Key Elements of a Lease Breakage Receipt

A lease breakage receipt serves as proof of payment when a tenant terminates a lease early and pays associated penalties or fees. It should clearly outline transaction details to avoid disputes. Ensure the receipt includes the following elements:

- Date of Payment: Clearly state when the payment was made.

- Tenant’s Name: Identify the party responsible for the lease breakage fee.

- Property Address: Specify the leased property to avoid confusion.

- Amount Paid: Mention the exact sum received.

- Reason for Payment: Indicate that the payment is for early lease termination.

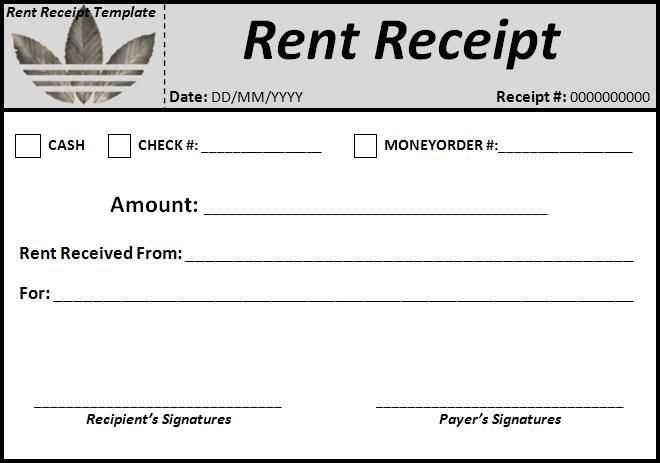

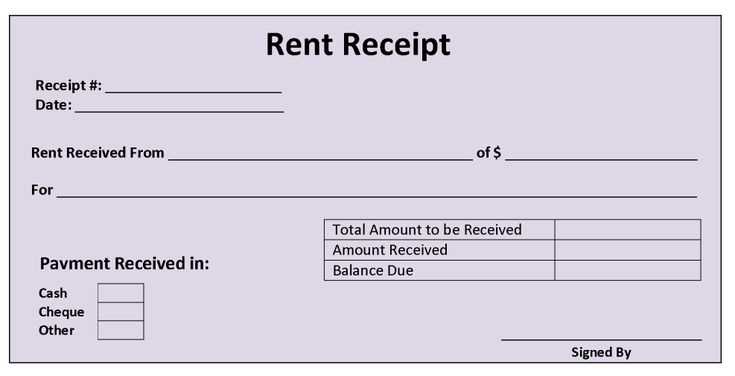

- Payment Method: Include cash, check, or electronic transfer details.

- Landlord or Property Manager Signature: Confirm receipt of funds with a signature.

Sample Lease Breakage Receipt

Below is a ready-to-use template that covers all necessary details:

Receipt for Lease Breakage Fee

Date: [MM/DD/YYYY]

Received From: [Tenant’s Full Name]

Property Address: [Rental Unit Address]

Amount Paid: $[Total Fee]

Payment Method: [Cash/Check/Bank Transfer]

Reason for Payment: Early lease termination fee per rental agreement.

Landlord/Property Manager Name: [Full Name]

Signature: ________________________

This receipt confirms that the tenant has fulfilled their financial obligation related to breaking the lease early. Both parties should keep a copy for records.

