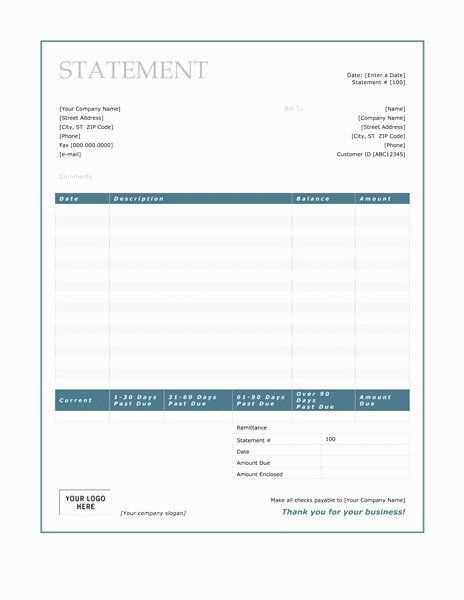

Start with a clear, structured template that includes a receipt at the bottom of the statement. This ensures a clean and easy-to-read format, making it simple for both you and your clients to track and review transactions. By positioning the receipt at the bottom, you maintain a logical flow of information, starting with the essential details at the top and concluding with the itemized list of charges.

Ensure the statement header includes all necessary company information such as name, address, and contact details. Follow with a section for the client’s name and transaction date. The middle section should focus on the billing details, such as the items or services provided, the quantity, and the cost. Finally, at the bottom, place the receipt with a summary of the total amount, any applicable taxes, and payment method.

To enhance clarity, use bold text for headings and italic for details that require emphasis. This not only improves readability but also ensures that important information stands out. Keep everything concise and organized for a professional appearance that clients will appreciate.

Monthly Statement with Receipt at Bottom Template

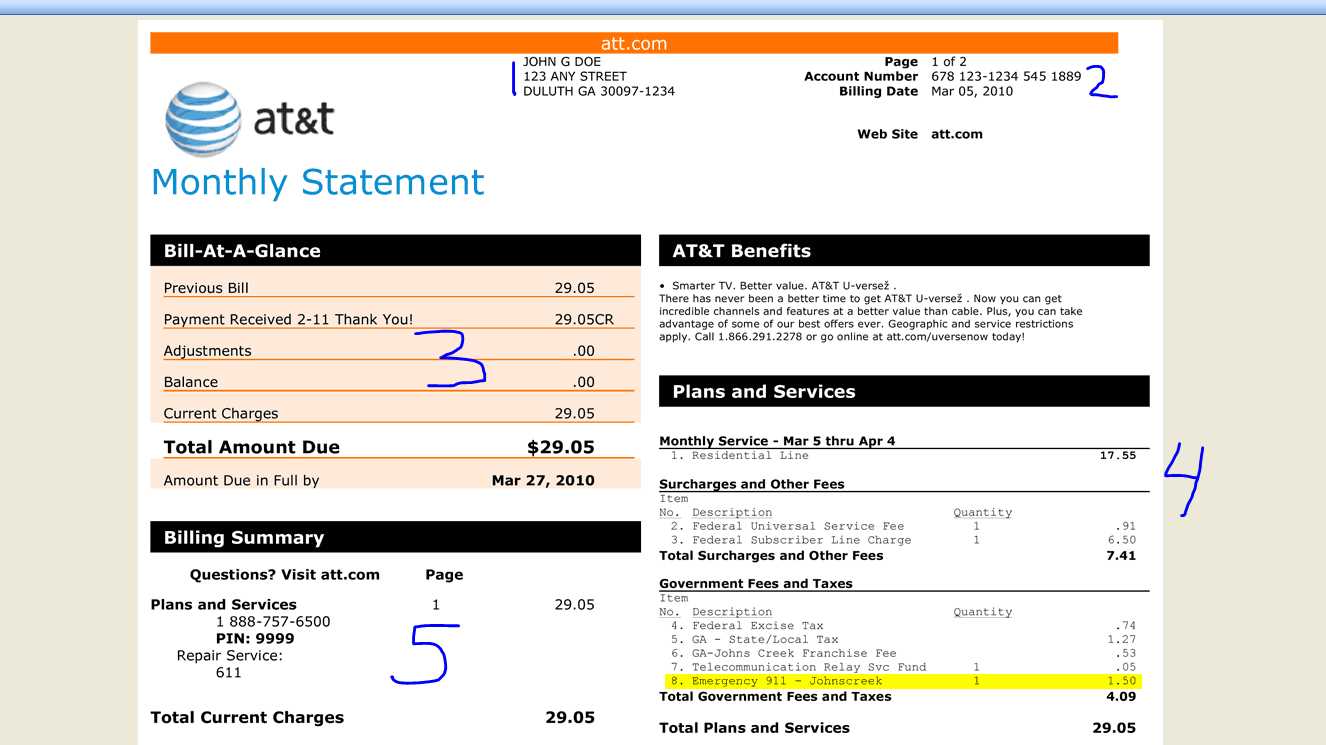

To create a clear and easy-to-read monthly statement with a receipt at the bottom, begin by organizing the statement into sections. Start with the company name and the statement date at the top, followed by the recipient’s details. List transactions with dates, descriptions, and amounts in a table format, ensuring each entry is aligned and readable. Make sure the totals are clearly highlighted at the end of the transaction list.

