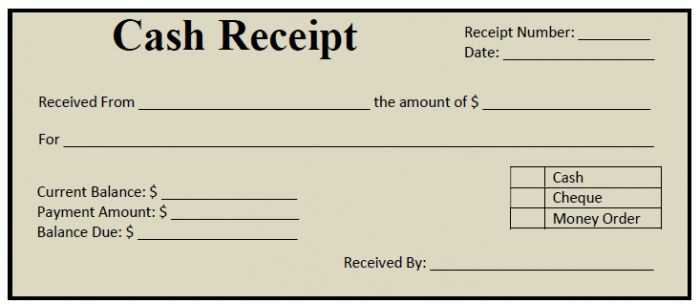

Use a monthly receipt template to streamline your financial record-keeping. This tool helps track all expenses and payments, ensuring no details are overlooked. Customize the template to reflect the necessary categories, such as date, description, amount, and payment method.

Accurate tracking is the key to maintaining clarity and avoiding mistakes. A structured format ensures that you capture all necessary information for each transaction. Adjust the template to fit your business or personal needs, adding fields like tax rate, total, and receipt number for further organization.

By using a standardized template, you can save time and reduce the risk of errors. Keep records simple yet complete, focusing on key aspects of each payment. A consistent format helps in reviewing past receipts and organizing your finances with ease.

Monthly Receipt Template

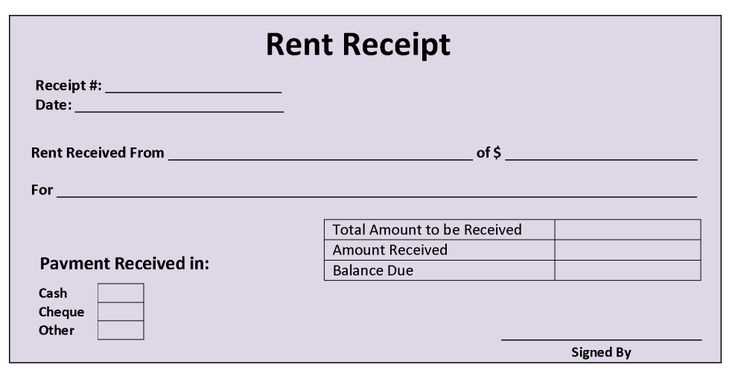

Organize your monthly receipts with a clear and straightforward template. Ensure each receipt includes the date, merchant name, transaction description, and the amount paid. Use columns for consistency: one for the date, another for the payment method, and a third for the total cost. This format helps you track your spending easily and efficiently.

For clarity, break down the total amount into subcategories if necessary, such as taxes or discounts. Adding a unique identifier, like a receipt number, provides a quick reference. Remember to include any relevant transaction details such as items purchased or services rendered.

A structured layout not only simplifies your record-keeping but also ensures you can access and review expenses without difficulty. By sticking to a consistent format, you’ll avoid confusion and maintain accurate financial records.

Creating a Clear Structure for Monthly Receipts

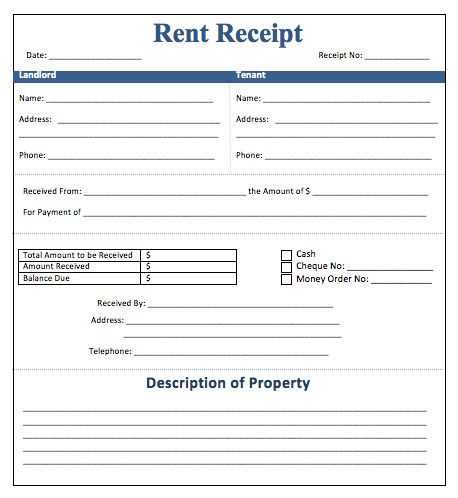

Begin by organizing the receipt into distinct sections. First, include a clear header with the company name, contact details, and the receipt date. This provides immediate context and ensures that essential information is visible at the top.

