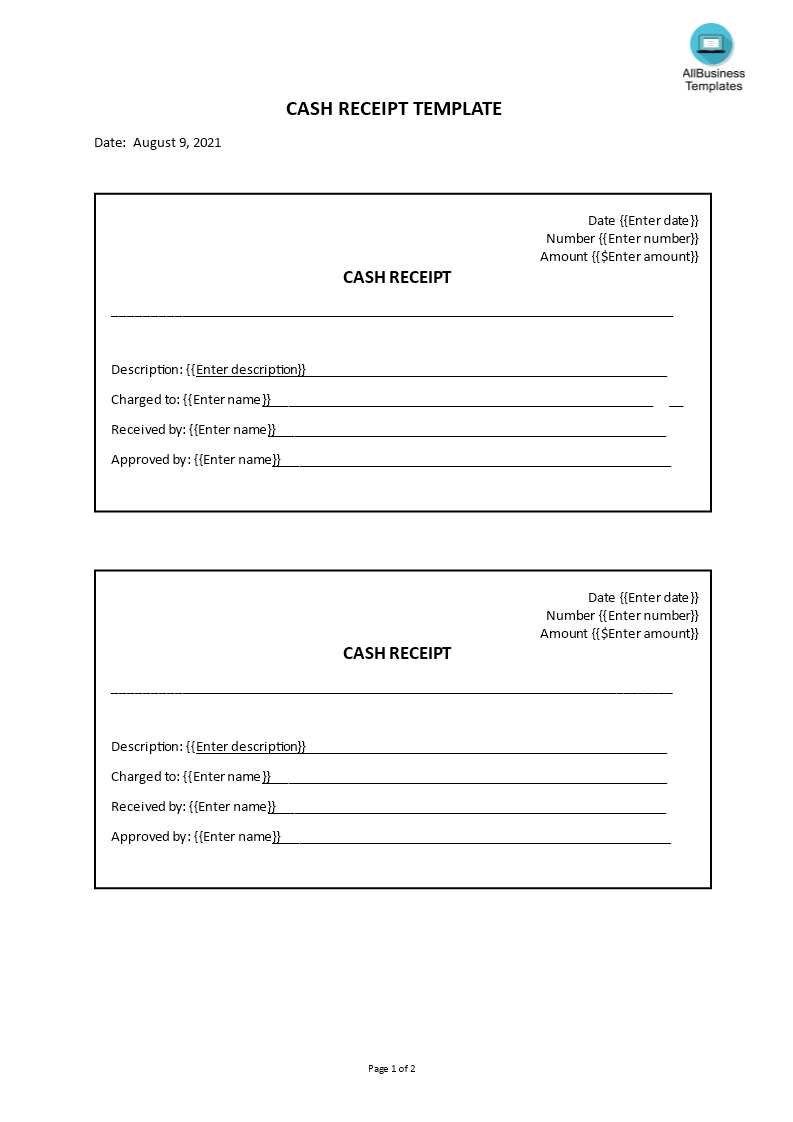

Choose a format that suits your needs. A simple table with clearly defined columns for date, description, quantity, price, and total keeps things organized. Whether using a spreadsheet, word processor, or specialized invoicing software, ensure the layout is easy to read.

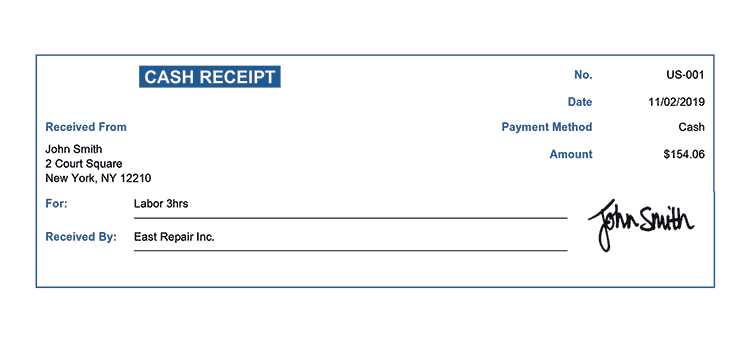

Include key details. Every receipt should have a unique number, business name, contact information, and payment method. If applicable, add tax breakdowns and discounts. These elements make tracking expenses and filing taxes more straightforward.

