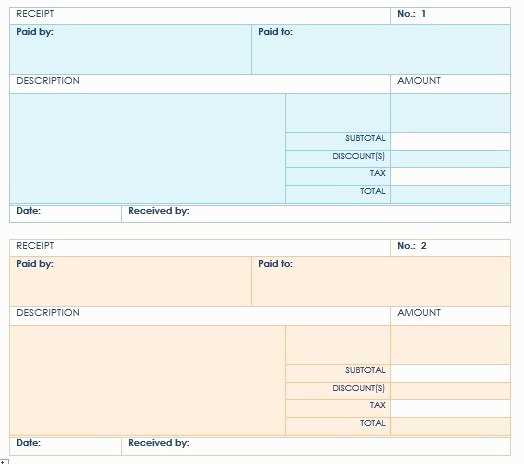

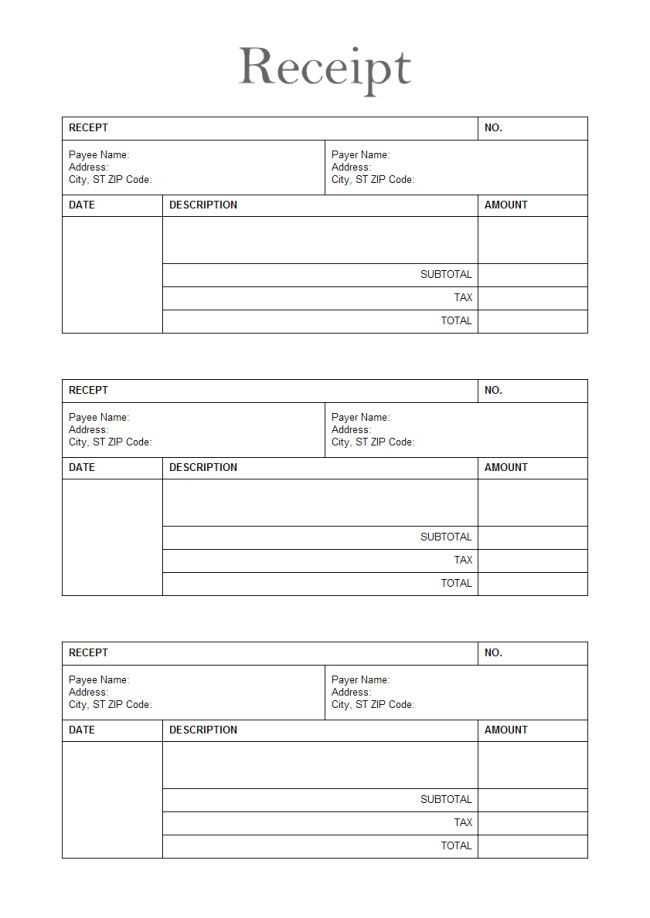

Use a detailed long receipt template to streamline transaction records, ensuring clarity and accuracy for both customers and businesses. This approach helps track every product or service purchased, along with itemized taxes, discounts, and additional fees. By maintaining a clean, organized format, users can easily reference past purchases or handle disputes without unnecessary confusion.

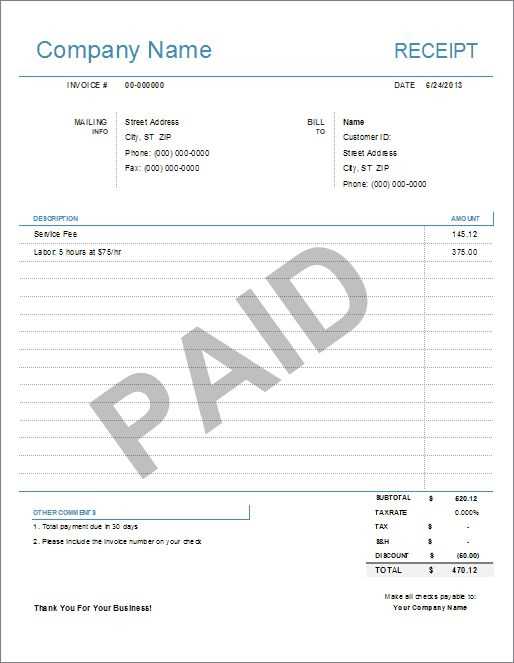

Structure the template to include sections for store information, item descriptions, and clear calculations. Each entry should include the product name, quantity, unit price, and total price. Implement a section for taxes and any applicable discounts. Providing a subtotal before taxes and fees ensures transparency in pricing, allowing both customers and businesses to double-check the final amounts.

