A well-structured lawyer receipt template ensures transparency in financial transactions and simplifies record-keeping. Every legal service, from consultations to case representation, requires clear documentation of fees. A standardized receipt format helps both attorneys and clients track payments efficiently.

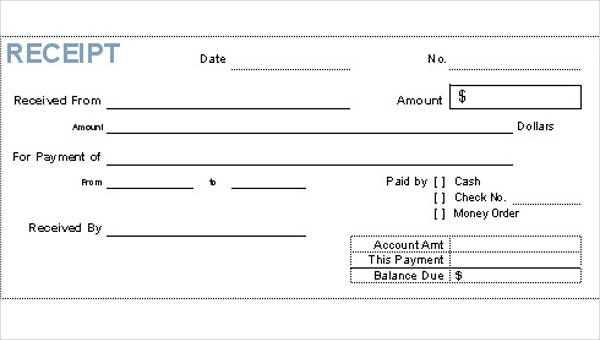

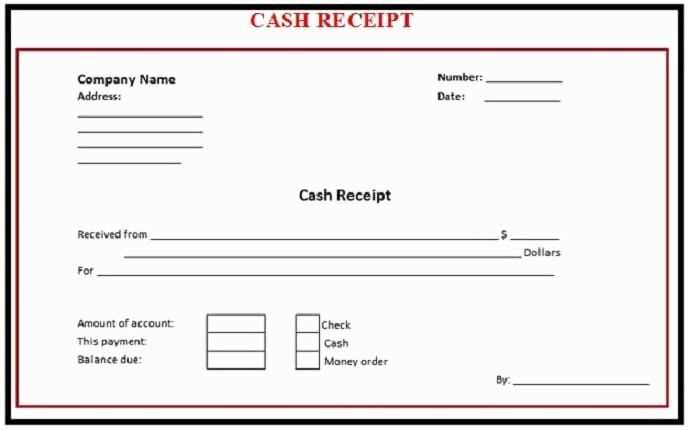

Include essential details such as the lawyer’s name, firm information, client details, payment date, and a breakdown of services rendered. A unique receipt number enhances organization, making it easier to reference past transactions. Specify the payment method–cash, check, or bank transfer–to maintain accurate financial records.

Adding a section for terms and conditions clarifies refund policies and payment obligations. Digital templates streamline the process, allowing lawyers to generate receipts quickly while maintaining a professional appearance. Whether using a pre-designed format or creating a custom template, ensure compliance with local regulations and tax requirements.

Here is the revised version with fewer repetitions of “Lawyer Receipt” while maintaining the meaning:

