Creating a manual credit card receipt template is a straightforward process that ensures smooth transactions and clear records. This template is especially useful for businesses that handle in-person payments and need to provide customers with a printed or handwritten record of their purchase.

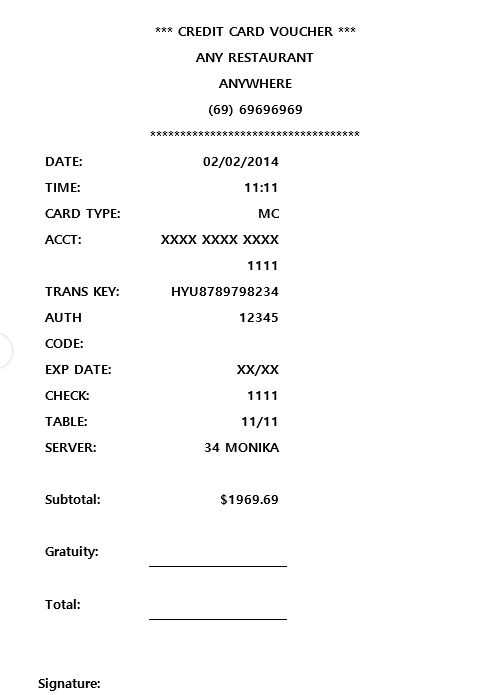

Start by including basic transaction details such as the merchant name, date, and time of the transaction. This information allows both the customer and the business to reference the purchase if needed. A field for the credit card number (last four digits) is important for identification without compromising the customer’s privacy.

