To track your monthly revenue accurately, use a monthly gross receipts template. This will help you record all incoming payments from sales or services without missing any details. It simplifies your bookkeeping, making it easier to calculate your gross income and understand your cash flow.

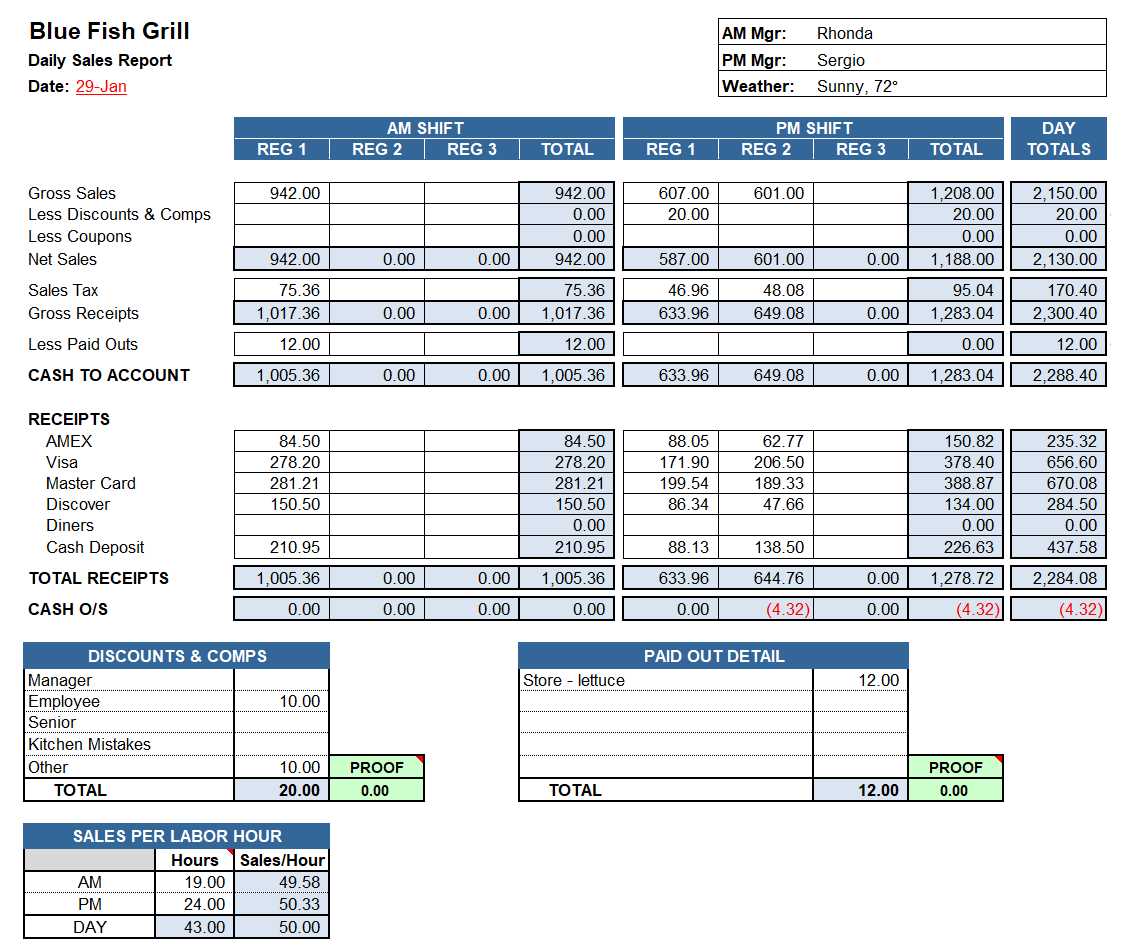

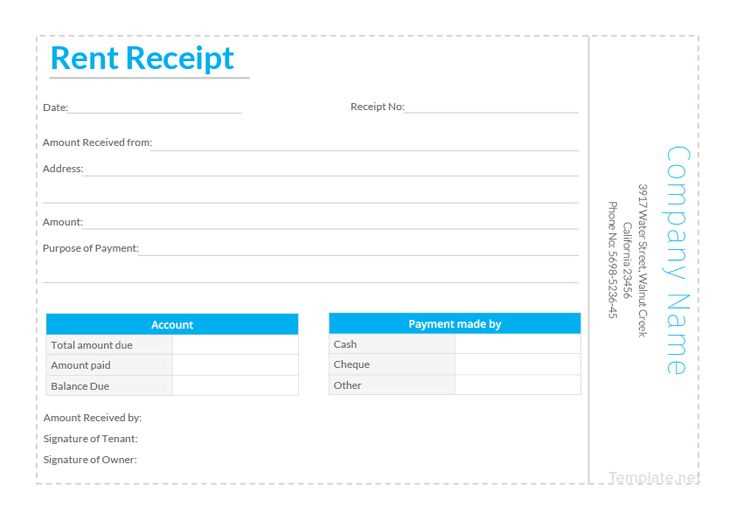

A well-designed template should include fields for the date, client name, description of services or products, and total