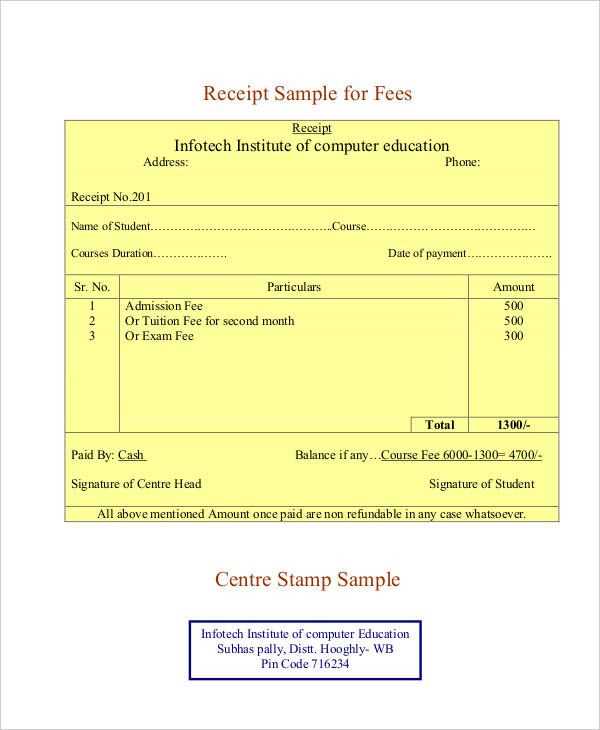

A well-crafted receipt template is necessary for maintaining clear, accurate, and legally compliant records of transactions. It should provide all key information required by law and meet professional standards for clarity and organization. Use a consistent format that can be easily understood by both the business and the customer.

