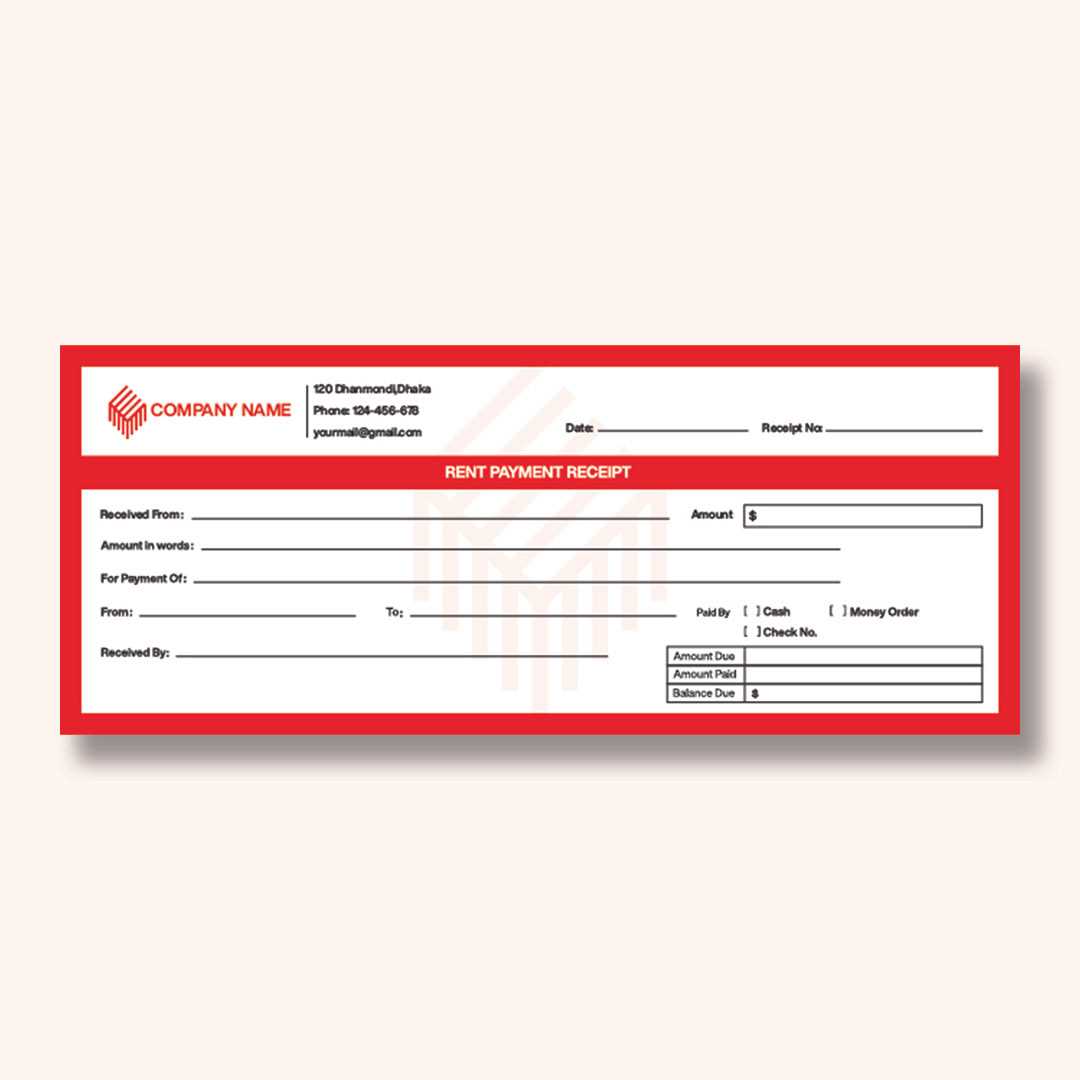

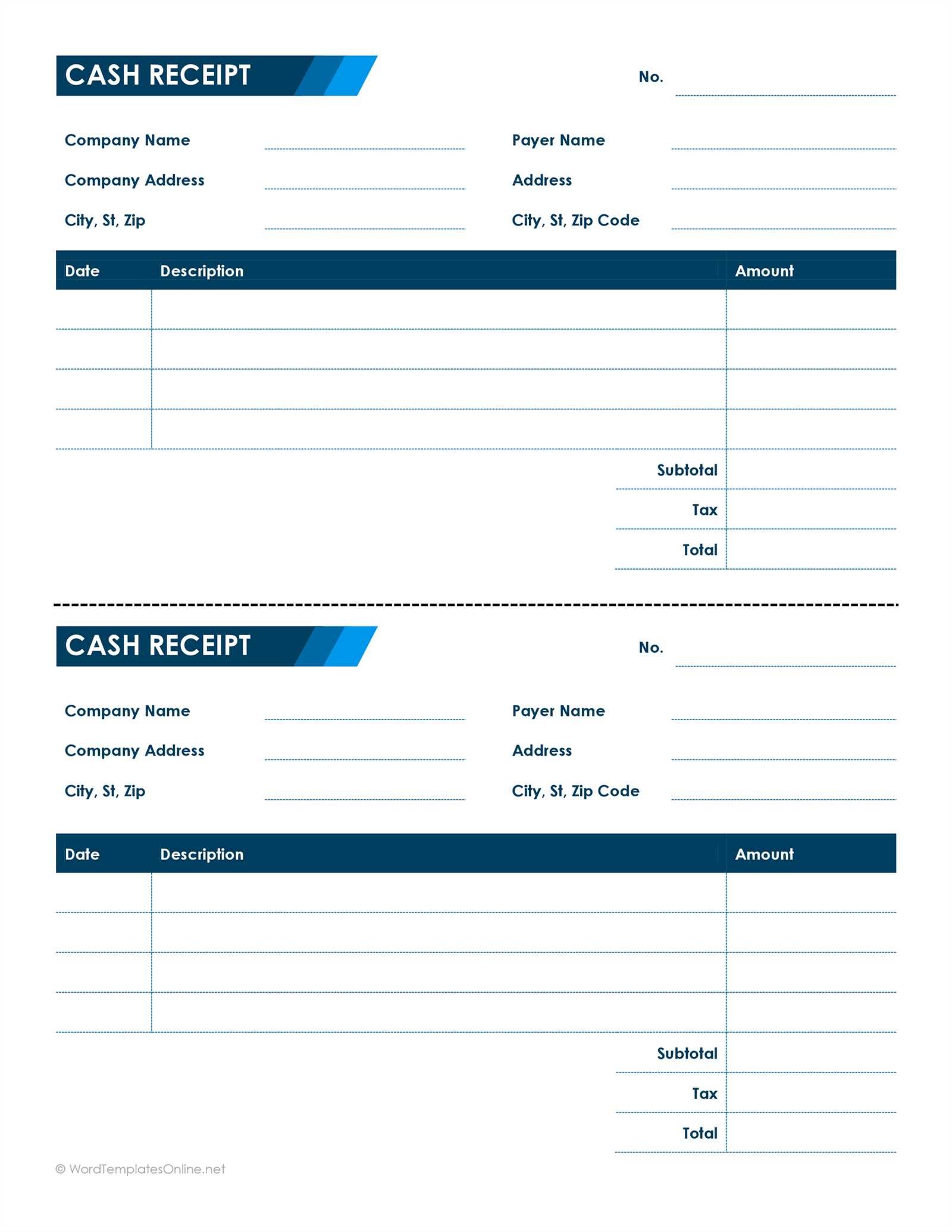

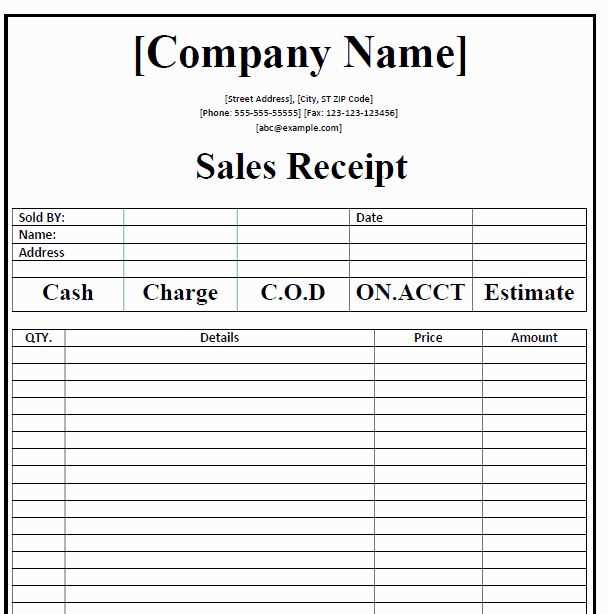

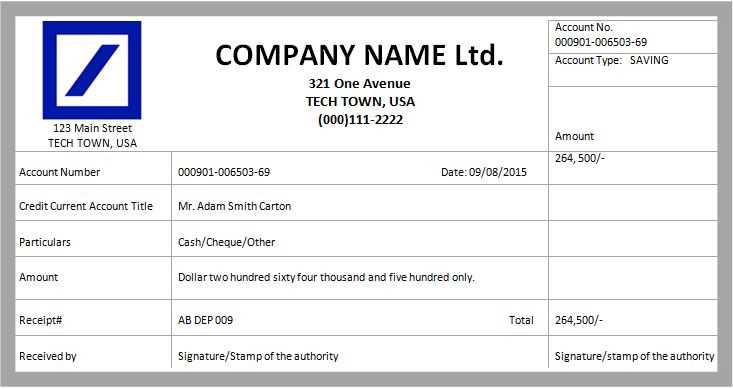

If you’re setting up a receipt for your limited company, a clear and structured template is key. A receipt must include the company name, contact details, date of the transaction, and an itemized list of goods or services provided. This template ensures transparency and allows both the company and customer to track payments accurately.

Include a section for the payment method, whether it’s cash, credit card, or bank transfer. This helps verify the transaction and avoid confusion down the line. Be sure to provide space for both the total amount and applicable taxes, as these details are crucial for accounting purposes.

