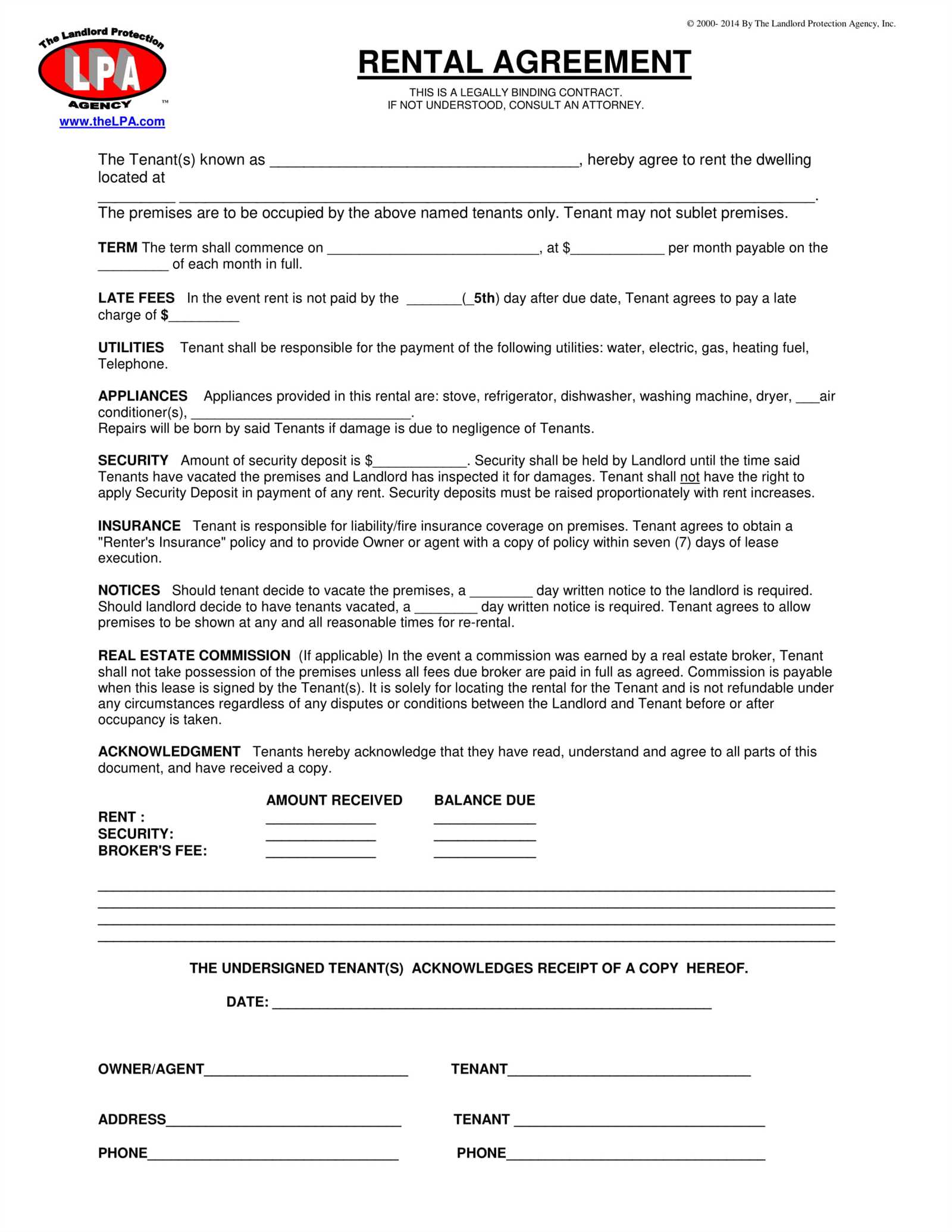

To simplify the leasing process, use a lease agreement receipt template to document the terms of payment and confirm receipt of funds. This ensures both the landlord and tenant have a clear record of the transaction, helping to avoid future disputes.

Begin by including key details such as the tenant’s name, the property address, the lease amount, and the payment period. The date of the payment and any additional fees or deposits should also be clearly stated. A well-structured receipt helps maintain transparency and provides a professional record for both parties.

