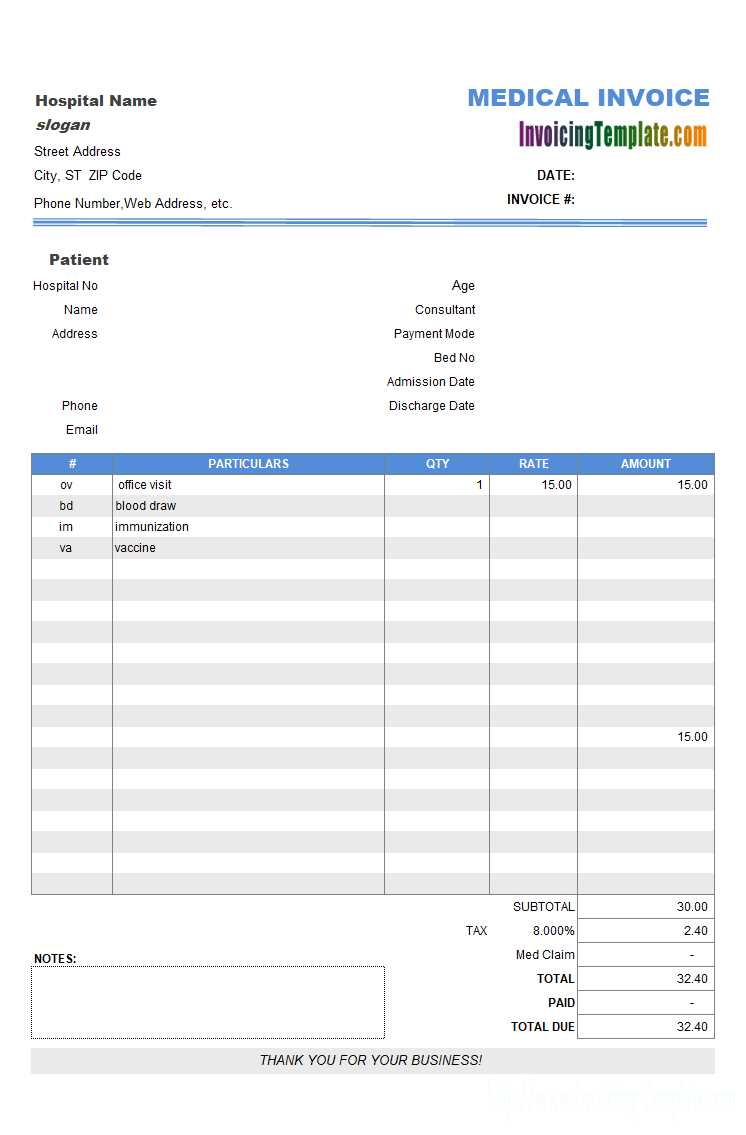

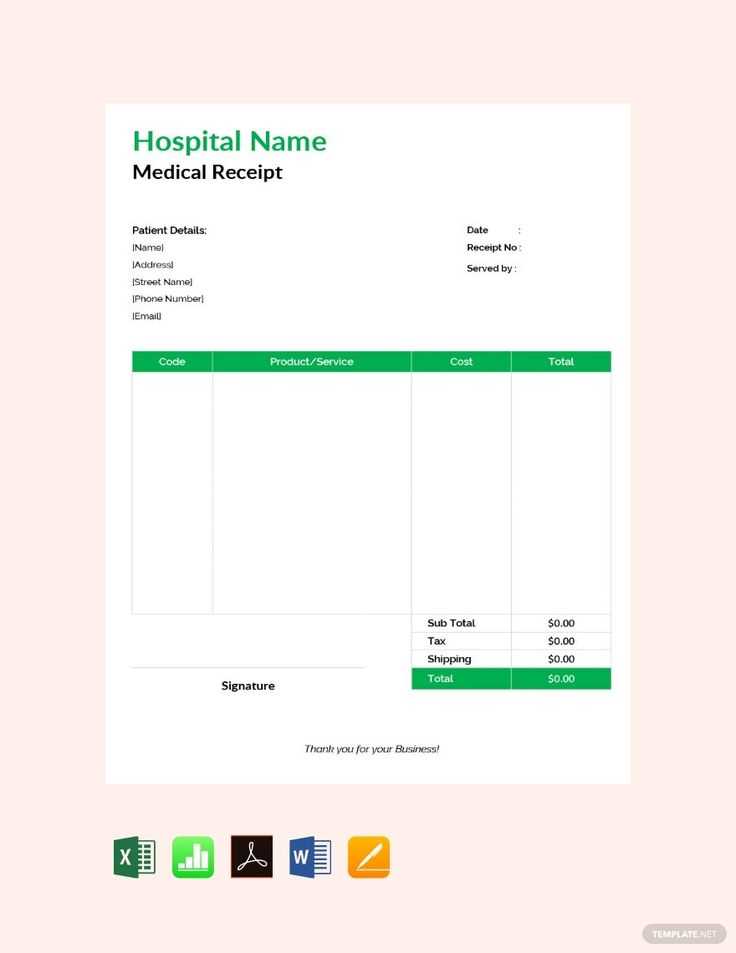

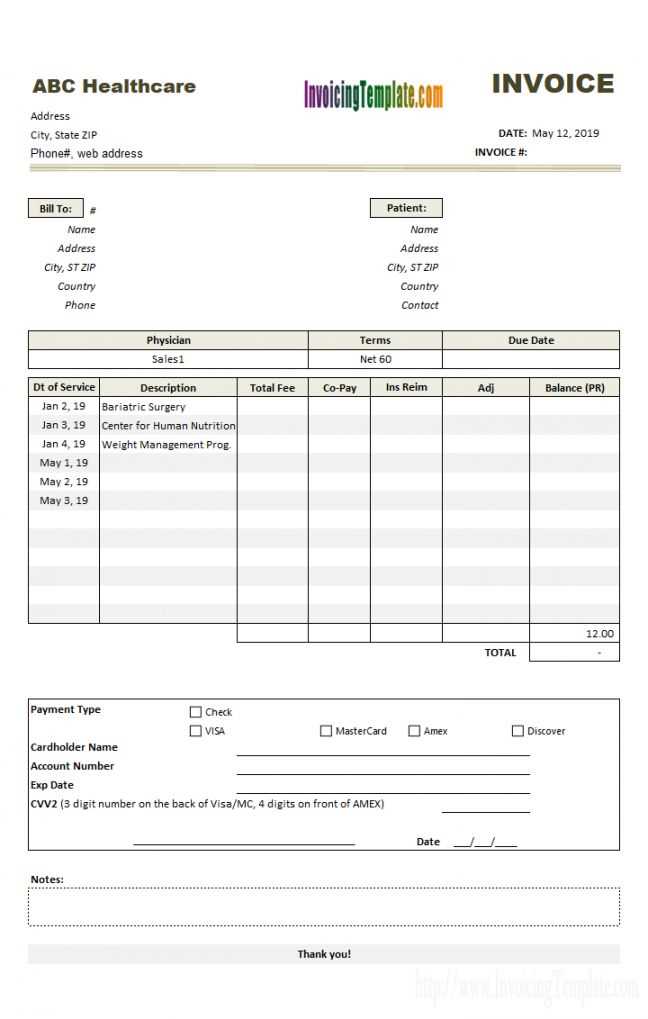

For creating a medical receipt in India, the template should include all necessary details such as patient information, treatment received, itemized costs, and tax information. This ensures transparency and helps both the healthcare provider and the patient maintain accurate records.

Patient Details: Include the patient’s full name, contact number, address, and unique identification number if applicable. These details help identify the patient in case of any future queries or claims.

Treatment and Services: Clearly list the medical services, procedures, or medications provided. Each service should be accompanied by a brief description and corresponding cost. This breakdown helps in verifying charges and ensuring accuracy in billing.

Tax Information: Include the applicable Goods and Services Tax (GST) on medical services or products, if applicable. In India, GST rates can vary, so this section is vital for both legal and financial clarity.

Receipt Number: Assign a unique receipt number for each transaction. This allows easy tracking of receipts for accounting purposes or audits.

Doctor’s or Clinic’s Information: Include the name, contact details, and registration number of the healthcare provider or clinic. This adds legitimacy to the receipt and ensures that it can be verified if needed.

Here’s the corrected version:

To ensure accuracy and clarity in medical receipts, make sure to include the patient’s full name, the healthcare provider’s details, the date of treatment, and a breakdown of services rendered. Clearly list each service or item with its respective cost, and include any applicable taxes or additional charges. Always specify the mode of payment and include any discounts or insurance coverage applied. Ensure the total amount due is prominently displayed for easy reference. Double-check all details for any discrepancies, and provide a receipt number for tracking purposes.

- Medical Receipt Template India

For accurate and professional medical receipts, make sure to include the following key elements: the name of the healthcare provider, the patient’s full name, the date of treatment, the list of services rendered, and their corresponding costs. Ensure that the format is clear and easy to read for both the patient and accounting purposes.

Key Components

Include the following details in your receipt template to meet Indian standards:

- Healthcare Provider Details: Name, address, contact details, and medical license number.

- Patient Information: Full name, age, and unique patient ID (if applicable).

- Service Description: Clearly describe each medical service or product provided, including consultations, tests, medications, and procedures.

- Billing Information: Itemized cost of each service with applicable taxes, discounts, and the total amount payable.

- Payment Method: Specify whether the payment was made by cash, cheque, card, or insurance.

