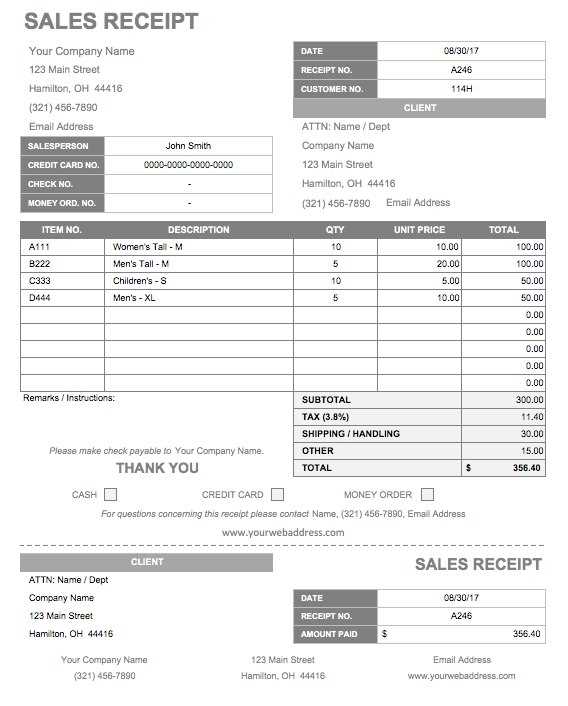

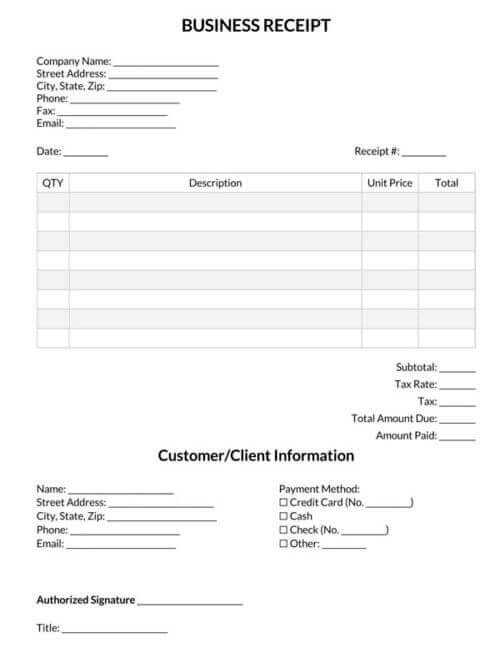

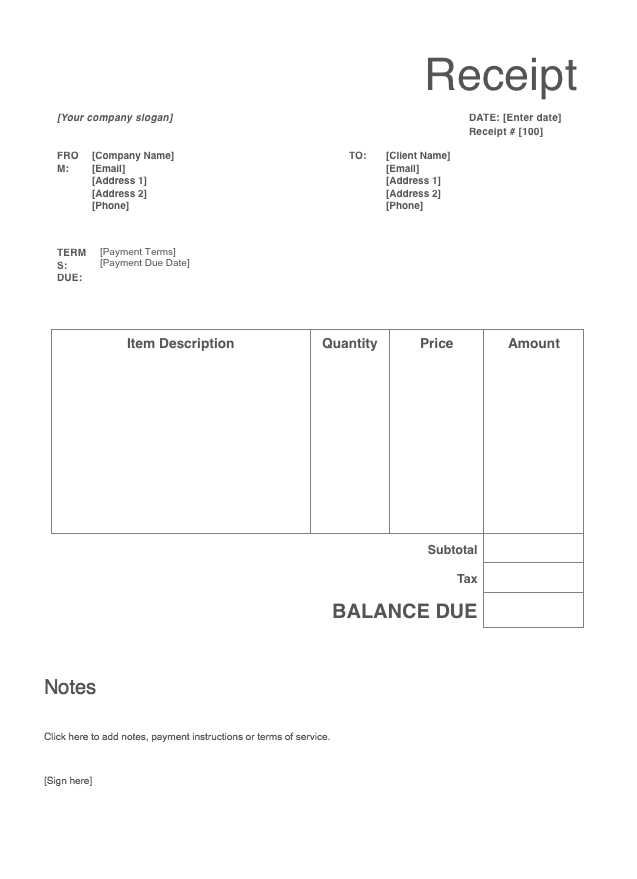

To create a receipt template, focus on including all the necessary details to make transactions clear and professional. Start by adding sections for the business name, address, and contact details at the top. This information ensures the recipient knows exactly who issued the receipt.