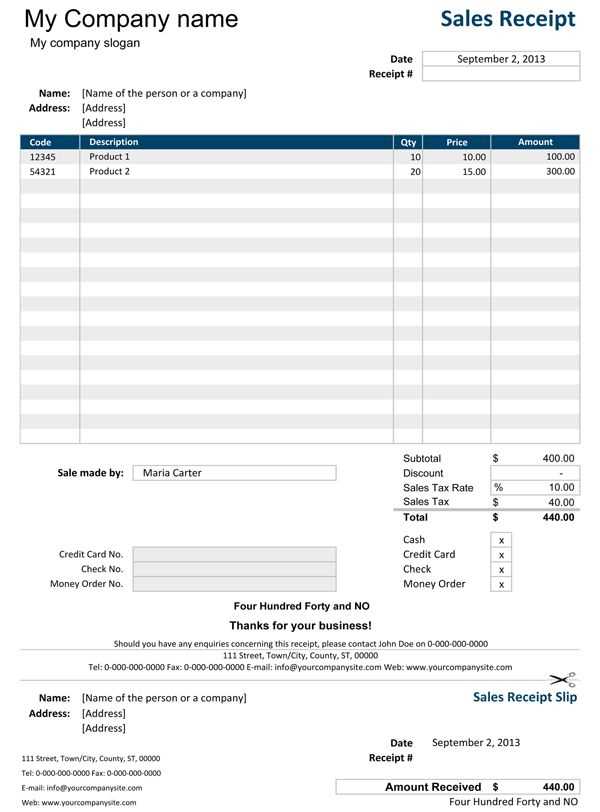

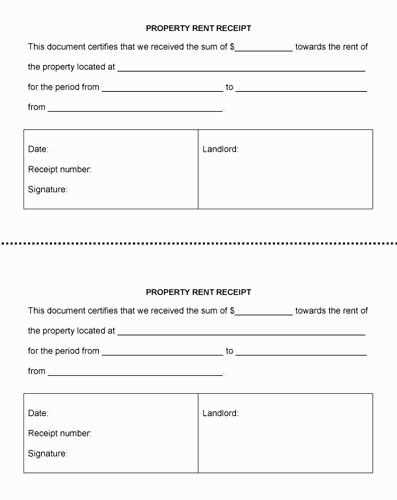

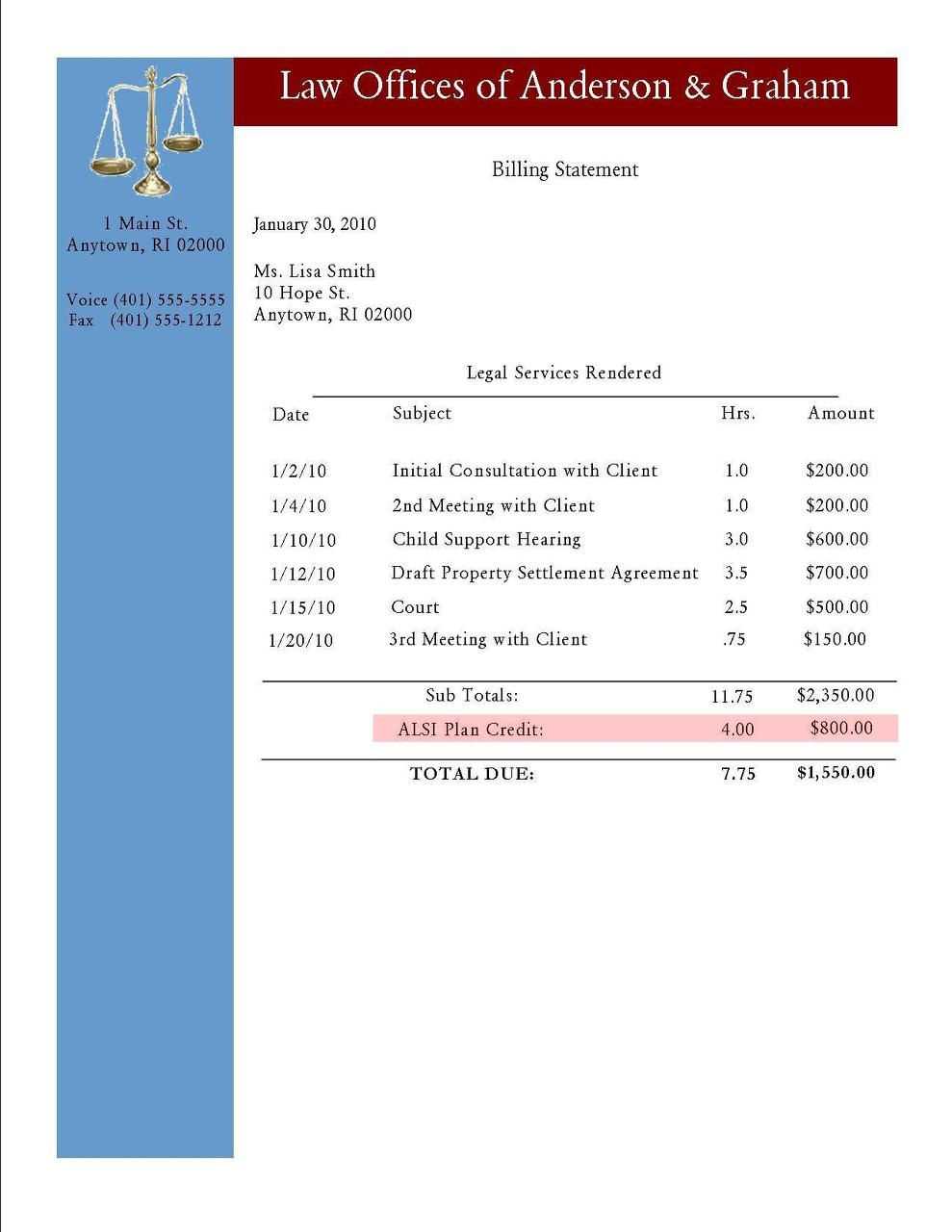

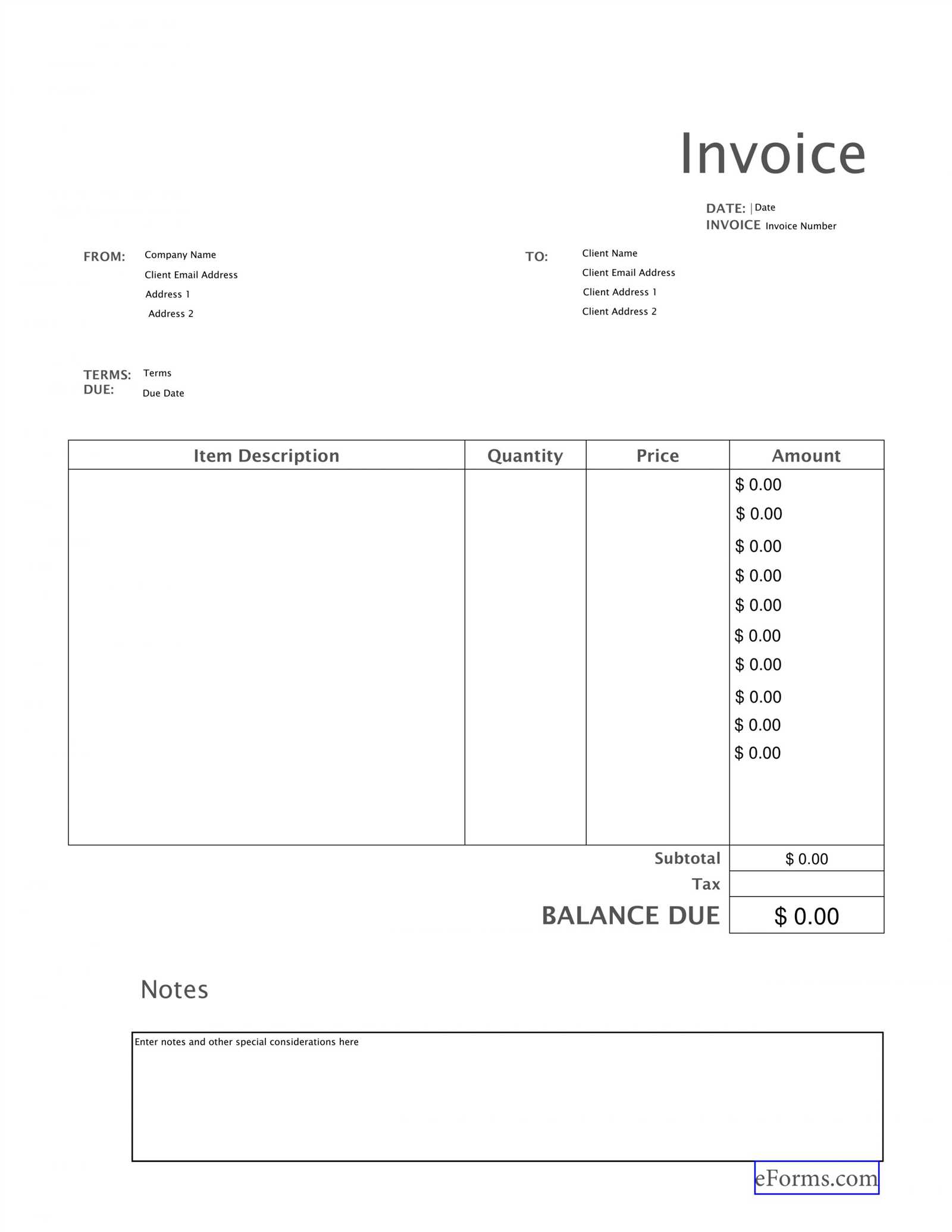

Start with basic details: Include the transaction date, name and contact details of both the buyer and the seller, the items or services purchased, and the agreed-upon prices. This helps in creating a transparent and formal record for both parties.

Include payment details: Specify the payment method, whether it’s cash, credit card, or bank transfer. This not only ensures accurate accounting but also prevents any confusion about the payment process. If relevant, mention taxes or discounts applied to the total amount.