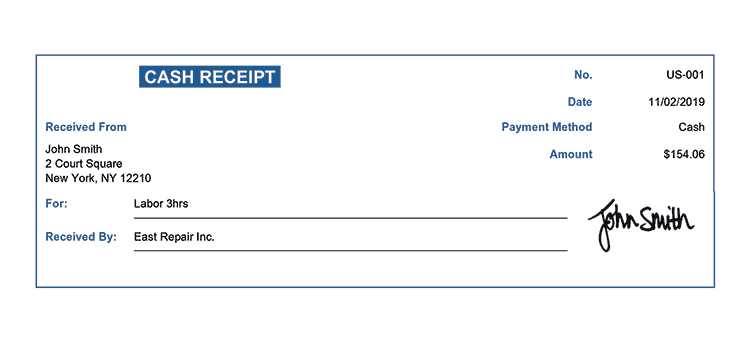

Incorporate customer contact details, the payment method used, and the transaction date to keep the receipt informative. Don’t forget to leave space for the store’s return policy or warranty information at the bottom for easy access when necessary. A well-crafted long receipt template builds trust by offering detailed, easy-to-understand purchase data, fostering positive customer relationships.

Here’s the revised version without word repetition:

The key to creating a concise and clear receipt template lies in avoiding redundant words. Instead of repeating terms, consider using synonyms or restructuring sentences for clarity and flow.

Key Adjustments to Consider:

- Avoid repeating product or service names. If multiple items are listed, group them together for a streamlined presentation.

- Instead of repeating “total amount,” use “final price” or “total cost” as appropriate.

- Clarify payment details by alternating between “paid” and “amount received” instead of repeating “payment” or “transaction” multiple times.

Examples of Effective Language Choices:

- Use “total cost” once, then refer to the “final amount” for the summary section.

- In the details section, say “Product 1,” then “Item A,” and alternate between these terms to avoid redundancy.

- For payment confirmation, state “Paid by credit card” and then “Amount cleared” in the payment section.

Implementing these simple modifications can drastically improve readability, ensuring that your receipt template looks professional and is easy to understand at a glance.

- Long Receipt Template Guide

Structure your long receipt clearly with key details to ensure the document is easy to follow. Break down each section logically and use proper formatting to enhance readability.

Header Information

Place your company name, logo, and contact information at the top. Include relevant identification numbers, such as tax or registration details. This section should be easily noticeable and professional.

Itemized List

Present each purchased item with its name, quantity, unit price, and subtotal. Clearly separate taxes, discounts, or additional charges to maintain transparency. The final total should be clearly displayed, and make sure to highlight payment methods, such as card or cash, for further clarity.

Incorporate a section for transaction details like date, time, and receipt number. This can help track the purchase and improve customer service.

Design a clear, easy-to-read structure for your receipt template by following these steps. Start with your business name, contact information, and logo at the top for immediate identification. Place customer details, like name and address, beneath this section for a personalized touch.

Detail the Transaction Information

List items purchased with columns for description, quantity, unit price, and total price. This helps the customer easily track their purchase. Follow the itemized list with a subtotal and tax breakdown. If applicable, show any discounts or promotions. Ensure the total amount is prominently displayed.

