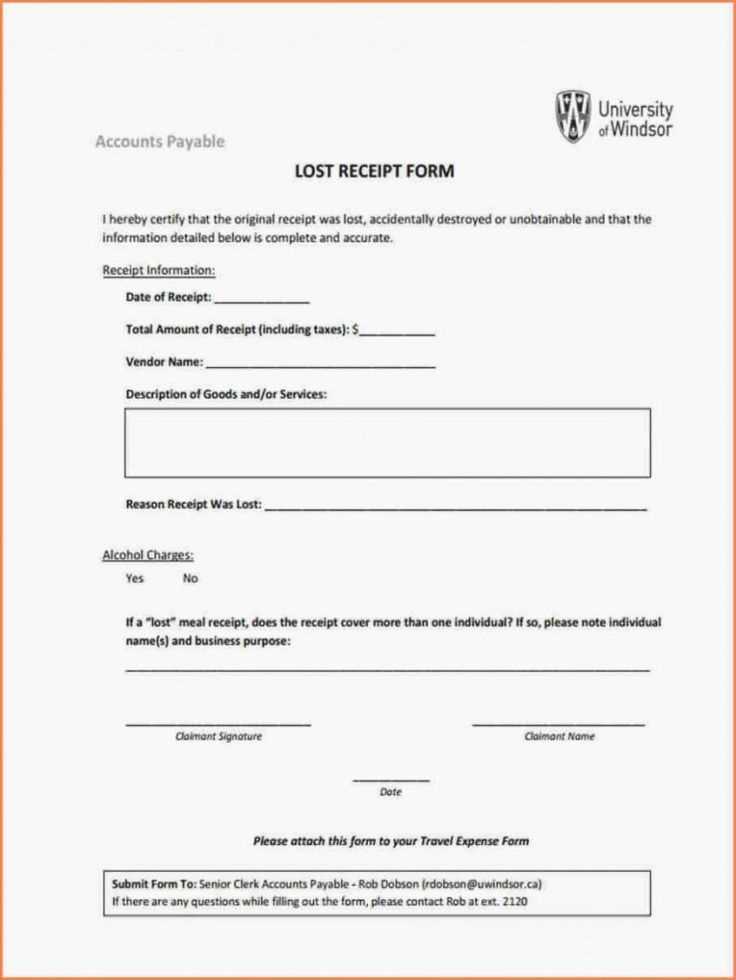

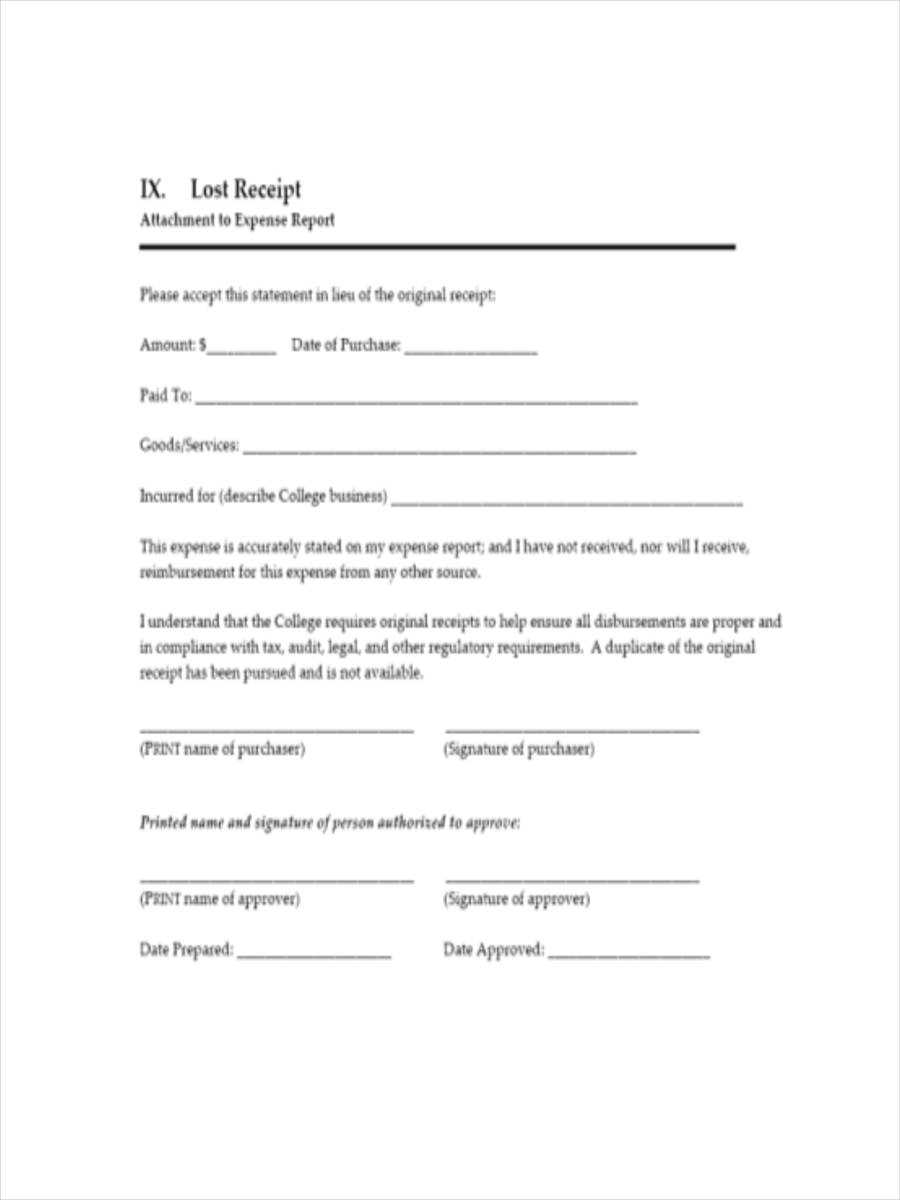

If you need to submit an affidavit for a missing receipt, ensure it includes specific details to satisfy the requirements. Start by clearly identifying the transaction in question, including the date, amount, and purpose of the expense. Make sure to provide context, such as why the receipt is unavailable and any efforts made to retrieve it.

In the affidavit template, include a statement affirming the authenticity of the expense. Acknowledge that you are aware of the policy regarding missing receipts and confirm that the information provided is accurate. Also, include a declaration of responsibility for any discrepancies or errors that may arise.

Finally, be sure to include your contact information and date the affidavit. This not only helps with record-keeping but also ensures transparency. Double-check the template against your organization’s guidelines to ensure compliance and prevent delays in approval.

Here’s the Revised Version:

To complete a missing receipt affidavit, gather relevant details like the transaction date, amount, and merchant information. Begin by stating that you are unable to provide the original receipt and specify why it’s missing, such as it being lost or never received. Provide any alternative proof of purchase, like bank statements or order confirmations. Clearly mention any attempts made to obtain a duplicate receipt from the vendor.

Ensure the following details are included:

- The exact date of purchase

- Transaction amount

- Merchant’s name and contact information

- Item or service purchased

If you have any supporting documentation, attach it to the affidavit. Sign the form and date it before submission. Keep a copy for your records in case further verification is needed.

- Missing Receipt Affidavit Concur Template Guide

To submit a Missing Receipt Affidavit in Concur, ensure the form is completed accurately. Start by downloading the official affidavit template from the Concur system. This document allows you to provide a valid explanation for any missing receipts while maintaining compliance with company policy.

Step 1: Complete the Affidavit

Fill out the necessary fields in the affidavit template. Include details like the transaction date, amount, and the reason the receipt is missing. Be honest and specific about why you were unable to retain the receipt. Providing clear context will help expedite the approval process.

Step 2: Attach Supporting Documentation

In addition to the affidavit, upload any relevant supporting documents that may validate the expense. This can include bank statements, credit card records, or invoices. These documents serve as proof of the transaction and strengthen the affidavit submission.

Once submitted, the finance team will review the affidavit. If all information is correct and satisfactory, the missing receipt claim will be approved, allowing your expense report to proceed.