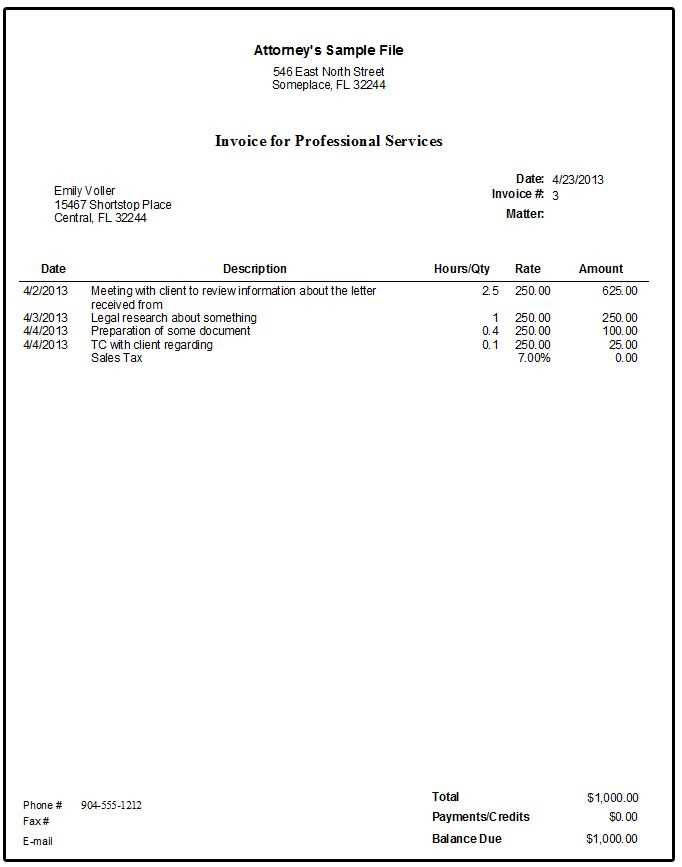

When preparing a receipt for legal services, clarity is key. Start by including the lawyer’s name, business address, and contact details. Next, specify the client’s information clearly, including their name and address. The date of the transaction should be mentioned, followed by a detailed description of the services provided, including the rate and total amount charged.

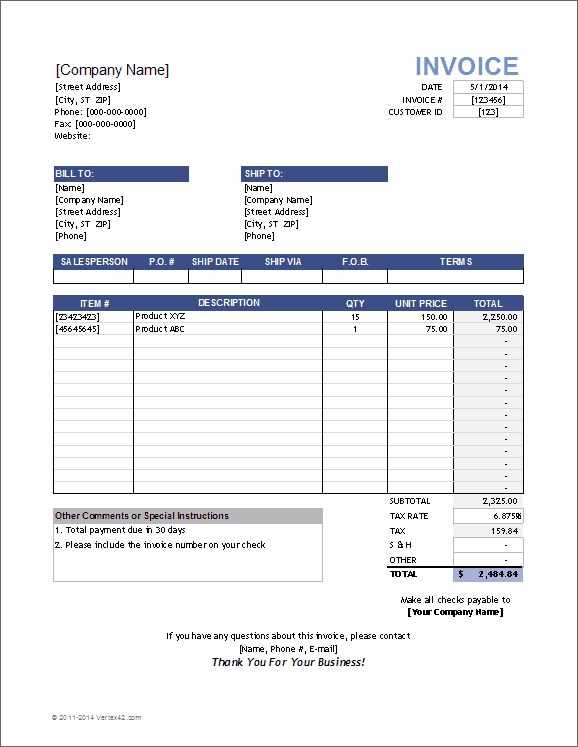

Formatting the Receipt

Ensure that the receipt layout is simple and professional. Use clear sections for each component: client details, lawyer’s details, services rendered, and total charges. If applicable, include payment method and any relevant transaction numbers. This structured approach helps in maintaining transparency and avoids ambiguity.

Additional Notes

To make the receipt more informative, include a section for any applicable taxes or additional fees. A note about payment terms can also be helpful, specifying whether the amount was paid in full or is subject to installment payments. Always provide a unique reference number for each receipt to make tracking easier in the future.

- Lawyer Receipt Template

A lawyer receipt template provides a structured format for documenting payments made for legal services. Use this template to detail the amount paid, date of payment, and the nature of the services provided. This ensures clarity and transparency between the lawyer and the client.

The template should include the following key elements:

- Client’s name and contact information – Ensure that the client’s full name, address, and other relevant details are clearly listed.

- Lawyer’s details – Include the lawyer’s name, business name (if applicable), and contact information.

- Invoice number – This helps track payments, particularly for accounting or tax purposes.

- Date of service and payment – Clearly state the date the service was rendered and the date the payment was made.

- Description of services – Be specific about the legal services provided (e.g., consultation, legal research, representation).

- Amount paid – Specify the amount paid by the client, including any applicable taxes or fees.

- Payment method – Document whether the payment was made by check, cash, credit card, or another method.

- Signature fields – Include space for both the lawyer and client to sign, confirming the payment and services provided.

This format helps avoid confusion and maintains a professional record of transactions. Always ensure the template is tailored to your specific legal practice, as different jurisdictions or types of legal work may require additional details.

A legal receipt must contain specific elements to be considered valid. These details ensure transparency and provide a clear record for both parties involved.

- Receipt Title: Clearly labeled as “Receipt” or “Invoice” to specify the nature of the document.

- Issuing Party’s Information: Include the full name, business name (if applicable), address, phone number, and email of the person or organization issuing the receipt.

- Recipient’s Information: The name and contact details of the individual or entity receiving the payment must be included.

- Date of Transaction: The exact date when the payment was received should be clearly stated.