- Receipt Number: A unique identification number for tracking purposes.

- Signature and Stamp: The healthcare provider’s signature or authorized stamp for validation.

Legal Considerations

Ensure that the receipt complies with the Goods and Services Tax (GST) regulations applicable in India. This includes providing the GSTIN (Goods and Services Tax Identification Number) for the healthcare provider and ensuring the receipt follows the prescribed tax calculation methods.

For seamless integration into accounting systems, consider using a digital template format that is easy to edit and update as needed, ensuring that all required information is consistently included in each receipt.

Begin by selecting a user-friendly software or platform, such as Microsoft Word, Google Docs, or specialized design tools like Canva. These options allow flexibility in adjusting the layout without complex design skills.

Focus on a clean layout with clear sections: patient details, treatment information, charges, and total cost. Use tables for easy alignment of data. Ensure the font is readable and standard across all sections. Use bold text for headings, and keep the font size consistent for better clarity.

Include a space for your practice or clinic’s name, logo, contact details, and registration number, if applicable. This adds professionalism and ensures patients can reach out if needed. Position this information at the top of the receipt, so it is immediately visible.

For treatment details, provide clear itemization of services or medications with corresponding costs. If relevant, include a breakdown of taxes and discounts. Be precise with descriptions to avoid confusion and ensure transparency in billing.

Offer customization options such as adding a payment method section or payment receipt number, which can be adjusted based on the transaction type. This helps create a more organized record for both the patient and the provider.

Finally, save the receipt as a template for future use. This allows you to quickly generate receipts with minimal effort, adapting details for each patient while maintaining a consistent and professional design.

A medical receipt must contain several key elements to ensure it complies with legal standards. These elements are necessary for both the provider’s protection and the patient’s ability to claim reimbursements or submit documentation for tax purposes.

- Receipt Number: A unique identifier for the receipt that allows easy tracking of transactions.

- Provider’s Details: Include the full name, license number, and address of the medical practitioner or clinic issuing the receipt.

- Patient Information: The name and contact information of the patient receiving the treatment, ensuring clear identification.

- Details of Services Rendered: A detailed list of medical services provided, including descriptions of treatments or consultations, along with the corresponding charges.

- Date of Service: The exact date when the medical service was provided should be listed clearly.

- Amount Charged: The total amount charged for each service rendered and the overall sum for the medical treatment.

- Taxes (if applicable): Mention any applicable taxes such as GST and provide a breakdown if necessary.

- Payment Method: Indicate how the payment was made (e.g., cash, card, or online transfer).

- Signature or Stamp: The medical practitioner’s signature or clinic stamp as proof of authenticity and authority.

Ensure these elements are presented clearly and correctly, as errors can lead to complications during reimbursement or legal disputes.

For designing medical receipts in India, EasyBill stands out as a reliable choice. It allows users to quickly generate professional invoices and receipts with customizable templates. The user-friendly interface simplifies the process, making it suitable for both new and experienced users.

Zoho Invoice is another excellent option. Its cloud-based platform provides flexibility to create customized receipt designs that cater to various business needs. With advanced features like multi-currency support and automated billing, Zoho Invoice is ideal for healthcare professionals handling a diverse set of transactions.

QuickBooks offers an intuitive receipt design tool, particularly beneficial for small clinics and private practitioners. It allows customization to meet specific requirements, such as adding medical codes or custom tax rates. QuickBooks also integrates with other financial software, streamlining overall financial management.

If you’re looking for a more cost-effective solution, Invoice Ninja is a good fit. It offers a free plan with essential tools to design and send receipts. The software allows easy editing of templates and is ideal for freelancers and small clinics who want a simple yet effective solution.

FreshBooks offers receipt design features along with strong reporting and time-tracking functionalities. It’s especially beneficial for medical professionals offering hourly services. FreshBooks allows easy creation of professional-looking receipts while keeping all financial information neatly organized.

For creating a medical receipt template in India, ensure that it includes all required legal and professional details. Start by placing the hospital or clinic’s name, logo, and address at the top. Below that, include a unique receipt number and the date of issuance for clarity.

Key Elements to Include

The receipt should clearly state the patient’s name, contact information, and the services provided. Include the following details:

- Itemized List of Services: Break down the treatments or consultations with clear descriptions and corresponding charges.

- Tax Information: Mention applicable GST (Goods and Services Tax) for each item.

- Total Amount: Provide a final amount, listing any discounts or adjustments made.

Legal and Compliance Details

Ensure the receipt adheres to the Medical Council’s guidelines. This means including the doctor’s name, registration number, and signature for validation. Also, if insurance or government health schemes are involved, specify any billing codes or references related to the coverage.

Finally, include a footer with the hospital’s contact details for follow-up queries. Maintain a professional and clean format to make the receipt easy to understand for patients and insurance purposes.