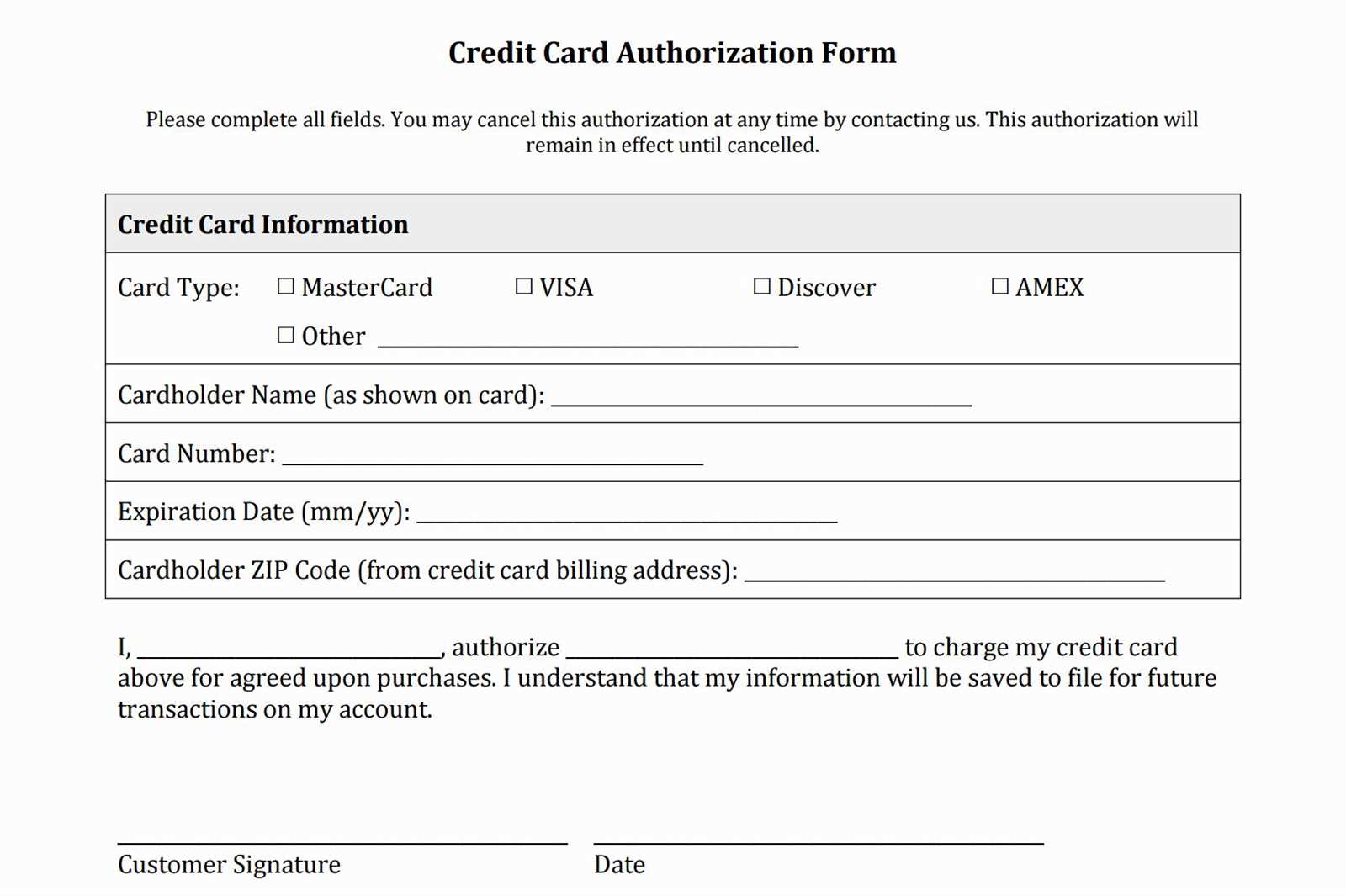

Next, make space for the purchase amount, listing both the total and any applicable taxes. It’s helpful to add a transaction ID to simplify future queries or potential disputes. If applicable, also include a signature field for the cardholder to authorize the payment, confirming the transaction took place.

For businesses that require extra flexibility, leaving space for additional notes or custom fields can help capture any other necessary details. Keeping the template simple, with clearly defined sections, helps streamline the process while still ensuring accuracy in the information provided.

Here’s the revised version, where words don’t repeat more than 2-3 times:

To create a clean and professional credit card receipt, make sure to use clear, concise headings. Begin with the merchant name, followed by the transaction date and time. Next, provide the amount charged, including the currency symbol, and list any applicable taxes. Below the total, indicate the payment method, whether it’s a credit card or other forms of payment. To finish, include the transaction ID for reference, ensuring that every element is easy to identify for both the customer and merchant.

Limit the number of repetitions for key terms like total and payment. This improves readability and keeps the document professional. Be sure to space sections clearly for better visual flow, and keep the language straightforward to avoid confusion.

After adding all necessary information, ensure the font and layout are consistent throughout. This helps the receipt look organized and ensures the customer can easily verify the transaction details.

