A well-organized gift receipt plays a key role in maintaining transparency and ensuring tax compliance for your nonprofit organization. By providing a clear and accurate template, you help donors document their contributions and fulfill legal requirements for tax deductions. Whether the donation is cash, goods, or services, a receipt serves as proof of the donation and outlines the details necessary for tax purposes.

Include the donor’s name, the date of the donation, and the specific items or amounts donated. For cash donations, the amount should be explicitly stated. If the donation is in kind, describe the items and their estimated value. Keep in mind that nonprofit organizations cannot assign a value to non-cash donations; the donor is responsible for determining the value of goods or services given.

Make sure the receipt includes a statement that no goods or services were exchanged for the donation if that’s the case. This helps avoid confusion and reinforces the tax-deductible nature of the contribution. The IRS requires that these details be included to maintain eligibility for deductions. Provide a copy of the receipt to the donor, and keep one for your records.

By using a consistent and accurate gift receipt template, you streamline the donation process, build trust with your supporters, and stay compliant with tax regulations. Make it easy for donors to claim their deductions while ensuring your nonprofit operates transparently and efficiently.

Non-Profit Gift Receipt Template: Practical Guide

A well-designed gift receipt helps ensure transparency and complies with IRS requirements for tax-deductible donations. To create an effective template, make sure it includes specific information such as the donor’s name, the donation amount or description of donated property, the date of the contribution, and a statement about whether any goods or services were provided in exchange for the donation.

Key Components to Include

Ensure the receipt contains the following details:

- Non-Profit Organization Name: Clearly list the full legal name of the organization.

- Donation Date: Include the exact date the donation was received.

- Donor Information: Name and address of the donor. If it’s a joint donation, list all involved parties.

- Donation Amount or Description: Specify the dollar amount for monetary gifts or provide a description of any in-kind donations.

- Tax Status Statement: Include a brief statement confirming that the organization is tax-exempt under section 501(c)(3) of the IRS code.

- Goods or Services Provided: If applicable, state whether anything of value was provided in exchange for the donation, and if so, include the fair market value of those goods or services.

