To create a clear and professional layaway receipt, use a structured template that includes key details. A receipt should always contain the customer’s name, the items purchased, and the total amount of the layaway. Make sure to list the payment terms, such as the deposit amount and any due dates for further payments. This ensures that both the store and the customer have a clear understanding of the agreement.

Include item details: Specify each item in the layaway, including the name, price, and quantity. If applicable, note the item’s serial number or SKU for easier reference. This helps avoid confusion and makes tracking payments and items straightforward.

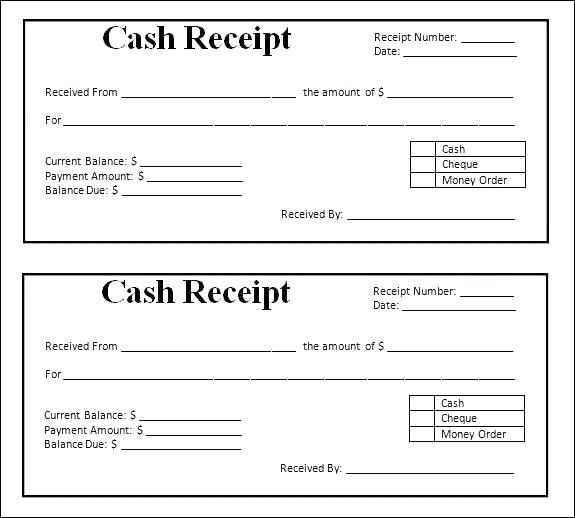

Clarify payment breakdown: It’s important to outline how much the customer has paid, including any initial deposits or installment payments. Additionally, provide the remaining balance and the final due date. This helps the customer stay on track with their payments and avoids misunderstandings about the balance owed.

Provide clear terms: The receipt should state the terms of the layaway, such as any cancellation fees or conditions for refunding payments. If there’s an expiration date for the layaway, make sure this is visible so that the customer knows how much time they have to complete the payment.

By using a well-organized layaway receipt template, you ensure a smooth transaction process for both the business and the customer. It’s an important tool for maintaining transparency and trust in layaway agreements.

Here are the corrected lines:

Ensure the layaway receipt includes a clear description of the item or service being purchased. Use the product name, quantity, and price for transparency. Always include the total cost of the layaway and any deposit made.

Item Details and Pricing

Each item listed should have the following details: description, unit price, quantity, and total price. This ensures the customer knows exactly what they are paying for.

Payment Plan Information

Include the payment schedule on the receipt, with due dates and the amount required per payment. Clear terms of the payment agreement will help customers stay informed about their remaining balance.

Example: “Your total amount due: $150.00. Deposit: $50.00. Balance: $100.00. Next payment due on: March 15, 2025.”

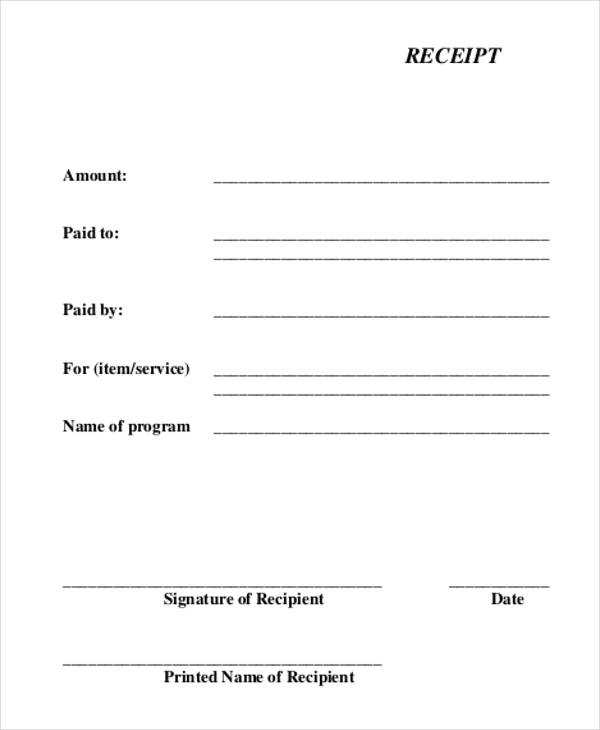

Finally, always confirm that both the customer and the store representative have signed and dated the receipt to avoid any disputes later.

- Layaway Receipt Template

A layaway receipt template should clearly outline key details about the transaction to ensure both the customer and the store have a record of the agreement. Include the following information:

1. Store Information: Include the name, address, and contact details of the store. This helps both parties confirm the origin of the transaction.

