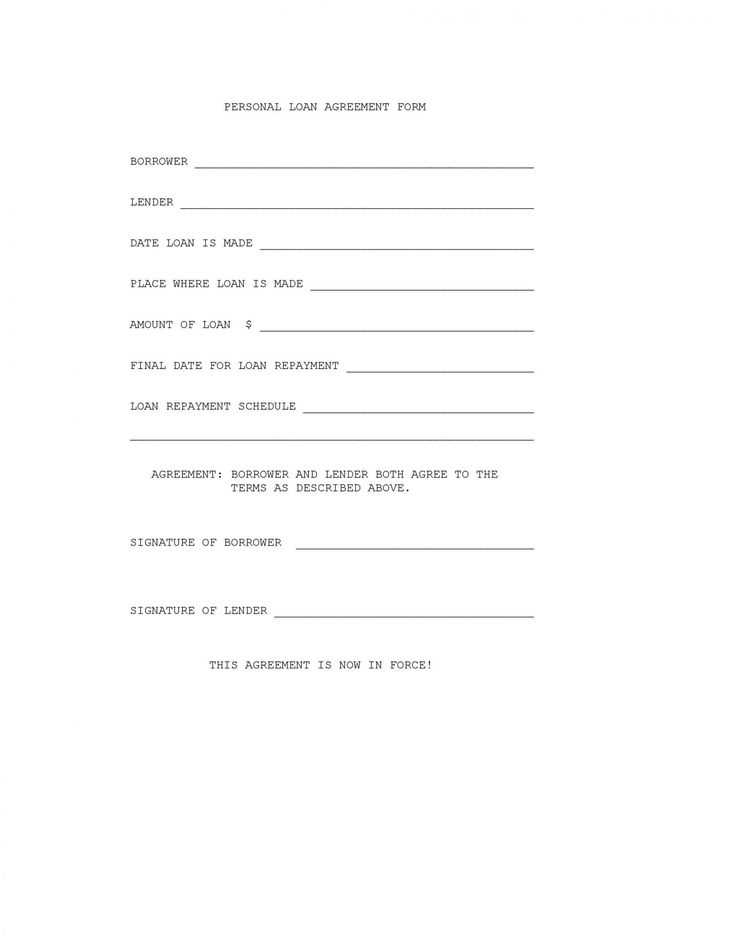

Creating a loan receipt agreement is a straightforward way to document the terms of a loan. It serves as a formal acknowledgment of the loan transaction, outlining the amount borrowed, repayment schedule, and any interest applicable. This agreement protects both the lender and the borrower by clearly stating the expectations and responsibilities of each party involved.

To ensure clarity and avoid misunderstandings, include key details such as the loan amount, interest rate (if applicable), repayment dates, and the consequences of non-payment. Customizing the template to suit your specific needs will help make the agreement more practical and enforceable. A well-drafted loan receipt agreement can prevent future disputes and foster a sense of trust between both parties.

Make sure the document is signed by both the lender and borrower, as this legally binding agreement confirms the loan terms and provides security for both sides. Use a loan receipt agreement template to streamline the process and ensure all necessary information is included without overlooking critical details.

Here are the revised lines with repetitions removed:

Ensure that the wording in your loan receipt agreement is clear and precise. Avoid redundant phrases that may confuse the reader or lead to unnecessary length. Below are examples of corrected lines:

- Original: “The borrower acknowledges the receipt of the loan amount, which is the total amount that has been borrowed.”

Revised: “The borrower acknowledges receipt of the loan amount.”

- Original: “The lender agrees to provide the loan, which the borrower has agreed to repay according to the terms.”

Revised: “The lender agrees to provide the loan, which the borrower will repay according to the terms.”

- Original: “The borrower will repay the total loan amount as per the agreed repayment terms.”

Revised: “The borrower will repay the loan as per the agreed terms.”

- Original: “This agreement outlines the terms of the loan, which both the borrower and the lender have agreed upon.”

Revised: “This agreement outlines the terms agreed upon by both parties.”

By eliminating repetitive wording, you streamline the document and enhance its clarity. Always aim to communicate terms as simply and directly as possible.