amount received. This structure ensures no vital information is overlooked, allowing for quick reference when filing taxes or assessing business performance.

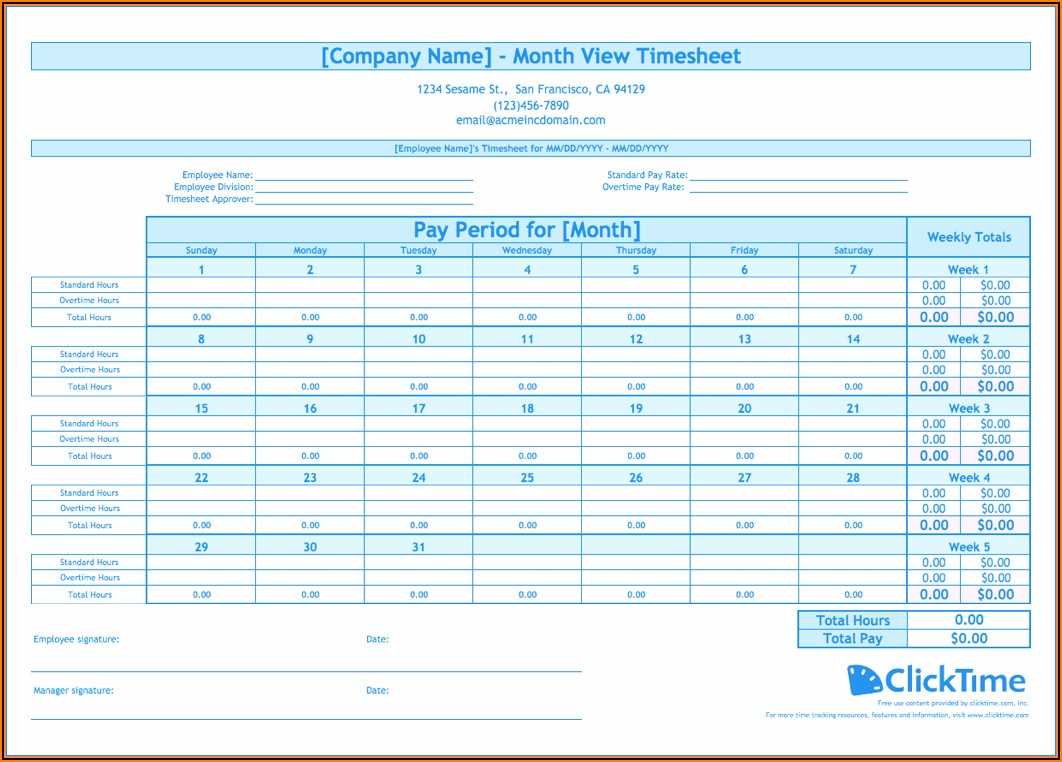

Set up the template to accommodate your specific needs, whether you’re running a small business or managing a larger operation. Make sure to update it regularly to ensure complete and accurate records, which will save you time and effort when preparing financial reports at the end of the month.