Lease Breakage Receipt Template

How to Draft a Receipt for Early Lease Termination

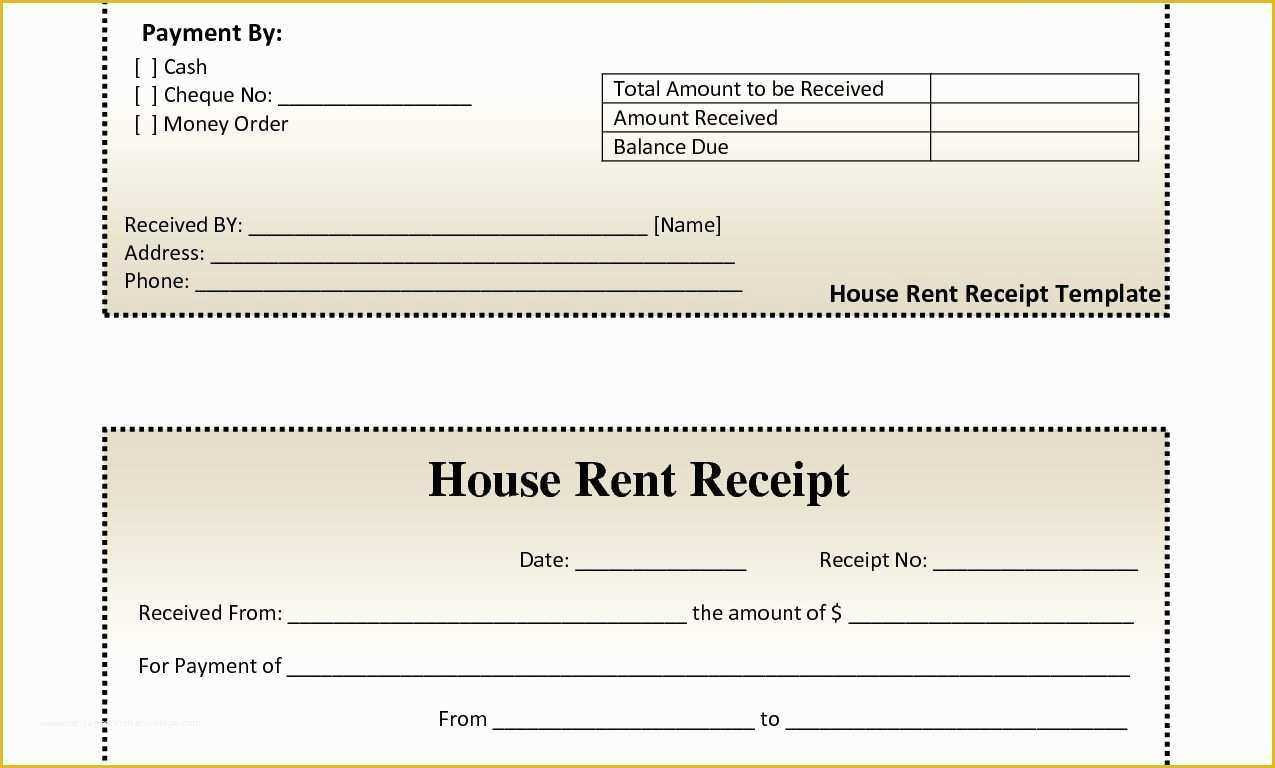

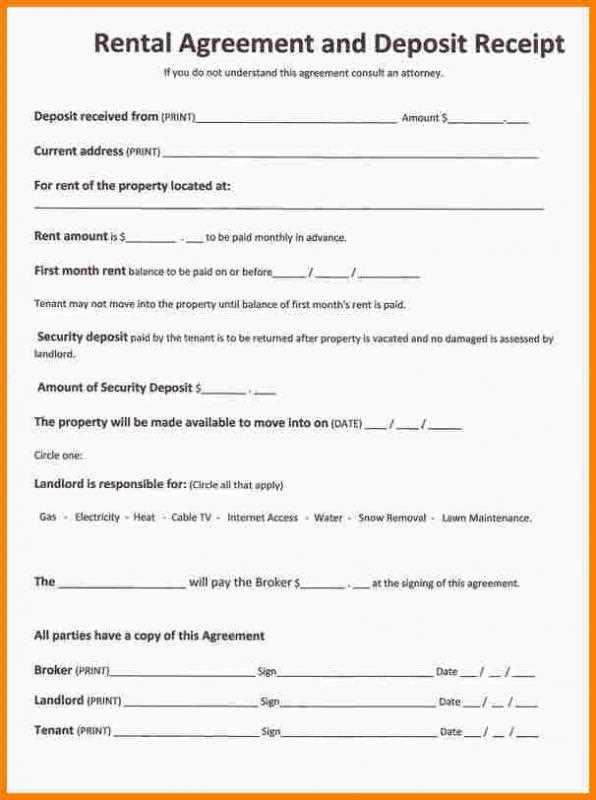

Specify the tenant’s full name, lease address, and termination date. Include the original lease term and the reason for early termination. State the agreed-upon financial obligations, such as fees or unpaid rent, and confirm payment received. Signatures from both landlord and tenant validate the receipt.

Key Information to Include in a Breakage Receipt

List payment details, including amount, date, and method (cash, check, transfer). Mention any deductions, such as repair costs, with explanations. Clearly outline the refund policy for security deposits. Provide a reference number for record-keeping.

Common Mistakes to Avoid When Using This Receipt

Do not omit key financial details, as this may cause disputes. Avoid vague language–state amounts and conditions explicitly. Ensure both parties sign the receipt to make it legally valid. Keep a copy for future reference.