- Description of Goods or Services: A brief yet accurate description of the products or services exchanged for the payment.

- Amount Paid: The total amount received, clearly broken down by items or services, including any applicable taxes or fees.

- Payment Method: Indicate whether the payment was made by cash, check, credit card, or other method.

- Receipt Number: Assign a unique receipt number for tracking and reference purposes.

Additional Considerations

- Signature: Some receipts may require the signature of the issuing party to authenticate the document.

- Legal Disclaimers: Depending on the jurisdiction, certain disclaimers or legal information may be required to be included.

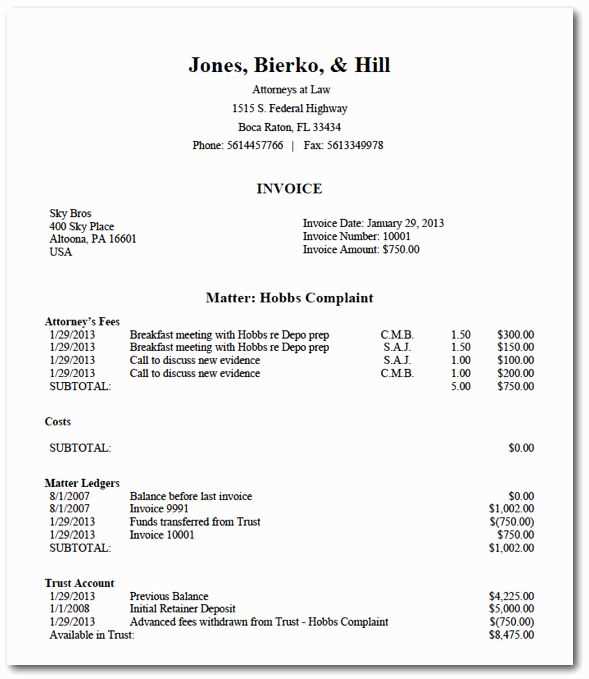

Attorney receipts must adhere to specific legal standards to ensure validity and transparency. First, they should include the full name of the attorney or law firm providing the service. This establishes the identity of the service provider and ensures accountability. The receipt must also specify the client’s name to confirm the recipient of the legal services.

Required Information on the Receipt

A clear description of the legal services rendered is necessary. This should include the type of legal services, dates of service, and the amount charged for each service or consultation. If the payment is for a retainer, the receipt should clarify how the retainer is applied and any remaining balance.

Taxation and Record-Keeping

In many jurisdictions, attorneys must issue receipts that comply with tax reporting requirements. Receipts should reflect the total amount paid and whether sales tax is applicable. This ensures that clients can accurately report payments in their tax filings. Keep copies of receipts for at least several years as part of professional record-keeping standards.

To ensure clarity and avoid confusion, format the receipt according to the payment method used. Each payment type requires specific details that confirm the transaction and provide a clear record for both the payer and the recipient.

Cash Payments

For cash transactions, note the total amount paid, the date, and the payment method clearly. Since there’s no traceable transaction record, specify that the payment was made in cash.

| Detail | Example |

|---|---|

| Amount Paid | $500 |

| Payment Method | Cash |

| Date | February 8, 2025 |

Credit and Debit Card Payments

For card payments, include the card type (e.g., Visa, MasterCard) and last four digits of the card number. Avoid full card numbers for security reasons. Also, include the payment authorization code and confirmation number when applicable.

| Detail | Example |

|---|---|

| Amount Paid | $750 |

| Payment Method | MasterCard (ending in 1234) |

| Authorization Code | ABCD1234 |

| Date | February 8, 2025 |

Cheque Payments

For cheque payments, list the cheque number, the bank’s name, and the date the cheque was issued. Make sure the amount matches the one written on the cheque.

| Detail | Example |

|---|---|

| Amount Paid | $300 |

| Payment Method | Cheque #123456 |

| Bank | ABC Bank |

| Date | February 8, 2025 |

Online Payment Methods

For payments made via platforms like PayPal or bank transfers, include the transaction ID, the payment platform used, and the payment date. Providing a reference number is crucial for tracking purposes.

| Detail | Example |

|---|---|

| Amount Paid | $1,000 |

| Payment Method | PayPal |

| Transaction ID | TXN123456789 |

| Date | February 8, 2025 |

When customizing receipts for legal services, clarity and detail are key. Tailor each receipt to reflect the specific legal work completed and the corresponding charges. This ensures clients understand exactly what they are paying for and prevents confusion.

