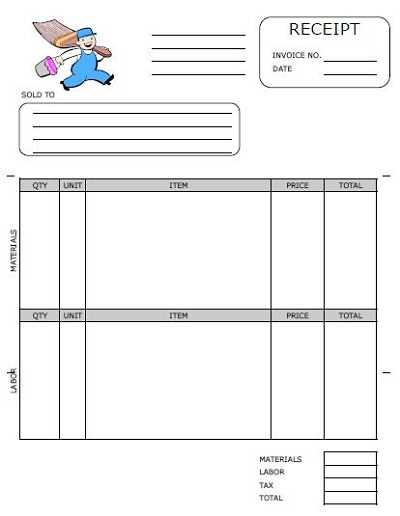

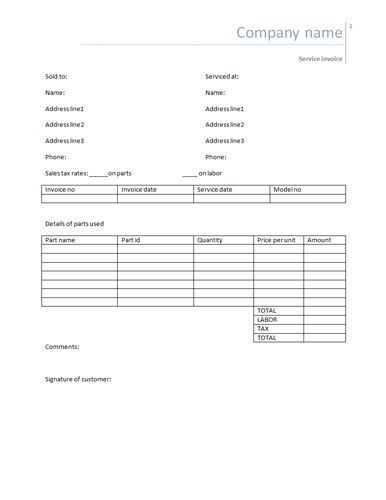

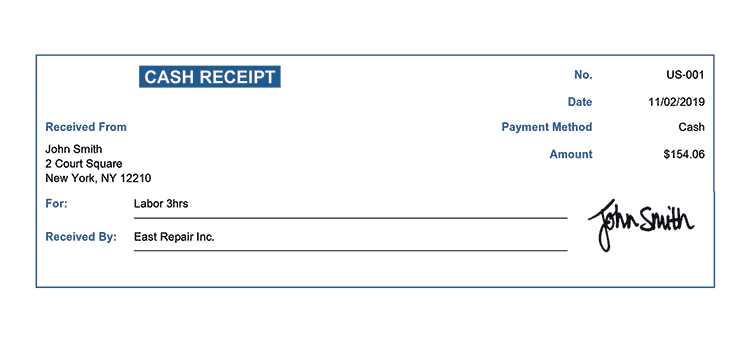

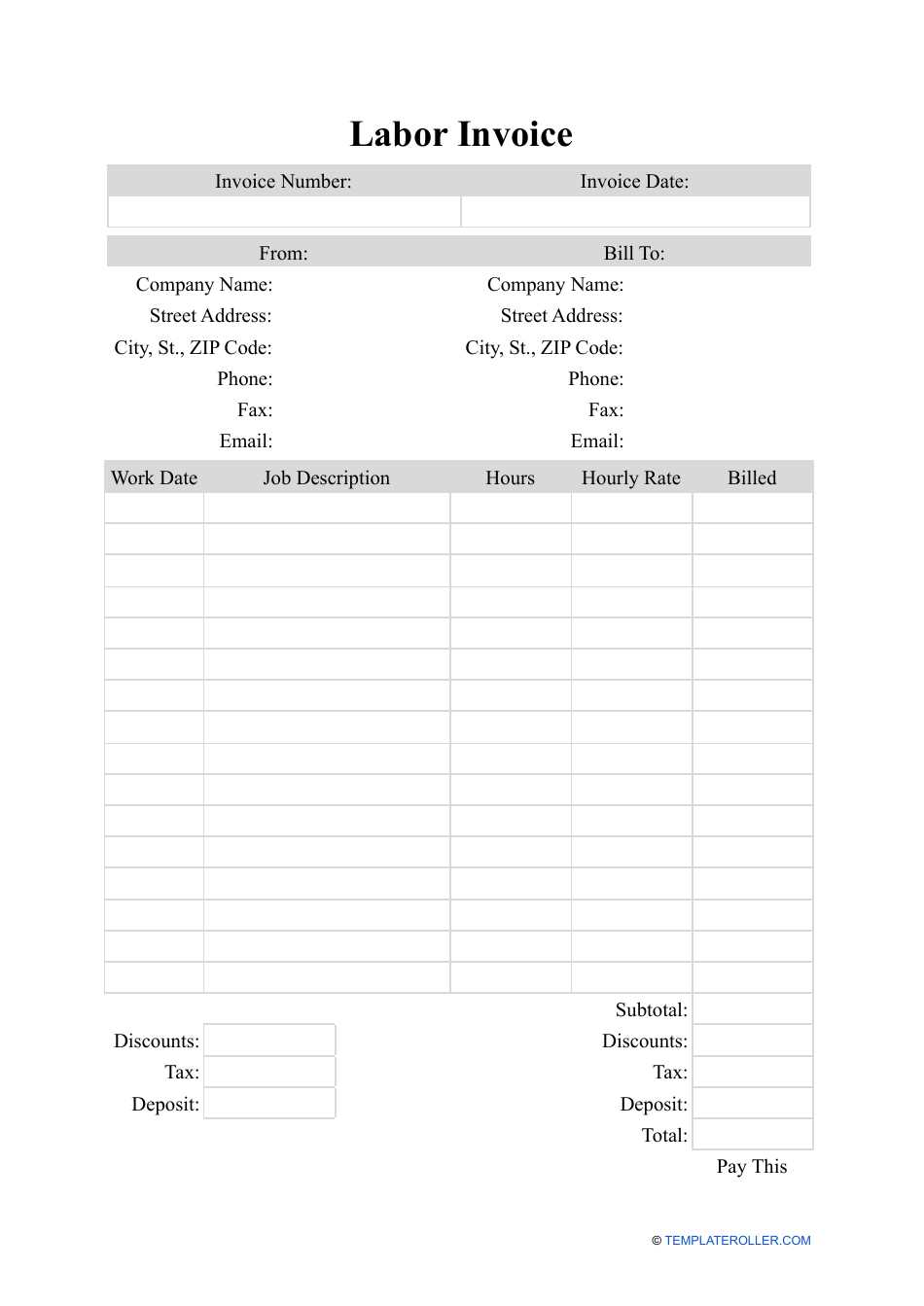

Creating a labor receipt template can simplify your administrative tasks and keep records clear. Whether you’re handling projects for clients or employees, a structured template ensures you track work accurately and professionally. A well-designed receipt includes key details like the worker’s name, work hours, rate of pay, and a breakdown of services provided.

Start by specifying the time period covered by the receipt. This could be weekly, bi-weekly, or based on specific projects. Including the worker’s name, contact information, and job title is also important for clarity. Clearly state the total number of hours worked, rate per hour, and the final payment amount. A simple breakdown of services or tasks performed will also enhance transparency and reduce confusion.

Once you have these sections covered, the next step is ensuring accuracy. Double-check the math for hourly rates and total amounts. This reduces errors and builds trust with both employees and clients. Finally, don’t forget to include spaces for signatures, either digital or handwritten, as it provides a clear agreement for both parties involved.

Here’s the corrected version:

Ensure the labor receipt includes all necessary fields for clarity and accuracy. First, specify the employee’s full name, position, and the date of service. Next, include a detailed breakdown of hours worked, including overtime or holiday rates if applicable. Be transparent with the pay rate and total compensation earned during the specified period. It’s essential to list deductions such as taxes, insurance, or retirement contributions clearly.

Formatting Tips

Use a clean layout that is easy to read. Bold headings like “Hours Worked” and “Deductions” to guide the reader through the document. Make sure the calculations are correct and double-check the figures before issuing the receipt to avoid discrepancies.