Consider adding a unique receipt number for each transaction. This number can serve as a reference for any future correspondence or inquiries. It’s also a great way to stay organized, especially as your business grows. Ensure the template can easily accommodate new entries and can be modified as your business needs evolve.

A simple, well-organized receipt template doesn’t just streamline transactions, it also builds credibility with your clients. By keeping it professional and easy to follow, you provide reassurance that your business operates smoothly and transparently.

Here’s a detailed HTML plan for an article on the topic “Limited Company Receipt Template” with 6 practical, focused headings:

1. Key Information to Include in a Receipt

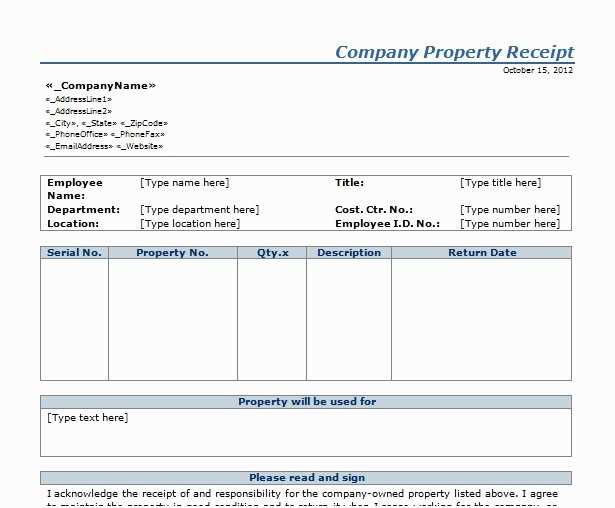

A limited company receipt should contain the company’s name, address, and registration number. Ensure the date of the transaction, a unique receipt number, and clear details of the items or services purchased are present. Don’t forget to list the total amount paid and any applicable taxes.

2. Formatting for Professional Presentation

Use a clean, professional layout with clearly defined sections. The header should feature the company’s name and contact details, while the footer can include payment terms or refund policies. Keep the font readable and the alignment consistent to enhance readability.

3. Tax Identification and VAT Details

For businesses registered for VAT, include the VAT number and specify the rate applied. This ensures the receipt complies with tax regulations. Make sure the breakdown of VAT is visible alongside the subtotal before taxes.