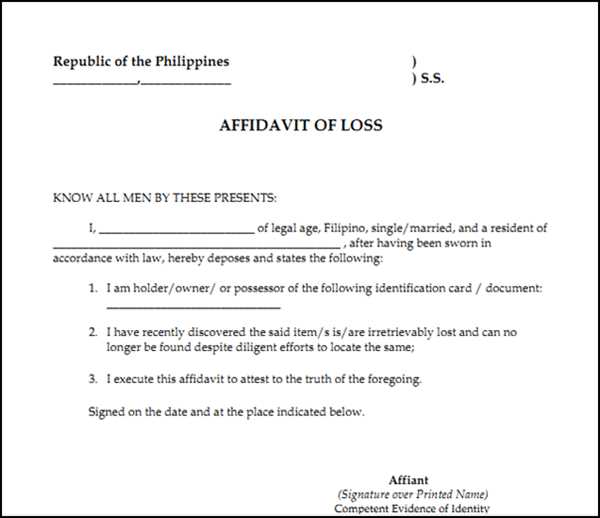

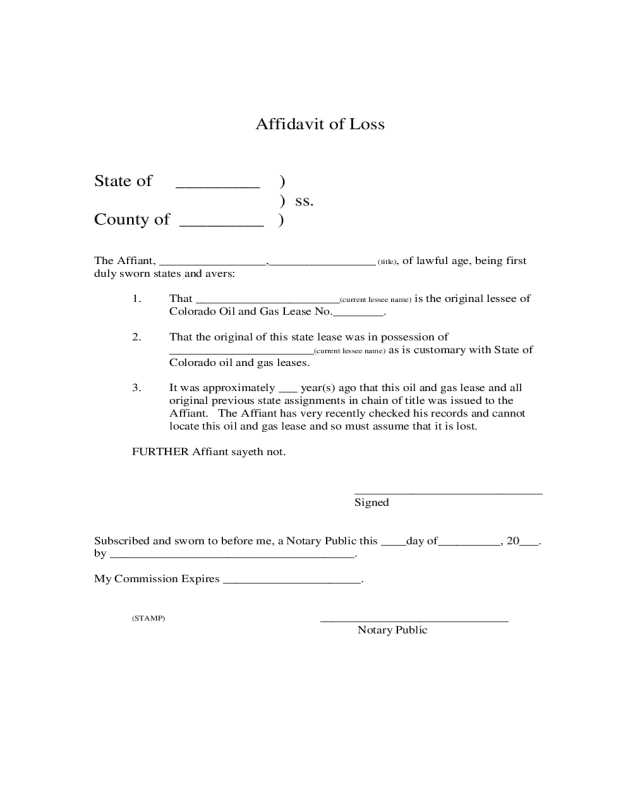

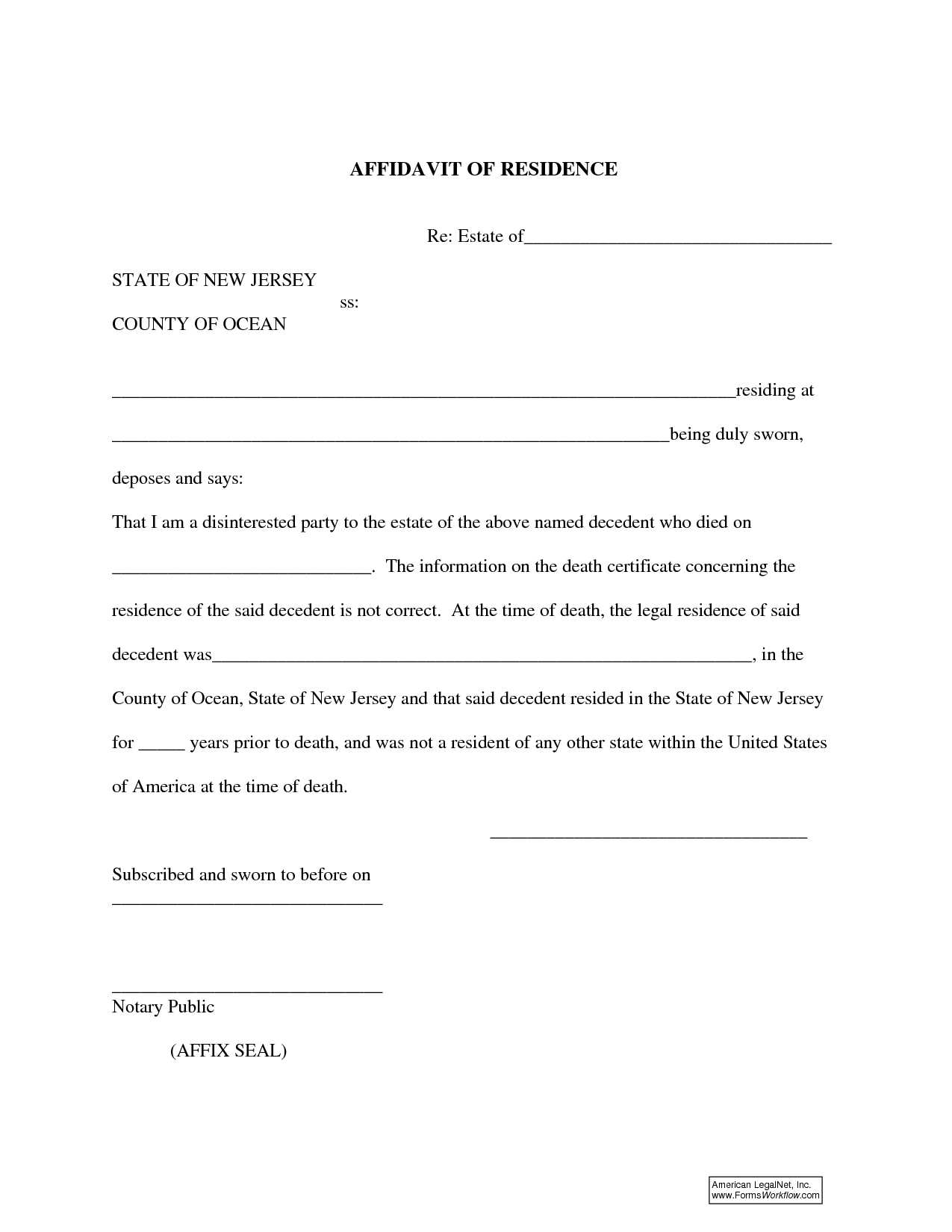

A Missing Receipt Affidavit allows individuals or businesses to explain the absence of a receipt for an expense that needs to be documented. It’s a formal declaration made under oath, usually required for reimbursement purposes or tax filings. The affidavit serves as a substitute when the original receipt is lost or unavailable, but it does not eliminate the need for proper documentation of the expense.

The main objective is to ensure that the transaction was legitimate and to provide details that would verify the authenticity of the expense. This can include the date of purchase, the amount, the purpose, and the vendor. It’s crucial that the affidavit is filled out accurately to avoid any potential issues with auditors or financial departments.

| Detail | Description |

|---|---|

| Affidavit Purpose | To explain the missing receipt for a specific expense. |

| Required Information | Date, amount, vendor, purpose of the expense. |

| Legal Implication | Affirming the truth of the statement under penalty of perjury. |

| Use Case | Reimbursement requests or tax filings requiring proof of expenses. |

To access the template for missing receipts in Concur, follow these steps:

- Log into your Concur account.

- Navigate to the “Expense” tab on the main dashboard.

- Click on “Create New Expense” to open the expense report section.

- Look for the option that says “Missing Receipt Affidavit” within the expense options.

- Click on the link to access the affidavit template.

The template will appear as a fillable form. Complete the required fields, including the date of the expense and the reason for the missing receipt. Once filled out, you can save it as part of your expense report.

If you cannot find the template, check if your company’s settings allow the use of the affidavit. Some companies may restrict access to this feature based on their expense policies.

