Essential Information for a Legal Receipt

A legally compliant receipt in the UK must include specific details to ensure transparency and proper documentation. Use the following structure for accuracy:

- Date of transaction – Clearly state the date when the transaction took place.

- Seller’s details – Include the name, business name (if applicable), and contact information.

- Buyer’s details – Mention the name and, if necessary, contact details of the purchaser.

- Description of goods or services – Provide a brief but precise list of items or services rendered.

- Amount paid – State the total amount, including currency and any applicable taxes.

- Payment method – Indicate whether payment was made in cash, by card, or another method.

- VAT details (if applicable) – If VAT applies, include the VAT rate, registration number, and amount.

- Receipt number – Assign a unique reference number for tracking purposes.

- Signature or stamp – While not mandatory, a signature or business stamp adds authenticity.

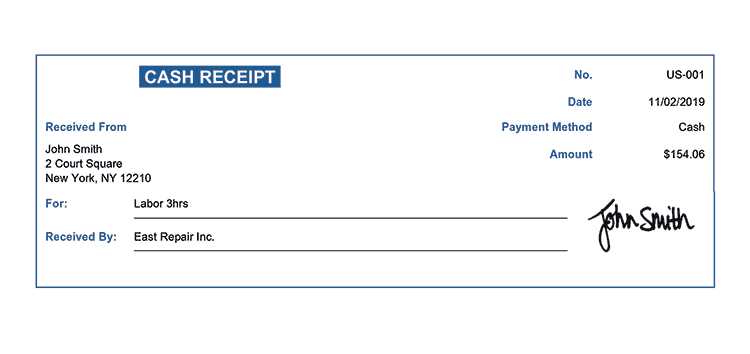

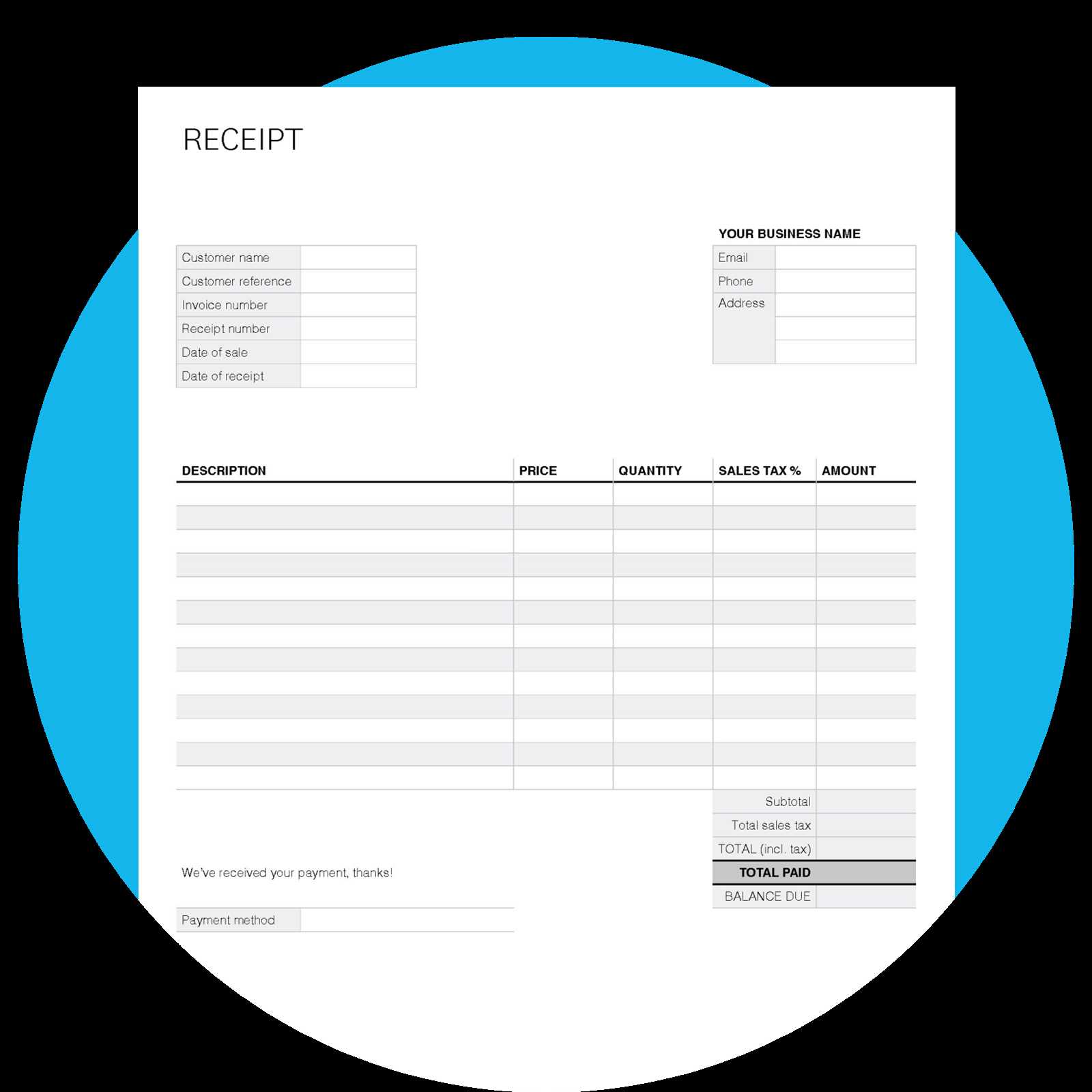

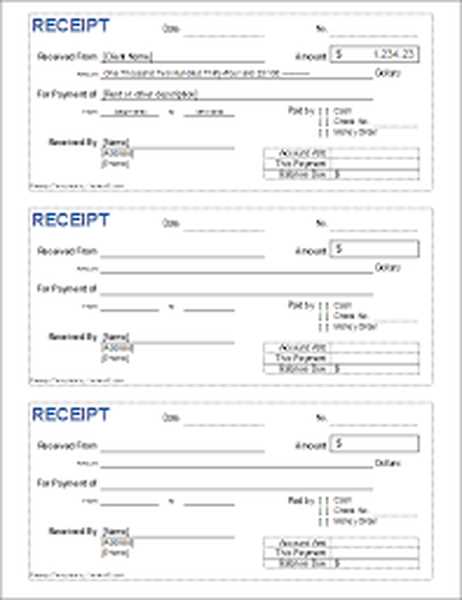

Example of a Legal Receipt Template

Use this template as a reference when creating a receipt:

Receipt Date: [DD/MM/YYYY] Receipt No: [Unique Number] Seller Information: Name: [Full Name or Business Name] Address: [Business Address] Contact: [Phone Number / Email] VAT No: [If applicable] Buyer Information: Name: [Full Name] Address: [Optional] Transaction Details: Description of Goods/Services: [List items/services] Total Amount: £[Amount] VAT: £[If applicable] Payment Method: [Cash/Card/Other] Authorized Signature: [Signature or Business Stamp]

Additional Considerations

