If you’ve lost a receipt and need to file an expense report, a missing receipt declaration template is a practical tool. It allows you to explain the situation, ensuring that your claim can still be processed. This document can save time and avoid delays when submitting expenses without receipts.

When creating your declaration, provide clear and accurate details. Include the date of the transaction, the vendor name, the amount, and a brief description of the purchase. If possible, add any additional documentation or reference numbers that can support your claim. This shows transparency and helps validate your expense request.

Use this template to outline the steps you took to retrieve the receipt, such as contacting the vendor. If no receipt is available despite your efforts, this declaration confirms your intention to comply with company policies. Make sure the document is signed and dated to finalize the process.

Here is the corrected version with minimized repetitions:

For clarity and simplicity, focus on providing the necessary details without repeating information. Clearly outline the steps involved in submitting a missing receipt declaration, ensuring each point is concise and easy to follow.

Step-by-Step Instructions

Start by gathering all available information related to the missing receipt. Identify the transaction, including the date, amount, and involved parties. Then, submit this data along with a brief explanation of the situation. Avoid repeating unnecessary details, such as reasons for the missing receipt if they don’t add value to the request.

Additional Recommendations

Double-check for any other required documents or forms before submitting the declaration. Keep the communication clear and focused on the specific issue to prevent confusion. Lastly, ensure that your declaration follows any provided guidelines or formats to improve processing speed.