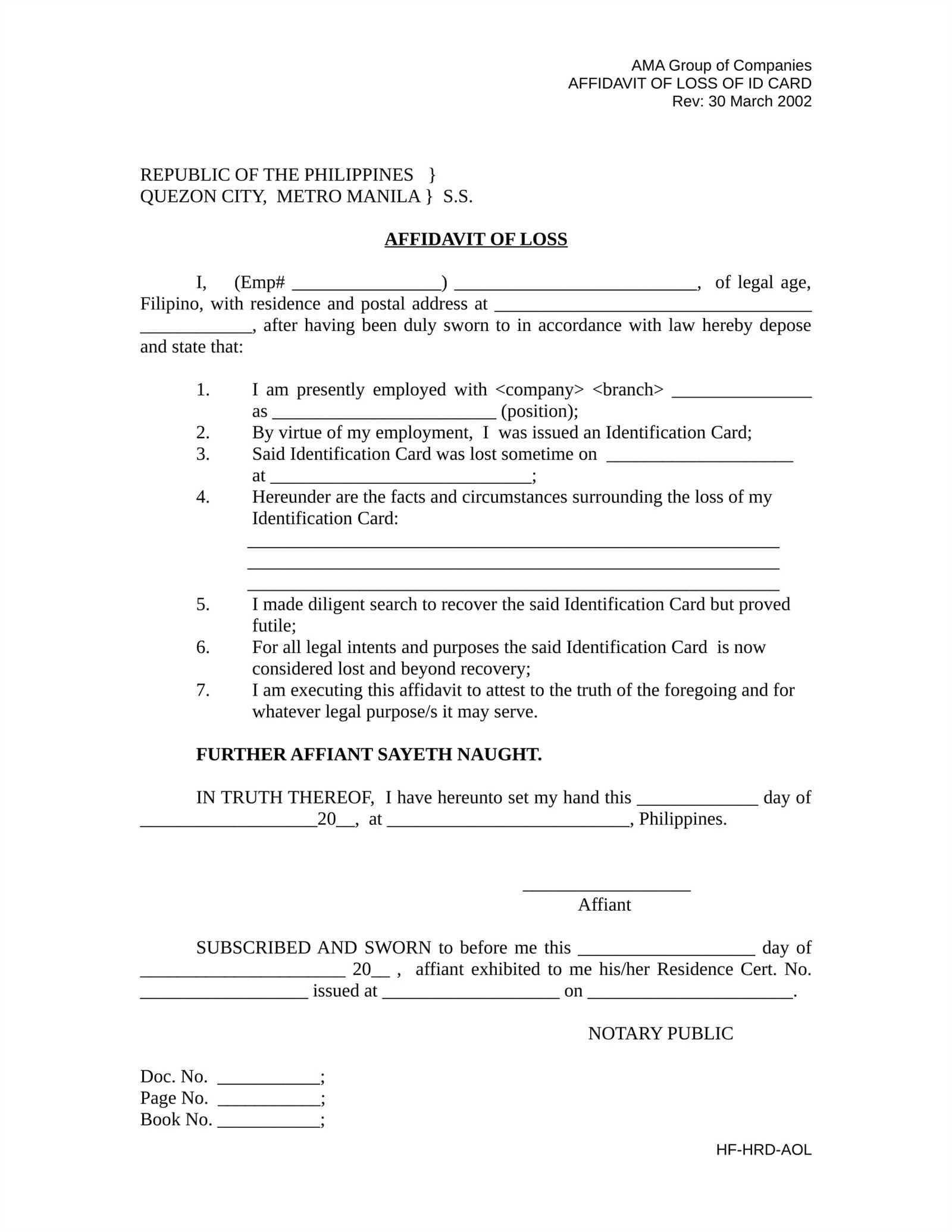

1. Gather Required Information

Collect all relevant details about the missing receipt, including the transaction date, amount, and merchant information. Ensure you have accurate facts before proceeding with the affidavit.

2. Fill in Personal Information

Begin by entering your full name, address, and contact details at the top of the affidavit. This ensures your identity is clear throughout the document.

3. Describe the Missing Receipt

Provide a brief but clear description of the receipt, including what was purchased and any specific details that could help identify the transaction. Include the merchant’s name and any reference numbers if available.

