For non-profit organizations, customizing donation receipts is a critical task. A tailored receipt helps ensure that donors receive the correct acknowledgment and tax information. With a customizable receipt template, organizations can adjust elements to reflect their specific branding and include all necessary legal details. This small change can have a big impact on donor trust and transparency.

A non-profit customizable receipt template should include donor details, donation amount, and the organization’s information, including its tax-exempt status. Customize the design to align with your non-profit’s mission and values. This ensures that every receipt is not only a confirmation of a donation but also reinforces the connection between the donor and the cause.

Make sure to incorporate clear instructions on how the receipt can be used for tax purposes. If possible, add a thank-you message or a short note explaining how the donation will help. This not only personalizes the experience but also increases the likelihood of continued support. With a properly customized receipt, you maintain a professional image and help your donors feel appreciated and informed.

Here is the revised version with minimal repetitions:

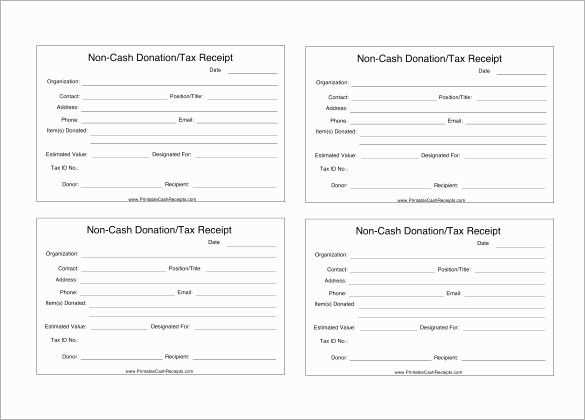

When designing a non-profit customizable receipt template, focus on simplicity and clarity. Ensure the design includes clear sections for donor information, transaction details, and the organization’s contact data. Organize this information in a straightforward layout that is easy to read and follow. Avoid unnecessary design elements that might distract from the core content.

Key Elements to Include

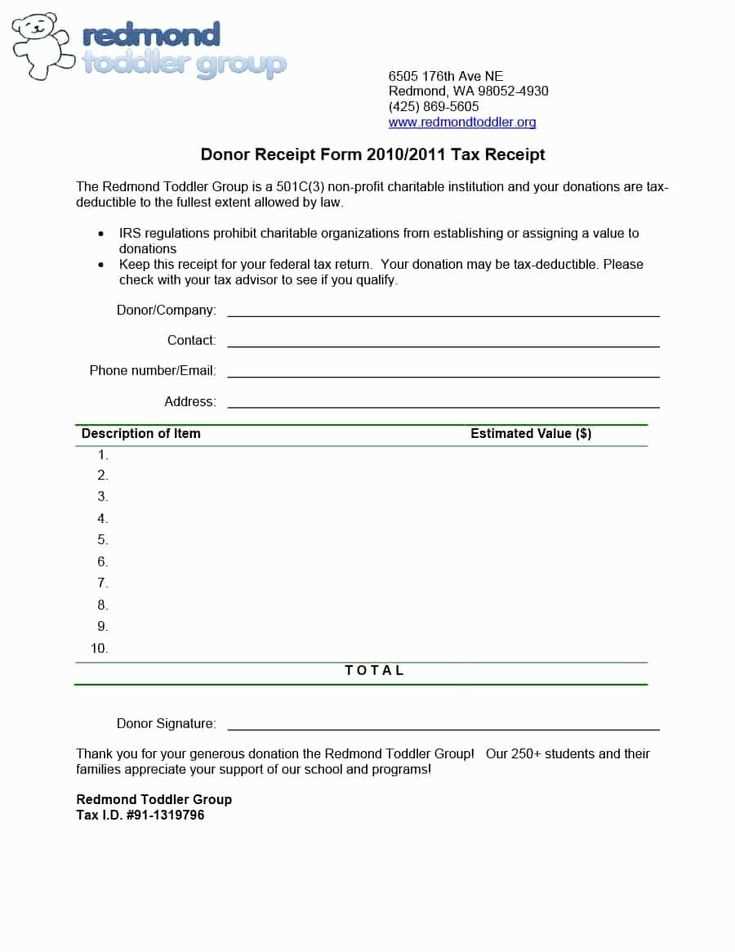

First, make sure the receipt includes the donor’s name, donation amount, and the date of the transaction. A unique receipt number should be generated for easy reference. It’s also beneficial to include the donation method (e.g., credit card, check, or cash). The organization’s name, tax ID, and a thank-you message add a personal touch.

