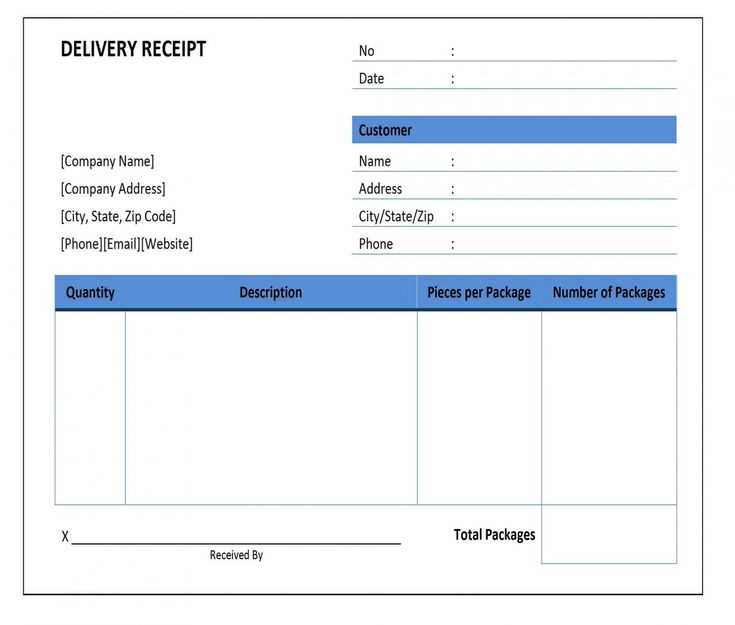

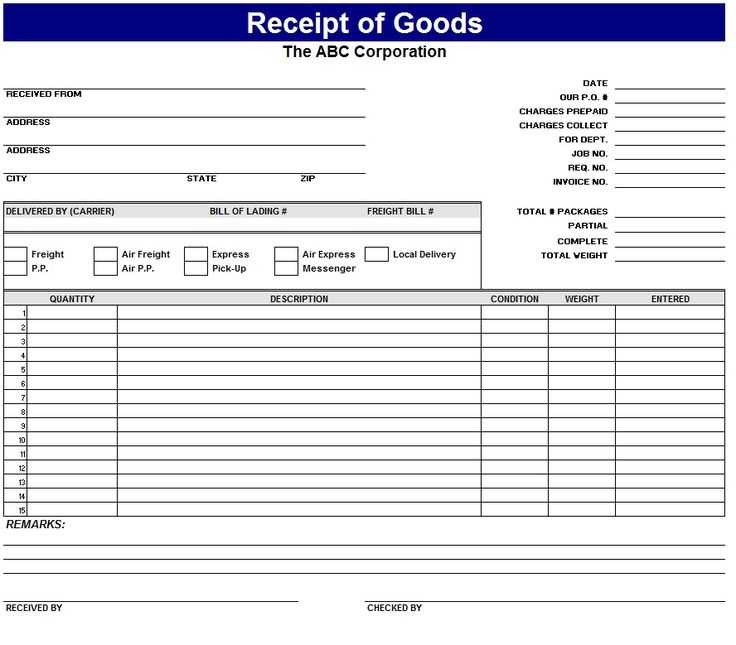

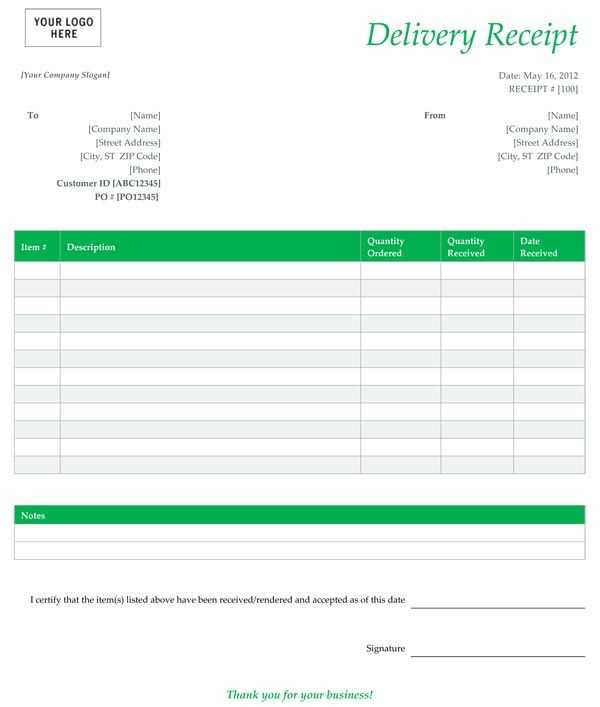

Choose a format that simplifies tracking financial transactions. A well-structured receipt template helps maintain clear records, whether for personal expenses or business purposes. Begin by including key details: date, item description, quantity, price per unit, and total cost. Keep the layout simple and organized for easy reference later on.

Focus on flexibility when designing the template. Customize it to fit specific needs, like adding tax calculations or payment methods. Including a space for the buyer’s and seller’s information enhances professionalism, especially for business transactions. Having a clear breakdown of each purchase makes reviewing records easier.

Additionally, make the template easy to update. Some receipts may require modifications, such as refunds or partial payments. A well-prepared document allows these adjustments to be reflected clearly. If using software tools, ensure the template can be easily exported or printed for convenience.

List of Receipts Template

Use a well-organized receipt template to streamline your documentation process. Start by listing the date, transaction number, and vendor information. Include the items purchased, their quantity, and the total amount charged, clearly separating taxes and discounts where applicable.

Receipt Components

Each receipt should have the following sections:

- Date: The exact date of the transaction.

- Vendor Information: Name, address, and contact details of the seller.

- Item Details: A description of the products or services, including quantity and price.