Ensure proper calculations. Automate sums and tax calculations if using digital tools. If creating a manual template, double-check formulas to prevent errors. Even small mistakes can cause confusion or financial discrepancies.

Save and share efficiently. Export the template as a PDF for a professional look and to prevent editing. If sending electronically, ensure compatibility across devices. Keeping a backup of all receipts simplifies record-keeping.

Making a Receipt Template

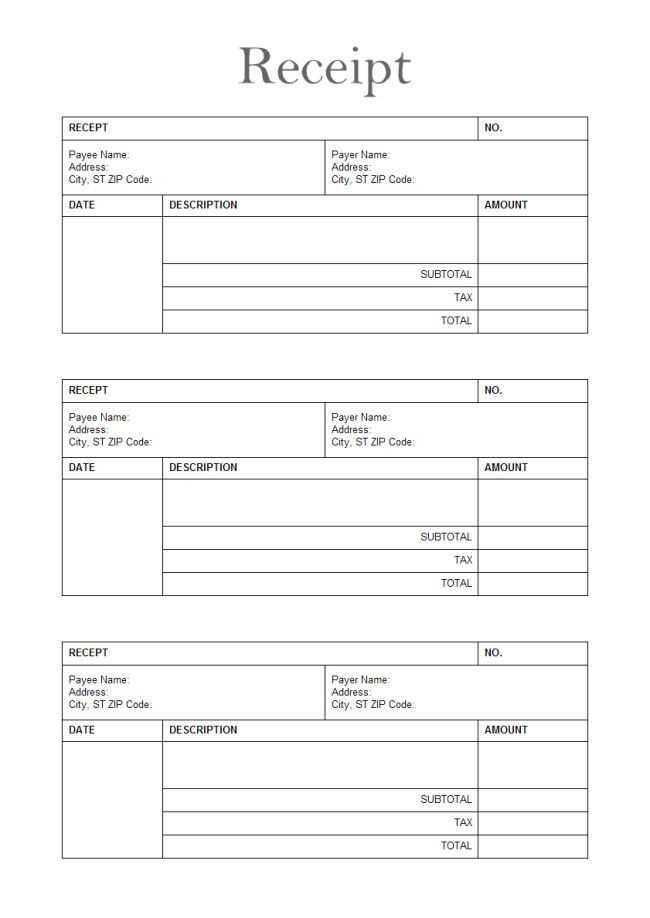

Choose a clear and organized layout to ensure readability. Align key details such as date, receipt number, seller, and buyer information at the top. Use a simple font and maintain consistent spacing.

