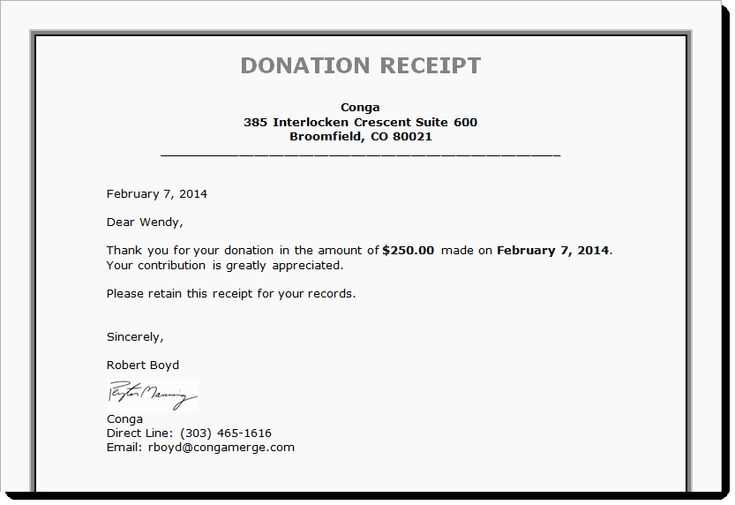

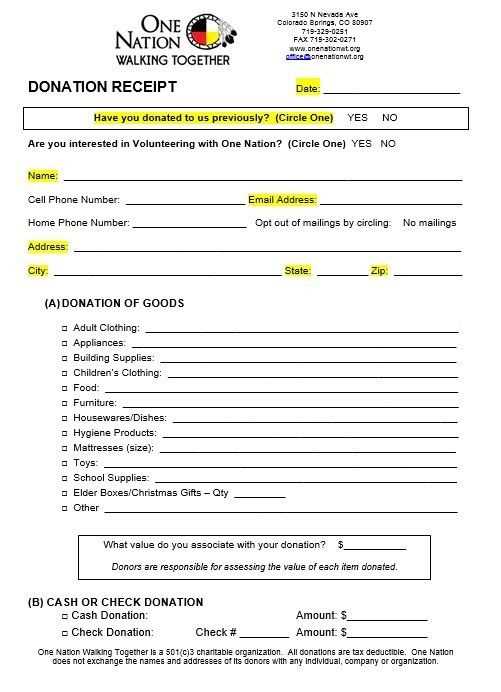

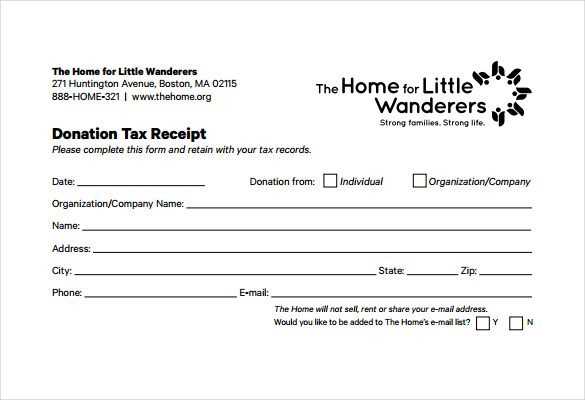

Providing a well-structured contribution receipt is essential for any non-profit organization. A clear and accurate receipt helps donors claim tax deductions and ensures transparency in financial records. The document should include key details such as the donor’s name, contribution amount, date of donation, and a statement confirming whether goods or services were provided in exchange.

To streamline the process, use a standardized template that covers all necessary information. The format should be simple, easy to read, and compliant with IRS guidelines or relevant local regulations. A well-designed receipt not only reassures donors but also simplifies record-keeping for your organization.

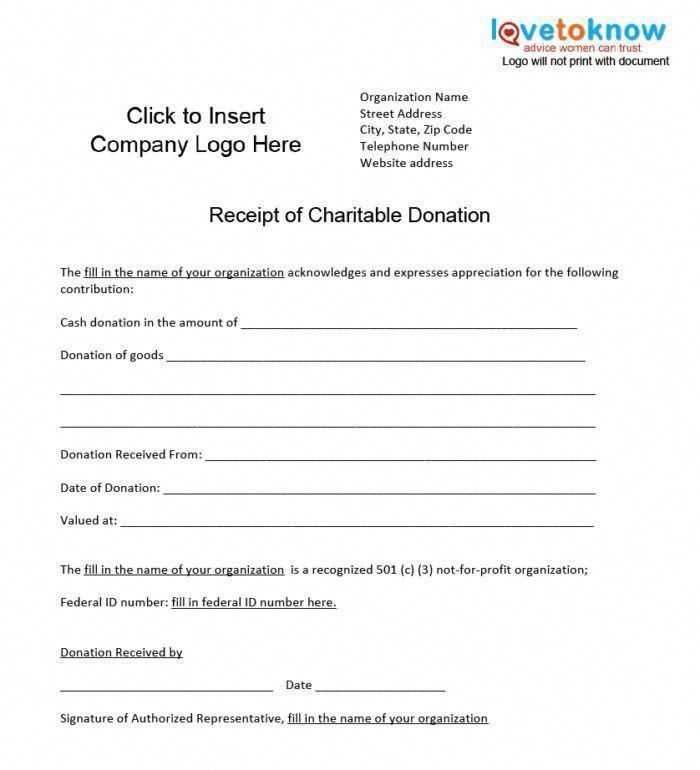

When drafting a receipt, include your organization’s name, address, and tax identification number. If the donation was non-monetary, describe the item and, if possible, provide a reasonable valuation. Always retain a copy for your records to ensure compliance and facilitate future audits if needed.