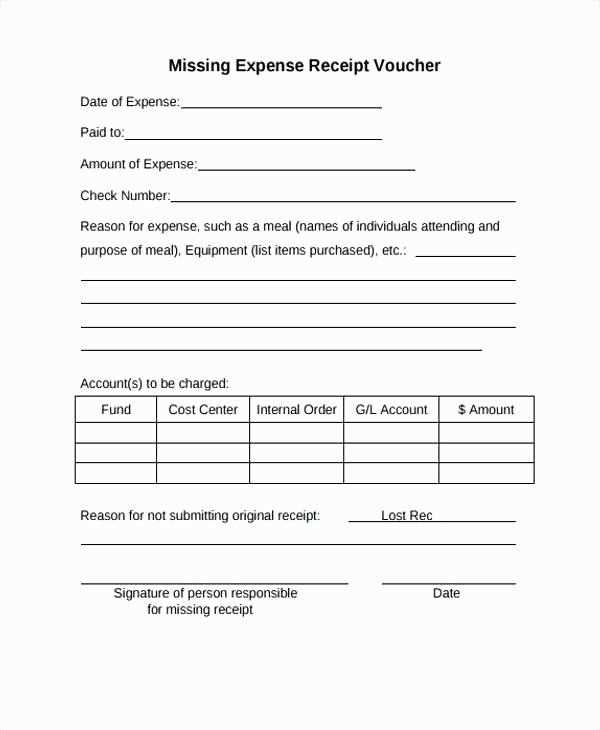

Missing Receipt Declaration Template

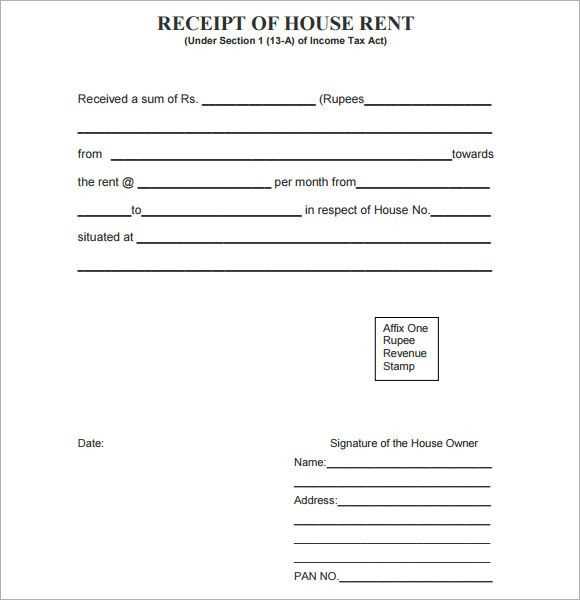

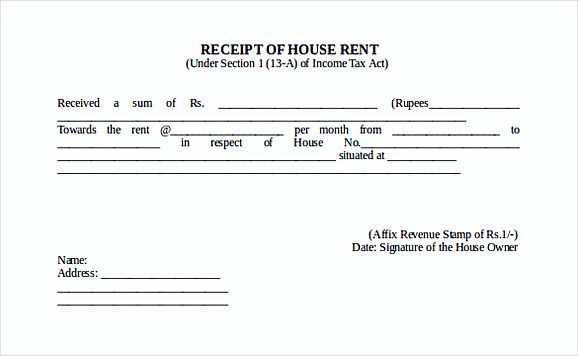

A missing receipt declaration is necessary when you cannot locate a receipt for a business-related expense. To create this form, start by clearly stating the reason why the receipt is missing and provide as much detail as possible about the transaction.

How to Create a Missing Receipt Form

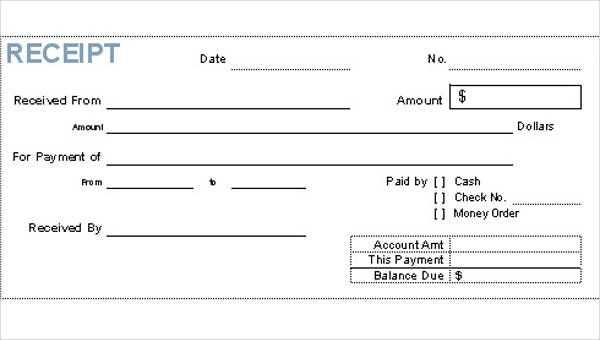

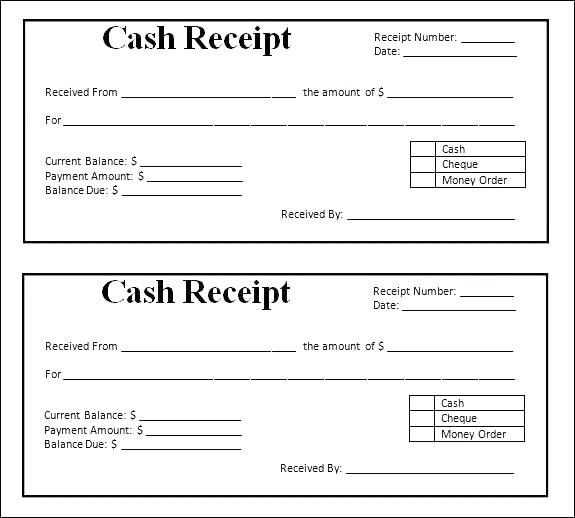

Begin by filling out your company’s standard form or template, which may include sections for the date, merchant, and amount of the transaction. Be sure to include an explanation of why the receipt is unavailable and any alternative proof of the expense, such as a bank statement or credit card record.

Key Information to Include in the Form

Include the following details in your missing receipt form:

- Transaction date

- Vendor or merchant name

- Amount spent

- Purpose of the expense

- Method of payment

- Any supporting documentation, such as a bank or credit card statement

Ensure the explanation is clear and concise. The more detail you provide, the easier it will be for the approval process.

Common Mistakes to Avoid

Avoid vague explanations and ensure all required fields are filled out completely. Do not submit the form without alternative documentation, as this may lead to rejection.

Legal Aspects of Missing Receipts

In some cases, failing to provide adequate documentation for an expense may violate company policy or tax regulations. It’s important to understand your employer’s rules and local laws about what constitutes valid proof for tax purposes.

How to Submit the Declaration for Approval

Once completed, submit your missing receipt form to the appropriate department for approval. Some companies may allow submission through an online portal, while others require a physical copy. Make sure to follow the proper channels to avoid delays in processing your claim.