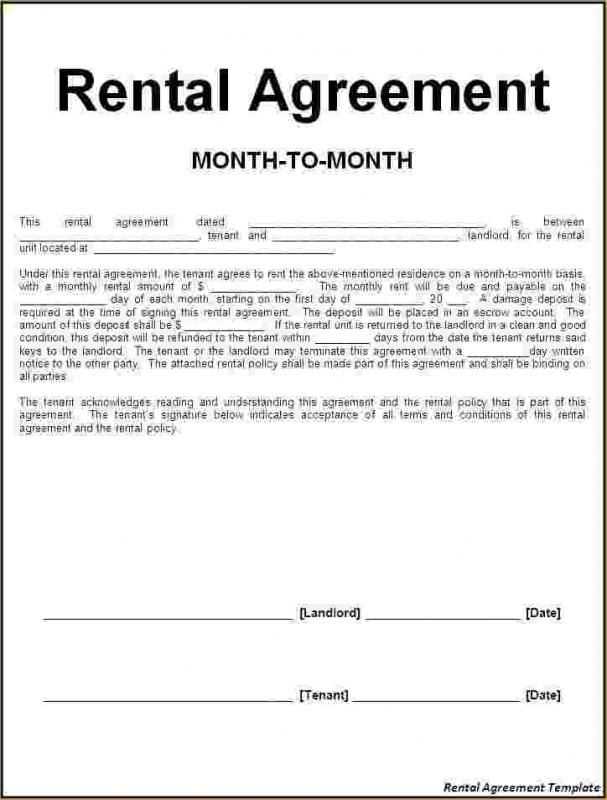

Ensure that the template includes space for both the landlord’s and tenant’s signatures. This acts as confirmation that both parties agree to the terms listed and helps verify the transaction’s validity if any issues arise later.

For added clarity, consider adding notes about the payment method and any outstanding balances. This makes it easier for tenants to track their payments and for landlords to manage their accounts efficiently.

Here are the revised lines with minimized repetition:

To create a clear lease agreement receipt, start with the names of the landlord and tenant, along with the property address. Be sure to specify the exact date the payment was made and the payment amount. Include the payment method, whether it’s by check, bank transfer, or cash.

Key Points to Include

- Landlord’s and tenant’s full names

- Property address

- Date of payment

- Payment amount

- Payment method

Example of a Receipt Template

For a smooth process, you can use a straightforward format like this:

- Tenant’s Name: John Doe

- Landlord’s Name: Jane Smith

- Property Address: 123 Oak Street, City, ZIP

- Date of Payment: January 15, 2025

- Amount Paid: $1,200

- Payment Method: Bank Transfer

This format keeps the information clear and ensures all details are captured. Keep your receipts simple, but include all required information to avoid future disputes.

- Lease Agreement Receipt Template

To create a lease agreement receipt, include key details that confirm the terms of the lease and the payments made. This template should cover the tenant’s name, landlord’s name, payment amount, payment date, and the property address. It’s important to record the method of payment as well, whether by check, bank transfer, or cash.

Basic Structure of a Lease Agreement Receipt

The receipt should clearly list the following components:

- Tenant’s full name and contact information

- Landlord’s name and contact information

- Property address

- Amount paid and date of payment

- Payment method (e.g., bank transfer, cash, check)

- Lease period covered by the payment

- Signature of the landlord or authorized representative

Additional Information to Include

In case of partial payments or special arrangements, it’s beneficial to note the balance owed or any future payments due. You can also add a reference number or lease agreement number to help with tracking and organization. This can be particularly useful for landlords managing multiple properties or tenants.

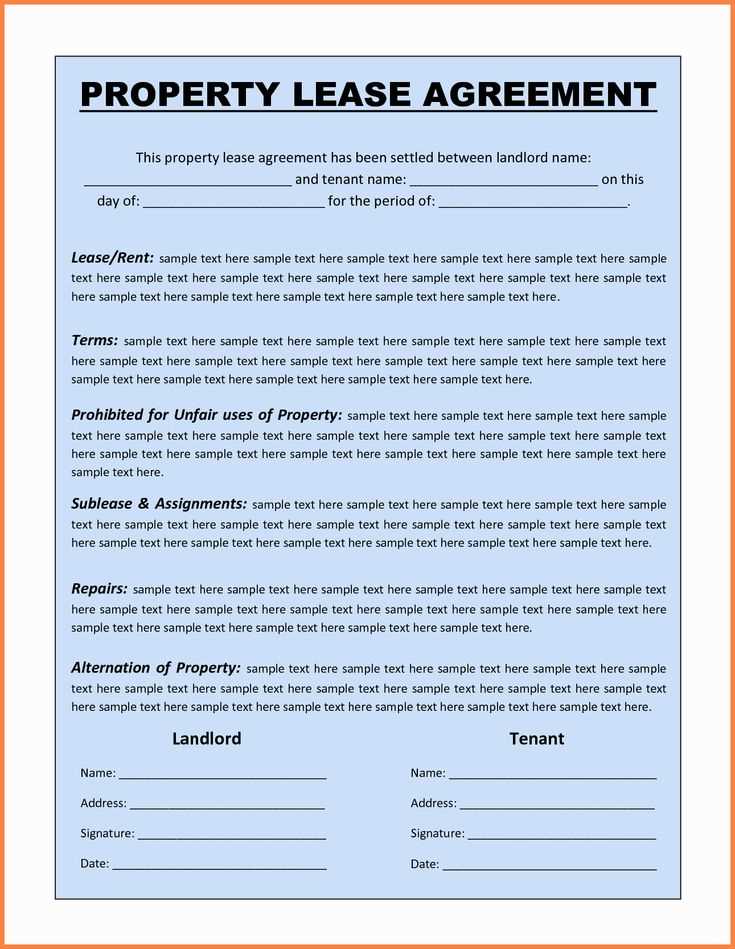

Creating a lease receipt involves including specific information to ensure clarity and legal validity. Below are key components to include in your receipt:

- Tenant’s and Landlord’s Names: Clearly state the names of both parties involved in the lease agreement. Include full legal names to avoid confusion.

