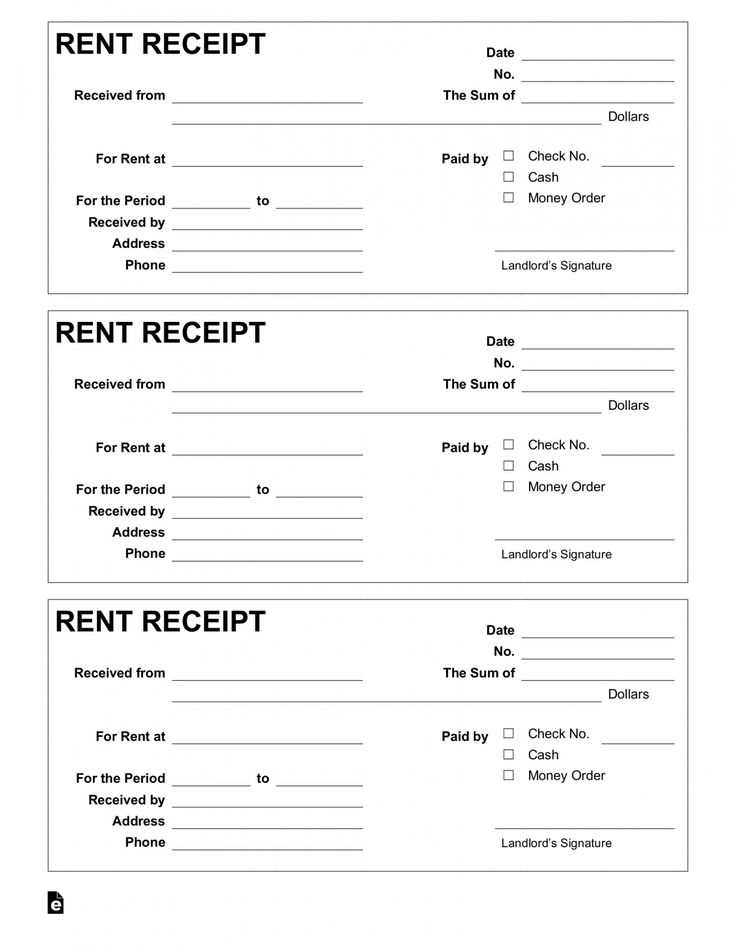

To create a leasing receipt, ensure the document includes the names of both the lessor and lessee, as well as the lease details such as the rental period, property address, and payment amount. Make sure the payment date and any deposit information are clearly stated. Include a statement acknowledging the receipt of the payment, specifying the method of payment used, whether by cash, check, or electronic transfer.

Provide space for the signature of both parties, confirming that the transaction has been completed. You should also include any additional terms or conditions related to the lease, such as late payment fees or maintenance responsibilities. A well-structured leasing receipt keeps both parties informed and helps avoid potential disputes.

Make sure to keep a copy of the receipt for your records and provide one to the tenant as proof of payment. This practice ensures transparency and provides a clear record for both parties in the future. By using a leasing receipt template, you can streamline the process and maintain consistency in your leasing transactions.

Sure! Here’s the revised version:

The leasing receipt should contain specific details for clear record-keeping and legal purposes. Include the tenant’s name, the leased property’s address, the rental period, and payment details. Make sure the receipt is easy to understand and properly formatted to avoid future disputes.

The following elements must be present on your receipt template:

| Field | Description |

|---|---|

| Tenant Name | The full name of the tenant renting the property. |

| Property Address | Exact location of the leased property. |

| Payment Amount | Amount paid by the tenant for the lease. |

| Payment Date | The date on which the payment was received. |

| Lease Period | The start and end dates of the rental agreement. |

| Receipt Number | A unique identifier for the transaction. |

Ensure to include both the landlord’s and tenant’s signatures, if applicable, for verification. You can also add a contact number or email for any future inquiries. This helps keep the process transparent and legally sound.

