Creating a receipt for donations or payments is a straightforward process, but it requires attention to detail. A well-structured receipt ensures transparency and can help your organization maintain accurate records. It also allows donors to track their contributions, which is useful for both tax purposes and keeping your organization accountable.

Make sure your receipt includes key details such as the donor’s name, the amount donated, and the date of the transaction. Clearly state the purpose of the donation (e.g., general support, event sponsorship, etc.) to avoid confusion later on. This helps the donor understand how their contribution is being used and strengthens their connection with your cause.

Include your organization’s name and contact information on the receipt. This ensures that recipients can reach out for any inquiries or follow-ups. Additionally, it provides a professional appearance, which is important when dealing with financial matters.

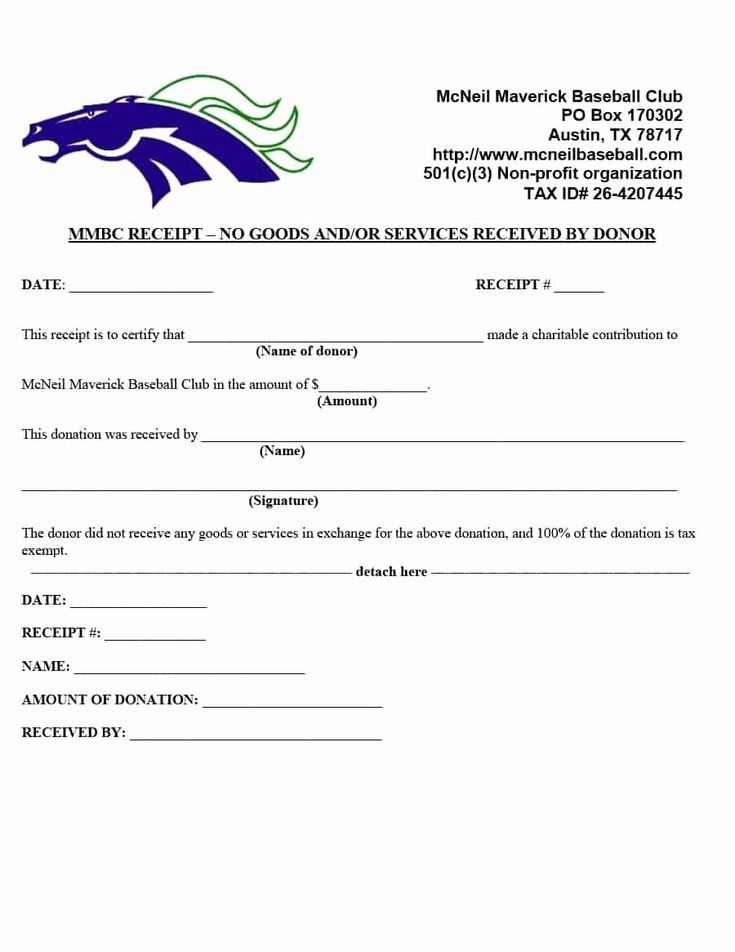

Always include a clear statement that no goods or services were provided in exchange for the donation, if that is the case. This ensures the donor is eligible for a tax deduction under IRS rules. Don’t forget to add your tax-exempt status number for their reference.