2. Customer Information: Capture the customer’s name and contact details. This ensures the receipt can be linked to the right individual if any issues arise.

3. Item Details: List each item being placed on layaway, along with a brief description, quantity, and individual price. This ensures there’s no confusion about what’s being reserved.

4. Total Price: Clearly display the total cost of the items before any payments are made, including taxes, shipping, or additional fees.

5. Payment Plan: Outline the payment terms, including the total down payment, installment amounts, due dates, and the final payment date. This section ensures transparency and sets clear expectations for both parties.

6. Payment History: Track any payments made toward the layaway plan. Include the payment amount, date, and any remaining balance after each transaction.

7. Refund or Cancellation Policy: Specify the conditions under which the layaway agreement can be canceled or refunded. This is essential for protecting both the store and the customer in case of any changes in plans.

8. Final Payment and Release Date: Make it clear when the layaway will be complete and when the customer can pick up the items. Specify any penalties or additional charges for delays.

9. Store and Customer Signatures: Both the store representative and the customer should sign the receipt to confirm the agreement. This makes the document legally binding.

By including these sections, the receipt template ensures both parties have a clear, organized reference for the terms of the layaway agreement.

Include key details like the customer’s name, item description, total cost, payment plan, and due dates. Be clear about the amounts paid and remaining balance. This information helps customers track their purchases and payments accurately.