Consistency is key. Using a uniform template for all contributions reduces errors and maintains a professional approach. Whether you generate receipts manually or use accounting software, keeping them standardized will save time and enhance credibility with donors.

Non-Profit Contribution Receipt Template

A clear and accurate receipt is a key part of managing donations. Ensure your non-profit provides donors with a detailed, well-structured receipt that includes specific information about their contribution. Below is a simple template you can use for this purpose:

Non-Profit Name: [Insert Organization Name]

Address: [Insert Organization Address]

Phone: [Insert Contact Number]

Email: [Insert Contact Email]

Donation Receipt

Donor Information:

Name: [Donor’s Full Name]

Address: [Donor’s Address]

Email: [Donor’s Email]

Donation Details:

Date of Donation: [Insert Date]

Amount: $[Insert Amount]

Type of Contribution: [Cash/Credit/Other]

If applicable, goods or services provided: [Details, if any]

Non-Profit Tax Status: This is a tax-deductible contribution for U.S. federal income tax purposes. Our tax-exempt status is 501(c)(3), and our EIN is [Insert EIN Number].

Thank you for your support!

Authorized Signature:

[Authorized Representative Name]

Title: [Representative Title]

Key Elements to Include in a Contribution Receipt

Ensure your contribution receipt includes these key elements to meet legal and tax requirements while providing transparency to donors:

- Organization’s Name and Address: Clearly state the full legal name and address of your nonprofit organization at the top of the receipt.

- Donor’s Information: Include the donor’s full name and contact details. If applicable, include their tax identification number.

- Receipt Date: Specify the date when the donation was received. This helps in tracking and reporting for tax purposes.

- Donation Amount: Clearly list the exact amount donated. If the contribution includes both cash and non-cash items, itemize them separately.

- Donation Type: Indicate whether the donation is in cash, check, or in-kind. For non-cash donations, provide a description of the items or services donated.

- Confirmation of No Goods or Services: If no goods or services were exchanged in return for the donation, explicitly state this to ensure the donor can claim the full tax deduction.

- Organization’s Tax-Exempt Status: Include a statement confirming your nonprofit’s tax-exempt status, along with your IRS or local tax identification number.

- Signature of Authorized Person: The receipt should include the signature of a person authorized by the nonprofit to acknowledge the donation.

Additional Considerations

- For Contributions Over a Certain Value: If a donor contributes an item valued at over a specified amount, provide a detailed description of the item to ensure accurate reporting.

- Donor Acknowledgment: If applicable, include a message of appreciation or acknowledgment for the donor’s generosity.

IRS Compliance and Legal Requirements for Donation Receipts

Donation receipts must meet IRS standards to ensure tax deductibility. A receipt must include the nonprofit’s name, the date of the donation, and the amount or description of the donated items. For cash donations, the exact dollar amount is required. Nonprofits must also specify whether any goods or services were provided in exchange for the donation. If so, the receipt must estimate the value of those goods or services.

The IRS mandates that any donation of $250 or more must be substantiated with a written acknowledgment from the nonprofit. This acknowledgment must clearly state whether any goods or services were provided and, if so, include a good faith estimate of their value. Donors cannot claim a deduction for gifts exceeding $75 without this acknowledgment.

Nonprofits are also required to maintain accurate records of donations, including receipts for contributions. These records must be available in case of an IRS audit. It’s critical for nonprofits to provide receipts promptly and in the proper format to avoid issues with tax deductions.

Failure to comply with these IRS requirements can result in the denial of tax-deductible status for donations, leading to significant consequences for both donors and nonprofits. Therefore, clear and precise donation receipts are a key part of maintaining legal compliance for all parties involved.

Best Practices for Formatting and Distributing Receipts

Clearly format all receipt information to enhance readability. Use distinct sections for donation details, including the donor’s name, address, donation date, amount, and your organization’s tax ID number. Keep fonts simple and legible, such as Arial or Times New Roman, with appropriate spacing between elements. Include a thank-you message to personalize the receipt, making it feel more meaningful for the donor.

Include Required Tax Information

Ensure the receipt complies with tax regulations. Clearly state that the contribution is tax-deductible, and list your organization’s name, address, and tax-exempt status. If any goods or services were provided in exchange for the donation, note their value, as this affects the deductible amount.

Distribute Receipts Promptly

Send receipts shortly after a donation is made, whether by email or mail. Timely distribution helps maintain transparency and trust with donors. Email receipts are efficient and eco-friendly, while printed receipts can be sent for larger donations or those who request them. Always verify contact details to avoid delays.