- Service Description: Clearly outline the legal service provided, such as consultations, court appearances, or document preparation. Break down each task to avoid vague terms like “legal services” or “consulting.” Include specific hours worked or tasks completed for full transparency.

- Itemized Fees: Provide an itemized list of all charges, such as hourly rates, flat fees, or retainer charges. Include any additional costs like filing fees or expert witness expenses. This helps clients identify exactly where their money is going.

- Payment Methods: Indicate the payment methods accepted (e.g., bank transfer, credit card, check) and include any payment terms, such as deposit requirements or payment deadlines.

- Tax Information: Include any relevant tax information for the service. Some legal services may be exempt from tax, while others may require it. Make sure to list the applicable tax rate if necessary.

By customizing receipts in this way, clients have a clear record of what they’re paying for, which helps maintain trust and professionalism. This approach also ensures compliance with legal billing standards.

For law firms, deciding between digital and paper systems is a matter of efficiency, cost, and client service. Below are key points to consider:

- Digital Documents

- Storage & Accessibility: Digital records are easy to store and retrieve from any location, enabling quicker access to information.

- Space-saving: Reduces physical storage needs, freeing up office space and lowering costs associated with filing cabinets and storage units.

- Security: Digital files can be encrypted, offering higher levels of security. Cloud storage services offer automatic backups, reducing risks of data loss.

- Environmentally Friendly: Going digital minimizes paper waste, contributing to a greener operation.

- Paper Documents

- Tactile Nature: Some clients or lawyers prefer physical copies for reviewing documents, finding it easier to annotate or highlight.

- Minimal Tech Dependency: Paper records do not require reliance on technology or the internet, ensuring access even during technical failures.

- Legal Acceptance: Paper documents are often seen as more traditional and might be preferred for certain legal processes, especially in jurisdictions that have not fully embraced digital filing.

For many firms, a hybrid approach–maintaining both paper and digital records–provides the best balance between flexibility and reliability. However, law firms should consider transitioning to digital as the long-term benefits of accessibility, security, and space savings continue to grow in importance.

One common mistake in legal receipts is failing to include complete details of the service provided. Always specify the type of legal service, whether it’s consultation, representation, or another service. This avoids confusion for both parties and ensures accurate records for future reference.

Missing Client Information

Omitting the client’s full name and contact details can create issues later. Ensure all the client’s details, such as their full name, address, and contact information, are correctly listed on the receipt. This helps in identifying the client and prevents misunderstandings.

Incorrect or Missing Dates

Dates are critical in legal transactions. Always include the date of the service, the payment date, and any relevant deadlines for payment. Incomplete or incorrect dates can lead to disputes regarding the timeline of services rendered and payments made.

| Key Elements of a Legal Receipt | Potential Mistakes | How to Avoid |

|---|---|---|

| Client Information | Missing or incomplete contact details | Double-check client name, address, and contact info |

| Service Description | Ambiguous or missing description of services | Clearly describe the legal service provided |

| Payment Details | Unclear or incorrect payment amount | Specify total amount paid, payment method, and any taxes |

Lastly, always confirm the payment method. Whether it’s a bank transfer, cash, or check, document this information on the receipt. Failure to do so may complicate any future inquiries or disputes over payment.

Lawyer Receipt Template

To create a professional lawyer receipt template, make sure to include these key elements:

Basic Information

Start with the lawyer’s name, contact details, and license number. Clearly mention the recipient’s name as well. This ensures both parties are easily identifiable.

Service Details

List the services provided along with a brief description of each. This could include consultations, document preparation, or court representation. Include hourly rates or flat fees as applicable.

Ensure to provide the date of the service and the total amount paid. It’s also helpful to include a unique reference number for future tracking.

Finish with the lawyer’s signature or a digital equivalent to confirm the transaction’s authenticity.