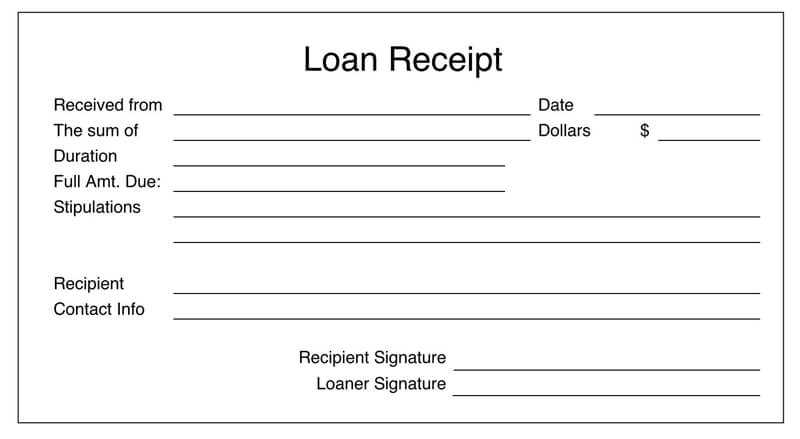

For a clear record of a loan transaction, always use a loan receipt template. This simple document serves as proof of the amount borrowed, terms, and repayment schedule. It ensures both parties understand their obligations and protects everyone involved.

Include key details in the template, such as the loan amount, interest rate (if applicable), repayment schedule, and the names of both the lender and borrower. Make sure the date and signatures are added to validate the agreement.

Using a well-structured template helps avoid confusion or disagreements later. It can be customized to suit personal loans, business transactions, or other financial agreements. Having everything clearly outlined minimizes risks and keeps both parties on the same page.

Here’s the revised version with the repetition of words minimized while keeping the meaning intact:

Use clear headings in your loan receipt template to define each section. Include details such as the borrower’s name, loan amount, and repayment terms. Avoid unnecessary terms and focus on the key facts.

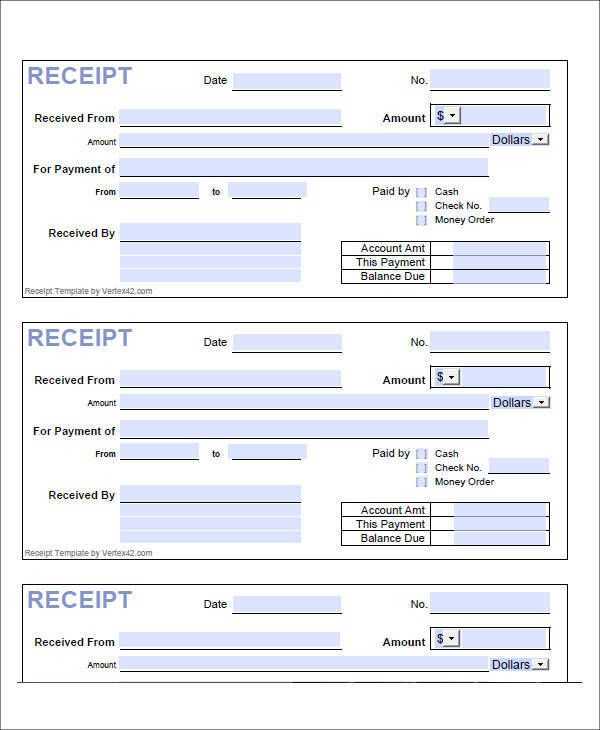

Structure and Layout

Ensure the template has a simple layout. Divide it into distinct sections: borrower information, loan specifics, and signature fields. This improves readability and reduces confusion.

Key Information to Include

Start with basic borrower details, followed by loan specifics. Specify the loan amount, interest rate (if applicable), and repayment schedule. Keep it direct and concise.

Finish with signature lines for both the borrower and the lender to confirm agreement. This makes the document official and avoids potential disputes.