4. State the Reason for Missing the Receipt

Clearly explain why the receipt is unavailable. Whether it was lost, damaged, or never provided, ensure your explanation is straightforward and accurate.

5. Sign the Affidavit

Once you have completed the form, sign and date it in the designated area. This confirms that all the information you have provided is truthful and accurate.

6. Notarization

Visit a notary public to have your affidavit notarized. The notary will verify your identity and witness your signature, ensuring the affidavit’s authenticity.

7. Submit the Affidavit

Submit the completed and notarized affidavit to the relevant party, such as the organization or financial institution requesting it.

Double-check the accuracy of the information you provide in the template. Errors in dates, amounts, or the name of the business can lead to delays or rejection of your claim.

- Incorrectly Filling in Fields: Ensure that all fields are properly completed. Missing details, especially related to the transaction or the reason for the missing receipt, can invalidate the affidavit.

- Not Signing the Affidavit: A common oversight is failing to sign the document. An unsigned affidavit is not considered valid, so always double-check the signature section before submission.

- Inconsistent Information: Do not provide conflicting information within the affidavit. For example, the date and amount on the missing receipt should align with the details provided in the affidavit. Any inconsistency will raise questions.

- Providing Vague Descriptions: Avoid vague or unclear explanations. Be specific about the transaction, especially the items or services purchased, and the circumstances that led to the missing receipt.

- Submitting the Wrong Template: Ensure you’re using the correct version of the affidavit template. Different institutions or companies may require specific versions with different fields or formats.

- Overlooking Required Documentation: Some institutions may require additional documents along with the affidavit, such as bank statements or credit card statements. Neglecting to include these can delay processing.

Summary of Key Tips

- Review all information for accuracy before submission.

- Sign the affidavit to ensure it is legally binding.

- Be specific in your descriptions to avoid ambiguity.

To submit your affidavit for missing receipts in Concur, open your expense report and locate the specific transaction for which you lack a receipt. Next, select the option to add a missing receipt affidavit. You will be prompted to fill in relevant details such as the date of the expense, the merchant, and the amount. Make sure to provide accurate and thorough information to support your claim.

Steps to Complete the Affidavit

After entering the details, you’ll need to confirm that you have made reasonable efforts to obtain the missing receipt. Be honest and precise in your response. Once all required fields are filled out, attach any supplementary documents or notes that may help clarify the situation. Concur may request additional information, so be ready to provide it if needed.

Finalizing and Submitting

After reviewing your affidavit, submit the form for approval. Keep track of the status through Concur’s notification system. If the affidavit is accepted, it will be processed and integrated into your expense report. If there are issues, you will be alerted with instructions on how to proceed.

Review the reason for rejection carefully. Correct any missing or inaccurate information, such as incorrect dates, signatures, or incomplete supporting documents. Double-check the affidavit against the guidelines to ensure it meets all requirements.

If the rejection was due to missing receipts, gather alternative documentation, such as bank statements or purchase orders. Provide a clear explanation for the missing receipts and attach any supplementary proof to support your claim.

Contact the relevant authority if you’re unsure about the rejection. Clarify the specific issues and ask for guidance on how to resolve them. Once you’ve made the necessary adjustments, resubmit the affidavit along with any new documents or evidence.

Keep a record of all communications and submissions. This helps track your progress and prevents future misunderstandings. Ensure your affidavit is as complete and accurate as possible to avoid further delays.

To ensure clarity and accuracy when dealing with a missing receipt affidavit, it’s important to focus on the necessary details. Begin by stating the purpose of the affidavit clearly: it confirms the loss of a receipt and provides details for verification. Be concise, as any unnecessary details might cause confusion.

Include Key Information

Specify the exact date, time, and amount of the transaction. Also, mention the reason for not having the receipt, such as loss or misplacement. If possible, provide supporting information like the method of payment (credit card, check, etc.) to help verify the transaction.

Signature and Notary

The affidavit must be signed by the person making the statement. Depending on local regulations, it may also need to be notarized to verify its authenticity. Check local requirements to ensure your affidavit meets all legal standards.