- Loan Receipt Agreement Template

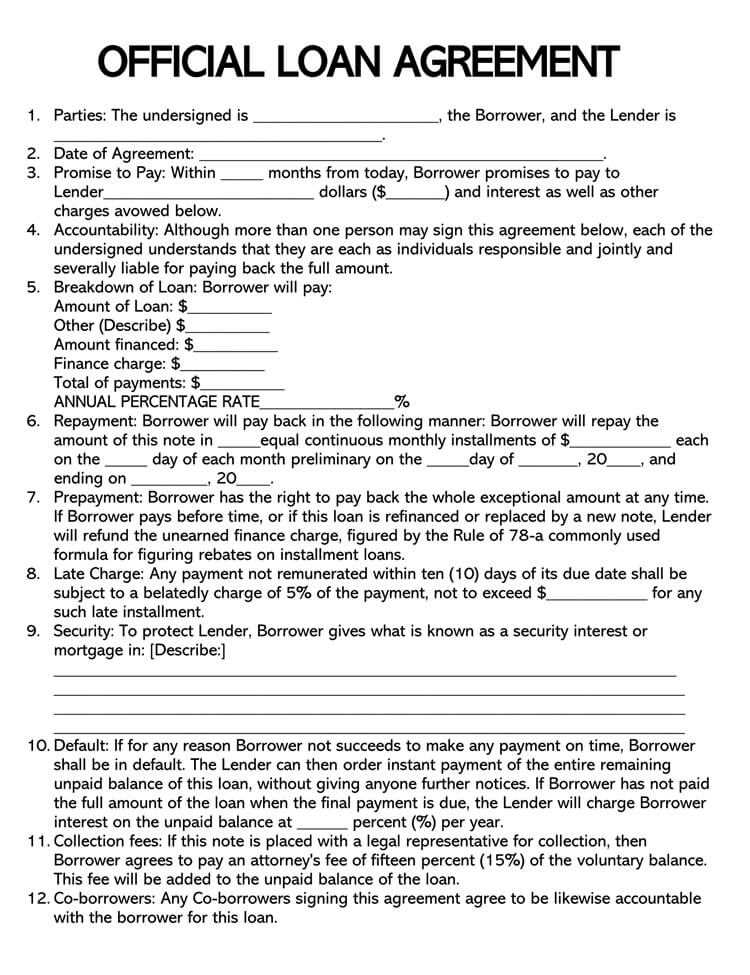

Clearly outline the terms of the loan in the agreement. Specify the loan amount, interest rate, repayment schedule, and the consequences for missed payments. The document should also include both the borrower’s and lender’s full names and contact information.

Loan amount and payment terms: Start with the exact sum being lent and how the payments should be made, whether in installments or a lump sum. Include payment deadlines, any late fees, and specify the interest rate if applicable. Add any clauses for early repayment options, if relevant.

Collateral and guarantees: If the loan involves collateral, clearly list the assets securing the loan. Make sure both parties understand the implications if the borrower defaults on the loan. Consider adding provisions for the lender’s rights in the event of non-payment.

Signatures and witnesses: Both parties should sign the agreement in front of a witness or a notary public. This adds a level of legal protection and ensures the contract is enforceable in case of disputes.

Always keep copies of the signed agreement for reference and future protection. Having these terms in writing helps avoid misunderstandings and ensures both parties are held accountable to the agreed terms.

Loan Amount: Specify the exact amount borrowed in clear terms. This ensures both parties agree on the financial sum and avoids misunderstandings later.

Repayment Terms: Outline the repayment schedule, including dates, amounts, and any late fees or penalties. This section defines how and when payments will be made.

Interest Rate: Clearly indicate whether there is an interest rate, its amount, and whether it is fixed or variable. If applicable, state how interest will be calculated over time.

Parties Involved: List the full names and contact details of both the lender and the borrower. This identifies each party legally and ensures clarity about their roles.

Loan Purpose: If the loan is for a specific purpose, mention it. This sets clear expectations on how the funds should be used.

Signatures: Ensure both parties sign the document, confirming their acceptance of the terms. This step finalizes the agreement and creates a legal bond between the lender and borrower.

Including these components creates a clear, effective agreement that protects both parties, ensuring mutual understanding and reducing potential legal conflicts.

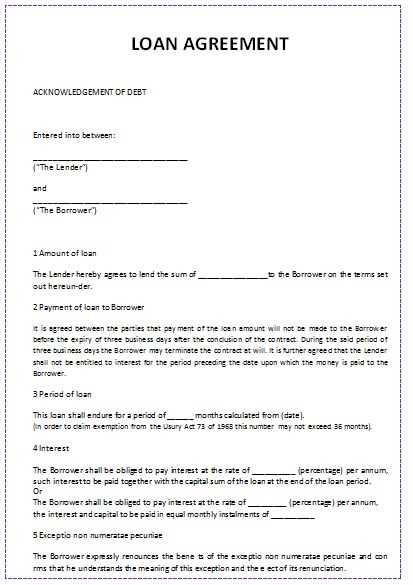

Begin by clearly identifying the lender and borrower. Specify the names, addresses, and roles (whether individual or business) of both parties. This ensures clarity in case of any disputes.

State the loan amount. Be specific about the sum being lent and the currency in which it is issued. Both the lender and borrower should have a clear understanding of the exact value of the loan.

Outline the repayment terms. Include the start date, payment frequency (e.g., monthly, quarterly), and duration of the loan. Clearly mention whether there is an interest rate applied, and specify the amount or percentage.

Include a clause on collateral if applicable. If the loan is secured, outline the collateral and any conditions related to its value or disposal in case of default. The terms for repossession or liquidation should be detailed and precise.