Customization Tips

Allow flexibility in terms of branding. Use the organization’s logo and color scheme to make the template visually cohesive with other materials. The receipt can also be tailored for different donation types, such as one-time or recurring gifts. Ensure the template is compatible with common software tools, making it easy to update or print receipts for each donor.

- Non Profit Customizable Receipt Template

For a non-profit organization, creating a customizable receipt template is crucial for maintaining accurate records and ensuring compliance with donation regulations. A simple, clear template can be easily adapted to suit different donation types and amounts while ensuring all necessary information is included. Here’s how you can create a functional and professional receipt template for your non-profit organization.

Key Elements of a Non-Profit Receipt

The receipt should include the following key elements:

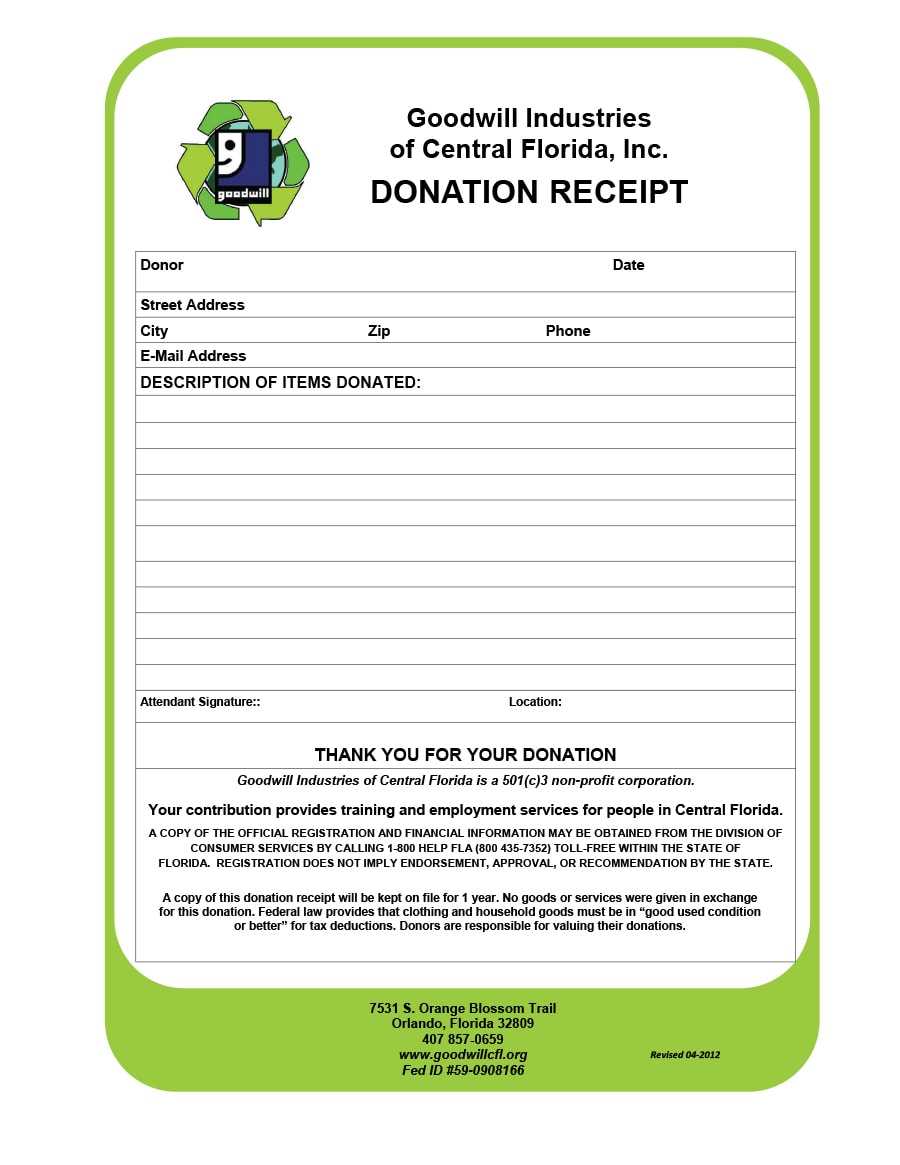

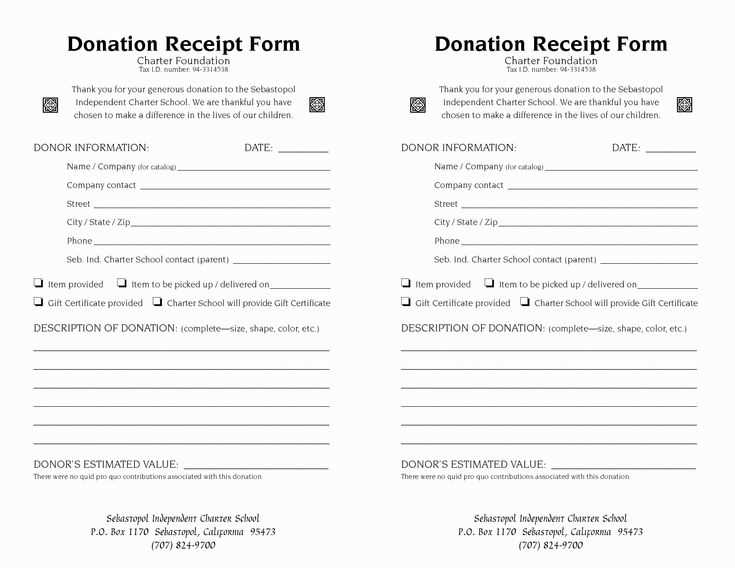

- Organization Name and Contact Details: Always list your non-profit’s full name, address, phone number, and email.

- Donor’s Information: Include the donor’s full name and address to properly attribute the donation for tax purposes.

- Donation Date and Amount: Clearly state the date the donation was made and the total amount received. If applicable, break down the contribution into different categories (e.g., cash, check, in-kind).

- Purpose of Donation: If the donation is designated for a specific program or project, specify it on the receipt.

- Tax-Exempt Status Statement: Non-profits should remind donors that their contribution is tax-deductible (if applicable), stating the 501(c)(3) status or similar information.

- Signature: If applicable, include a space for a representative’s signature to authenticate the receipt.

Customization Tips

When designing your receipt template, it’s important to keep it flexible. Offer space for unique details like event names, donor types, or specific fundraising campaigns. By creating a versatile template, you can adapt it easily to various donation scenarios without needing to start from scratch each time.