Here’s a detailed plan for an informational article on the topic “Leasing Receipt Template” in HTML format, with specific, practical subheadings:

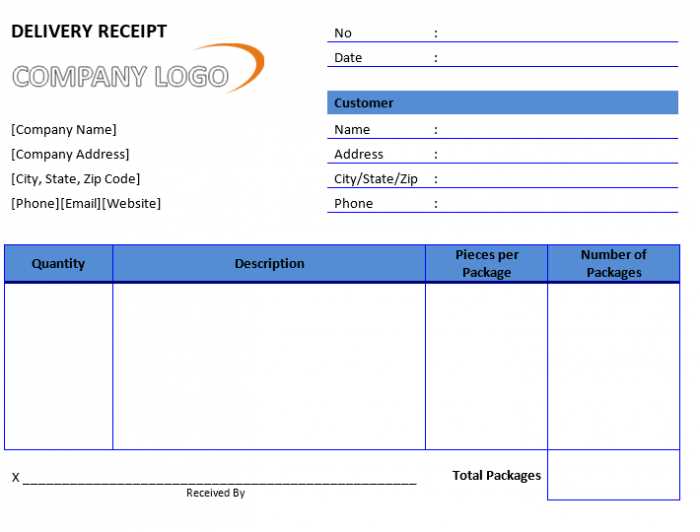

A leasing receipt template should provide clear details about the lease transaction, ensuring both parties have a record of the agreement. It should be concise but cover all necessary points to avoid confusion. Here’s a practical breakdown of the sections to include in your template:

1. Lease Information

Start with key lease details like:

- Lessee Name: The name of the tenant or business leasing the property.

- Lessor Name: The name of the landlord or leasing company.

- Property Description: A brief description of the leased property or item.

- Lease Duration: Start and end dates of the lease period.

- Payment Schedule: Monthly, quarterly, or annual payment terms.

2. Payment Details

List the financial aspects of the lease:

- Amount Paid: Total amount paid for the lease.

- Payment Method: Cash, check, online transfer, or another method.

- Payment Date: The exact date the payment was received.

- Late Fees: Specify if any late fees are applicable or have been charged.

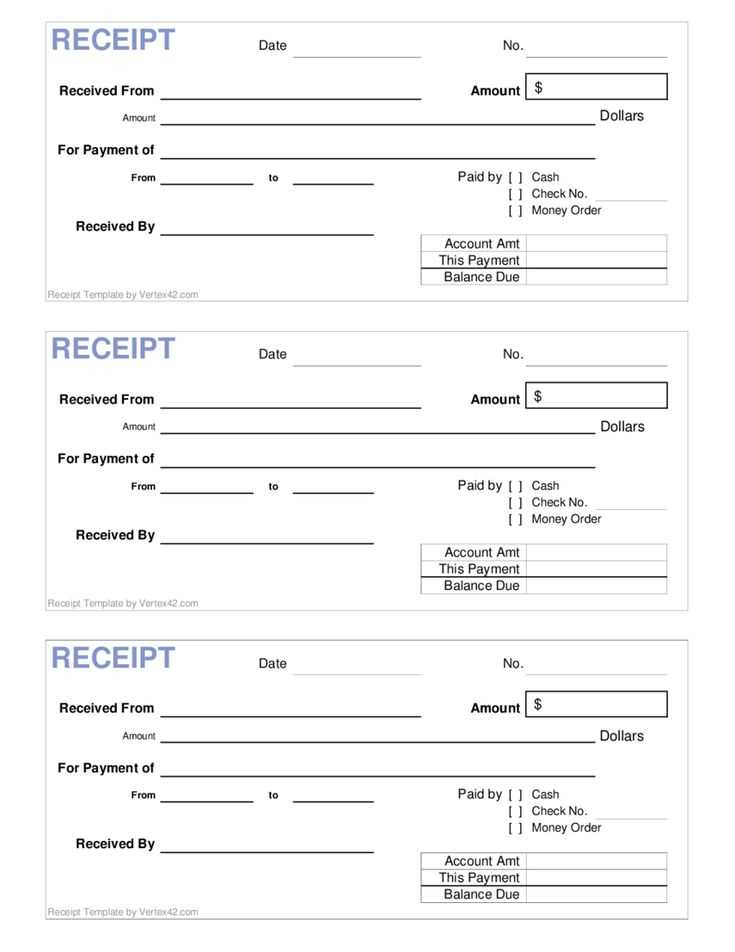

3. Receipt Confirmation

Provide an area for the lessor to confirm receipt of payment. Include:

- Lessor’s Signature: A space for the landlord or company representative to sign.

- Lessee’s Signature: A space for the tenant’s signature, confirming receipt of the receipt.

- Date of Receipt: Date the receipt was issued.

