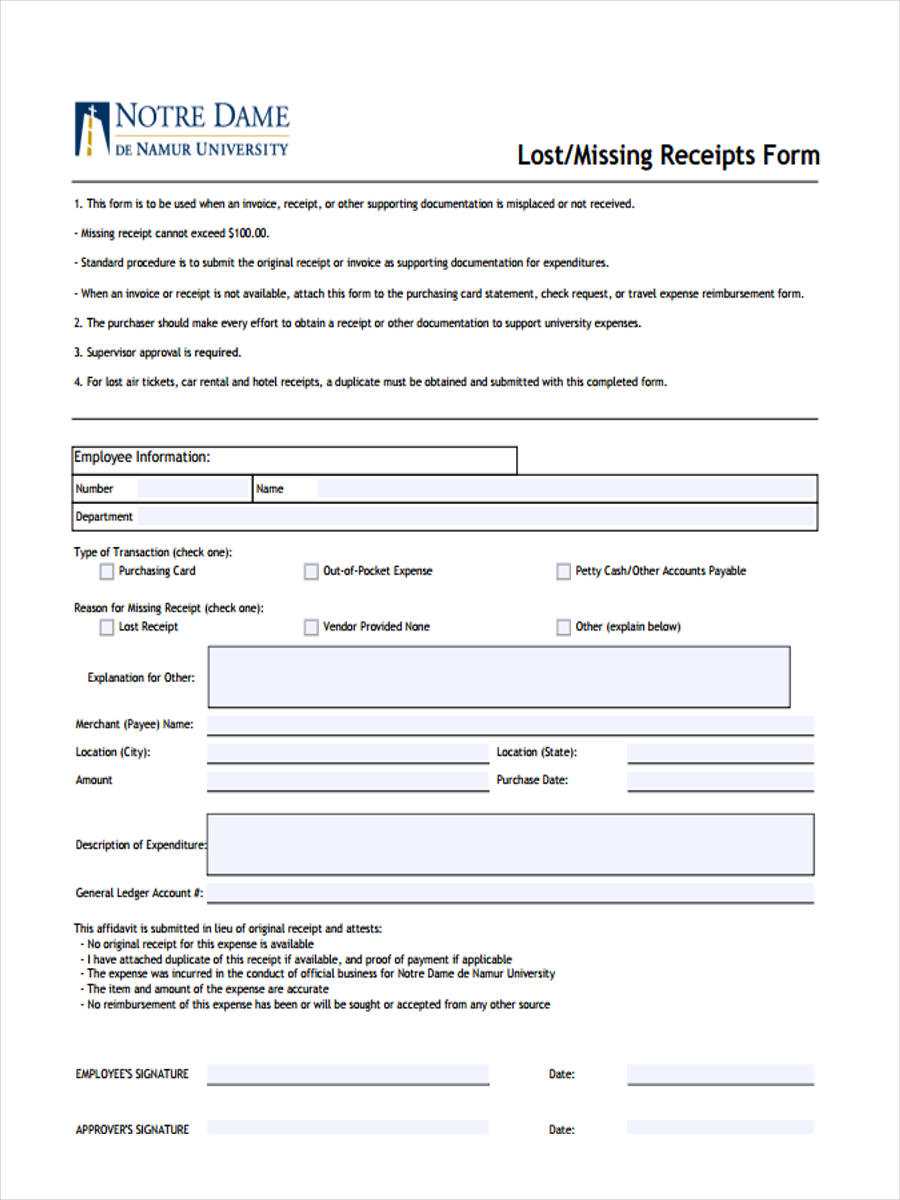

If you’ve lost a receipt needed for reimbursement or accounting purposes, a missing receipt affidavit can serve as a substitute. This document verifies the expense, ensuring compliance with financial policies. Many organizations require it to process reimbursements while maintaining accurate records.

To create a valid affidavit, include essential details: the date and amount of the expense, the vendor’s name, the payment method, and a brief explanation of why the receipt is unavailable. Some templates also require a signature from a supervisor or finance officer to confirm authenticity.