Legal Considerations

Ensure compliance with local labor laws by including any mandated benefits or bonuses. If the receipt is used for tax purposes, include relevant information such as employee tax ID or reference number. Always retain a copy of the receipt for both the employer’s and employee’s records.

Labor Receipt Template: How to Customize a Labor Receipt for Your Business

To create a tailored labor receipt for your business, focus on a clean, simple layout that highlights key information. Ensure that it includes the worker’s name, job description, hours worked, hourly rate, and total amount paid. Consider adding your company’s logo for branding purposes, as well as a unique receipt number for easy tracking. You can design your template in a word processor or a spreadsheet program, making it easy to adjust details as needed.

Key Elements to Include for Legal Compliance in a Labor Receipt

Each labor receipt must meet specific legal requirements, depending on your location. Include the worker’s full name, the dates of employment or the period worked, and a clear breakdown of the wages. List the hourly rate and the total amount earned, ensuring that any applicable taxes or deductions are also displayed. If your jurisdiction mandates it, add a statement confirming compliance with labor laws. Always verify the legal requirements based on your region to avoid fines or disputes.

Best Practices for Distributing and Storing Receipts

Distribute the labor receipt as soon as possible after the work is completed, ideally on the same day or within a week. You can provide physical copies or send them electronically, depending on your preference and the worker’s. For record-keeping, store receipts in a secure, organized system, whether in a physical file or through digital records. Make sure all receipts are backed up regularly if stored electronically to prevent data loss.