A well-structured receipt template ensures transparency and professionalism in legal transactions. Every issued receipt should include key details such as the firm’s name, client information, payment date, service description, and the amount paid. Providing a clear breakdown of fees and applicable taxes eliminates confusion and builds trust with clients.

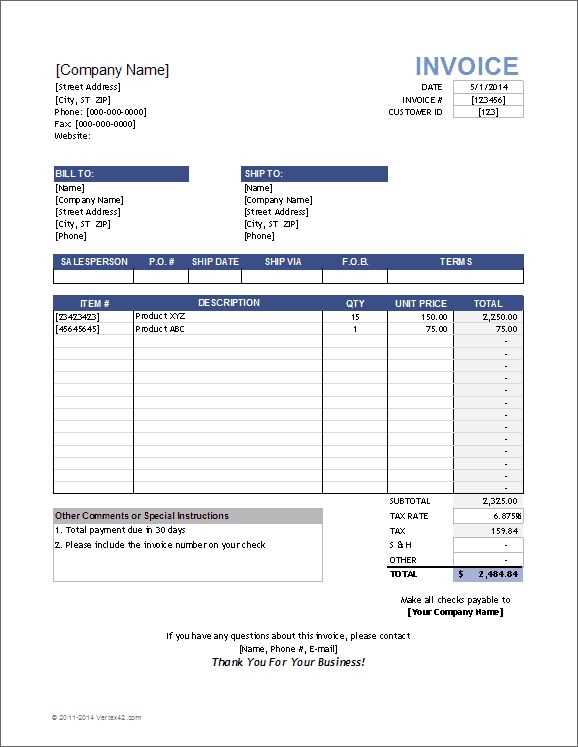

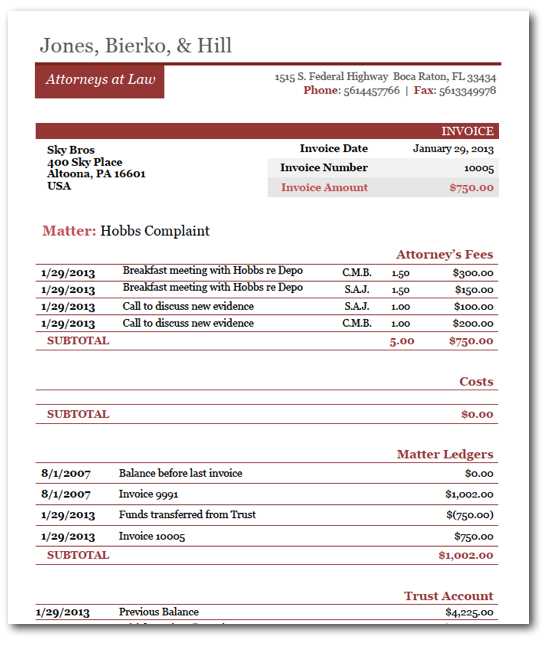

Use a consistent format that aligns with legal and accounting standards. A structured layout with distinct sections for invoice number, payment method, and attorney details simplifies record-keeping. Adding a disclaimer about non-refundable fees or retainer policies clarifies terms and prevents disputes.

Digital receipts enhance efficiency and security. Implementing electronic templates with auto-generated numbers and client details reduces manual errors. Ensure compliance with data protection laws by securing sensitive client information and using encrypted storage solutions.

Customizing templates for different case types improves accuracy. Criminal defense, family law, and corporate legal services often have distinct billing structures. Tailoring receipts to reflect specific legal services helps maintain organized financial records and simplifies tax reporting.

Law Firm Receipt Template: Key Aspects and Practical Considerations

Itemized breakdown ensures transparency. List services separately, specifying dates, descriptions, and associated costs. Clients appreciate clarity, and this minimizes disputes.

Payment details must be explicit. Indicate accepted payment methods, transaction IDs, and due dates. If applicable, note any retainer deductions or outstanding balances.

Legal disclaimers protect both parties. A brief statement clarifying that the receipt is not an invoice and does not imply ongoing representation prevents misunderstandings.

Tax and compliance requirements vary. Ensure alignment with jurisdictional tax laws, including VAT or sales tax where applicable. If exempt, state the reason.

Digital and physical formats serve different needs. A digital version allows for quick distribution and record-keeping, while a printed copy may be necessary for specific legal or client preferences.

Mandatory Elements in a Law Firm Receipt

Include these key elements to ensure clarity, accuracy, and compliance in every receipt:

- Firm Information: Display the law firm’s full name, address, phone number, and email for easy reference.