- Manual Credit Card Receipt Template

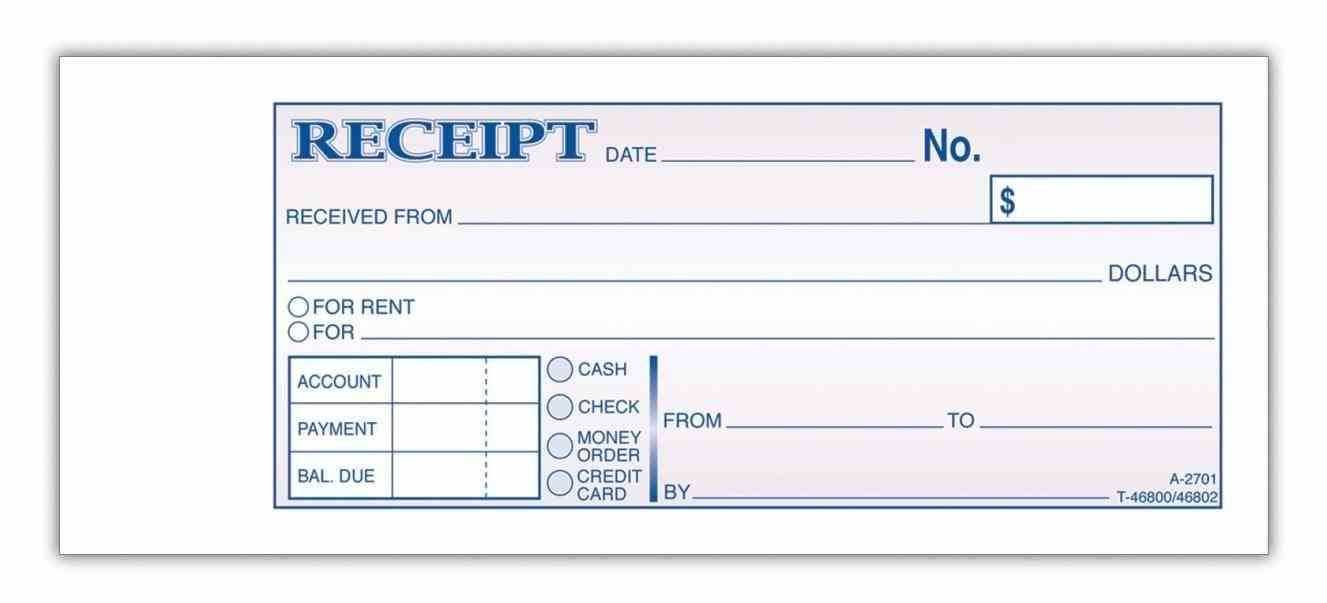

Create a clear and concise manual credit card receipt using these key elements:

- Merchant Information: Start with the name, address, and contact details of your business. This makes the receipt valid for customers and keeps the transaction professional.

- Receipt Number: Include a unique receipt number for tracking purposes. It helps maintain records and simplifies refunds or disputes.

- Date and Time: Clearly state the date and time of the transaction. This is important for both accounting and customer reference.

- Card Information: Only include the last four digits of the credit card number to maintain customer privacy. Do not store sensitive data like the full card number.

- Amount: Specify the total transaction amount, including taxes or fees. Make sure it aligns with the customer’s purchase.

- Authorization Code: If available, include the authorization code or transaction ID. This adds verification to the receipt and aids in resolving any discrepancies.

- Signature Line: Provide space for the customer’s signature, which serves as confirmation of the transaction.

- Payment Method: Clearly indicate that the payment was made via credit card. This helps distinguish it from other forms of payment.

By incorporating these elements into your manual receipt template, you ensure a professional and organized approach to credit card transactions, making the process smoother for both your business and customers.

To create a custom receipt template in Word, follow these steps:

- Open Microsoft Word: Launch Word and start a new blank document.

- Set up the Page Layout: Adjust the page size, margins, and orientation. Typically, receipts are formatted in portrait mode with 1-inch margins. Go to the “Layout” tab and adjust the settings as needed.