Loan Receipt Template

What Key Details Should a Loan Receipt Contain?

How to Format a Loan Receipt for Clarity and Readability?

Customizing Loan Receipt Templates for Various Loan Types

Steps to Complete a Loan Receipt Template Correctly

Common Errors to Avoid When Using a Loan Receipt Template

How to Store and Retrieve Loan Receipts for Future Reference?

Loan receipt templates should include several key details to ensure accuracy and clarity. The borrower’s and lender’s names, loan amount, repayment terms, and date of the transaction must be clearly stated. It’s also important to include a description of the loan’s purpose and any relevant interest rates or fees. This information guarantees the validity and transparency of the receipt.

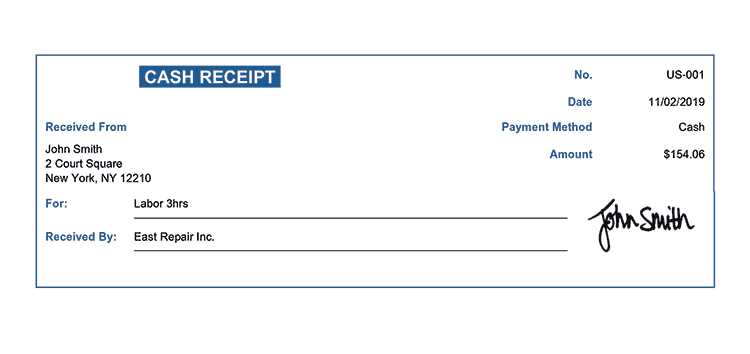

Formatting a loan receipt for clarity means organizing the content in a structured manner. Begin with headings for each section, such as “Borrower Information,” “Lender Information,” and “Loan Details.” Bullet points or tables can help break up large blocks of text, making the receipt easier to read. Make sure the font is clear, and there is enough space between sections to avoid clutter.

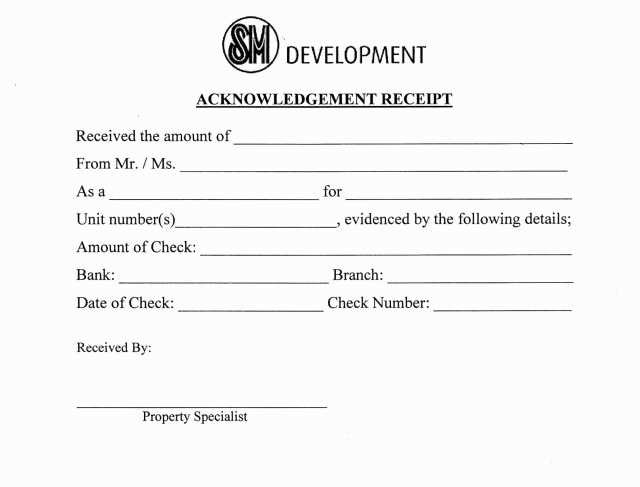

Customizing loan receipt templates for different types of loans requires adjusting the fields according to specific loan agreements. For example, a personal loan might not include collateral details, whereas a mortgage loan receipt should have property-related information. Add or remove sections based on the type of loan, such as adding the vehicle description for an auto loan.

To complete a loan receipt template correctly, fill in all required fields carefully. Double-check the loan amount, dates, and any specific terms. Ensure that both parties sign and date the document for confirmation. If the loan is being repaid in installments, list the payment schedule clearly.

Common errors when using a loan receipt template include leaving out critical details like the interest rate or loan term. Another common mistake is using vague language that might cause confusion later. Always ensure all figures are accurate and clearly defined to avoid any misunderstandings.

For future reference, loan receipts should be stored in a secure, easily accessible place. Use digital storage methods, such as cloud-based systems, to organize and retrieve receipts when necessary. Make sure to label each receipt clearly, including the date and loan type, to simplify searching.