A well-structured landlord receipt template ensures clear financial records and prevents misunderstandings between property owners and tenants. Every receipt should include the payment date, received amount, rental period, payment method, and recipient details. This guarantees transparency and simplifies tax reporting.

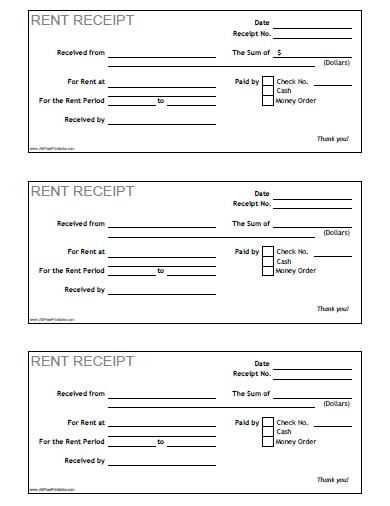

Using a structured format minimizes errors and makes it easier to track rental payments. A proper template includes essential fields such as tenant name, property address, and a unique receipt number. This helps landlords maintain organized records while providing tenants with proof of payment.

Electronic receipts offer additional convenience, allowing for easy digital storage and quick access when needed. Whether issued in paper or digital format, a receipt should always be signed or stamped to confirm authenticity.

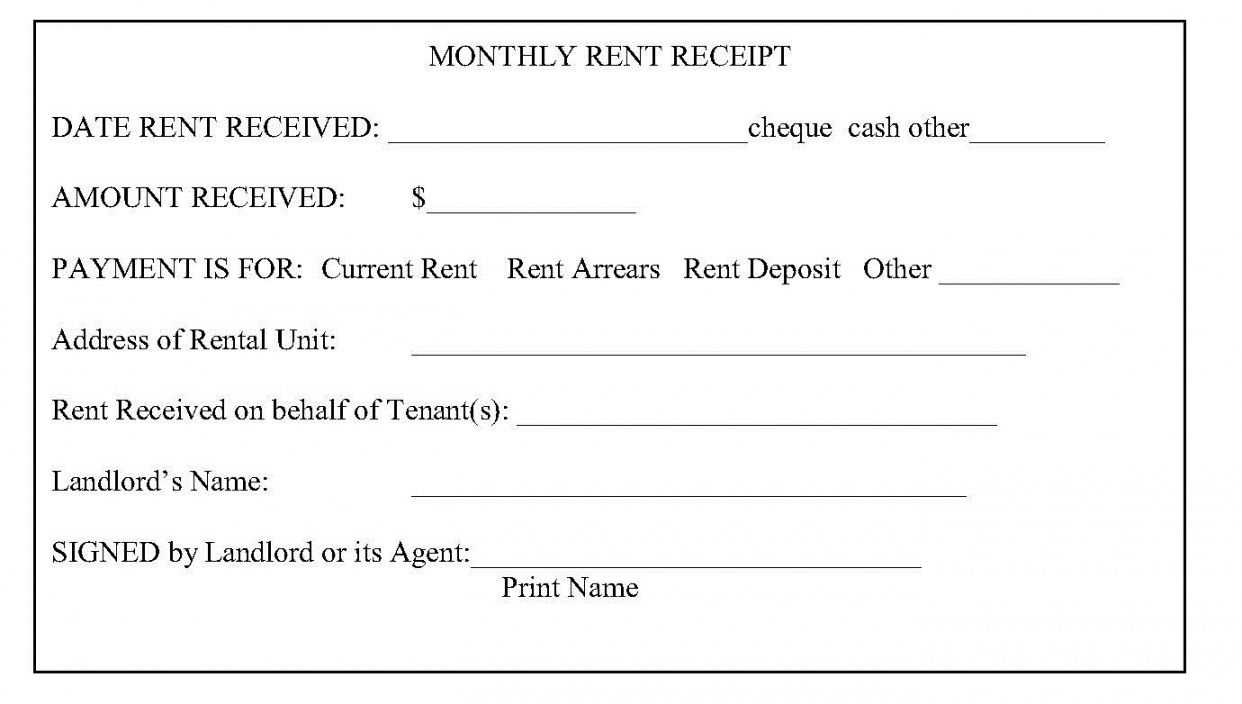

Landlord Receipt Template

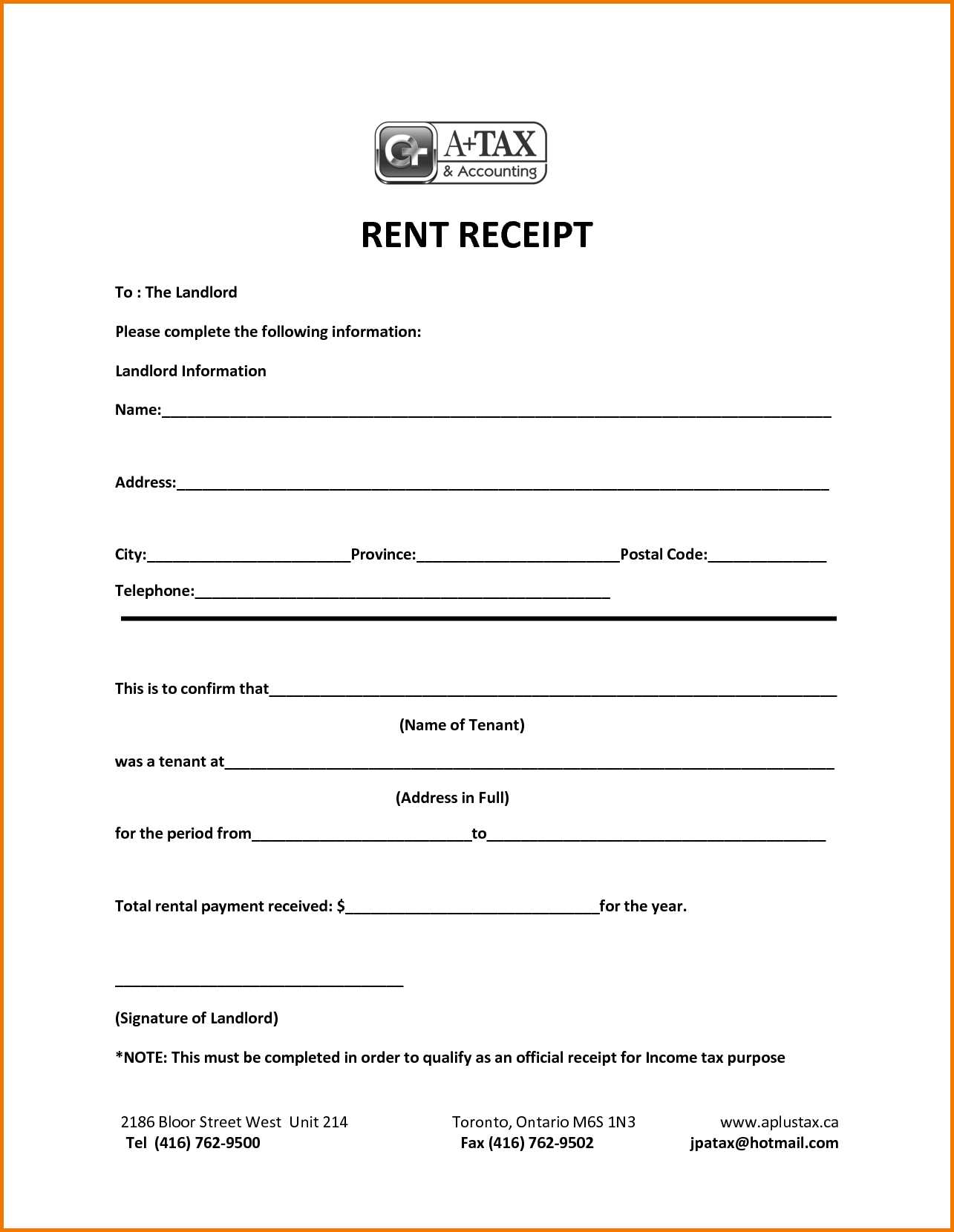

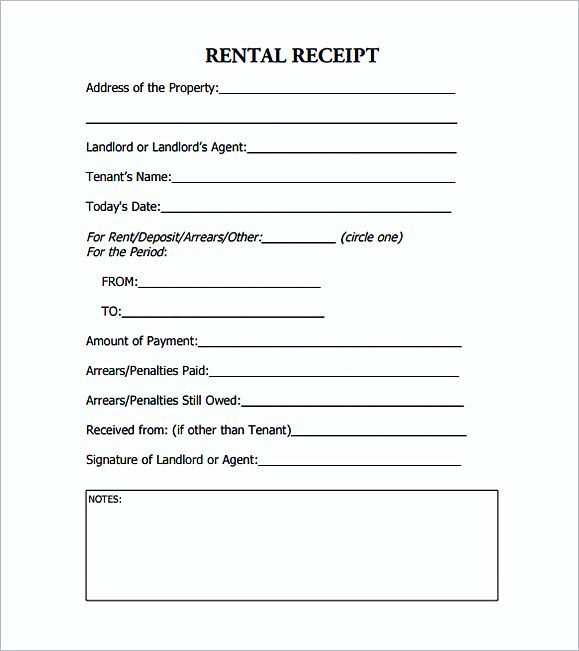

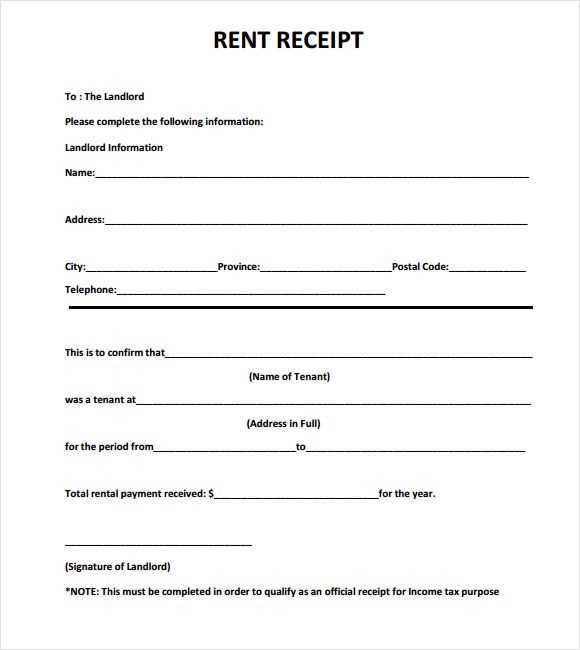

A well-structured receipt should include the tenant’s full name, rental property address, payment date, amount received, and payment method. Specify whether the payment covers rent, security deposit, or other charges.

Ensure the receipt includes the landlord’s name, contact details, and signature for authenticity. Numbering receipts sequentially helps maintain organized records.

Use clear, concise language to avoid misunderstandings. Digital templates with auto-fill features can streamline record-keeping while ensuring consistency. Keep copies for tax purposes and future reference.

Avoid handwritten receipts unless necessary. A professionally formatted document reinforces credibility and simplifies tracking for both parties.

Key Elements to Include in a Rental Receipt

Include the tenant’s full name and the rental property address to ensure clarity. This prevents disputes and provides a clear record of payment.

Payment Details

Specify the exact amount paid, the payment date, and the period the payment covers. Use a consistent format for currency and dates to avoid misunderstandings.

Payment Method and Confirmation

Indicate how the payment was made–cash, check, bank transfer, or other methods. If applicable, include a check number or transaction ID for tracking purposes.

