For a clean and professional liquor store receipt, focus on including key details like the store name, itemized list of purchased products, quantities, prices, and taxes. Make sure each item has its price and total displayed clearly for the customer.

Include a barcode or QR code for easy inventory tracking or returns. If your POS system supports it, this feature will improve operational efficiency. Also, add a transaction number and timestamp to keep track of sales and simplify any future inquiries or audits.

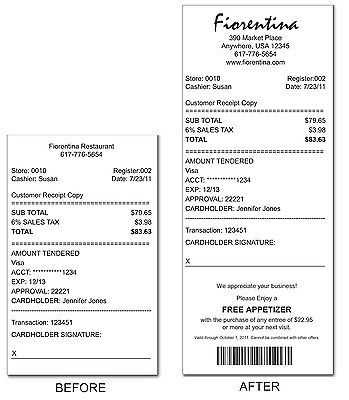

Design the template in a way that is easy for both customers and staff to read. Use clear fonts, and maintain a logical flow of information from top to bottom. Provide space for promotional details or loyalty rewards, as well as return or exchange instructions if needed. Keeping the receipt simple but informative is key to creating a user-friendly experience.

Liquor POS Receipt Template Guide

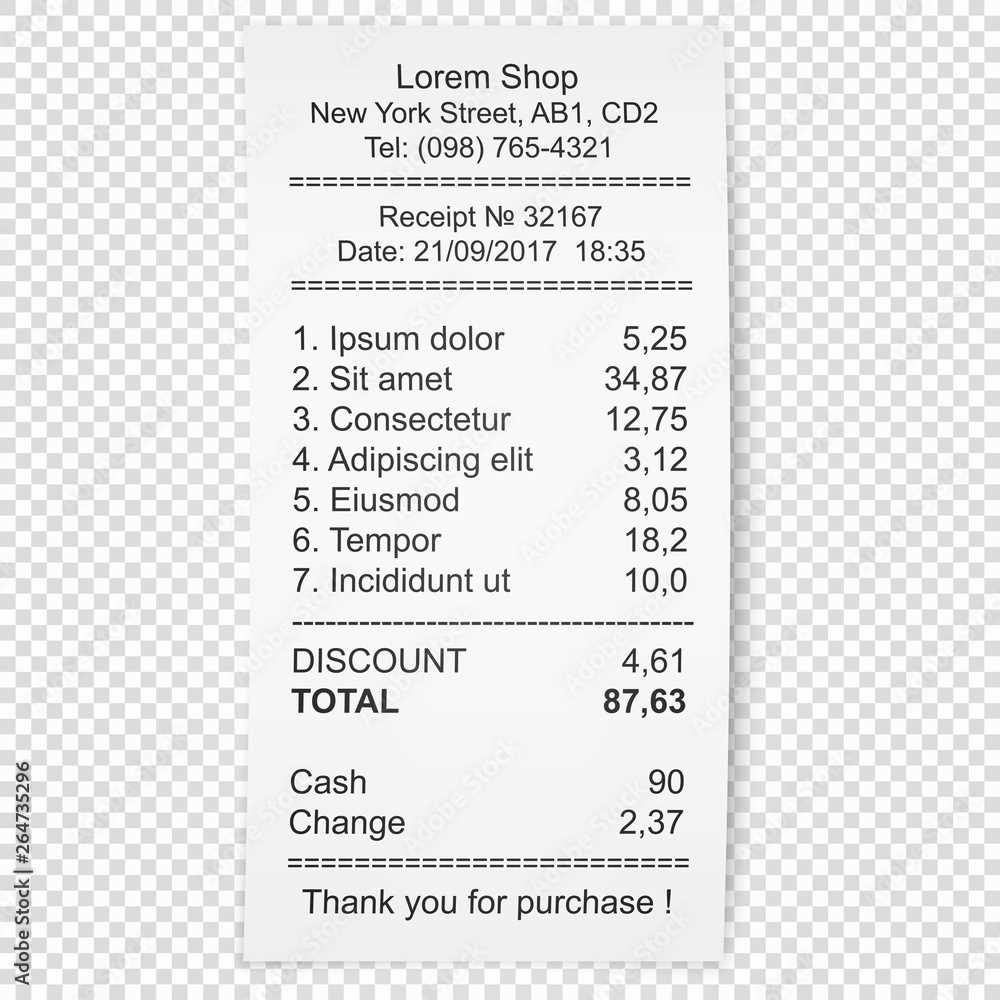

A well-structured POS receipt template for liquor stores ensures a smooth transaction process and provides customers with clear, concise information. Focus on including key details: item names, quantities, unit prices, and total cost. Each receipt should clearly display the date and time of the purchase, store name, and contact information. Ensure the format is simple and readable, with clearly defined sections for each item and its cost.

Key Elements of a Liquor POS Receipt

Each receipt should have the following components:

- Store Information: Include the store’s name, address, phone number, and tax ID number.

- Transaction Date and Time: Ensure the timestamp is accurate for future reference.

- Itemized List: Break down each product, including its quantity, description, and unit price. Highlight the total cost for each item.

- Taxes: Specify the applicable tax rate, ensuring customers understand the breakdown.

- Total Amount: Display the total cost at the bottom, including taxes and any discounts or promotions.

Additional Considerations

Some receipts may include payment methods, loyalty points, or membership details if applicable. Customizing the template to fit your store’s unique needs is recommended, but clarity and ease of reading should always remain the priority. Avoid cluttering the receipt with excessive information that might confuse customers.

Creating a Custom Template for Liquor Store Receipts

Begin by focusing on the layout of the receipt. Ensure that it is clear and easy to read. A clean design will help customers quickly identify the necessary information. Organize the receipt into distinct sections such as the store name, purchase items, pricing, and total amount.

- Store Name and Contact: Include the store’s name and contact information at the top of the receipt. This can also include the store’s address and website.