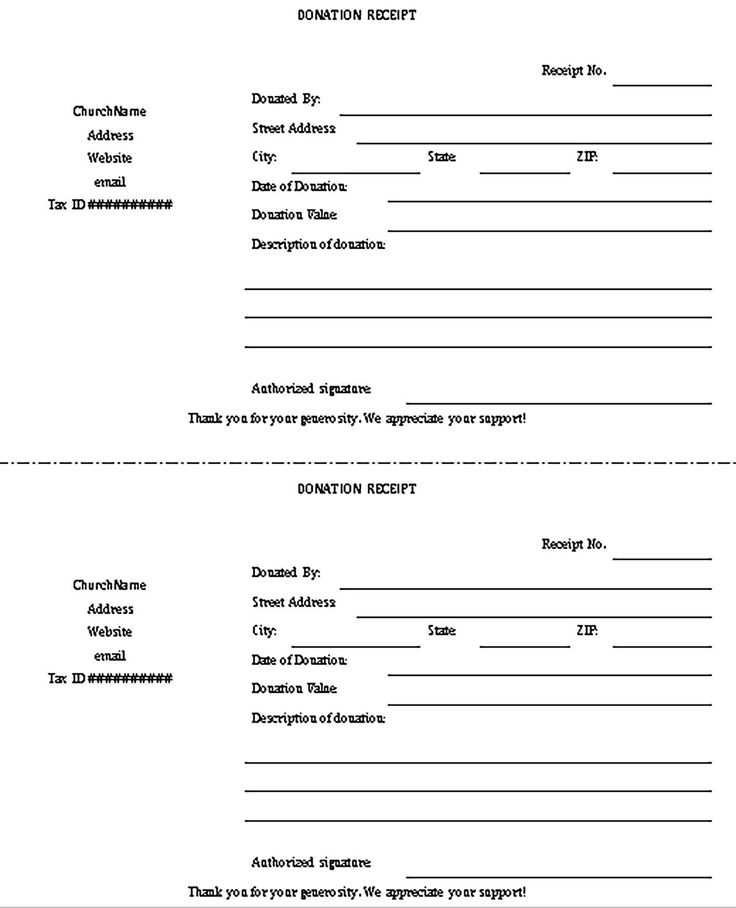

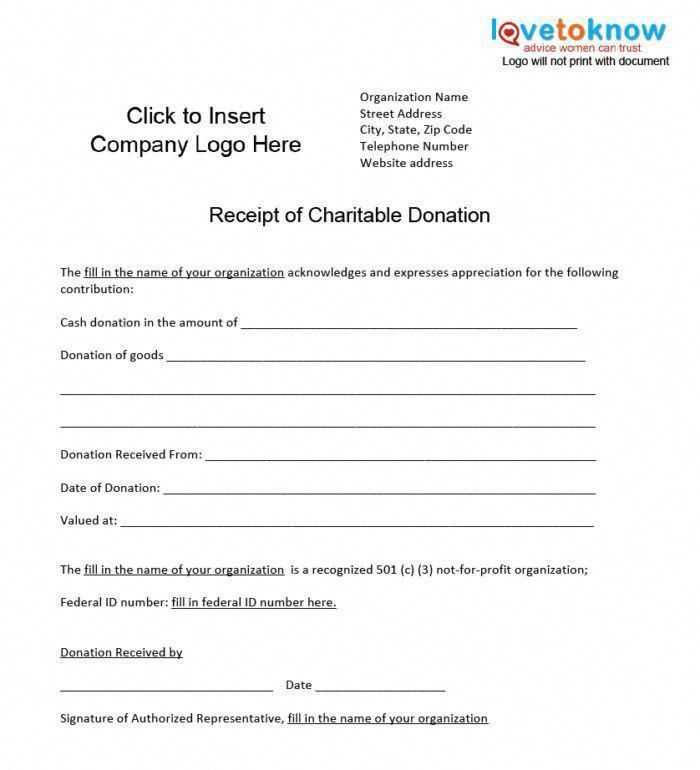

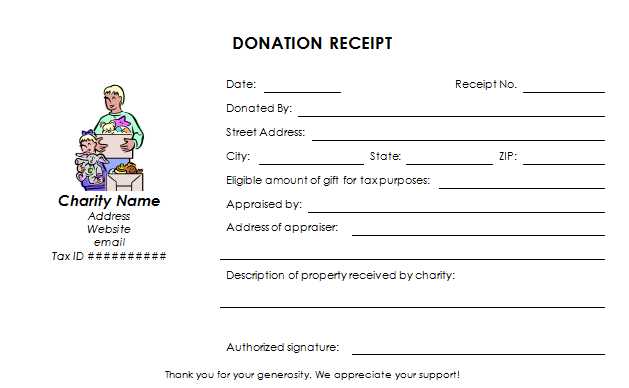

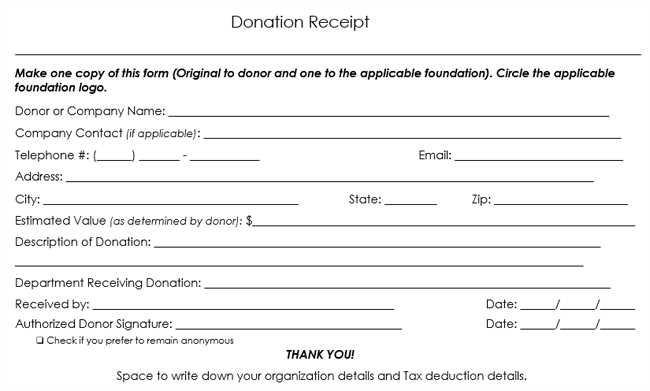

Sample Template

Here’s an example template:

------------------------------------------------------ Organization Name: [Your Organization's Name] Tax-Exempt Status: [IRS 501(c)(3) Status] Address: [Organization's Address] Phone: [Organization's Phone Number] Email: [Organization's Email] Donor's Name: [Donor's Full Name] Donor's Address: [Donor's Address] Donation Date: [MM/DD/YYYY] Donation Amount or Description: [Monetary Amount or Description of Property] No goods or services were provided in exchange for this donation. OR Goods/Services Provided: [Brief Description, including Fair Market Value] Thank you for your generous contribution. Signature: ______________________ Authorized Representative ------------------------------------------------------

By providing all necessary details in your receipt, you help ensure that donors can easily claim their tax deductions and that your organization stays compliant with regulations.

How to Structure a Non-Profit Gift Receipt Template

A well-structured gift receipt helps both donors and organizations stay compliant with tax laws and maintain clear records. Here’s a straightforward guide to building an efficient receipt template for non-profit donations:

Key Information to Include

- Organization Details: Include the non-profit’s full name, address, and tax identification number (EIN). This ensures the donor can verify the organization’s legitimacy for tax purposes.

- Donor Information: Include the donor’s name and address. This should match the details provided by the donor when they made the gift.

- Donation Date: Clearly state the date the donation was received. This is important for tax reporting and record-keeping.

- Donation Amount: Specify the amount of the donation, including whether it was cash, check, or another form of payment.

- Description of Non-Cash Gifts: For donations of goods or services, provide a detailed description of the items or services, including their condition. You do not need to assign a value, but be clear about what was donated.

- Tax Deductibility Statement: A statement confirming whether the donation is tax-deductible. For example: “No goods or services were provided in exchange for this donation,” if applicable.

Format Considerations

- Clear Structure: Keep the receipt simple and easy to read. Use bullet points or numbered lists to organize information.

- Legal Language: Use language that meets IRS guidelines for charitable donations. Ensure the wording about tax-deductibility is correct to avoid confusion.

- Signature or Authorized Representative: Include space for the signature of an authorized representative of the non-profit if required. This confirms the receipt’s validity.

Key Information to Include in a Non-Profit Donation Receipt

A non-profit donation receipt should include specific details to ensure accuracy and transparency. Here’s what to include:

1. Donor’s Information

Include the donor’s full name and address. This helps both parties keep accurate records for tax purposes. Make sure to use the donor’s legal name as listed on their tax documents.

2. Donation Details

Clearly state the date of the donation and the amount given. If the donation is monetary, specify the exact amount. If the donation is in-kind (e.g., goods or services), describe the item(s) and estimate the fair market value.

If the donation is a pledge or recurring, mention the payment schedule or terms.

3. Non-Profit Information

Include the name of the non-profit, its address, and its federal tax identification number (EIN). This information is necessary for the donor to claim tax deductions.

4. Statement of No Goods or Services Received

If the donor did not receive any goods or services in exchange for the donation, include a statement confirming this. If any benefits were provided, mention them and include their fair market value. This helps clarify the deductible amount.