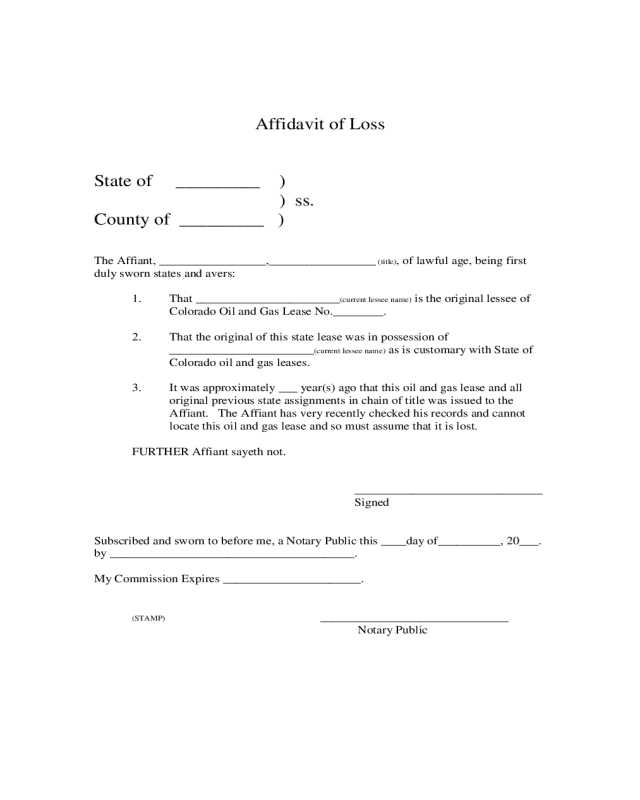

Many companies provide standardized forms, but if none is available, you can draft your own. A well-structured template ensures consistency and simplifies the approval process. Below, you’ll find key elements to include and a sample format for quick use.

Here is the corrected version without redundant repetitions:

To create a Missing Receipt Affidavit, make sure to include clear details: the date of the transaction, the amount, the purpose of the expense, and the reason the receipt is unavailable. Keep the language simple and straightforward. Specify any efforts made to obtain a duplicate receipt, if applicable. You may also need to sign the affidavit in front of a notary to verify its authenticity. Always check with your employer or organization for any specific format requirements.

If the affidavit is being submitted for reimbursement purposes, ensure that all necessary supporting documents, like bank statements or credit card transaction records, are attached to help validate the expense. Double-check for accuracy, as incorrect information could delay processing.

Once completed, submit the affidavit along with your other expense claims or reimbursements, as per the guidelines provided. Avoid submitting this affidavit unless it’s absolutely necessary to maintain a smooth process and prevent delays in reimbursement.

Missing Receipt Affidavit Template

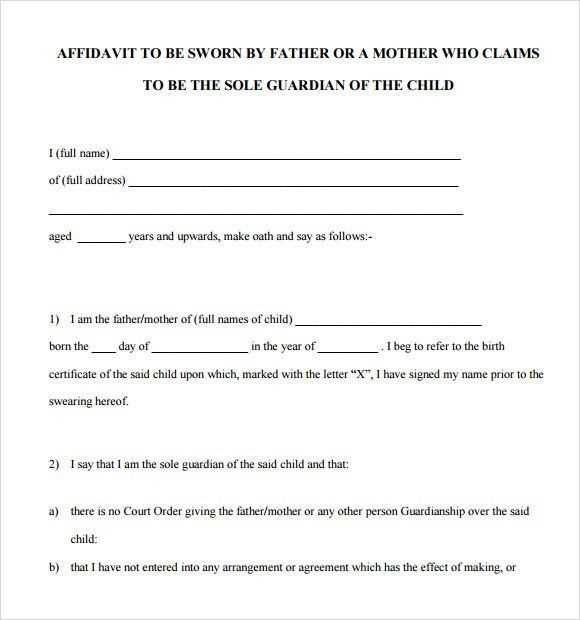

If you lose a receipt, you can use a missing receipt affidavit to explain the situation. The affidavit serves as a sworn statement where you confirm that the receipt was either lost or never issued. It’s commonly used for reimbursement or tax deduction purposes. The form should include specific details, such as the date of purchase, the amount spent, the purpose of the expense, and the vendor’s name. A well-structured affidavit can help smooth over any issues related to missing receipts.