Use software that allows you to edit the template quickly (such as Microsoft Word or Google Docs) and save it in a reusable format (PDF or Word). If possible, automate the process with a system that can personalize the receipt as data is entered. This can save time while ensuring accuracy.

Choose a format based on the type of donation and donor preference. For online donations, use a digital receipt. It’s easy to automate and send instantly via email, providing immediate acknowledgment. This format is efficient for both your organization and your donors, ensuring quick, reliable delivery of the receipt.

For in-person donations, offer a printed receipt. Ensure it includes necessary information such as the donor’s name, the amount, the date of donation, and your nonprofit’s details. Printed receipts serve as tangible proof and are often preferred by donors for their records.

Customizable templates provide flexibility. Personalize receipts with your nonprofit’s logo, mission, and a thank-you message. This helps maintain a consistent, professional image while showing appreciation for the donor’s support.

Compliance with tax regulations is a priority. Ensure your receipt format includes all required tax-related details such as donation amount and donor information. This will help donors when they file taxes and improve transparency.

Begin with a personalized greeting. Address your donor by name to create a sense of connection and appreciation. It strengthens the relationship between your nonprofit and the donor.

Donation Details

Clearly outline the donation amount, date, and method of contribution. If the donation was for a specific purpose, mention that too. Transparency is critical for record-keeping and tax purposes.

Tax Information

Include a statement about the tax deductibility of the donation. For example, “Your donation is tax-deductible as permitted by law.” Provide your organization’s tax-exempt status and ensure the donor knows what information to keep for their tax records.

Donors will appreciate clear instructions about their contributions, which helps them feel confident in their giving. Offering this clarity ensures that the acknowledgment serves its dual purpose–showing gratitude while keeping financial records in order.