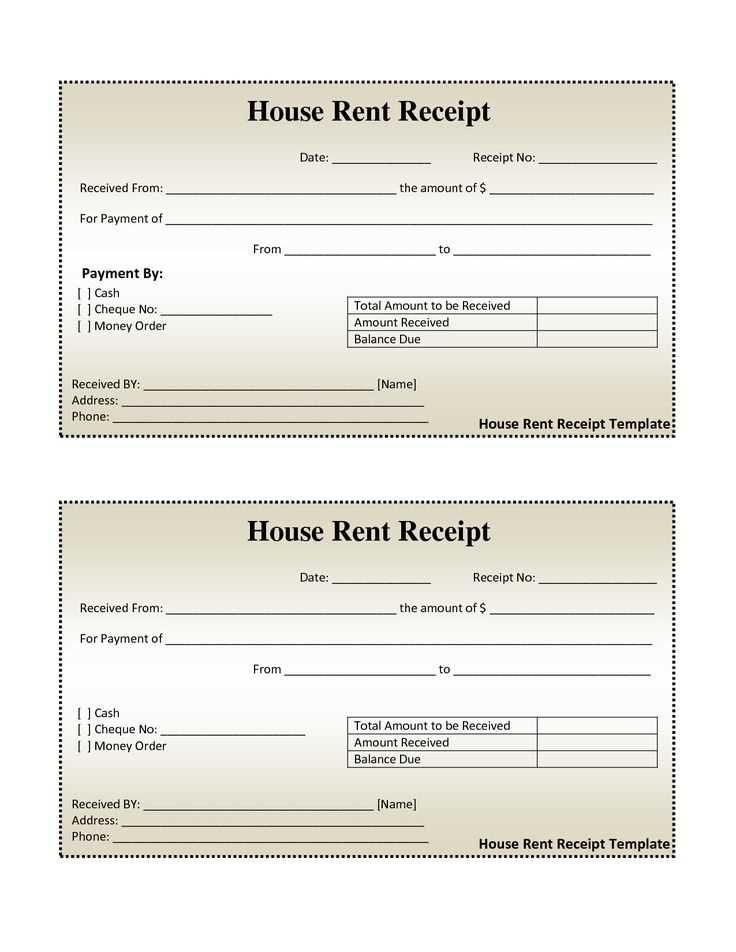

At the bottom of the statement, include the receipt. This should be a separate section, marked clearly with a “Receipt” heading. The receipt should display a summary of the most recent transaction, including item details, quantity, price, and total. Also, add a payment method and transaction number for easy reference. Ensure the font is legible and well-spaced to enhance readability.

Use borders or lines to separate sections and improve the flow of information. Adjust the layout to make sure there’s a smooth transition from the statement to the receipt, creating a professional and organized document. Lastly, double-check all numbers for accuracy and ensure the design complements the company’s branding without overcrowding the page with unnecessary elements.

How to Structure the Template for Clear Information Delivery

Begin with a clean layout. Ensure that key details like the transaction date, item descriptions, and amounts stand out. Use a grid system to separate sections clearly, allowing users to scan the information quickly.

Next, organize the content logically. Place the most important details at the top, such as the summary of charges, followed by more specific information like itemized lists or detailed descriptions. A clear hierarchy of information ensures readers can easily follow the flow of data.

For the receipt section at the bottom, position it in a way that it naturally concludes the document. Include space between the last item and the receipt to prevent clutter. Ensure the receipt includes essential information like transaction number, payment method, and total amount.

- Use headings to define each section–”Transaction Summary”, “Itemized List”, “Payment Information”.

- Keep the font size consistent and readable throughout, especially in key areas like totals and dates.

- Provide clear spacing between items to avoid confusion between line items.

- Ensure all figures are formatted correctly with currency symbols and decimal places for clarity.

Align the information consistently to the left, with totals or key points centered for emphasis. This structure promotes easy reading and ensures important information catches the eye quickly.

By maintaining consistency in both design and content layout, your template will deliver a clear, professional statement with all the necessary information easily accessible. This approach minimizes errors and enhances the user’s experience when reviewing the document.

Steps to Include a Receipt at the Bottom of the Statement

To ensure your statement is clear and organized, add a receipt at the bottom following these steps:

1. Organize the Transaction Details

Before adding the receipt, gather all relevant transaction details: date, amount, itemized purchases, taxes, and any discounts. These elements provide transparency for the recipient.