Finally, close the receipt with a statement of receipt acknowledgment. This confirms the business’s commitment to keeping proper records while providing the customer with a clear, concise document. A good template can also include space for any necessary terms or refund policies that could clarify future expectations.

Here are the corrected lines with minimal repetition:

When designing a legal and professional receipt template, prioritize clarity and simplicity. The template should highlight key information such as the buyer’s and seller’s details, transaction amount, and payment method without redundancy. Avoid repeating terms like “Total” or “Amount Due” unnecessarily. Each section of the receipt must serve a distinct purpose, ensuring that information flows logically from one section to the next.

Payment Details Section

The payment section should only mention the amount once, using precise language to avoid confusion. Specify whether the payment is made via credit card, bank transfer, or cash. Repeating the payment method or amount in multiple places can clutter the design and reduce legibility.

Transaction Information

Ensure the transaction date, time, and invoice number are clearly stated but avoid repeating this information throughout the receipt. Each detail should be placed in its respective field and not duplicated in the footer or header. This approach makes the receipt easier to read while maintaining a professional appearance.

Got it! Let me know how I can assist you today, whether it’s with documentation, technical details, or anything else.

Legal receipts must contain specific components to ensure they hold validity in legal matters. Each section plays a role in verifying the transaction details and providing clear evidence of the exchange. Here are the key elements to include:

- Receipt Number: This unique identifier helps track the receipt and is essential for referencing in case of disputes.

- Date and Time of Transaction: Always specify the exact date and time the transaction occurred. This proves the timing of the agreement.

- Seller and Buyer Information: Include the full legal names, addresses, and contact details of both parties involved. This ensures clarity and accountability.

- Description of Goods or Services: Provide an accurate description of the items or services exchanged, along with quantities and unit prices. This information is critical for proving the transaction’s specifics.

- Total Amount Paid: Clearly state the total sum paid, including any taxes, fees, or discounts. This prevents misunderstandings regarding the payment.

- Payment Method: Specify whether the transaction was made via cash, credit card, bank transfer, or another method. This shows the payment’s legitimacy.

- Signature of the Seller: The seller’s signature or authorization mark provides personal confirmation that the transaction was completed according to their records.

- Terms and Conditions (if applicable): Any additional agreements made between the parties, such as return policies or warranties, should be included. This adds transparency to the transaction.

Ensure all these elements are included and legible for the receipt to be valid in legal contexts. Missing or unclear details can lead to disputes or a lack of enforceability.

Adjust your receipt template by tailoring the layout to suit the type of service provided. For a retail transaction, include product details such as item name, quantity, and price per unit. For a professional service, highlight hours worked, rate per hour, and a detailed breakdown of the services rendered. Adjust the font size or style to make critical information more visible, like payment terms or due dates.

For businesses that offer both goods and services, use separate sections for each. Keep the design clean and avoid clutter, with clear labels for each part of the transaction. Ensure your template allows for flexible itemization, especially if discounts or taxes need to be added or removed. Adjust the header and footer to include appropriate branding or contact information depending on the service, whether it’s a retail shop or a consulting business.

If you provide subscription-based services, include recurring billing details, such as the frequency of payment and the next billing date. For one-time services, emphasize the total due amount and payment method. Custom fields allow you to tailor each receipt based on specific needs, like project names, client IDs, or custom service descriptions.

To ensure compliance with local and global tax regulations, include the following elements in your receipt template:

| Regulation | Action |

|---|---|

| Tax Identification Number (TIN) | Clearly display the business’s TIN on the receipt. This is required by tax authorities in many regions for proper identification. |

| Tax Breakdown | Provide a detailed breakdown of taxes for each item or service sold, including applicable local and national rates. |

| Currency and Tax Codes | Ensure the receipt uses the local currency and includes specific tax codes when required by local tax laws. |

| International Transactions | For cross-border sales, ensure the correct application of VAT or sales tax according to the destination country’s rules. |

| Digital Signatures | Some jurisdictions require receipts to have a digital signature for authenticity, particularly for e-commerce transactions. |

By incorporating these elements, you ensure the receipt meets both local and global tax requirements, reducing the risk of compliance issues during audits.