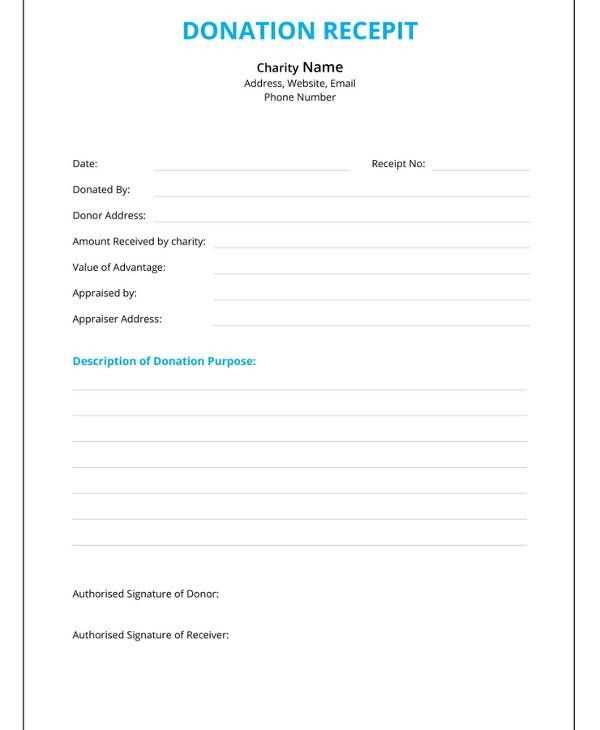

Finally, consider using a template to standardize your receipts. This will save you time and ensure consistency across all donations and payments. Customizable receipt templates allow for easy updates, so you can adapt them as your organization grows or changes its donation policies.

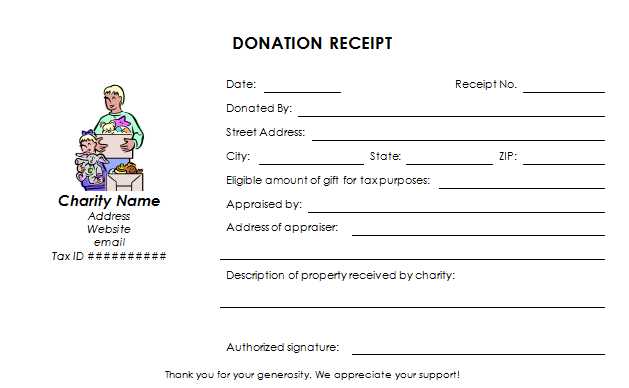

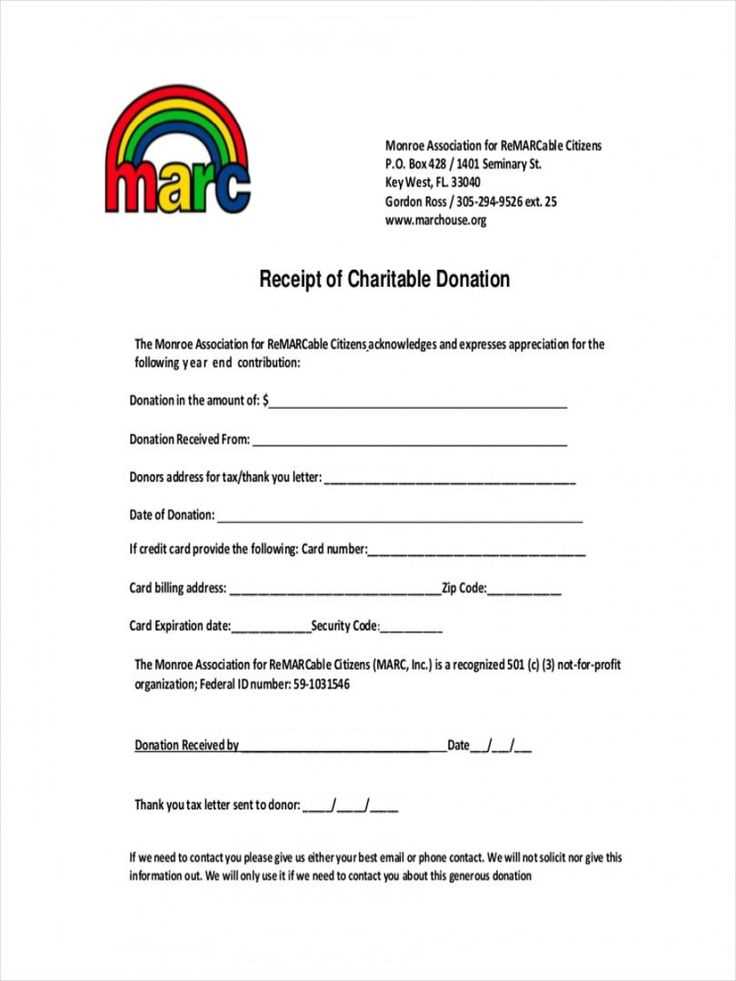

Non Profit Organization Receipt Template

For a non-profit organization, a well-structured receipt is necessary to acknowledge donations and maintain transparency. A standard receipt should include the following details:

- Organization Name: Clearly display the full legal name of the organization.

