Key Elements to Include

A well-structured lending receipt helps avoid disputes and keeps both parties accountable. Include these key details:

- Names and Contact Information: Clearly state the lender and borrower’s full names and phone numbers.

- Item Description: Provide a detailed description, including brand, model, serial number (if applicable), and condition.

- Loan Date and Return Deadline: Specify when the item was given and when it must be returned.

- Loan Terms: Mention any usage restrictions, liability for damage, or late return penalties.

- Signatures: Both parties should sign to confirm their agreement.

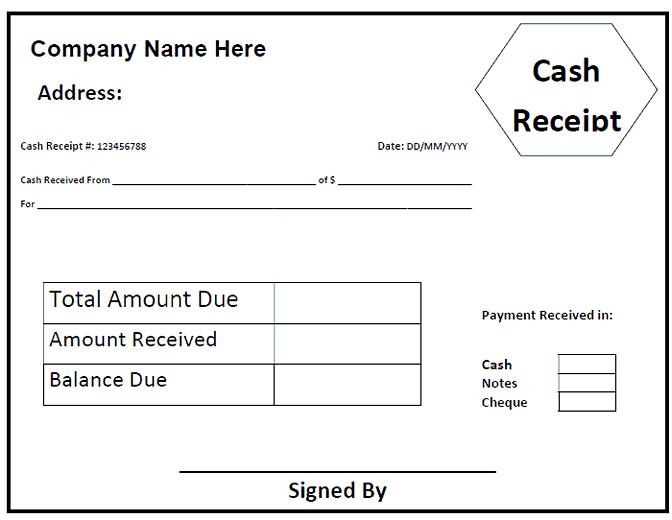

Simple Template Example

Use the following structure to create a straightforward receipt:

LENDING RECEIPT Date: [MM/DD/YYYY] Lender: [Full Name] Phone: [Contact Number] Borrower: [Full Name] Phone: [Contact Number] Item Description: [Brand, Model, Serial Number, Condition] Loan Date: [MM/DD/YYYY] Return Date: [MM/DD/YYYY] Terms: [Specify usage conditions, liability, and penalties] Signatures: Lender: ___________________ Borrower: ___________________

Why a Receipt Matters

Even among friends, a written record prevents misunderstandings. It ensures both parties acknowledge the agreement and their responsibilities.

Lending Things Receipt Template

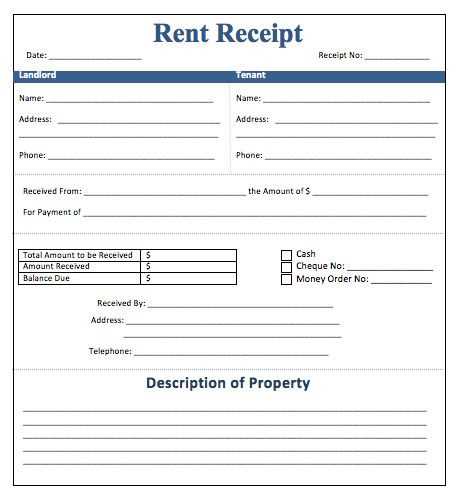

Key Elements to Include in a Loan Receipt

Include the lender’s and borrower’s full names, contact details, and addresses. Specify the item being lent with a clear description, including brand, model, serial number, or any distinguishing features. State the loan duration with a defined return date. Outline any conditions for use, potential fees for late return, or damage penalties. Both parties must sign and date the document to confirm agreement.

How to Format a Clear and Legible Document

Use a structured layout with distinct sections for each detail. Keep font size readable and spacing consistent. Highlight critical terms such as due dates and penalties in bold. Arrange information logically, starting with borrower details, followed by item description, terms, and signatures. For digital formats, ensure the document is easily printable and supports electronic signatures if required.