Clarity in design helps customers quickly verify the details of their purchase. Ensure that the layout is neat, with information such as the company name, contact details, item description, quantity, price, and total amount clearly organized. Avoid clutter by leaving adequate spacing between sections.

Use a consistent and readable font. Avoid decorative or hard-to-read fonts that may confuse recipients. Stick to a simple, clean typeface like Arial or Times New Roman for the main content. This ensures the receipt is easily legible in various lighting conditions.

Including a unique receipt number is vital for tracking and reference. This helps both the business and the customer to refer to a specific transaction if any issues arise. Ensure that the number is placed prominently at the top of the receipt, allowing for quick retrieval.

List all applicable taxes separately. Display taxes clearly alongside the total amount, so customers can quickly verify the breakdown of their payment. This promotes transparency and avoids confusion about pricing.

Include a professional footer with additional details, such as return policies, warranty information, or contact support. This gives the receipt a well-rounded feel, reflecting the company’s commitment to customer service and legal compliance.

Lastly, ensure that your receipts are free from errors. Double-check that prices, quantities, and other details are correct before printing. Any mistakes can damage the company’s credibility and potentially cause disputes with customers.

Store receipts in organized folders with clear names, such as “2025 Business Expenses” or “Personal Receipts January.” Use a file naming convention like “Receipt_StoreDate_Vendor” for easy searching. For example: “Receipt_2025-01-12_Amazon.”

Use Cloud Storage

Upload receipts to cloud platforms like Google Drive or Dropbox to ensure easy access and backup. Set up automatic syncing from your phone to avoid losing files due to device failure.

Leverage Receipt Scanning Apps

Utilize apps like Expensify, Shoeboxed, or Receipt Bank to scan and categorize receipts. These apps can extract important data like date, amount, and merchant, automatically storing receipts in relevant categories.

Maintain Multiple Formats

- Save receipts in both image and PDF formats for easier retrieval.

- Store both scanned images and text-based documents, as some digital receipts may be readable by text search tools.

Set Up a Regular Review Schedule

Allocate time weekly or monthly to go through your stored receipts. Review and delete any duplicates or unnecessary files. This ensures that your receipt storage system remains clean and organized.

Organize by Tax Year

- Create separate folders for each tax year, such as “Tax Year 2025” or “2024 Expenses,” to simplify tax filing.

- For tax purposes, ensure receipts are categorized by their nature: “Business Expenses,” “Medical Expenses,” etc.

Keep Receipts Secure

For sensitive receipts, apply encryption or store them in password-protected folders. This helps prevent unauthorized access to your personal financial data.

Ensure all details are accurate. Double-check the date, time, and transaction amounts before finalizing the receipt. Even minor mistakes can cause confusion and lead to disputes. Always verify that the correct payment method is listed, whether cash, credit card, or other options.

1. Include Complete and Correct Information

Omit no essential details. Make sure the buyer’s and seller’s names are clearly visible, as well as any applicable addresses, tax rates, and transaction IDs. Misunderstanding arises when this basic information is left out or incorrect.

2. Consistency is Key

Avoid using different formats for similar items. Maintain uniformity across all receipts to make them easy to read. Stick to the same font style, date format, and item descriptions. Inconsistency can lead to confusion and mistrust in the accuracy of your receipts.

Ensure that each item in your receipt is clearly listed and categorized. Use bullet points or numbered lists to make it easier for the recipient to understand the charges and items.

Organize Payment Details

List the payment methods separately, including any transaction reference numbers or bank details. This helps in case the customer needs to follow up or dispute the charge later.

Include Necessary Legal Information

Clearly state your business’s legal name, contact details, and any other required information according to local laws, such as tax registration number or VAT details. This ensures compliance and transparency.