- Donor Information: Include the name and address of the donor. This information is important for tax deduction purposes.

- Date of Donation: Mention the exact date the donation was received.

- Donation Amount: Specify the value of the donation. If it’s a monetary donation, list the exact dollar amount. For in-kind donations, provide an itemized list with estimated values.

- Description of Donation: For non-cash donations, describe the donated items or services. This helps donors claim the appropriate tax deductions.

- Tax-Exempt Status: Clearly state that the organization is a tax-exempt entity under IRS rules (e.g., 501(c)(3) status in the U.S.).

- Statement of No Goods or Services Provided: If the donor did not receive anything in return for the donation, include this statement: “No goods or services were provided in exchange for this donation.” If goods or services were provided, state the fair market value of the benefits.

- Receipt Number: Assign a unique receipt number for internal tracking purposes.

- Signature of Authorized Representative: The receipt should be signed by someone from the organization to authenticate it.

This template format helps ensure donors have all the necessary documentation for tax purposes and keeps the organization compliant with regulations.

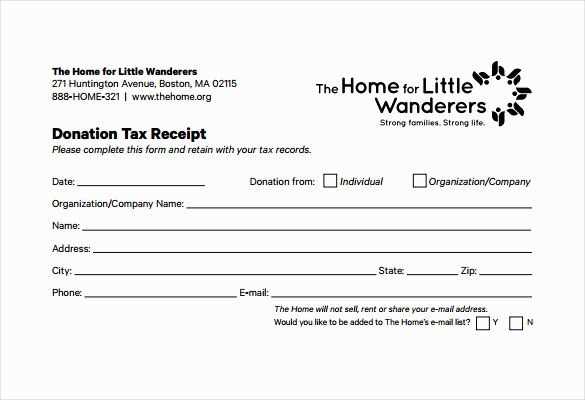

How to Create a Donation Receipt for Non-Profit Organizations

Ensure each donation receipt contains the following key details to remain compliant and provide clear documentation for donors:

- Non-Profit’s Name and Address: Clearly display the full name and physical address of your organization.

- Date of Donation: Include the exact date the donation was received. This is critical for tax purposes.

- Donor’s Name: Use the name of the donor as provided during the transaction. Make sure it matches their records.

- Amount Donated: Specify the exact amount of money or the description of donated items. If it’s a cash donation, state the value. If it’s non-cash, describe the items and give an estimated value.

- Tax Deductibility Statement: State that your organization is a tax-exempt non-profit. For example, “Your donation is tax-deductible as allowed by law.”

- No Goods or Services Received: If the donation was fully tax-deductible, make a clear statement that the donor did not receive goods or services in exchange for the donation.

- Signature or Authorized Representative: Include the signature of the person in charge of issuing the receipt (e.g., Executive Director).

- Receipt Number: Assign a unique identifier to each receipt for record-keeping purposes.

Double-check all information for accuracy before issuing the receipt. Donors will rely on this document for their tax filings, and incorrect details can lead to confusion or issues down the line.

Key Legal Information to Include in Non-Profit Donation Receipts

Include the following key legal elements in your non-profit donation receipts to stay compliant and transparent:

1. Name and Tax-Exempt Status

Clearly state the name of your non-profit organization and confirm its tax-exempt status. If applicable, include the IRS tax-exempt number (EIN) to verify that donations are tax-deductible under IRS regulations.

2. Date and Amount of Donation

Record the exact date of the donation and the amount received. This is crucial for donors to claim deductions on their tax returns. For non-cash donations, provide a description and fair market value estimate.