2. Design the Layout

Position the receipt towards the bottom, but ensure it doesn’t disrupt the flow of the statement. Keep the layout clean by using clear sections to differentiate the statement information from the receipt details.

| Date | Item Description | Amount |

|---|---|---|

| 01/01/2025 | Product A | $20.00 |

| 01/01/2025 | Product B | $15.00 |

| 01/01/2025 | Tax | $2.00 |

| Total | $37.00 | |

Using a table like this helps recipients easily identify and verify the details of the transaction. Make sure the font is legible and consistent with the statement.

3. Include Payment Information

After listing the itemized details, add payment information such as the method (credit card, cash, etc.) and the payment confirmation number, if applicable.

4. Add Contact Information

At the bottom of the receipt, include customer support contact details, such as a phone number or email. This provides a point of reference for any questions or clarifications.

Customizing the Template for Different Businesses

Adjust the layout and design to reflect your business identity. For a retail store, include sections for product descriptions and prices, and place customer purchase details clearly. For service-oriented businesses, emphasize service names, durations, and rates, with extra space for detailed descriptions.

Branding consistency is key. Use your logo, brand colors, and fonts that match your marketing materials. Custom fields for tax or discount codes are useful for businesses like e-commerce or restaurants where promotions are common.

Custom sections may be needed based on industry-specific requirements. For example, if your business requires shipping details, adding a section for shipping status or tracking numbers can enhance the usefulness of the template.

Lastly, ensure that the footer includes necessary contact information and any disclaimers relevant to your industry, like terms of service or warranty conditions.

Formatting and Styling Options for Professional Presentation

Choose clean, consistent fonts like Arial or Helvetica for a polished look. Limit font families to two, ensuring that one is used for headings and another for body text. This approach creates a balanced and clear visual hierarchy. Use larger font sizes for headings to guide the reader’s attention naturally. Keep body text between 10px and 12px for readability.

Color Scheme and Contrast

Opt for a minimalist color scheme. Stick to neutral shades like black, gray, or navy for the text, with accent colors that align with your branding for headings or key sections. Ensure there is enough contrast between text and background for easy readability, especially for printed statements.

Spacing and Alignment

Proper spacing enhances clarity. Use sufficient line spacing (1.5x the font size) and add margins around the edges of your statement. Align text left for consistency and readability. Avoid center alignment for body text as it disrupts the flow of reading.

Include a clearly separated footer with the receipt or payment details. Make sure the footer text is smaller in size to differentiate it from the main content but still legible. Use borders or shading to highlight this section without overwhelming the reader.

By integrating these formatting and styling strategies, your document will not only be professional but also more effective in conveying key information with ease and clarity.

How to Automate Monthly Statement Creation with Templates

Use a reliable template system to speed up the creation of monthly statements. Set up your template with placeholders for data such as names, amounts, dates, and receipts. Tools like Excel, Google Sheets, or dedicated invoicing software can handle template automation with ease.

- Choose your platform: Google Sheets or Excel can automate data insertion using formulas. Tools like QuickBooks or Xero also allow integration with your accounting systems for automatic report generation.

- Set up dynamic fields: Configure fields that update automatically with data pulled from a central database. Use functions to fill out client names, dates, and amounts based on a defined schedule.

- Include receipt tracking: Embed a section at the bottom of the template for receipts. Include placeholders that pull from your receipts database, automatically populating relevant information like payment methods and amounts.

Once the template is configured, set it up to generate statements on a set schedule. For example, an automatic trigger could create and send monthly reports by pulling data from your accounting software at the end of each month.

- Automate with macros or scripts: Use macros in Excel or Google Sheets to automate repetitive tasks. Alternatively, use scripts in Google Apps Script or VBA to trigger reports at regular intervals.

- Schedule email delivery: Some software allows you to set up automatic emails that include the completed statement as an attachment, saving time and reducing manual effort.

Streamline your workflow by taking full advantage of template systems, automating repetitive tasks and improving your efficiency in managing monthly statements.

Legal and Compliance Considerations When Creating Monthly Statements

Ensure accuracy in the details presented on your monthly statements. Verify all charges, dates, and amounts to meet legal requirements. Misleading or incorrect information can lead to compliance issues or disputes. Maintain a clear and precise breakdown of all services, products, and payments, including taxes, fees, and discounts. This transparency prevents legal challenges regarding billing practices.

Adherence to Consumer Protection Laws

Always follow consumer protection laws that apply to your region. Include clear information about how to contact customer support, dispute charges, or resolve issues. Avoid hidden fees or ambiguous terms that might be seen as deceptive practices. Ensure your statements comply with the local regulations, such as providing clear itemization for all services or goods billed.

Data Privacy and Security

Secure personal and financial information when sending monthly statements. Implement encryption and follow data protection regulations to avoid breaches. Always inform your customers about how their data is handled, stored, and used, complying with laws like GDPR or CCPA, depending on your location. This protects both your customers and your business from legal ramifications.