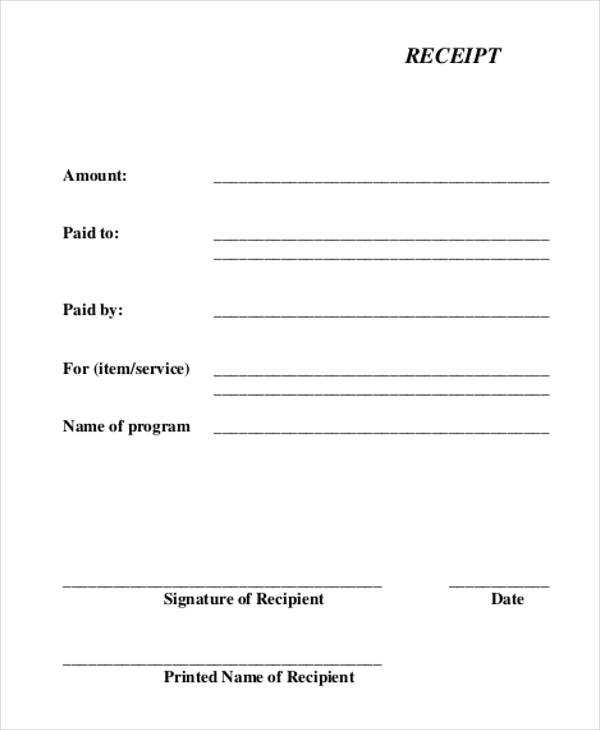

Include Payment and Policy Information

Include a section for payment method (e.g., credit card, cash) and transaction ID, if necessary. Add any relevant refund or return policies. Conclude with a thank-you note or a call to action for customer feedback or future purchases. This section helps in building rapport and encourages customer loyalty.

Tax compliance requires clarity and accuracy. To ensure a receipt meets tax standards, include the following key details:

1. Business Information

Include the full name of the business, its tax identification number (TIN), and the physical address. This establishes the legitimacy of the transaction and is required by tax authorities.

2. Transaction Details

Clearly outline the date and time of the transaction, the total amount paid, the breakdown of items or services purchased, and the applicable taxes. This information helps authorities verify that the correct tax rate was applied and ensures the correct documentation of each sale.

| Item Description | Quantity | Price | Tax Rate | Total |

|---|---|---|---|---|

| Product A | 2 | $50.00 | 10% | $110.00 |

| Service B | 1 | $100.00 | 10% | $110.00 |

Ensure that each line item is easily identifiable, with clear unit prices and applicable taxes, providing full transparency of the purchase process.

3. Tax Breakdown

List the specific tax rate applied and the tax amount separately from the total amount. It is also useful to state the jurisdiction under which the tax rate is valid, whether it is state, federal, or local.

4. Payment Method

Indicate how the transaction was paid (e.g., cash, credit card, bank transfer). This confirms the legitimacy of the payment and may be useful for future audits.

Place your logo at the top for quick brand recognition. Use your brand’s color scheme and fonts to create a seamless experience that reflects your overall branding.

Include a short thank-you message to show appreciation for your customers’ business. You can also add a personalized offer or discount to encourage future purchases.

Make key details like total price, items, and payment method easy to locate. A clean and organized layout ensures customers can quickly review the important information on their receipt.

Add value by including details like return policies, loyalty program information, or customer service contacts. This provides customers with useful information, enhancing their experience and encouraging repeat visits.

Update your receipt template regularly to reflect changes in your business or branding. This keeps your receipts fresh and in line with any new offers or promotions you might have.

Use the </ul> tag to close an unordered list in HTML. It should always be placed after the last <li> element within the list. Ensure that every opening <ul> tag has a corresponding closing </ul> tag to maintain proper HTML structure and prevent layout issues.

Closing Tags in Lists

Remember, </ul> doesn’t contain any content. Its only function is to signal the end of the list. An improper or missing closing tag can lead to unexpected formatting behavior or render additional items outside the intended list structure. Always double-check for correct tag pairing.

Best Practices

While the </ul> tag is necessary, it’s important to avoid leaving unnecessary empty spaces before or after the closing tag. Clean, concise HTML makes for better performance and easier readability, especially when the document becomes more complex.