3. Statement of No Goods or Services Provided

If the donor did not receive anything in exchange for the contribution, include a statement such as: “No goods or services were provided in exchange for your donation.” If something was exchanged, mention its value and nature.

4. Acknowledgment of Gift

Provide a clear acknowledgment of the gift, including a thank-you message that reassures donors of their impact on your organization’s mission.

5. Legal Compliance and Receipt Signature

For donations over a certain threshold, especially non-cash donations, ensure that the receipt complies with IRS or local jurisdiction rules. For larger contributions, consider having an authorized person sign the receipt.

Including these legal details in your donation receipts not only helps your donors with their tax filings but also builds trust with your supporters. Ensure your receipts are precise, transparent, and legally compliant to maintain integrity.

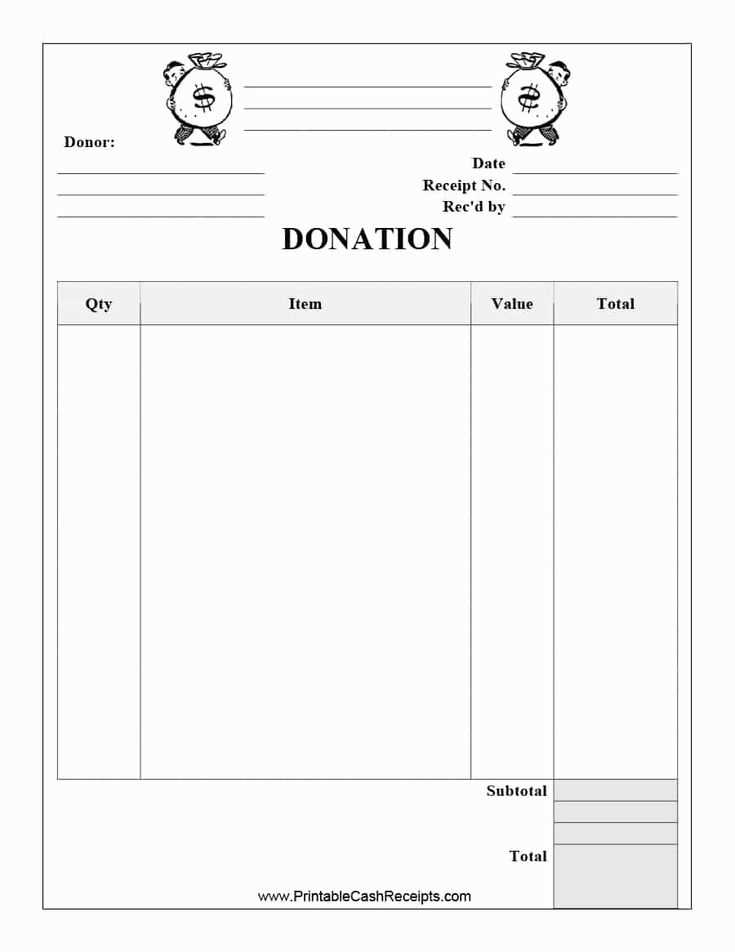

Customizing Your Receipt Template for Different Donation Types

Tailor your receipt template to reflect the specific donation type for clarity and accuracy. For monetary donations, include the exact amount, date, and a clear statement acknowledging the donor’s contribution. For in-kind donations, list the donated items along with their approximate value, ensuring the donor receives proper recognition for their generosity.

If your organization accepts stocks or securities, detail the number of shares, the donation’s market value on the transfer date, and any associated tax implications. For pledges, specify the pledge amount, the expected payment schedule, and the balance remaining.

Be sure to include a unique reference number or ID on each receipt to streamline record-keeping. If your organization has specific programs or campaigns, mention them to link the donation to the correct initiative.

Lastly, for recurring donations, clearly outline the frequency and total amount of the donor’s commitment, and include an easily accessible way for them to update or cancel their subscription if needed.