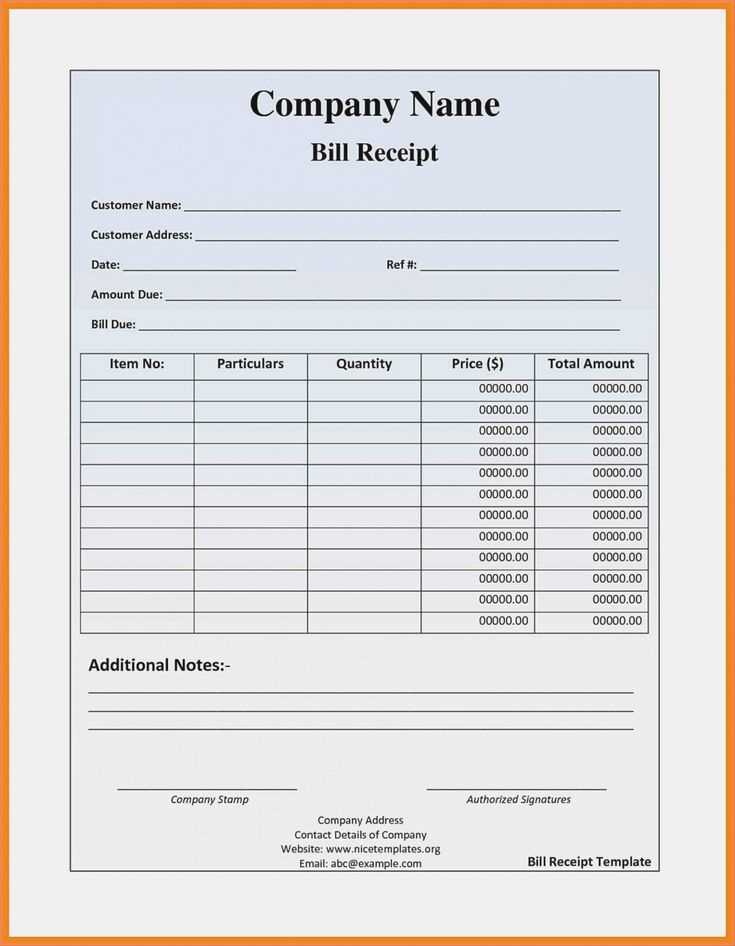

- Design the Header: Include your business name, logo, and contact information. Use a larger font size to make the header stand out. Align these elements according to your preference, either left, center, or right.

- Insert Transaction Details: Below the header, add the transaction information. Include fields like:

- Receipt number

- Transaction date and time

- Amount charged

- Payment method (credit card)