Key Components of the Affidavit

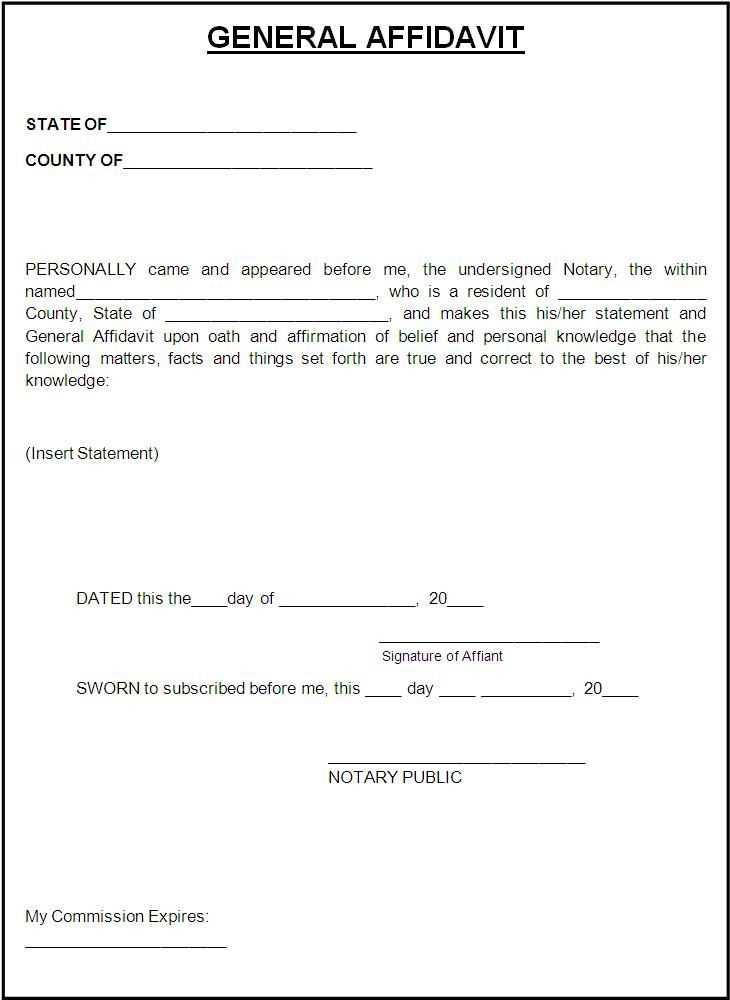

1. Personal Information: Include your full name, address, and contact details to identify the person making the affidavit.

2. Details of the Expense: Clearly state the date, amount, and purpose of the transaction. You may also mention the method of payment used (e.g., credit card, cash).

3. Explanation of the Missing Receipt: Describe why the receipt is unavailable. Be concise but detailed about the circumstances surrounding the loss.

4. Signature and Date: The affidavit should be signed and dated to confirm the truthfulness of the statement. Depending on your needs, you may need to have it notarized.

How to Use the Affidavit

Once completed, submit the affidavit to the appropriate party–whether it’s your employer, an insurance company, or the tax authority. Some organizations may require supporting documentation or additional verification before processing the claim. Make sure the affidavit is clear and accurate to avoid delays.

Each affidavit should clearly state specific details to ensure its validity and usefulness. Below are the key elements you need to include when drafting a missing receipt affidavit:

1. Affiant’s Full Name and Contact Information

The affidavit must include the affiant’s full name, address, phone number, and email address. This ensures that the person making the statement can be contacted for any necessary follow-up. The affiant should also confirm that the information provided is true and accurate to the best of their knowledge.