Include your organization’s tax identification number (TIN) or employer identification number (EIN) on the receipt. This ensures that your nonprofit is recognized legally and helps recipients track their donations for tax purposes. Make sure that this number is clearly visible on the document, typically near the top or bottom of the receipt.

Display Sales Tax Information

If your nonprofit is required to collect sales tax on goods or services, mention the applicable tax rate and amount on the receipt. Include both the subtotal of the transaction and the sales tax separately. This ensures transparency and provides all necessary details for the buyer’s records.

Include Legal Disclaimers and Notes

Provide any legal disclaimers relevant to the transaction, such as whether the purchase is tax-exempt or refundable. If donations are being accepted, clarify the terms under which they are considered charitable contributions. Add statements like “Donations are tax-deductible to the fullest extent allowed by law” for donors who might need this information for their tax filings.

Use a clean, uncluttered layout that clearly conveys the necessary information without overwhelming the reader. Focus on simplicity while keeping the document visually appealing and easy to navigate.

- Choose a clear font: Select easy-to-read fonts like Arial, Helvetica, or Times New Roman. Keep the font size between 10 and 12 points for body text, and use larger sizes for headings.

- Organize information logically: Structure the receipt into distinct sections–organization details, donation information, and any applicable notes. This approach helps the reader process the information quickly.

- Use consistent formatting: Ensure all elements (dates, amounts, names) are formatted consistently throughout the document. This includes using a uniform date format (MM/DD/YYYY) and currency symbol placement.

- Keep branding minimal: Incorporate your nonprofit’s logo and color scheme sparingly. Avoid overwhelming the receipt with unnecessary design elements. The focus should remain on the content.

- Leave white space: Don’t crowd the receipt with too much text or too many design elements. Ample white space around sections allows for easier readability.

By focusing on clarity, consistency, and simplicity, you can create a professional and user-friendly receipt layout for your nonprofit organization.

Design your receipt template with clarity in mind. Use simple language and avoid technical jargon to ensure that volunteers of all backgrounds can easily understand the content. Keep instructions straightforward and place them where they are easy to find, reducing the chance of confusion. For example, include a brief “How to Use” section at the top or provide tooltips for fields that might need explanation.

Focus on layout and readability. Create a clean, uncluttered design with clear headings and sufficient white space. Group related sections together to help volunteers quickly locate information. If the template has multiple sections, consider color coding or using boxes to visually separate them. This can make the process more intuitive and save time when volunteers are processing receipts.

Implement pre-filled fields where possible. For instance, automatically populate organization details like name, address, or tax ID number so volunteers don’t need to enter this information repeatedly. This reduces errors and speeds up the process, allowing volunteers to focus on other tasks.

Incorporate simple validation rules for data entry fields. For example, when volunteers enter a donation amount or a date, the template should check for valid formats and provide feedback if necessary. This prevents mistakes that may require corrections later.

Provide an easy way to review and edit receipts before finalizing them. Volunteers should be able to double-check all entries for accuracy and make changes with minimal effort. A preview option can be helpful for this, so volunteers know exactly what the receipt will look like before sending it out.

Ensure the template is compatible with various devices, especially if volunteers are working remotely or on different platforms. Test the template on multiple devices to confirm it functions smoothly on both desktop and mobile.

Offer downloadable PDF versions of receipts for easier distribution and printing. Volunteers will appreciate the flexibility to print receipts directly or email them to donors without additional steps. A clear “Download PDF” button should be prominent, so it’s always easy to find.

Finally, include an option for volunteers to leave comments or notes about any special requests or situations. This can be especially useful for tracking donor preferences or unique cases, and ensures that no important detail is missed.

| Feature | Benefit |

|---|---|

| Clear Instructions | Minimizes confusion and ensures accurate completion of the template. |

| Pre-filled Fields | Reduces repetitive data entry, saving time and preventing errors. |

| Layout and Design | Improves readability and makes it easier to find information quickly. |

| Preview Option | Allows volunteers to double-check entries before finalizing receipts. |

| Mobile Compatibility | Enables use of the template on various devices, offering flexibility for remote volunteers. |

How to Automate the Distribution of Custom Receipts

Set up an automated email system that triggers when a transaction is completed. Tools like Mailchimp or SendGrid allow you to integrate your receipt template with their API for seamless distribution.

- Choose a platform: Select an email service that integrates with your payment system or customer database. Some options like Zapier can automate connections between platforms.