Here’s the revised version:

When creating a monthly gross receipts template, include these key details for clarity and accuracy:

Income Breakdown

List all sources of income separately. Specify categories like sales revenue, services rendered, or any additional income streams. This will ensure transparency and help track each type of receipt individually.

Expenses

Record all business-related expenses, such as rent, utilities, and supplies. Make sure to categorize them clearly. This section should provide a clear snapshot of costs versus income for accurate financial tracking.

Include a summary field at the bottom of the template to calculate total income, total expenses, and net profit. This allows for quick review and helps identify trends in monthly financials.

Finally, ensure the template is user-friendly with well-labeled sections, consistent formatting, and a simple layout. This will help prevent errors and streamline the process of updating monthly receipts.

Monthly Gross Receipts Template

How to Structure Your Monthly Receipts Template for Easy Tracking

Key Elements to Include in a Monthly Gross Receipts Record

Common Mistakes to Avoid When Using a Monthly Receipt Template

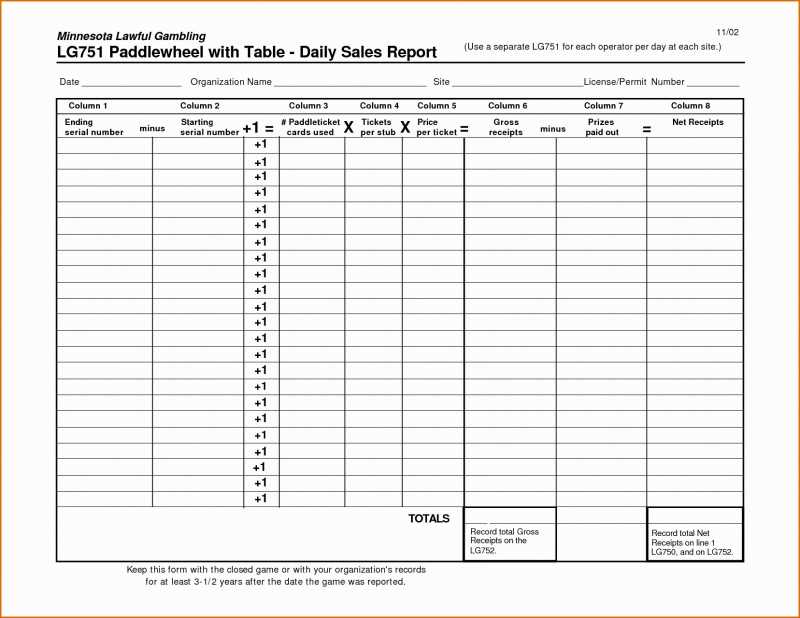

To create an efficient monthly gross receipts template, focus on organizing the data in a clear, structured format. Divide the information into relevant sections like sales, returns, taxes, and discounts. Ensure each section is labeled clearly for quick access. Use a consistent layout so it’s easier to review the records at a glance.

Key Elements to Include in a Monthly Gross Receipts Record

Each entry should contain the following key elements: the date of the transaction, the item or service sold, the sale amount, applicable taxes, any discounts or refunds, and the total gross receipt. Additionally, include any payments received, such as cash, credit card, or other forms of payment. This ensures you have a complete and accurate record for the month.

Common Mistakes to Avoid When Using a Monthly Receipt Template

Avoid neglecting to update the template regularly. Missing entries can create gaps in tracking. Also, ensure consistency in how you categorize transactions. Misclassifying items or services can lead to confusion and errors in your records. Lastly, double-check calculations for accuracy to prevent discrepancies in your gross receipt totals.