- Transaction Details: Below the store details, list the transaction date and time. This provides a timestamp for future reference.

- Itemized List: Display each purchased item in a clear, concise list. Include the name of the product, quantity, and price per unit. Use an easy-to-read font and spacing to separate each line.

- Taxes and Discounts: Add a section for any taxes applied and any discounts, if applicable. This ensures transparency and avoids confusion.

- Total Amount: Clearly highlight the total amount due. Use a larger or bold font to make it stand out.

Next, include a footer with payment details. Indicate the payment method, whether it was cash, credit card, or other options. This section can also have a thank-you note or store policy reminders.

- Payment Method: Specify how the customer paid for their purchase.

- Thank You Message: A short message of appreciation can improve the customer experience.

Lastly, ensure the design accommodates the printing format. Use a template that works with your receipt printer’s dimensions, making the most of the available space. Keep margins consistent, and consider adding logos or branding elements where appropriate to reinforce the store’s identity.

Incorporating Alcohol Tax Information on Receipts

Ensure transparency by itemizing alcohol taxes on receipts. Clearly separate the base price from applicable taxes to help customers understand their total cost.

| Item | Base Price | Alcohol Tax | Total Price |

|---|---|---|---|

| Whiskey 750ml | $25.00 | $2.50 | $27.50 |

| Red Wine 1L | $18.00 | $1.80 | $19.80 |

Use predefined tax rates based on local regulations and update them regularly. Label tax fields clearly, such as “State Alcohol Tax” or “Excise Tax,” for clarity.

Format receipts consistently across all transactions. Align decimal points, use readable fonts, and include a subtotal before tax calculations.

For digital receipts, ensure taxes are dynamically calculated and displayed in a structured format. Provide a breakdown per item rather than applying a single tax line to improve transparency.

Designing the Layout for Easy Legibility and Compliance

Use a clear font with high contrast. Choose a sans-serif typeface like Arial or Verdana in at least 10pt size. Black text on a white background ensures readability, while light gray or blue shades work well for secondary details.

Structure key information logically. Organize sections in a natural reading order: business details at the top, itemized purchases in the center, and total with payment method at the bottom. Separate each section with subtle spacing to improve clarity.

Ensure compliance with local regulations. Include tax breakdowns, business registration numbers, and legal disclaimers as required by jurisdiction. Highlight age restrictions for alcohol sales in bold near the receipt’s footer.