Define the consequences of default. Indicate the penalties for missed payments, including interest on overdue amounts or any additional charges that may apply. This provides the lender with protection in case of non-payment.

Clarify the dispute resolution process. In case of any disagreements, outline the procedures for resolving them, such as mediation or arbitration, to avoid lengthy court processes.

Specify the loan’s governing law. Determine which jurisdiction’s laws will govern the agreement, especially if the parties are from different regions.

Conclude with both parties signing the agreement. Ensure that both the lender and borrower sign and date the document, preferably in front of witnesses or a notary, to authenticate the agreement.

| Section | Description |

|---|---|

| Loan Amount | Clearly state the loan sum and the currency. |

| Repayment Terms | Specify the loan duration, payment frequency, and interest rate. |

| Collateral | Include any collateral and its related conditions if secured. |

| Default Consequences | Outline penalties for missed payments or non-compliance. |

| Dispute Resolution | Set out the procedure for resolving conflicts. |

| Governing Law | Specify which jurisdiction’s laws apply. |

Ensure you don’t overlook customizing the template with accurate details. Generic templates can lead to mismatched terms that don’t reflect the actual agreement. Review each section to match the specific loan terms, amounts, and repayment schedules.

Don’t ignore legal clauses. A common mistake is leaving out important legal protections or forgetting to include clauses specific to the loan type. These can provide clarity on defaults, late payments, and other contingencies that might arise.

Be cautious about unclear or vague language. Ambiguities in the agreement can lead to disputes later on. Use clear, precise terms and avoid language that can be misinterpreted by either party.

Don’t skip signing requirements. Ensure both parties sign the agreement. Without signatures, the loan may not be legally enforceable. Also, witness or notarization requirements, if applicable, should not be neglected.

Double-check for consistency throughout the document. Ensure dates, amounts, and names are correctly stated in every section. Inconsistencies can lead to confusion or problems in enforcement.

Lastly, avoid assuming the template covers all legal aspects. Templates provide a starting point but may not address specific regulations or requirements for your jurisdiction. Consulting with a legal professional ensures the document complies with local laws and protects your interests.

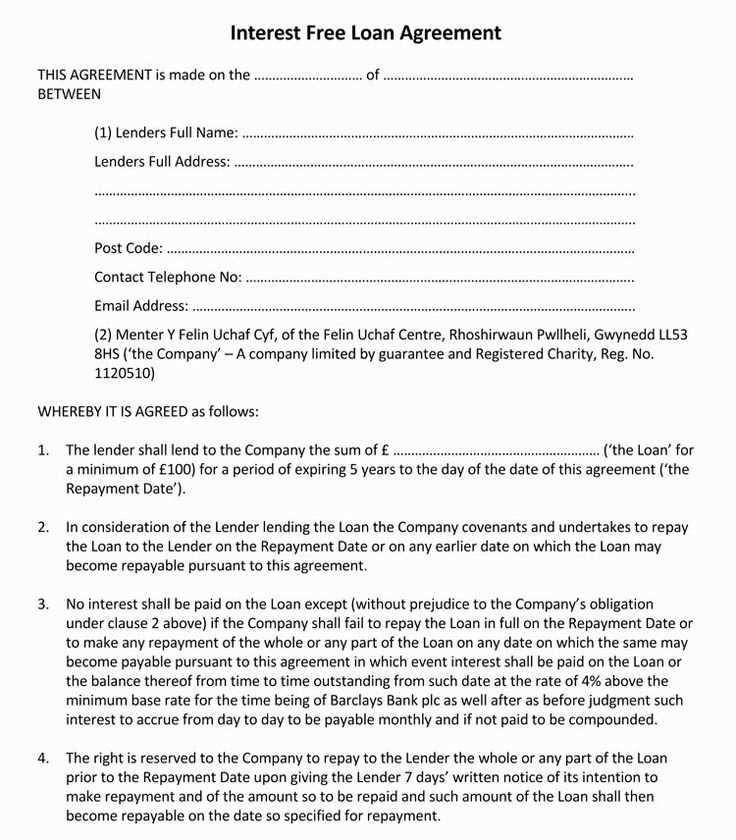

Ensure you clearly outline the loan terms within the agreement. Specify the loan amount, interest rate, repayment schedule, and any collateral involved. Without these details, both parties might face confusion or disputes in the future. Make sure to include the date of the agreement, loan duration, and any penalties for late payments.

Key Loan Details to Include

Clearly define the total loan amount and the interest rate. Add a payment schedule that lists how and when payments will be made, including due dates. If there are any fees associated with late payments or early repayment, make sure these are specified as well.

Security and Guarantees

If the loan is secured by collateral, provide a detailed description of the collateral. State the actions to be taken if the borrower defaults. If there are personal guarantees involved, include the specifics of these guarantees.