For businesses, digital receipts with electronic records help streamline accounting and reduce paperwork. Ensure compliance with HMRC guidelines, especially for VAT-registered entities. Keeping copies for both parties is recommended for future reference.

Legal Receipt Template UK

Key Requirements for a Receipt in the UK

Mandatory Details to Include in a UK Receipt

How to Format a Compliant Receipt

Digital vs. Paper Receipts: Key Considerations

Common Mistakes in UK Receipt Samples

Best Practices for Storing and Issuing Records

Every legal receipt in the UK must contain accurate details to serve as proof of payment and meet tax regulations. Include the transaction date, names of both parties, a clear description of goods or services, the total amount paid, and the payment method. If VAT applies, state the VAT amount and registration number.

Format receipts consistently by structuring them with distinct sections for seller and buyer information, itemized lists, and payment details. Use clear fonts and avoid unnecessary elements that may cause confusion. Numbering receipts sequentially helps with tracking and auditing.

Digital receipts provide a secure, searchable record, reducing storage needs and the risk of loss. Paper receipts remain useful for face-to-face transactions but should be stored in an organized system to prevent fading or misplacement. Businesses using digital receipts must ensure compliance with HMRC requirements for electronic record-keeping.

Common mistakes include missing VAT details for taxable transactions, incorrect totals, and unclear descriptions of goods or services. Inconsistent formatting or failing to issue a receipt when required can lead to disputes or compliance issues.

Store receipts for at least six years, as required by HMRC. Use cloud storage for digital copies and fireproof storage for physical records. Backing up electronic records ensures accessibility if needed for tax inspections or refunds.