- Client Details: List the client’s full name and contact information to match records accurately.

- Receipt Number: Assign a unique identifier to track transactions and prevent duplication.

- Date of Payment: Clearly state when the payment was received for proper financial recording.

- Payment Description: Specify the legal service provided, including case details if applicable.

- Amount Paid: Break down charges, taxes, and the total amount in a straightforward format.

- Payment Method: Indicate whether the transaction was completed via cash, check, credit card, or bank transfer.

- Balance Status: Show whether the amount covers the full fee or if an outstanding balance remains.

- Authorized Signature: Provide space for a lawyer or firm representative to sign, confirming receipt of funds.

Maintaining consistency in these elements ensures that every receipt serves as a reliable financial record.

Formatting Guidelines for Clear and Professional Receipts

Use a structured layout to enhance readability. Include the law firm’s name, address, and contact details at the top. Align this information to the left or center for a polished appearance.

Key Details to Include

Ensure the receipt contains all relevant transaction details. Clearly list the date, receipt number, client’s name, and payment method. Organize the charges into an itemized table for clarity.

| Description | Hours | Rate | Total |

|---|---|---|---|

| Consultation | 2 | $200 | $400 |

| Legal Document Drafting | 3 | $250 | $750 |

| Grand Total | $1,150 | ||

Finalizing the Receipt

Summarize the total amount paid and any outstanding balance. Include a note specifying whether the payment is partial or full. Conclude with a statement confirming receipt of funds and provide a signature line if necessary.

Compliance with Tax and Legal Regulations

Ensure that every receipt issued includes the firm’s tax identification number, client details, and a breakdown of services. This helps meet reporting requirements and simplifies audits.

Standardized Formatting

Use a consistent format with clear itemization, tax rates, and total amounts. This reduces disputes and ensures smooth processing during financial reviews.

Retention and Documentation

Store copies for the required period based on jurisdictional rules. Digital records with timestamps enhance security and provide easy access during regulatory checks.

Customization Options for Different Legal Services

Tailor receipts to reflect the specifics of the legal service provided. For transactional legal work, include the case number and transaction details. For ongoing representation, list the scope of services, such as consultations or court appearances.

Adjust the billing format depending on the service type. For fixed-fee services, specify the agreed amount, while for hourly billing, break down the hours worked and the hourly rate clearly. Clients appreciate transparency, and this approach helps avoid disputes.

For contingency-based services, emphasize the percentage agreed upon and any additional costs that may apply. Clearly outline the conditions under which the payment is due to keep everything transparent.

Consider adding a section for payment instructions, including preferred methods (bank transfer, credit card, etc.), and a payment due date. Customization options can also include different tax rates based on local regulations or the type of service offered.

To enhance the client’s experience, offer options for both digital and printed receipts, including a personalized thank-you note for their business or a reminder of the next steps in the case.

Digital vs. Paper Receipts: Pros and Cons

Digital receipts offer a clear advantage in terms of storage. They take up no physical space and can be easily organized into folders on any device, making them easy to access whenever needed. Paper receipts, however, can pile up and clutter spaces, often getting lost or damaged. Digital receipts also reduce the need for physical storage solutions like filing cabinets, making them more eco-friendly. However, not all businesses support digital receipts, meaning customers still rely on paper for certain transactions.

Paper receipts are often preferred for their simplicity and familiarity. Some customers feel more secure with a physical copy, especially for returns or warranty claims, as these can be handed directly to store staff. Digital receipts, though, require an electronic device to view, and there can be issues with file formats or losing access if devices break or data is deleted. However, businesses can easily track digital receipts through integrated software systems, which saves time for both customers and companies.

Common Mistakes to Avoid When Issuing Receipts

Always ensure that all receipt details are complete and accurate. Double-check the client’s name, date, and payment amount before finalizing the document. An incomplete or incorrect receipt can cause confusion or disputes later.

1. Not Including a Unique Receipt Number

A unique receipt number makes it easy to track transactions and avoid mix-ups. Ensure each receipt has a different number, and avoid using the same number for multiple receipts, even if they belong to the same client.

2. Failing to List the Services or Goods Provided

Receipts should clearly state what was purchased or paid for. A vague description of services or goods can lead to misunderstandings. Be specific, mentioning the exact services, hours worked, or products provided.

Remember, every detail counts in avoiding issues down the line. Double-checking each part of the receipt ensures smooth record-keeping and client satisfaction.