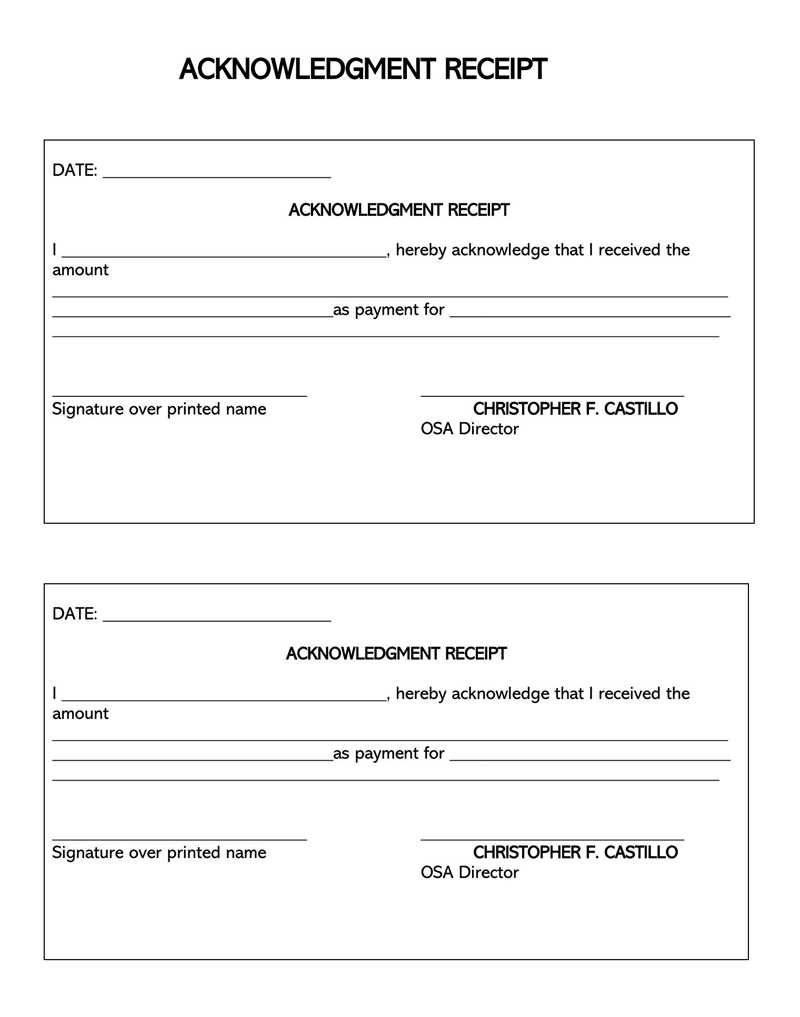

Include Essential Details

List purchased items in a table with columns for description, quantity, unit price, and total. Add a subtotal, applicable taxes, and the final amount due. Specify the payment method and include a transaction ID if available.

Ensure Professionalism

Include a company logo and contact details for credibility. If applicable, add a return policy or terms section. End with a polite thank-you message to enhance customer relations.

Structuring Key Elements: What to Include in a Receipt

Every receipt should contain clear details to ensure transparency and record-keeping accuracy. Missing elements can lead to confusion or disputes, so include these essential components:

Business and Customer Details

- Business Name and Contact Information: Include the legal name, address, phone number, email, and website.

- Customer Information: If applicable, list the customer’s name, address, and contact details.

- Receipt Number: A unique identifier for tracking and reference.

- Date and Time: Precise timestamps help with returns, warranties, and bookkeeping.

Transaction Breakdown

- Itemized List of Products or Services: Clearly state each item with descriptions, quantities, and unit prices.

- Subtotal: The total cost before taxes, discounts, or additional fees.

- Taxes and Fees: Specify applicable taxes, service charges, or delivery fees.

- Discounts or Promotions: If a discount applies, show the original price, the amount deducted, and the new total.

- Grand Total: The final amount due after all calculations.