- Card type and last four digits of the card number

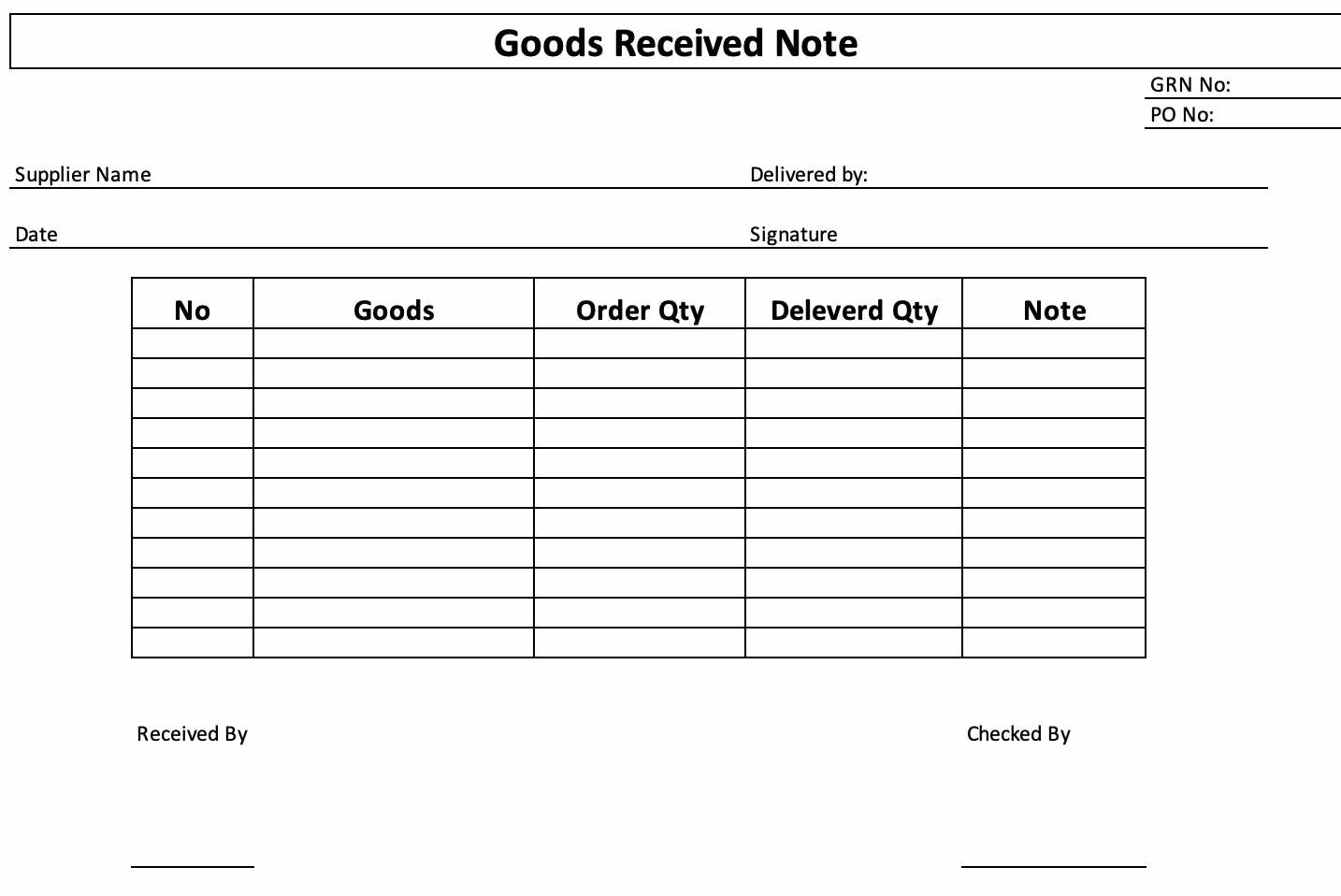

- Add Line Items: If necessary, list the purchased items, their quantities, and prices. Use a table to organize this data for a clean, structured look.

- Include a Footer: The footer should display return policies, customer service contact information, or disclaimers. Use smaller text for this section to keep it discreet.

- Save as a Template: Once you’re satisfied with the design, save the document as a Word template (.dotx). This will allow you to reuse the template for future receipts.

Once the template is ready, you can quickly generate receipts by filling in the transaction-specific details. Make sure to save each receipt separately for easy access and record-keeping.

Each credit card receipt must clearly display several key fields to ensure accuracy and transparency. These details help both the merchant and the cardholder confirm the transaction. Below are the most critical fields to include:

- Merchant Information: The name, address, and contact details of the business processing the payment are essential. This helps identify the source of the charge.

- Transaction Date and Time: Indicate the exact date and time of the transaction. This ensures both parties have a clear record of when the payment took place.

- Receipt Number: A unique number tied to each receipt provides an easy way to track and reference specific transactions.

- Cardholder Information: Include the last four digits of the credit card number to identify which account was charged (but never the full card number for security reasons).

- Transaction Amount: Clearly state the total amount charged, including any applicable taxes or fees. This ensures clarity for both the merchant and the cardholder.

- Payment Method: Specify the payment method used, such as credit card, debit card, or another form of payment.

- Authorization Code: This is a unique code generated by the payment processor to verify the transaction’s legitimacy.

- Signature Line (if applicable): Include a space for the cardholder’s signature, particularly for card-not-present transactions, to confirm the purchase.

- Refund/Return Policy: Provide a brief mention of the store’s return policy, if relevant, to inform the customer of their rights regarding refunds.

By including these fields, you can ensure that both parties have a clear, detailed, and verifiable record of the transaction. This reduces the risk of disputes and promotes trust between customers and merchants.

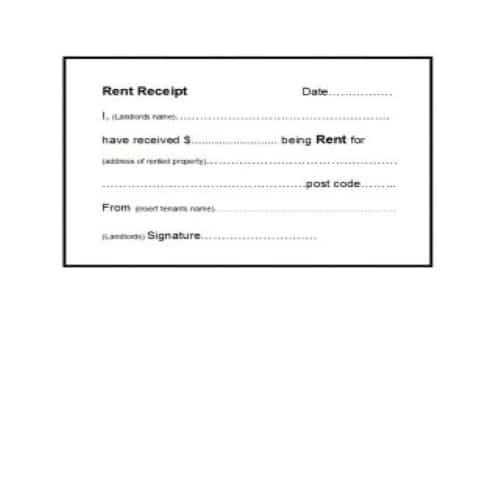

Begin by clearly writing the date of the transaction. This should match the day of the purchase to avoid confusion. Place it in the top section of the receipt.

Next, write the name of the cardholder as it appears on the credit card. Ensure the spelling is accurate to prevent issues during verification.

Include the full credit card number. Do not write the entire number–just the last four digits, for security purposes. This helps to identify the card used without revealing sensitive information.

Write the amount of the transaction, indicating the currency. Be specific with the total, including cents if applicable, to avoid discrepancies.

Record the transaction type–whether it is a purchase, refund, or chargeback. This will clarify the nature of the transaction for both the merchant and the customer.