4. Additional Clauses

Include any other relevant details such as:

- Security Deposit: Amount of the deposit, if applicable, and conditions for its return.

- Renewal Terms: Terms for lease renewal or extension.

- Maintenance Responsibilities: Who is responsible for property upkeep during the lease.

5. Template Design

For clarity and ease of use, the layout should be simple and professional. A clean, well-organized format helps both parties understand the terms and prevents misunderstandings.

- How to Create a Leasing Receipt

Begin by including the leasee’s name and address at the top of the receipt. This ensures that the document is clearly associated with the person or business receiving the leased property. Right below, specify the name of the lessor, or the entity providing the lease. Include their address as well.

Next, include the leasing details: date of the lease transaction, a description of the leased property, and the amount paid. Include any specifics, such as the payment frequency, and whether it was a one-time or recurring payment.

It’s important to provide a breakdown of any fees associated with the lease. Include rental amounts, taxes, late fees (if applicable), and any other related charges. Make sure each charge is clearly labeled and easy to read.

Don’t forget to include payment method information. This helps establish the method used to transfer the funds, whether it’s cash, check, or bank transfer. If the payment was made electronically, you can specify the transaction reference or confirmation number.

Finally, add the signature or authorization from the lessor to confirm the transaction. This could be either a physical signature or a digital one if using an electronic system.

Always double-check the date. A common mistake is entering the wrong date, leading to confusion about the transaction’s timeline. Ensure the date is accurate before finalizing the document.

Ensure the recipient’s information is correct. Misspelled names or incorrect addresses can make the receipt invalid. Verify every detail with the involved parties to prevent errors.

Payment Method Clarification

Clearly state the payment method used, whether it’s cash, card, or another form. Avoid ambiguity here, as it can lead to disputes or misunderstandings.

Avoid Vague Descriptions

Be specific with the item or service descriptions. Avoid generic terms like “product” or “service.” Include exact details to prevent future disagreements or confusion.

Check the amounts. Recheck the totals and individual prices for any miscalculations. Even small mistakes can lead to mistrust or legal issues if discrepancies are noticed later.

Don’t forget to include relevant tax information. In some cases, tax rates are critical. If applicable, list the tax rate and total separately to ensure transparency.

Always issue receipts promptly. Delay in providing receipts can lead to confusion and doubts about the legitimacy of the transaction.

Adjust the layout and fields to match the purpose of your leasing receipt. Identify the key details needed for your business, whether it’s rent amount, due dates, tenant information, or special payment conditions. Each section of the template should align with your specific requirements, allowing for clarity and consistency across all documents.

- Incorporate Custom Fields: Add fields for specific leasing details like property type, lease duration, or deposit amounts. This ensures each receipt serves its function without extra data.

- Adjust Formatting: Modify font sizes, spacing, and alignment to improve readability. A well-organized receipt makes it easier for tenants to understand payment terms.

- Include Legal Clauses: Depending on your region, you may need to insert specific legal disclaimers. Make sure to customize the template to include these details in the right place.

- Payment Methods: Tailor the template to reflect the available payment methods in your leasing contract. Add options like bank transfers, credit card payments, or online platforms to ensure accuracy.

- Branding: Use your company’s logo and color scheme to make the receipt visually distinct and professional. This creates consistency with your business’s brand identity.

By adjusting the leasing receipt template to fit these specific needs, you ensure all important details are captured clearly and consistently, streamlining your leasing process.

To create a leasing receipt template, focus on clarity and accuracy. Ensure the template includes the following key components:

- Tenant’s Information: Clearly list the tenant’s full name, contact details, and lease number. This helps ensure the document is personalized and traceable.

- Property Details: Specify the address and type of property being leased. Include any unit number or special identifiers if applicable.

- Lease Period: Indicate the start and end dates of the lease term, ensuring both parties are clear on the duration of the agreement.

- Payment Information: Include the total amount paid, payment date, and payment method. This provides a record of the financial transaction.

- Signature Line: Ensure a section for both the tenant and the landlord to sign, confirming the transaction.

Customizing the Template

Tailor the template by adding any additional clauses relevant to your agreement, such as late payment fees or security deposit details. Make sure these clauses are clearly outlined to prevent confusion later.

Legal Compliance

Double-check that the receipt complies with local leasing laws. Including all required information helps avoid disputes and ensures the lease agreement is enforceable in court.