- Property Address: Mention the exact location of the leased property. This ensures there is no ambiguity regarding the rental unit.

- Payment Date: Note the date the rent was paid. This helps establish a record of payment for future reference.

- Amount Paid: Indicate the exact amount received from the tenant, specifying the rent or any additional charges.

- Payment Method: Include the method of payment (cash, check, bank transfer, etc.), which adds transparency.

- Receipt Number: If applicable, assign a unique receipt number to each payment for easy tracking.

- Period Covered: Specify the rental period for which the payment was made (e.g., January 1, 2025 – January 31, 2025).

- Late Fees (if any): If a late fee was charged, include the details to clarify the reason for the additional amount.

- Signature: Both the landlord and tenant should sign the receipt to confirm the transaction.

Ensure all details are accurate and easy to read. A well-drafted lease receipt can prevent future disputes and serve as proof of payment.

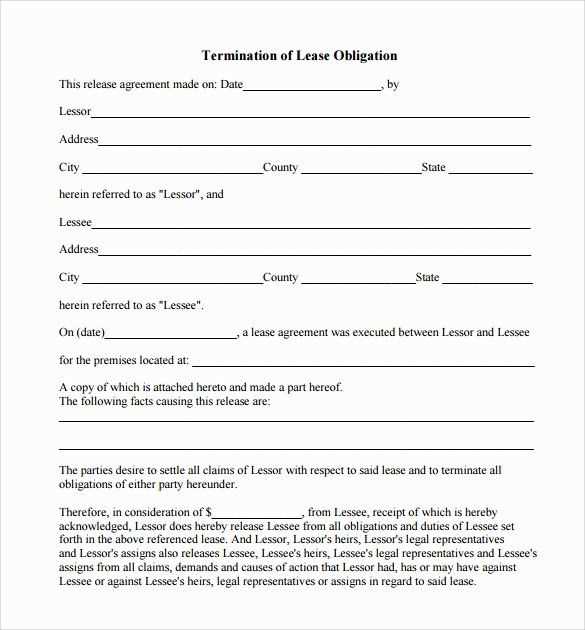

Include the correct lease period. Forgetting to specify the start and end dates of the lease can lead to confusion. Always confirm the rental period is accurate before finalizing the receipt.

Clarity of Payment Details

Clearly list the payment amount and any additional charges like late fees or utilities. Avoid leaving out information that may cause disputes later, such as security deposits or payment terms.

Incorrect Tenant and Landlord Information

Double-check names and contact details for both the tenant and landlord. An error in spelling or missing contact information can create unnecessary complications, especially in case of legal disputes.

| Common Mistakes | Consequences |

|---|---|

| Omitting the lease start and end dates | Leads to confusion about lease terms |

| Missing payment details | Potential for disputes over payments |

| Incorrect tenant or landlord details | Problems with contacting parties in the future |

Always include the payment method as well. Not specifying how the rent is paid (check, cash, or online transfer) can lead to misunderstandings about the transaction.

Make sure to keep a copy of the receipt for your records. Landlords and tenants both benefit from having a proof of payment in case of future disagreements.

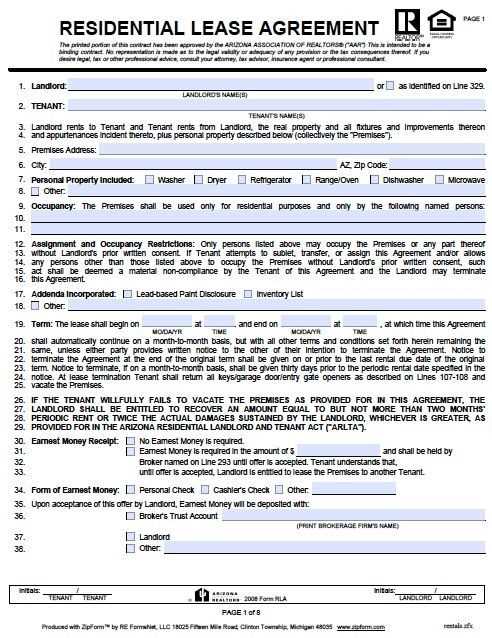

Store lease receipts digitally to prevent loss or damage. Use a cloud storage service like Google Drive or Dropbox, which allows easy access and ensures files are secure and backed up. Organize receipts into folders by year or property to maintain order and streamline retrieval when needed.

Use Clear File Naming Conventions

Label each file with details like the tenant’s name, lease date, and payment type. For example, “JohnDoe_LeasePayment_Jan2025.pdf” makes it easier to search and identify the document later.

Share Receipts Securely

When sharing receipts with tenants or property managers, use encrypted methods such as password-protected PDFs or secure email services. Avoid sending receipts over unprotected channels like regular email to ensure privacy and security.

Lease Agreement Receipt Template

For a clear and concise receipt, ensure you only include necessary details like the rental amount, payment date, and lease term. Limit the use of the word “Lease” to two or three instances, so the message remains straightforward without redundancy. Focus on the essential elements, such as tenant and landlord information, payment confirmation, and any additional terms relevant to the transaction.