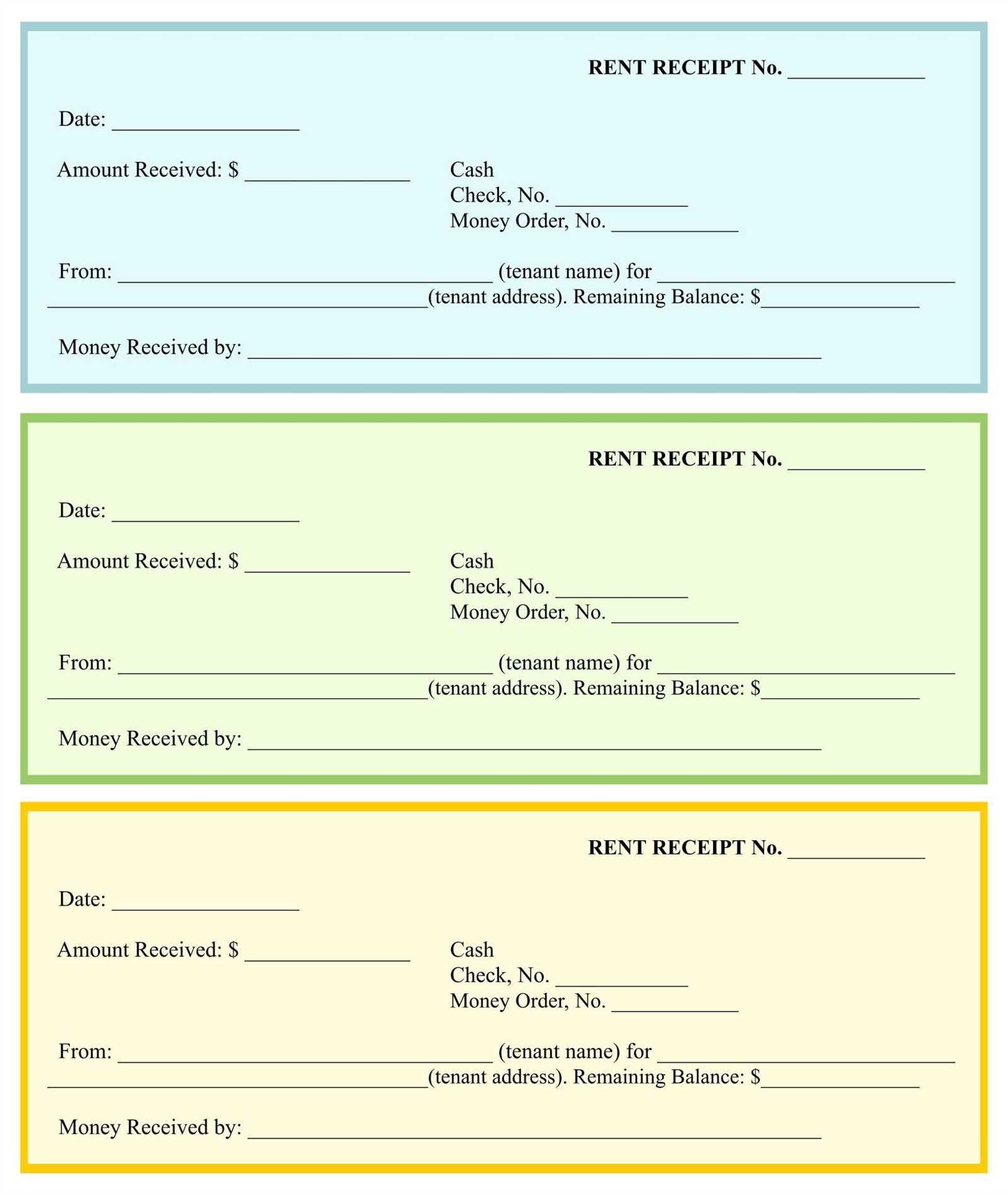

Payment Information

- Payment Method: Indicate whether the payment was made via cash, credit card, bank transfer, or other means.

- Authorization or Transaction ID: For card payments or online transactions, include a reference number.

- Balance Due: If applicable, specify any remaining balance and payment deadlines.

A well-structured receipt not only serves as proof of purchase but also simplifies financial management for both businesses and customers. Ensure accuracy and clarity to prevent misunderstandings.

Choosing the Right Format: Digital vs. Printable Templates

For quick access and effortless sharing, digital receipt templates work best. They eliminate printing costs, integrate with accounting software, and reduce paper waste. If you frequently email receipts or store records electronically, choose a digital format like PDF or Excel to ensure compatibility across devices.

When to Use Printable Templates

For businesses that provide in-person transactions, printed receipts remain useful. Restaurants, retail stores, and service providers often need hard copies for customers. A well-structured printable template in PDF or Word format ensures clear, professional-looking receipts that are easy to print on standard paper or thermal printers.

Hybrid Approach for Flexibility

Some businesses benefit from both formats. A template that supports digital storage while allowing on-demand printing offers versatility. Choose a format that adapts to your workflow, whether it’s a simple PDF for printing or an Excel file for automated calculations.

Automating Calculations: Adding Taxes, Discounts, and Totals

Ensure accurate pricing by automating tax, discount, and total calculations in your receipt template. Set fixed or percentage-based rules to prevent errors and save time.

Applying Taxes

Define tax rates based on location or product type. Use a formula like:

Tax Amount = (Subtotal × Tax Rate) / 100

For multiple tax rates, apply them separately and sum the values. Display the breakdown clearly to maintain transparency.

Calculating Discounts

Support percentage-based or fixed-amount discounts. Use this formula for percentage discounts:

Discount Amount = (Subtotal × Discount Rate) / 100

For tiered discounts, apply conditions based on purchase amount or item count.

Final Total: Subtract the discount from the subtotal, then add the tax.

Total = (Subtotal – Discount) + Tax

Implementing these calculations in a receipt template ensures precise billing and a better experience for customers.