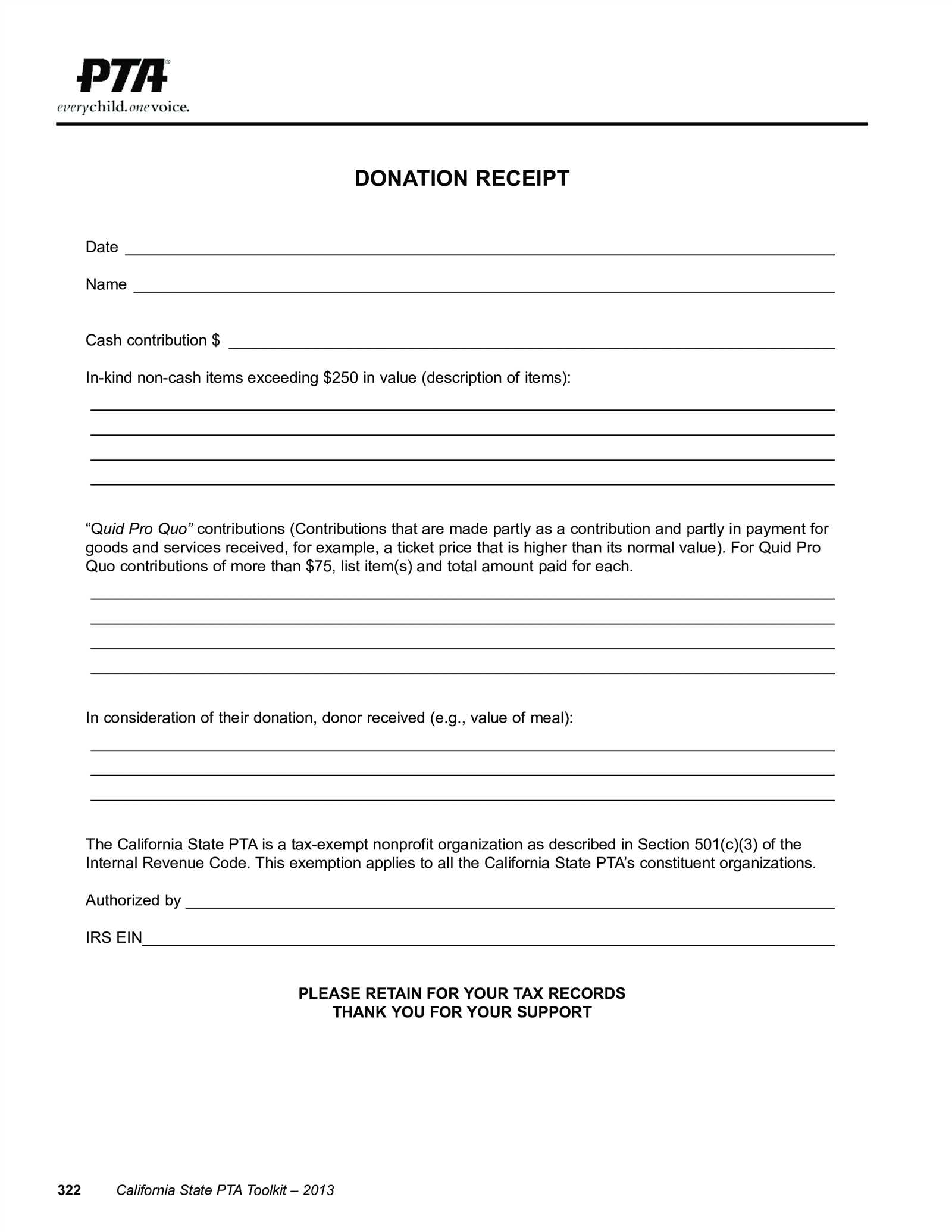

Legal and Tax Considerations for Non-Profit Gift Receipts

Non-profit organizations must adhere to specific rules when issuing gift receipts to donors. Accurate documentation is necessary to ensure both compliance and transparency. Ensure each receipt includes the donor’s name, the donation amount, and a statement confirming that no goods or services were provided in exchange for the gift. This is vital for the donor’s tax purposes.

The IRS mandates that donations over $250 must be substantiated by a written acknowledgment from the charity. For these contributions, the receipt must include a description of the property donated, the fair market value, and whether any goods or services were received in return. This helps donors claim their tax deductions without issues.

Non-profits should maintain records of all donations and receipts for at least three years in case of IRS audits. It’s crucial to stay updated with local tax regulations, as they can vary by region and donation type.

For non-cash gifts, such as property or securities, the receipt should also specify the method used to determine the fair market value. If the donor claims a deduction for a non-cash gift exceeding $500, they are required to file IRS Form 8283 along with their tax return. Non-profits must keep a copy of this form for their records.

Ensure that all receipts are clear, accurate, and compliant to protect both the donor’s and the organization’s interests. Any discrepancies could lead to tax penalties or loss of charitable status.