Sign or provide the landlord’s contact details to authenticate the receipt. If issued digitally, ensure it includes a verification method, such as an electronic signature or receipt number.

Legal Considerations for Landlord Receipts

Always include the full name of the tenant and the exact rental property address. Missing or incorrect details can lead to disputes.

Specify the payment amount, method (cash, check, electronic transfer), and date received. Without this information, a receipt may not hold up in court.

State what the payment covers–rent, security deposit, or other charges. If multiple items are included, break them down with individual amounts.

Ensure compliance with local laws. Some jurisdictions require specific wording or disclosures, such as a statement confirming receipt of funds without waiving future claims.

Keep copies of all receipts for record-keeping. Digital backups help prevent loss and provide proof if needed.

Use a consistent format. Standardized receipts reduce errors and maintain clarity for both parties.

Customizing a Receipt for Different Payment Methods

Tailoring a receipt to match the payment method improves clarity and record-keeping. Each transaction type has unique details that should be reflected in the receipt format.

Cash Payments

- Include the amount received and change given.

- Add a signature line for verification.

- Specify the payment date and time.

Card Transactions

- Display the last four digits of the card number.

- Mention the authorization or transaction ID.

- Indicate whether the payment was contactless or chip-based.

For digital payments, such as bank transfers or mobile wallets, include the reference number and payment platform. If handling checks, note the check number and issuing bank. Customizing receipts this way ensures accuracy and simplifies financial tracking.

Digital vs. Paper Receipts: Pros and Cons

Choose digital receipts for secure storage, easy retrieval, and automatic expense tracking. These receipts reduce clutter and minimize the risk of loss or damage. Many landlords prefer digital records due to seamless integration with accounting software and tax reporting tools.

Advantages of Digital Receipts

| Benefit | Details |

|---|---|

| Accessibility | Instant access from any device with cloud storage. |

| Security | Encryption protects data from unauthorized access. |

| Automation | Integration with bookkeeping software reduces manual work. |

Challenges of Paper Receipts

Paper receipts degrade over time, making record-keeping difficult. They require physical storage and are prone to loss. For landlords managing multiple tenants, maintaining an organized paper trail adds unnecessary complexity.

| Drawback | Details |

|---|---|

| Durability | Ink fades, and paper can be lost or damaged. |

| Storage | Requires physical space for organization and retrieval. |

| Manual Processing | Sorting and filing take time compared to digital methods. |

For landlords handling multiple properties, a digital system offers better efficiency. However, if tenants prefer paper copies, providing both options ensures flexibility.

Common Mistakes to Avoid in Rental Receipts

Omitting Key Details

Missing critical information makes a receipt useless for record-keeping. Always include the tenant’s full name, rental property address, payment date, amount, and payment method. A generic receipt without specifics can lead to disputes and confusion.

Using Vague Descriptions

A receipt should clearly state what the payment covers. Simply writing “Rent” may not be enough if additional fees are included. Specify if the amount covers rent, late fees, utilities, or security deposits to avoid future misunderstandings.

Keep receipts structured, legible, and detailed. Digital records or copies can prevent issues in case of loss or disputes. A well-documented receipt protects both landlords and tenants.

How to Store and Organize Receipts for Future Reference

Use a dedicated folder or envelope to keep paper receipts sorted by month or category. Label each section clearly to find documents quickly when needed. If storing receipts digitally, scan them with a mobile app and save them in a structured folder system.

Choose a Reliable Digital Storage Method

Save scanned receipts in cloud storage services like Google Drive or Dropbox. Create subfolders for different expense types, such as rent, utilities, and repairs. Use consistent naming formats, including date and purpose, to simplify searches.

Set a Routine for Organization

Schedule time each week to file new receipts. Immediately sort and label them after scanning or placing them in a folder. Regularly back up digital copies to an external drive or another cloud service to prevent data loss.