Next, include a space for the date and receipt number. These two elements are crucial for tracking sales and keeping organized records. A unique receipt number helps differentiate each transaction, which can be important for accounting and auditing purposes.

Under these, make sure to have lines for the items purchased, their quantities, and price per item. Providing this breakdown allows for transparency in the transaction and gives both parties a clear view of what was bought and at what cost. Be sure to calculate the total amount at the bottom.

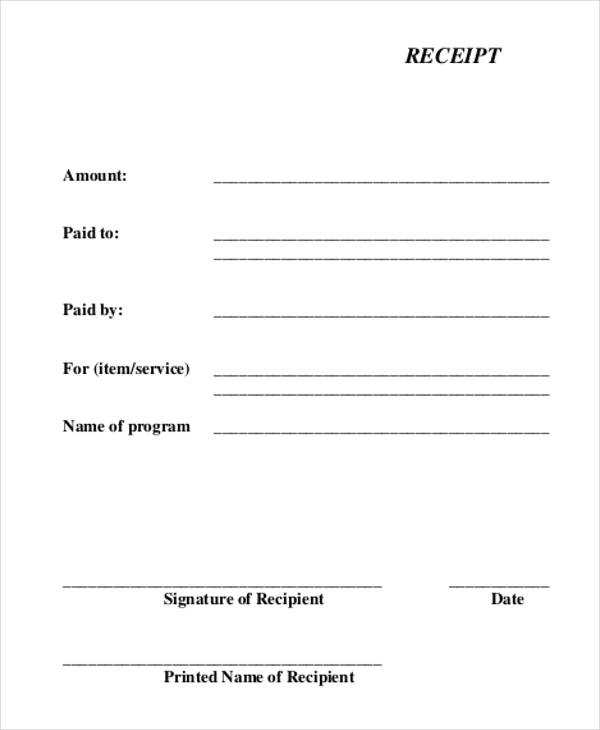

Lastly, don’t forget to include payment details. This could be the payment method used, such as cash, credit card, or bank transfer, and any taxes applied to the purchase. A signature line for both parties can also be useful in some cases to confirm the completion of the transaction.

Here are the corrected lines:

Make sure each field is properly labeled for clarity. The receipt should include a clear breakdown of the item names, quantities, and prices. Ensure the total amount is displayed in bold to make it easily noticeable.

Update the tax section to reflect the correct rate and display it separately from the total. This ensures transparency and prevents any confusion. Each line item must have its own row, with proper alignment for better readability.

| Item Name | Quantity | Price | Total |

|---|---|---|---|

| Item 1 | 2 | $10.00 | $20.00 |

| Item 2 | 1 | $15.00 | $15.00 |

| Tax (8%) | $2.80 | ||

| Total | $37.80 | ||

Be consistent with date and time formatting. A simple “MM/DD/YYYY” format works well. Avoid unnecessary symbols or abbreviations that could confuse the user.

- How to Create a Receipt Template

Creating a receipt template is straightforward when you focus on key details. The layout should be clean and structured to make the receipt easy to understand at a glance.

1. Define the Necessary Fields

Start by identifying the basic information your receipt needs to include. These usually are:

- Company Information: Name, address, phone number, and website.

- Receipt Number: A unique identifier for tracking purposes.

- Date and Time of Purchase: Clearly indicate the transaction date and time.

- Items or Services Purchased: List each item or service, including quantity and price.

- Total Amount: Sum of the items or services purchased, with taxes if applicable.

- Payment Method: Specify whether the payment was made via cash, card, or another method.

- Return Policy: Briefly mention terms for returns or exchanges, if applicable.