4. Payment Method and Transaction Details

Indicate the method of payment (cash, card, bank transfer, etc.). Include transaction IDs or reference numbers for electronic payments to track and verify the payment process. This helps in record-keeping and resolving disputes.

5. Customization Options for Different Transactions

If the receipt is for a specific service, include additional fields such as service descriptions or contract numbers. Tailor the template for specific industries, such as retail, consulting, or hospitality, by adding relevant information, such as service hours or item specifications.

6. Legal Considerations for Receipt Templates

Ensure the receipt complies with local legal requirements. This may include specifying the refund policy or indicating that the company is a limited liability entity. Review the legal standards for receipts in your country or region before finalizing your template.

- HTML Plan for Limited Company Receipt

Design the receipt with clear sections to ensure easy navigation and readability. Start with a header that includes the company name, registration number, and contact details. This gives the document legitimacy and context right away. Make sure the transaction date and receipt number are prominently displayed for record-keeping.

The next section should list the purchaser’s name and address. This personalizes the receipt and confirms the transaction details. Beneath that, create a detailed itemized list of products or services, including descriptions, quantities, and prices. Use a table format for clean alignment and easy reading.

Incorporate a total section at the bottom of the list, showing the sum of all items with applicable taxes, fees, or discounts clearly stated. Ensure this section is easy to spot by making the total amount bold and larger in font size.

Include a footer with payment method information (e.g., credit card, bank transfer), along with any terms and conditions related to refunds or exchanges. This adds professionalism and clarity to the transaction. Close the receipt with a thank you note or a company slogan, adding a personal touch.

Choose a format that aligns with your business operations and simplifies record-keeping. The right template helps streamline the transaction process, ensuring clarity and compliance.

Consider the following key factors when selecting a format:

| Factor | Recommendation |

|---|---|

| Business Size | Small businesses benefit from simpler, more straightforward templates. Larger companies may require detailed fields for multiple departments or accounts. |

| Transaction Volume | If you handle numerous transactions daily, opt for a template that offers more organization and allows for easy data retrieval. |

| Legal Requirements | Ensure the template complies with local tax regulations and includes necessary fields like VAT numbers or purchase order references. |

| Customization Needs | Select a template that allows for easy customization, especially if your business model involves unique transactions or services. |

By addressing these factors, you can create or choose a receipt template that supports your workflow and minimizes administrative overhead.

To ensure clarity and compliance, include these key details in every receipt:

- Business Name and Contact Details: Include the full name of the company, its physical address, phone number, and email. This makes it easy for customers to reach you if needed.

- Receipt Number: A unique number for each receipt helps with tracking and organizing transactions.

- Date of Transaction: Clearly state the date when the transaction occurred. This is important for both customer records and tax purposes.

- Itemized List of Products/Services: List each product or service purchased, including quantity, unit price, and total cost per item. This provides transparency for the customer.

- Total Amount Paid: Ensure the total is clearly stated, including any applicable taxes or discounts applied during the transaction.

- Payment Method: Specify how the payment was made, whether by cash, credit card, or another method.

- Tax Information: If applicable, list the tax rate, tax amount, and the total tax included in the payment. This is especially important for businesses subject to VAT or sales tax.

- Terms and Conditions: If relevant, include any return or exchange policies to set clear expectations for the customer.

To tailor a receipt template that reflects your business identity, focus on the key elements that customers recognize and associate with your brand.

- Company Logo: Place your logo at the top for instant recognition. This reinforces your branding every time a receipt is issued.

- Contact Information: Include a phone number, email, and website address to make it easy for customers to reach you for support or inquiries.

- Payment Methods: Clearly state accepted payment methods like credit cards, cash, or digital wallets. This avoids confusion during transactions.

- Customizable Fields: Add or remove fields like transaction ID, order number, or special instructions based on your business needs.

- Color Scheme: Use your brand’s color palette to create a visually appealing layout. It reinforces your business’s visual identity while making the receipt stand out.

- Legal Information: Depending on your region, add necessary tax details or legal disclaimers to comply with local regulations.

These small but significant changes will help build a consistent brand image while improving the customer experience during checkout.

Receipts must meet specific legal requirements depending on the jurisdiction in which a business operates. In many countries, a receipt must include certain elements to comply with tax laws and business regulations. These requirements can vary greatly across regions.

