Creating a clear and professional receipt template for your non-profit organization helps ensure proper documentation for donations and other contributions. A receipt serves as proof for both the donor and the organization, and it’s vital that it contains specific details.

Include donor’s name, donation amount, and date in a visible and easy-to-read section. This is the most critical information for both accounting and tax purposes. Make sure the wording specifies that the donation is tax-deductible, if applicable, with the necessary legal language.

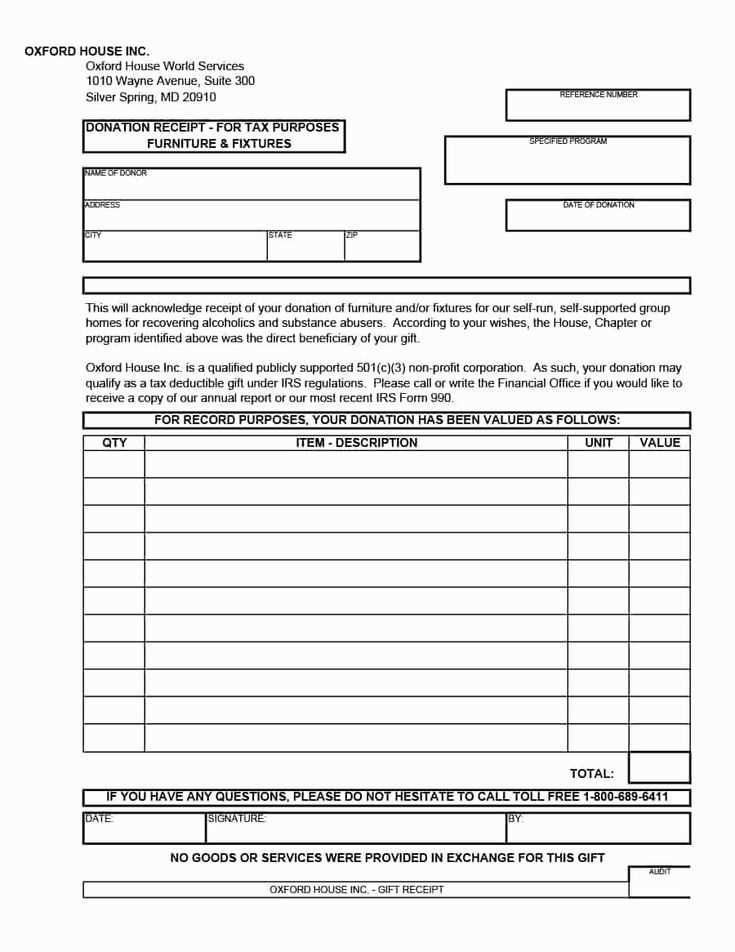

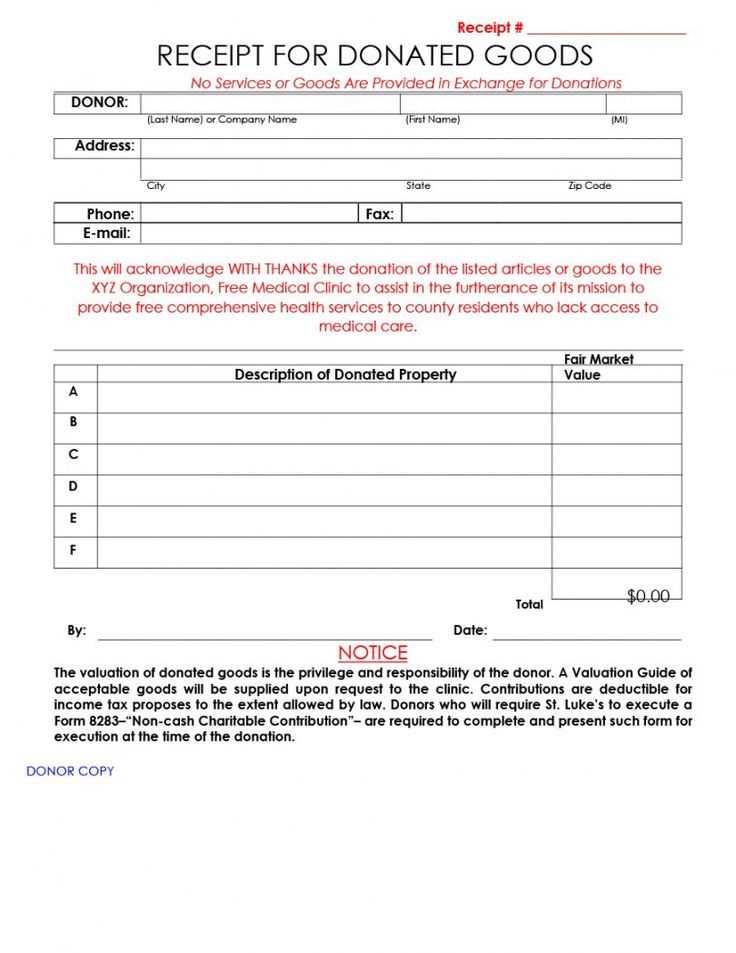

Ensure transparency in the donation breakdown. If the contribution includes multiple items or services, list each one separately. This adds clarity for the donor, especially when large contributions or itemized donations are involved.