2. Explanation of Missing Receipt

Provide a clear and concise explanation about why the receipt is missing. Specify whether the receipt was lost, misplaced, or never received. Include relevant details such as the date and place of purchase or transaction, along with the name of the vendor or service provider. This helps establish the context of the missing receipt.

3. Date and Details of the Transaction

Accurate transaction details are important. Include the date, time, amount, and any other relevant information about the purchase or payment. This supports the claim and helps verify the transaction in case additional documentation is required later.

4. Affiant’s Declaration

The affiant must declare that the information provided is truthful. The declaration should state that the affiant understands the consequences of providing false information, which may include legal penalties. The affiant’s signature and date should be included at the end of this statement.

5. Supporting Evidence

If available, include any evidence that supports the claim that the receipt is missing. This could be a bank statement showing the transaction, an email receipt, or any communication with the vendor confirming the purchase.

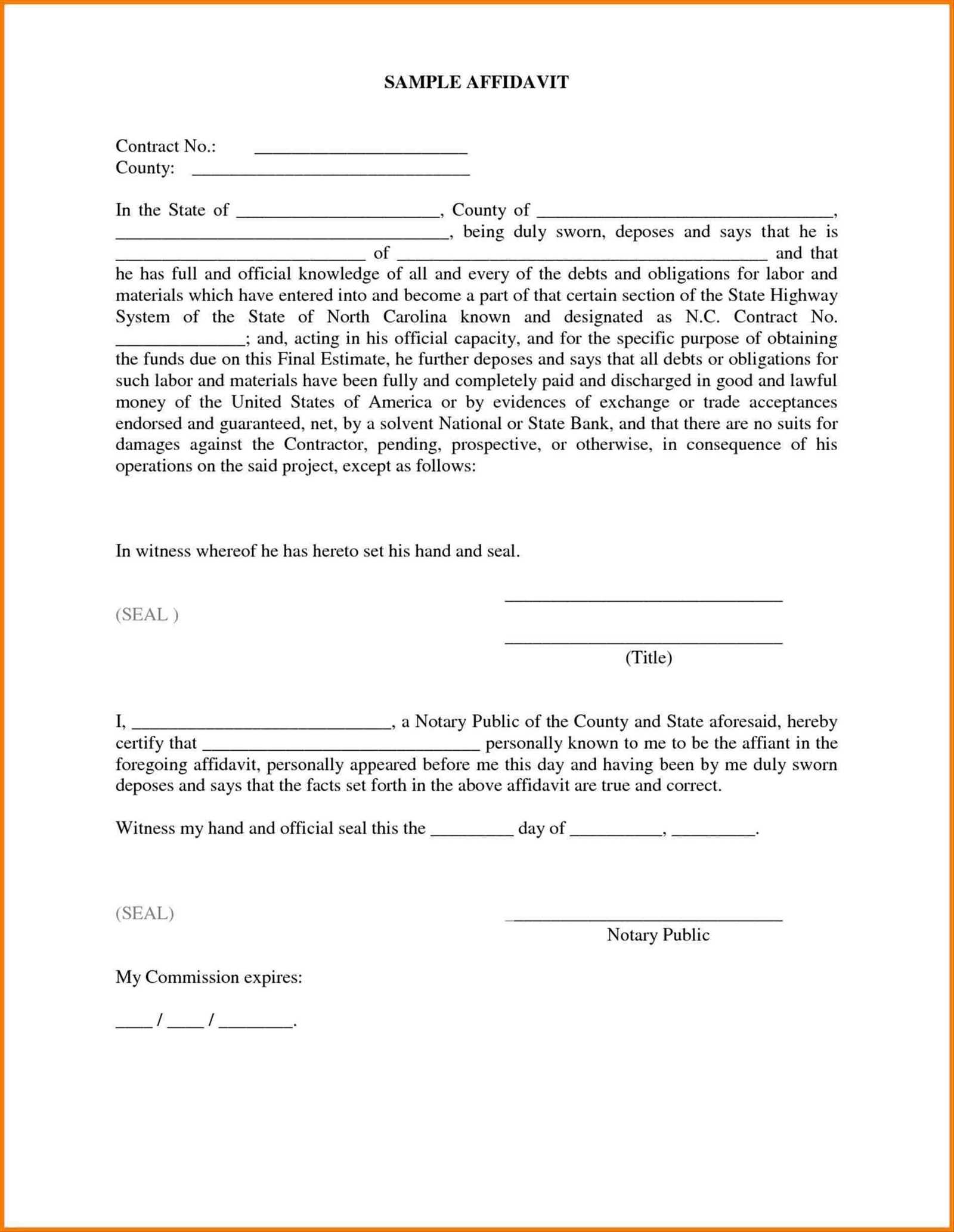

6. Notary Public Section

The affidavit must be notarized to be legally binding. A notary public will verify the affiant’s identity and witness the signing of the document. This is a necessary step to ensure the affidavit holds legal weight in official matters.

Table Example: Missing Receipt Affidavit Template

| Section | Details to Include |

|---|---|

| Affiant’s Information | Full name, address, phone number, email |

| Explanation of Missing Receipt | Reason for missing receipt (lost, never received, etc.) |

| Transaction Details | Date, time, amount, vendor or service provider |

| Affiant’s Declaration | Statement of truthfulness, signature, and date |

| Supporting Evidence | Bank statement, email receipt, or vendor communication |

| Notary Public | Notary’s signature, seal, and date |

To fill out the Missing Receipt Affidavit correctly, follow these steps:

- Start with your personal information. Provide your full name, address, and contact details at the top of the document.

- State the purpose of the affidavit. Clearly mention the transaction or purchase for which the receipt is missing.

- Provide details about the purchase. Include the date, amount, and description of the item or service purchased.