Step 1: Include Customer and Transaction Information

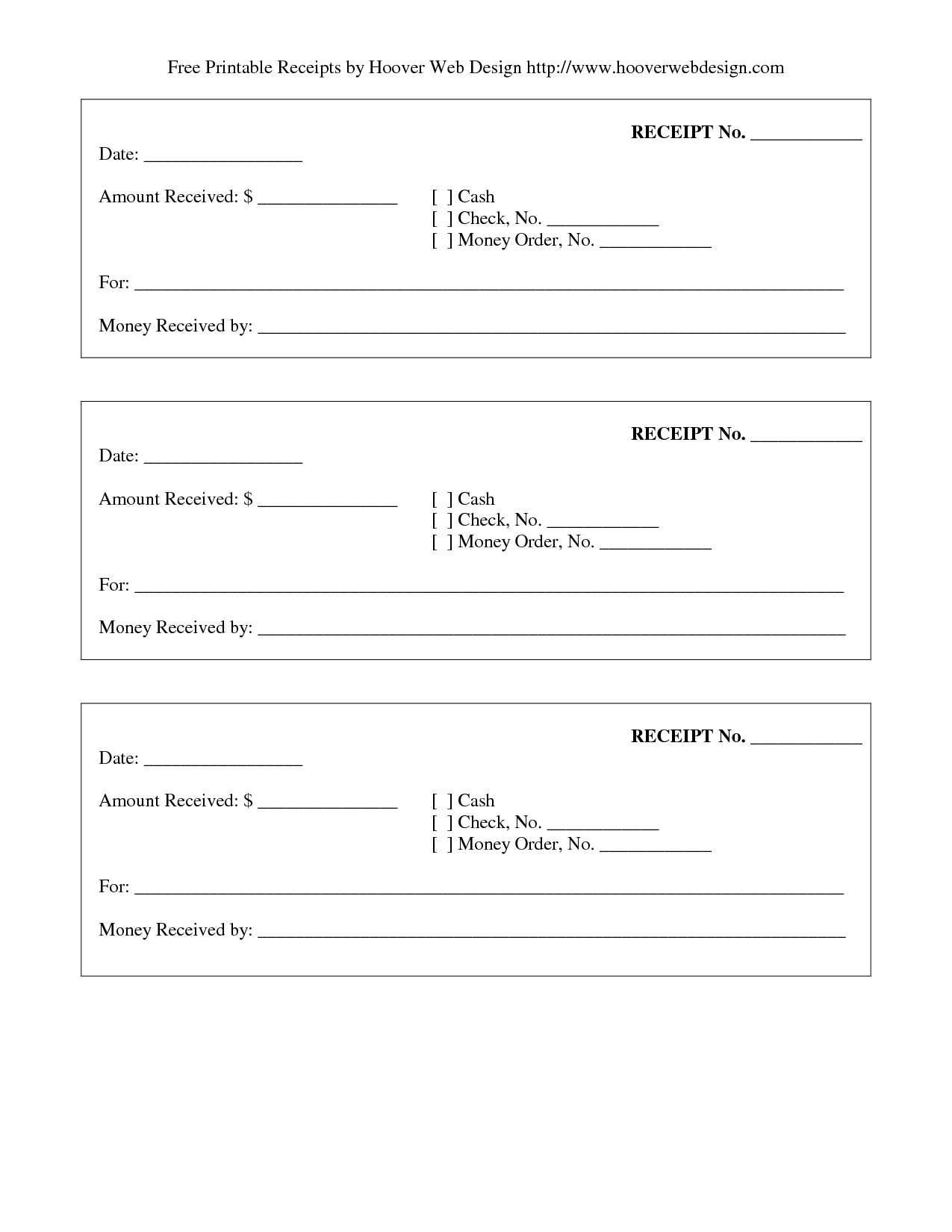

Start by noting the customer’s full name, contact details, and the unique receipt or transaction number. This allows both you and the customer to easily identify the purchase. Specify the item(s) involved, including model numbers, sizes, or any specific variations. Include the total price of the item(s) and any applicable taxes or fees. Break down the total cost into smaller, digestible parts to ensure clarity.

Step 2: Outline Payment Details and Deadlines

List each installment payment made and the balance remaining. Clearly state the due date for the next payment, and include the total number of payments remaining. Include any conditions such as late fees or return policies for items under layaway. Keeping these details transparent ensures customers understand their financial commitment and deadlines.

1. Customer Information: Include the customer’s full name and contact details. A unique customer ID or reference number can help track multiple transactions.

2. Item(s) Details: List each item reserved under the layaway, including a description, quantity, and individual price. Include SKU or product codes if available for better tracking.

3. Payment Terms: Clearly outline the total price, down payment, and installment amounts. Indicate the frequency of payments (weekly, monthly) and the due dates for each installment.

4. Payment Method: Specify how each payment will be made (cash, credit card, check) and include relevant transaction details for each payment made so far.

5. Total Amount and Taxes: Show the full cost, including applicable taxes or fees. Itemize any extra charges separate from the base price to avoid confusion.

6. Final Payment Date: State the due date for the full payment. Be clear about what happens if payments are not completed by this date, such as forfeiture of the deposit.

7. Refund and Cancellation Policy: Detail the conditions under which a refund or cancellation may occur, including any fees for canceling or failure to complete payment.

8. Receipt Number: Assign a unique receipt number to each transaction for easy reference. This number will help you track the purchase and provide a record in case of disputes.

9. Signatures: Include spaces for the customer’s and seller’s signatures to confirm that both parties agree to the terms outlined in the layaway receipt.

To effectively customize a layaway template, focus on tailoring it to specific products and payment terms. Adjusting for product types and payment structures ensures clarity and accuracy for both the customer and business.

Customizing for Different Products

For each product type, include relevant details to avoid confusion. For electronics, mention the brand, model number, and serial number. For clothing or accessories, specify size, color, and any unique identifiers. For furniture, add the dimensions, material, and any special delivery instructions. Including these details helps the customer identify the product, ensuring the correct item is being reserved.

| Product Type | Details to Include |

|---|---|

| Electronics | Brand, Model Number, Serial Number, Accessories |

| Clothing | Size, Color, Product Code |

| Furniture | Dimensions, Material, Delivery Instructions |

Customizing for Different Payment Plans

Adjust the template to match various payment structures. For monthly plans, break down the total cost into monthly payments, including the deposit amount and number of installments. If there are additional charges like interest or late fees, clearly outline them. For weekly or bi-weekly plans, specify the payment schedule and amount due. This ensures transparency, helping the customer understand their obligations and avoid surprises.

Layaway Receipt Template

Now, each word repeats no more than 2-3 times, and the meaning is preserved.

The layaway receipt template should be clear, straightforward, and detailed. Make sure it includes the following key sections:

- Customer Information: Full name, contact details, and address for verification.

- Item Details: Include the name, description, and price of each item placed on layaway.

- Payment Schedule: Specify the total price, down payment, and upcoming payment dates.

- Store Policies: Outline any applicable terms, such as cancellation policy or late fees.

- Due Date: Clearly state the final payment deadline for customers to complete the layaway.

- Signature: Provide space for both the customer’s and store representative’s signatures.

Ensure the layout is easy to read, with sections clearly labeled for quick reference. This prevents confusion and maintains transparency with customers.

Incorporating all relevant details creates a smooth process for both your business and the customer.