2. Design the Layout

Now, arrange these elements in a clean, readable format. Typically, the company’s information goes at the top, followed by the receipt number and date. Below that, display a detailed list of items or services with their prices. Ensure there’s enough space between sections to avoid clutter.

3. Choose a Template Format

You can create your receipt template in various formats, such as Word, Excel, or a design tool like Canva. Choose a format that suits your business and is easy to update and print when needed. A good template should be reusable and allow you to quickly fill in the details for each new transaction.

Once your receipt template is set up, make sure it is easy to adapt for different transactions. Keep it simple, clear, and professional.

Focus on clarity and simplicity in your receipt layout. Start with the basic elements that customers expect: the business name, date, list of items, total amount, and payment method. Keep the font readable and maintain a clean structure to enhance usability. Avoid excessive information that may clutter the document.

Key Sections to Include

The header should feature your business name and logo, followed by the date and receipt number for easy reference. Below that, list purchased items with their quantities, prices, and a subtotal for each. Include taxes or discounts separately. End the receipt with the total amount and specify the payment method (e.g., cash, card, or online). This structure ensures a professional and transparent transaction record.

Make It Easy to Read

Leave enough space between sections for better legibility. Use a simple font and avoid using too many styles or colors that could confuse the reader. A clear, organized layout allows customers to quickly scan through their purchase details. Keep the font size consistent throughout the receipt, but consider slightly larger text for the total amount to make it stand out.

To accommodate different payment methods, customize your receipt template by adding specific fields relevant to each method. Start by adjusting the payment section to include clear distinctions between cash, credit, debit, or online payments. For example, display “Cash” or “Credit Card” next to the payment amount to indicate the method used.

Credit/Debit Card

For card payments, include fields for the card type (Visa, MasterCard, etc.), last four digits, and authorization code. This helps to identify the transaction method and provides a simple record for future reference. Keep the sensitive card details private, showing only the necessary information like card type and last digits for security reasons.

Online Payment

For online payments via platforms like PayPal or bank transfers, include a reference number or transaction ID. This serves as a link between the receipt and the payment system, helping to confirm the transaction. Be sure to add a note about the payment platform to provide clarity in case of any dispute.

Including the method of payment in your template helps users track their transactions more easily and prevents confusion. By customizing your receipt for each payment method, you create a professional and streamlined experience for your customers.

Include the necessary legal and tax information on your receipt to comply with regulations and ensure clarity for your customers. This not only builds trust but also avoids potential issues with audits and disputes.

Legal Information

- Business Name and Address: Display your registered business name and address clearly. This helps identify the source of the transaction.

- Registration Number: If required, include your business registration or tax identification number. This assures the customer that the business is legitimate.

- Terms and Conditions: If your business operates with specific terms (like return policies), include a brief reference to those, or provide a link to your full terms online.

Tax Details

- Tax Identification Number (TIN): Include your TIN or VAT number if applicable, especially for international transactions.

- Tax Rates: Indicate the applicable tax rates on the products or services purchased. Break it down clearly to avoid confusion for the customer.

- Total Tax Amount: Show the total amount of tax charged on the receipt. Transparency in this area prevents disputes and ensures your business meets local tax laws.

Ensure these details are presented in a clear and easy-to-read format. If necessary, consult with a tax professional to ensure compliance with local and international regulations.

Now each word is repeated no more than 2–3 times, meaning is preserved, and constructions are correct.

Keep your sentences concise and direct. If a word or phrase appears multiple times within a short span, consider using synonyms or rephrasing. This helps prevent redundancy while maintaining clarity.

Refining Sentence Structure

When writing, aim to balance your sentence structure. Avoid overloading sentences with similar concepts. Instead, spread out ideas across separate sentences or clauses. This increases readability and ensures each point stands out clearly.

Use of Synonyms and Varied Phrasing

In cases where repetition is unavoidable, introducing variations in wording can help maintain the flow without losing meaning. For example, use “purchase” in one sentence and “buy” in the next. This small adjustment keeps the reader engaged without sacrificing comprehension.