- Amount: The total sum, broken down into item cost, taxes, and discounts.

- Payment Method: Indicate whether the payment was made by cash, credit card, or other methods.

Formatting Tips

Ensure that the receipt is easy to read. Use a consistent layout with aligned text and clearly visible headings. For larger businesses, consider incorporating barcodes or QR codes for easy tracking. Adjust the font size for legibility and keep the text well-spaced.

How to Create a Simple Payment Receipt

Begin by clearly listing the payer’s details. Include the name, address, and contact information. If it’s a business transaction, add the company name and tax identification number.

Next, add the payment date and receipt number. These help in organizing and referencing the transaction later.

Clearly state the amount paid. Mention the currency and break down the payment into individual items or services if applicable. For example:

- Service or product name

- Quantity

- Price per unit

- Total amount

Don’t forget to specify the method of payment. Common options include cash, credit card, check, or online transfer. Add any transaction numbers or references, if necessary.

Finally, leave space for both the payer’s and recipient’s signatures. This can help verify the authenticity of the transaction.

Ensure the receipt is clear, professional, and free from clutter. Avoid unnecessary information that might confuse the parties involved.

Customizing a Receipt for Specific Transactions

For tailored receipts, adjust the template based on transaction details. Include transaction-specific information like item descriptions, quantities, and pricing variations. For example, if you’re processing a return, ensure the receipt reflects the returned items and any refunded amounts.

Incorporating Discounts and Taxes

Adjust the receipt to display any discounts or taxes applied during the transaction. Show the discount value clearly and apply it to the final total. Similarly, indicate any taxes separately to ensure transparency in the breakdown.

Personalizing with Customer Information

For personalized receipts, include customer data such as name or membership number. This adds a layer of customization, especially for businesses with loyalty programs, helping track customer history and future interactions.

How to Include Taxes and Discounts in Receipts

To include taxes and discounts correctly on receipts, follow a clear structure. Start by listing the pre-tax price of the product or service, followed by the applied taxes and discounts as separate line items. Taxes should be shown as a percentage of the subtotal, and the total tax amount should be clearly indicated. For discounts, list them as a percentage or fixed amount off the subtotal, and subtract the discount from the total price before taxes are applied.

Applying Taxes

For tax calculations, make sure to show the exact tax rate used. If there are multiple tax rates (for example, different rates for different products), each rate should be displayed along with the corresponding amount. This helps ensure transparency and clarity for the customer. If your location has a standard tax rate, it should be stated clearly on the receipt.

Applying Discounts

Discounts should be listed in a way that clearly shows how much the customer is saving. For percentage discounts, display the original price, the discount percentage, and the amount saved. For fixed discounts, simply show the amount deducted from the subtotal. Both types of discounts should be deducted from the subtotal before applying taxes to ensure accuracy in the final total price.

Adding Company Branding to Receipt Templates

To strengthen your brand identity, incorporate your company logo, color scheme, and fonts directly into receipt templates. This will not only make your receipts visually cohesive with your other marketing materials but also enhance brand recognition.

Logo Placement

Place your company logo at the top or in a prominent position on the receipt. Ensure it is clear and visible, but not overwhelming. Keep the size proportional to the rest of the elements on the receipt.

Consistent Color Scheme

Use your brand’s color palette for text, background, and accent elements. Choose colors that contrast well to ensure readability while maintaining brand consistency. Avoid using too many colors–limit it to two or three to keep the design clean.

Typography and Fonts

Stick to your brand’s font style for any text on the receipt. Use bold or italic styles sparingly to highlight important information such as the company name or contact details. Consistent typography across all materials builds a recognizable brand look.

Table Layout Example

Here’s an example of how to structure your receipt with branding elements:

| Item | Price |

|---|---|

| Product 1 | $10.00 |

| Product 2 | $15.00 |

| Total | $25.00 |

Incorporating your branding into receipt templates doesn’t just promote your business but also provides a professional and cohesive customer experience.

Organizing and Storing Receipt Records Digitally

Scan or photograph receipts as soon as you receive them. This keeps everything organized from the start and avoids the risk of losing paper copies. Store these images in a dedicated folder on your computer or cloud storage service. Using subfolders by date or category will help you locate specific receipts quickly when needed.

Label each file with clear names, such as the date and store or item. Avoid vague filenames like “Receipt1.” This makes it easy to search for a receipt later. If possible, use Optical Character Recognition (OCR) software to convert receipt data into searchable text, saving you time when you need to find a particular entry.

For ongoing organization, consider using a receipt management app. These apps can scan, store, and categorize receipts, often offering the ability to track expenses automatically. Look for features like expense reports, tax preparation tools, and integration with accounting software.

Always back up your digital records in multiple locations. Cloud storage is ideal for this purpose, but maintaining a physical backup on an external hard drive or flash drive provides additional security. This ensures that even if something happens to your primary storage, you still have access to your receipt records.

Legal Considerations for Issuing Receipts

Always include key details when issuing receipts: the name of the business, date of transaction, description of goods or services, and the total amount paid. These elements provide clarity and protect both the buyer and the seller.

Incorporate Local Tax Information

Include applicable tax rates, especially if your jurisdiction mandates it. Receipts should reflect any taxes collected, ensuring compliance with local regulations. This detail prevents misunderstandings and helps with future tax filings.

Ensure Clear Refund Policies

If your business offers refunds, clearly state the terms on the receipt. Make refund procedures simple to understand. This prevents disputes and builds trust with customers.

- State refund deadlines.

- Specify whether refunds are store credits or monetary returns.

- Clarify conditions under which refunds are offered.

For legal protection, always store receipts for the required period defined by local laws. This helps if a dispute arises or if you need to provide evidence of transactions for auditing purposes.