Make totals easy to find. Display the subtotal, taxes, and grand total in a larger, bold font. If discounts or promotions apply, list them clearly beneath the affected items rather than at the bottom.

Minimize clutter. Avoid excessive logos, decorative elements, or long promotional messages. If branding is necessary, place it in the header or a small footer section.

Use consistent alignment. Left-align text for easy scanning. Align numerical values, such as item prices and totals, to the right to improve readability.

Consider QR codes for digital integration. A compact QR code linking to loyalty programs, surveys, or digital copies keeps the receipt clean while adding functionality.

Including Item Descriptions and Alcohol Content Details

Provide clear descriptions for each item on the receipt to help customers verify their purchases. List the brand, type, and volume of liquor, ensuring transparency and accuracy. For example:

Whiskey – Jameson Irish, 750ml

Indicate alcohol content as a percentage by volume (ABV) to comply with regulations and assist customers in making informed decisions. Place this information next to the product name or in a dedicated column:

Whiskey – Jameson Irish, 750ml, 40% ABV

For mixed beverages or cocktails, list the main ingredients and their proportions if applicable. This improves clarity and helps customers understand what they are purchasing:

Margarita – 2oz Tequila (40% ABV), 1oz Triple Sec (30% ABV), Lime Juice

Ensure consistent formatting for readability. Use abbreviations like “ABV” for alcohol by volume and “ml” for milliliters. Keep descriptions concise while maintaining all necessary details.

Ensuring Legal Compliance with Local Alcohol Sales Regulations

Verify that every transaction follows local alcohol laws by integrating automated age verification into your POS system. Scanning government-issued IDs ensures accuracy and prevents underage sales.

- Maintain Digital Records: Store sales logs securely to track alcohol transactions, assisting in audits and legal inquiries.

- Display License Information: Clearly present required permits on receipts to confirm compliance with local authorities.

- Monitor Purchase Limits: Some jurisdictions impose restrictions on alcohol quantity per sale. Set up automatic alerts in your system to prevent violations.

- Apply Proper Taxation: Ensure the correct excise taxes are included in receipts, as tax rates vary by region and beverage type.

- Train Employees Regularly: Staff must recognize restricted sale hours and compliance rules. Regular training minimizes errors and legal risks.

Failure to comply can result in hefty fines or license suspension. Keep systems updated, monitor regulations, and implement compliance safeguards to avoid penalties.

Integrating Payment Methods and Total Calculation on Receipts

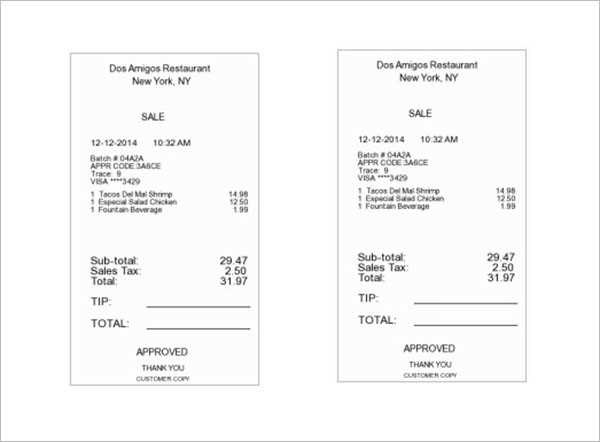

List payment methods clearly to eliminate confusion at checkout. Display cash, credit, debit, gift cards, and digital wallets with labels like “Payment Type: Visa” or “Paid via Apple Pay.” If multiple payments are used, list them separately: “Cash: $20, Card: $15.”

Breaking Down the Total

Ensure clarity by itemizing the receipt with subtotals, tax, and discounts. Example:

Subtotal: $45.00

Tax (8%): $3.60

Discount: -$5.00

Total: $43.60

Round totals accurately and use consistent decimal formatting ($10.00, not $10). If tips are allowed, add a line: “Tip: ____.”

Automating Calculation

Program the POS to apply tax based on location and automatically split payments when necessary. Ensure discounts and promotions adjust dynamically at checkout to prevent errors.

For digital receipts, provide itemized breakdowns and payment details in a structured format to improve readability.