If applicable, note the transaction reference number, which can be used for tracking purposes. This number can usually be found on the payment system’s terminal or on the merchant’s receipt system.

Indicate the name and location of the business making the transaction. This helps to identify where the purchase occurred in case of any future inquiries.

Sign the receipt in the designated space. The merchant’s signature affirms the transaction, while the customer may also sign if necessary to complete the process.

Finally, include any additional details relevant to the transaction, such as tax or discount information, to make the receipt more complete.

Keep your receipt clean and organized by dividing it into clear sections. Begin with your business name and contact details at the top, including your phone number and email for customer support. Ensure these are visible and easy to find.

Next, include transaction details in a well-structured layout. Show the transaction date, amount, and method of payment. Use bold text for the total amount to make it stand out. Avoid clutter by keeping these details aligned and concise.

Provide the last four digits of the credit card number to reassure the customer that their payment has been processed securely, but never display the full card number for safety reasons.

For tax-related information, ensure tax rates and any applicable fees are clearly outlined below the subtotal, without overwhelming the receipt with unnecessary details. Use simple bullet points or tables for easy reading.

Always include a transaction ID or receipt number. This helps with future reference and troubleshooting. This ID should be placed at the bottom for easy access after the other key information.

Finally, leave space for a thank-you message or a prompt for future business. This humanizes the interaction and builds a stronger connection with the customer.

Ensure that all the necessary details are accurately filled in on the manual credit card receipt. A frequent mistake is omitting important information like the transaction date, cardholder’s name, or transaction amount. Leaving these fields blank or incomplete can lead to confusion or even disputes.

Another common issue is incorrect card information. Double-check the card number and expiration date for accuracy. Transposing numbers or using outdated details can cause problems when processing the payment later. Make sure the card type (Visa, MasterCard, etc.) is properly indicated as well.

Handwriting legibility is crucial. Ensure that the text is clear and readable. Poor handwriting can lead to errors when entering data into systems or processing payments. Consider printing the receipt or using a template with predefined fields to avoid such mistakes.

Don’t forget to include the authorization code. This is a critical part of the receipt, confirming that the transaction was approved. Without it, the payment may not be verified or processed correctly.

Lastly, avoid mixing personal and business transactions on the same receipt. Keep these records separate to maintain clarity and proper accounting.

Store printed credit card receipts in a locked, secure location like a safe or filing cabinet. Avoid leaving documents in open spaces where unauthorized individuals might access them. For added security, choose storage solutions that offer fire and water protection to safeguard sensitive data.

Keep documents organized by date, transaction, or merchant name to make retrieval easier. Use folders or labeled binders to prevent clutter and confusion. This organization ensures quick access if you need to reference a receipt later, such as for returns or tax purposes.

If digital records are necessary, scan your receipts and store them on a secure, encrypted cloud storage service. This reduces the risk of physical theft and ensures you have backups in case of damage to the originals. Always set strong passwords for online storage and enable two-factor authentication when possible.

Dispose of paper receipts properly by shredding them once they are no longer needed. Shredding prevents identity theft and keeps your sensitive data from falling into the wrong hands. Avoid tossing receipts into trash bins without destroying them, as this can expose you to potential fraud.

Periodically review and update your storage practices to stay ahead of potential security risks. Evaluate the effectiveness of your storage and disposal methods, and make adjustments if necessary to ensure continued protection.

Design your credit card receipt template by focusing on clarity and readability. Begin with a clean header that includes your business name, address, and contact information. This helps customers identify the transaction and reach out if needed.

Next, list the transaction details in a structured format. Include the date of the transaction, the amount paid, the payment method, and the card number (last four digits only for security). Use bold text for the transaction amount to make it stand out.

For better transparency, add a breakdown of any additional fees, taxes, or discounts. Provide clear labeling for each item so customers can easily understand the charges.

Ensure the receipt includes a unique transaction ID for easy reference. This ID helps both your business and the customer track the transaction in the future.

Finally, place a thank-you message or a note about returns and exchanges at the bottom. Keep it short, professional, and welcoming.