Itemizing Products or Services

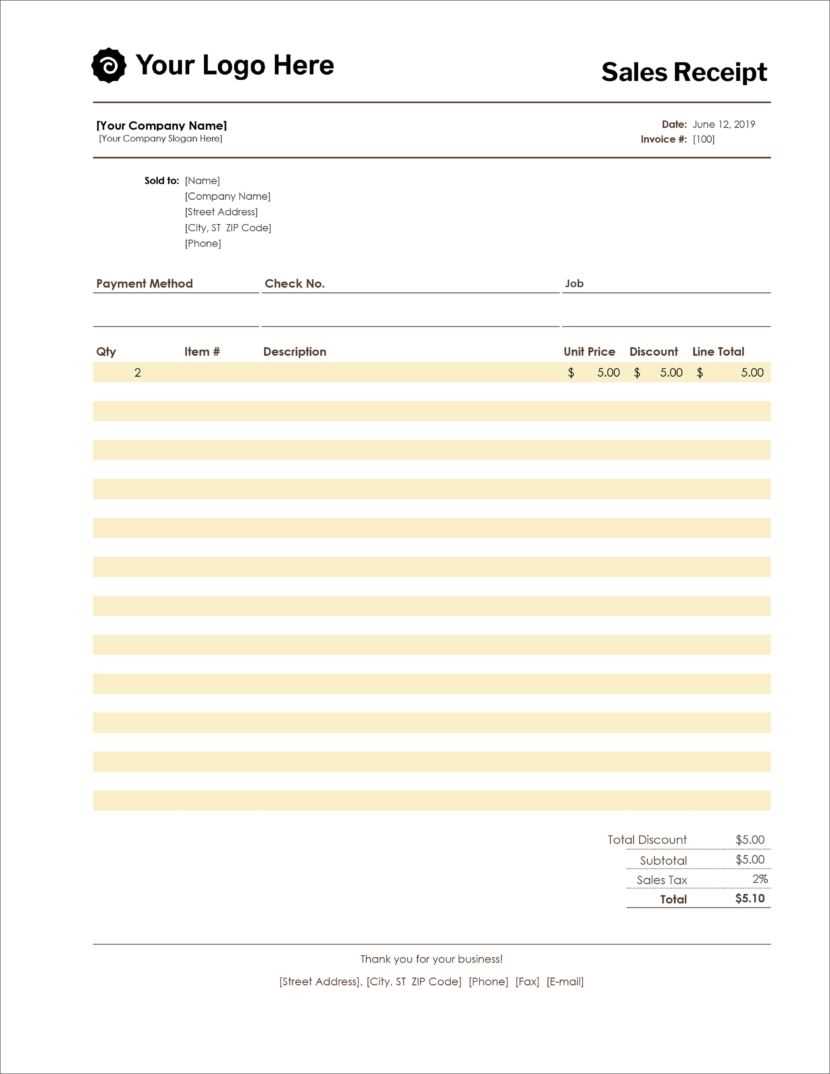

Next, list each item or service with its description, quantity, price per unit, and total cost. Use a simple table format to enhance readability. Ensure the columns are properly aligned, making it easy for the reader to track individual charges. A subtotal should appear after each section for better clarity.

Including Taxes and Discounts

At the bottom of the list, clearly display any applicable taxes or discounts. If there are multiple tax rates, break them down separately. Add a final total that includes the subtotal, taxes, and discounts, so the customer can easily verify the final amount due.

By using a structured layout, you help ensure that the receipt is easy to understand and professionally presented.

Incorporating Tax Information into the Template

Include tax rates and amounts in clear sections to avoid confusion. Place them under a “Tax” heading near the total price, with separate line items for each applicable tax rate. This layout ensures transparency, making it easier for customers to understand how their total is calculated.

Tax Rate Breakdown

List each tax rate with the corresponding amount. For example, if there are multiple tax categories (state, local, VAT), show them individually to keep everything clear. Include the tax percentage beside each category, ensuring customers see exactly what they’re being charged for.

Final Tax Amount

Clearly display the total tax amount at the bottom of the breakdown. The final figure should be highlighted and easy to locate, ensuring no confusion about the tax charge added to the total cost. This helps maintain accuracy and ease of review for both the customer and the business.

Customizing Your Monthly Receipt for Different Expenses

Tailor your monthly receipt to accurately track various expenses by categorizing them. This helps you better understand where your money goes and make adjustments accordingly. Here’s how you can break down your receipt for different types of expenditures:

1. Categorize Your Spending

Group your expenses into clear categories such as utilities, groceries, entertainment, and transportation. For each category, list the specific items or services purchased and their individual costs. This method provides clarity and makes it easier to analyze spending patterns.

2. Include Detailed Descriptions

For each expense, include specific details such as the item or service, the date of purchase, and the vendor. This transparency helps in case you need to reference any purchases later and ensures accuracy in your records.

- Utilities: Gas, electricity, internet bills, etc.

- Groceries: Weekly shopping, specific food items, etc.

- Entertainment: Movies, dining out, subscriptions, etc.

- Transportation: Fuel, public transport, rideshare, etc.

Consider separating one-time purchases from recurring expenses, as this distinction will allow for more effective budgeting and planning for the future.

3. Use Different Formats for Subcategories

If your expenses require further breakdown, use subcategories to create a more detailed view. For example, within “Groceries,” you could separate “Fresh Produce” from “Snacks” or “Household Items.” This helps in managing each type of purchase individually.

- Groceries:

- Fresh Produce

- Snacks

- Household Items

- Entertainment:

- Subscriptions

- Dining

- Movies

By structuring your monthly receipt with these simple categories and subcategories, you create a more organized and manageable expense report that simplifies tracking and budgeting.