For example, in the European Union, receipts for transactions exceeding a certain threshold must display VAT details, including the VAT number of the business and the rate applied. In the United States, receipts are generally required to include the date, amount, and a description of the goods or services. Some states may have additional requirements such as providing a return policy or warranty information on the receipt itself.

In countries like Japan, businesses must also include specific details such as the customer’s name or the method of payment for certain types of receipts, especially for transactions involving business expenses. Meanwhile, in some Middle Eastern countries, receipts may need to be digitally signed or include encrypted information to ensure authenticity.

Failure to meet these requirements could lead to penalties or invalid receipts in case of audits. It’s important to stay updated on the specific regulations for your jurisdiction and ensure that your receipt template includes all necessary information to remain compliant with local laws.

Choosing between digital and paper receipts requires assessing the specific needs of your business. Digital receipts reduce physical clutter and streamline record-keeping, while paper receipts offer a tangible option for customers who prefer physical copies. Both formats have their advantages, but selecting the right one depends on factors like customer preferences, costs, and environmental impact.

Digital receipts are quicker to issue and easier to store. With software solutions, you can send receipts directly to customers’ emails, minimizing the risk of loss. Additionally, they provide a convenient option for managing records, offering faster retrieval and better organization. However, not all customers may be comfortable with digital receipts, especially in industries where face-to-face interactions are common.

Paper receipts, on the other hand, are sometimes required by law or for specific industries like retail and hospitality. They can be kept as physical proof of purchase, which some customers may find reassuring. However, printing costs and the need for storage can add up, especially if your business processes a high volume of transactions.

| Aspect | Digital Receipts | Paper Receipts |

|---|---|---|

| Cost | Lower long-term costs, no paper or ink | Higher due to paper, ink, and printer maintenance |

| Storage | Easy digital storage and retrieval | Physical space required for storage |

| Customer Preference | Increasingly popular, but not universal | Preferred by some customers for tangibility |

| Environmental Impact | More eco-friendly, no paper waste | Less eco-friendly due to paper waste |

| Compliance | May not meet requirements in all regions | Accepted universally in most industries |

When deciding, consider what works best for your customer base and business operations. For companies focused on minimizing costs and environmental impact, digital receipts might be the better choice. On the other hand, if your customers expect paper receipts or your business is in an industry with strict regulations, paper receipts could be necessary. Hybrid systems that offer both options are also available for flexibility.

When using receipt templates, always double-check that all fields are completed correctly. Missing or inaccurate information can create confusion and lead to compliance issues. Ensure the following details are included:

- Business name and contact details

- Customer name and contact details

- Transaction date and unique receipt number

- Itemized list of goods or services with prices

- Total amount, including taxes

Another common issue is using templates with outdated or irrelevant fields. If the template includes sections that are no longer required by local regulations or business needs, remove them. This helps to keep the receipt clear and concise.

Don’t forget about formatting. A cluttered, difficult-to-read template can cause misunderstandings or errors. Use clean fonts, adequate spacing, and logical arrangement of information. This not only ensures clarity but also helps with faster processing of transactions.

Lastly, avoid using generic or unbranded templates. Customizing the receipt with your company’s logo and branding makes the receipt look professional and reinforces your business identity. It also builds trust with customers.

In this revision, I’ve reduced repetition while maintaining clarity and accuracy.

To streamline your receipt template, remove redundant phrases and ensure each section serves a clear function. For instance, avoid using similar terms for the same concept within the same section. Instead of repeating the same information, try to consolidate details where possible. For example, instead of listing “invoice number” and “receipt number” as separate fields, consider combining them under one label such as “Transaction ID” if applicable.

Enhancing Structure and Readability

Use bullet points or tables to organize information more effectively. Each section of the receipt should focus on a single element–date, item description, amount, and payment method. Reorganize the template layout to present these elements in a logical flow. This not only minimizes repetition but also improves the user experience by making the receipt easier to follow.

Optimize Terminology

Ensure that the terminology is consistent throughout the document. For example, choose either “total amount” or “grand total” but avoid using both terms interchangeably. Consistency in wording reduces unnecessary complexity and makes the document more straightforward for users to interpret.