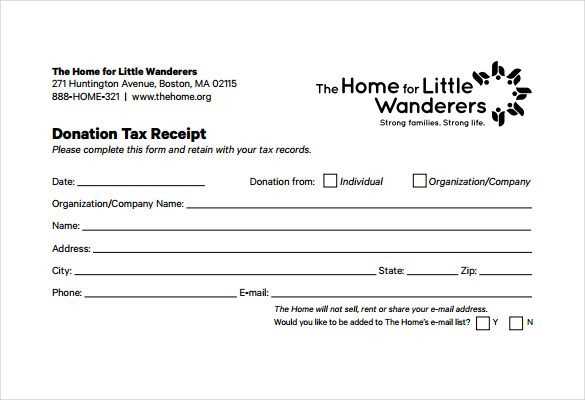

Lastly, add your organization’s contact details, including address, email, and phone number. This ensures that if any questions arise, donors can easily get in touch with you for further clarification.

Here is the revised version without excessive repetition:

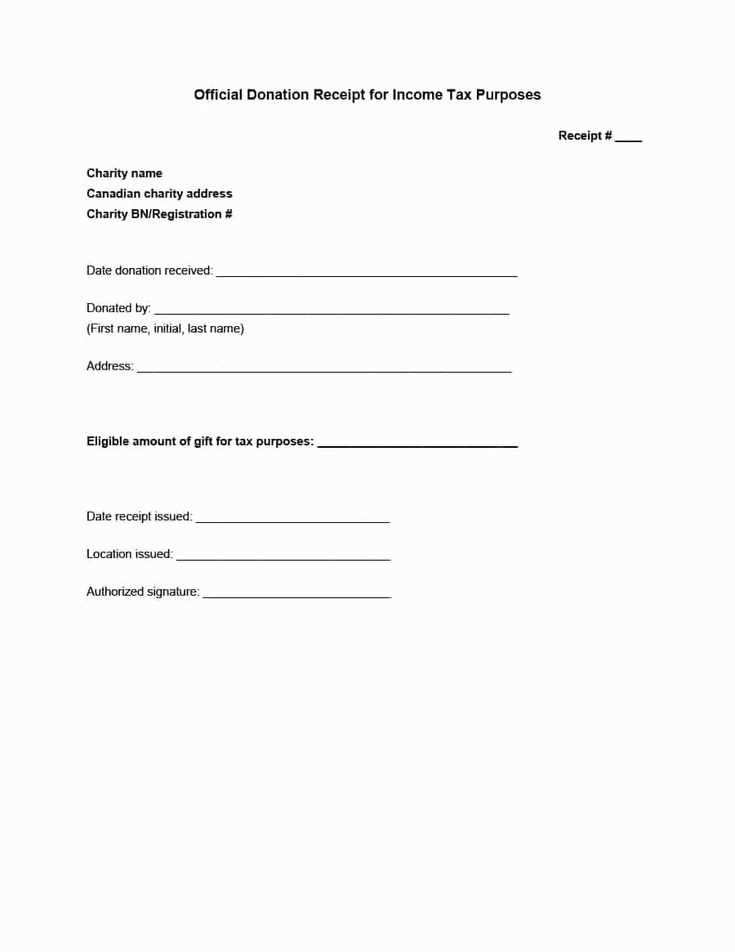

To create a streamlined non-profit receipt template, focus on including only the necessary details. Start with the organization’s name, address, and contact information. Clearly state the donation amount, whether monetary or in-kind. If applicable, specify any restrictions or purpose tied to the donation. Include the donor’s name, the date of the contribution, and a unique receipt number for tracking purposes.

Key Elements

Provide a brief description of the donation, ensuring transparency without redundancy. Avoid unnecessary phrases that do not add meaningful information. Clearly mark the receipt as tax-deductible, if applicable, and include a statement about no goods or services being provided in exchange for the donation.

Format and Organization

Ensure a clean, easily readable layout. Use distinct sections for each piece of information, and keep the language straightforward. A well-structured template allows donors to quickly verify their contributions without unnecessary details cluttering the document. Make sure all required fields are present and easily identifiable.

Non-Profit Receipt Template Guide

Selecting the Best Format for Your Non-Profit Receipt

Essential Elements to Include in a Donation Receipt

Customizing Your Receipt Template for Contributions

Ensuring Legal Compliance in Non-Profit Receipts

Creating an Easy-to-Use Receipt Template for Donors

Distributing Your Non-Profit Receipts Digitally

Choose a clear and simple format that donors can easily understand. A receipt should provide all necessary details while being visually clean and organized. Stick to a design that can be printed or emailed without confusion, and ensure it aligns with your organization’s branding.

Incorporate key information like the donor’s name, donation amount, date of contribution, and your non-profit’s contact details. You may also need to include a thank-you note or recognition of the donation, especially for significant contributions. If the donation includes a good or service, state the fair market value of the items or services provided in exchange.

Tailor your receipt template to reflect the unique needs of your organization. Include specific fields for the donation type, whether it’s one-time, recurring, or in-kind. Additionally, leave space for personal messages or customized notes from the organization’s leadership to strengthen donor relations.

Check the legal guidelines in your jurisdiction to ensure the receipt meets all necessary tax requirements. Include a statement confirming your organization’s tax-exempt status, along with a disclaimer for the donor to retain the receipt for tax deduction purposes. Make sure it aligns with IRS or local regulations regarding donor receipts.

Create a receipt template that is easy for donors to fill out or receive automatically after their donation. Offering a digital format, like an email or downloadable PDF, provides a quick way for donors to obtain and store their receipts. Be sure to have a streamlined process that requires minimal effort on their part while keeping it accurate and timely.

Distribute the receipts digitally, using an automated system that triggers immediate delivery after the donation is made. This allows donors to access their receipts quickly and store them for tax purposes. Consider implementing an online portal or email system to manage and track all receipts efficiently, ensuring prompt and secure delivery.