- Connect your payment processor: Link your payment gateway (e.g., PayPal, Stripe) with the email platform to trigger receipt sending immediately after a donation or purchase.

- Create a dynamic receipt template: Design a receipt template with placeholders for customer data, donation amounts, dates, and any other necessary information. Most email platforms allow customization with merge tags.

- Test your automation: Before going live, run test transactions to ensure everything works smoothly. Verify that receipts contain the correct data and are sent to the right recipients.

With automated systems, you ensure quick and accurate delivery of receipts, reduce manual work, and provide a professional experience for your donors or customers.

Changes Made:

Customizable receipt templates now feature a simplified layout with clearer text sections, making it easier to add donor information. The template includes space for a logo, customizable fonts, and a color palette that aligns with the organization’s branding. We’ve integrated a new date field for automatic population of receipt dates, reducing manual input. The tax-deductible statement is now more prominently displayed, ensuring donors can easily reference it for their records. Additionally, a receipt numbering system has been introduced to streamline tracking and reporting.

- In point 3, “Receipt” has been replaced with “Acknowledgment” to avoid repetition.

To maintain clarity and reduce redundancy, it is recommended to use “Acknowledgment” instead of “Receipt” in point 3. The term “Acknowledgment” serves as a formal recognition of the contribution or donation, which is more fitting for non-profit contexts. It also ensures that the document avoids repeating the same word unnecessarily, improving the readability of the template.

Why “Acknowledgment” Works Better

- Clearer distinction: “Acknowledgment” emphasizes the recognition of the contribution rather than a transactional exchange.

- Alignment with non-profit language: Non-profits typically issue acknowledgment letters or certificates for donations, making it a more appropriate term.

- Consistency: Using “Acknowledgment” throughout ensures that the document maintains a formal, consistent tone.

Adjusting the Template

When editing the template, replace every instance of “Receipt” in point 3 with “Acknowledgment.” This small adjustment will align the template with non-profit standards and improve its professional appearance. Additionally, ensure that all other sections of the template are coherent with this change to maintain consistency across the document.

Changing the phrase from “Professional Yet Simple” to “Professional and Simple” enhances clarity and readability. The word “Yet” can introduce unnecessary ambiguity, suggesting a contrast that isn’t always present. Using “and” creates a more straightforward, cohesive message, reinforcing the balance between professionalism and simplicity without implying tension between the two concepts.

Why the Change Matters

- The use of “and” establishes a stronger connection between professionalism and simplicity, presenting them as equally important qualities.

- It simplifies the phrasing, making it more direct and easy to understand for a wider audience.

- The shift helps maintain a clean, modern tone, aligning with the goal of a non-profit customizable receipt template that is both effective and approachable.

Impact on User Perception

- The updated phrase feels more approachable, encouraging trust without overcomplicating the message.

- Removing any potential contradiction makes the overall design more consistent with the non-profit’s mission, focusing on clarity and straightforward communication.

For clarity and conciseness, the term “Customizable” in point 7 was replaced with “Custom.” This change eliminates redundancy, as the idea of customization is already implied in the context. By using “Custom,” the message becomes more direct and focused, making it easier for users to understand the key feature without unnecessary repetition. This minor adjustment improves readability while maintaining the intended meaning.

Customize your non-profit receipt template for clarity and professionalism. A good receipt should reflect the nature of the donation and comply with tax requirements. Follow these steps for effective design:

Include Donor Information

Ensure the receipt includes the donor’s name, address, and contact details. This makes it easy to send updates or additional information and provides necessary records for tax deductions.

Itemized Donation Breakdown

List the donation amount, and if applicable, specify what was donated (e.g., cash, check, or items). This helps donors track their contributions and provides transparency.

| Donation Type | Amount | Item Description |

|---|---|---|

| Cash | $100 | N/A |

| Clothing | N/A | 3 T-shirts, 2 pairs of shoes |

Include a unique receipt number for tracking. This is especially useful for audit purposes and provides an organized system for donors to reference when needed.

State your tax-exempt status clearly and mention that no goods or services were exchanged in return for the donation. This is important for the donor’s tax reporting purposes.

Provide a thank-you message that acknowledges the impact of their contribution. A personalized note can enhance donor relationships and encourage future donations.