- Explain why the receipt is unavailable. Specify whether it was lost, never received, or damaged beyond recognition.

- Sign and date the affidavit. Ensure that you sign the document in the presence of a notary if required by your institution or company. This adds legal validity to your statement.

After signing, submit the affidavit along with any other supporting documentation if needed. Make sure to keep a copy of the completed form for your records.

Ensure all required fields on the affidavit are filled out. Leaving sections incomplete can delay the process or result in rejection. Verify that the name and date of the transaction match the corresponding receipts or records you are referencing.

Do not forget to include all supporting documents. A missing receipt or proof of payment will undermine your submission. If any receipts are unavailable, make sure to provide a clear explanation in your affidavit.

Double-check the affidavit’s signature and date. An unsigned or undated form will cause unnecessary back-and-forth with the recipient, prolonging the process.

Avoid vague or generic explanations. Be specific about why you cannot provide a receipt, and provide details that will clarify the situation for the reviewer.

Review your affidavit for accuracy before submission. Small errors, such as incorrect spelling or incorrect amounts, can raise doubts about the legitimacy of your claim.

Don’t submit a scanned or illegible copy of the affidavit. Ensure the document is clearly legible to prevent delays due to misinterpretation.

Missing Receipt Affidavit: Key Points

When submitting a missing receipt affidavit, it’s crucial to be accurate and clear. Begin by including your full name, address, and contact details. State the reason why the receipt is missing and provide as much context as possible, such as the transaction date, amount, and the vendor involved.

Specific Information to Include

Specify any efforts made to retrieve the original receipt, such as contacting the vendor or searching for duplicates. Mention if the purchase was made online, via email, or in person, as this can influence the details you provide. Double-check the amounts and dates for accuracy to avoid complications.

Sworn Statement

The affidavit should include a sworn statement that you made a genuine effort to find the receipt and that all the provided information is true to the best of your knowledge. Sign the document in front of a notary if required by your organization or institution.