For non-profit organizations, issuing tax-deductible receipts is a key responsibility. A well-structured receipt not only ensures compliance but also helps donors keep track of their contributions for tax purposes. It’s important to include specific details on these receipts to meet IRS requirements and provide transparency to your donors.

The template should include the name and address of your non-profit, the donor’s information, the date of the donation, and a description of the gift. If the donation involves goods or services, the receipt must specify whether any goods or services were provided in exchange for the contribution, along with their fair market value. Donors must be able to see what portion of their donation is deductible for tax purposes.

It’s also essential to mention whether the donation is fully deductible or if there are any restrictions on the donation’s deductibility. This transparency helps maintain trust with donors while ensuring that your organization complies with tax regulations.

Here are the corrected lines with repetitions removed:

Ensure each donation receipt includes the donor’s full name, address, and donation amount. You should also list the nonprofit’s name, address, and tax ID number. If the donor received any goods or services in exchange for the donation, include a description of those items along with their estimated value.

| Field | Description |

|---|---|

| Donor’s Full Name | Complete name of the donor receiving the receipt. |

| Donor’s Address | Donor’s full mailing address, including city, state, and zip code. |

| Donation Amount | The exact value of the donation provided. |

| Nonprofit’s Name | Full legal name of the nonprofit organization. |

| Tax ID Number | Include the nonprofit’s federal tax ID number (EIN). |

| Description of Goods or Services | If applicable, a brief description of any goods or services provided in exchange. |

| Estimated Value of Goods | The value of any goods or services the donor received. |

Make sure to include a clear statement indicating no goods or services were provided if this applies. These guidelines will help ensure the receipt meets IRS standards for tax-deductible donations.

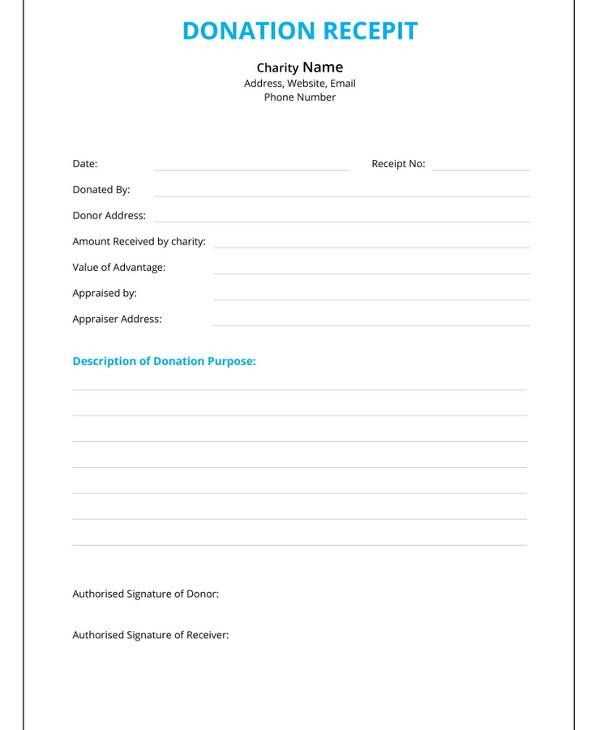

- Non-Profit Tax Deductible Receipt Template

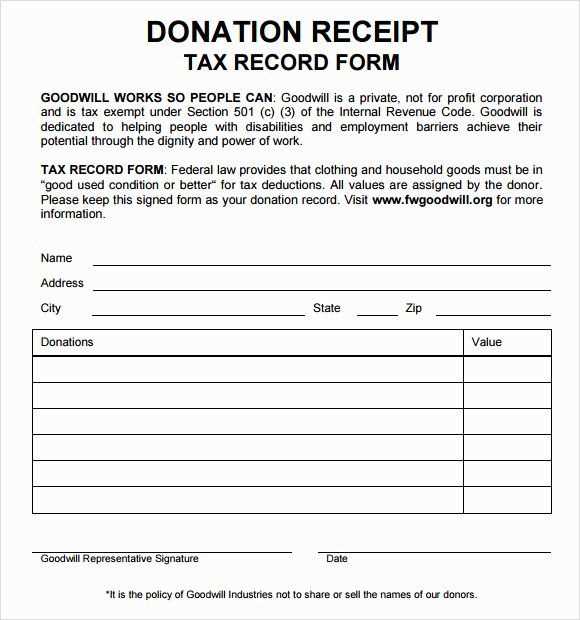

To create a valid non-profit tax deductible receipt, include specific details to ensure it complies with IRS guidelines. Start with the organization’s name, address, and tax-exempt status. Clearly state that the donation is tax-deductible and provide a description of the donated items or cash amount. For cash donations, include the exact amount given. For non-cash donations, provide a description of the items along with their estimated value. Specify whether the donor received any goods or services in exchange for the donation, and if so, provide the value of those goods or services.

Include the date of the donation and the donor’s name. If the donor is an individual, use their full legal name. For businesses, include the company’s name. Ensure that the receipt is signed by an authorized representative of the non-profit organization.

Here’s a basic template structure for reference:

- Organization Name

- Organization Address

- Tax-Exempt Status Number

- Donor Name

- Donation Date

- Donation Description (including cash amount or item details)

- Value of Goods or Services Provided (if applicable)

- Authorized Representative Signature

Make sure to customize the template according to the specific donation and organization’s needs. A well-detailed receipt ensures both the donor and the organization stay in compliance with tax regulations.

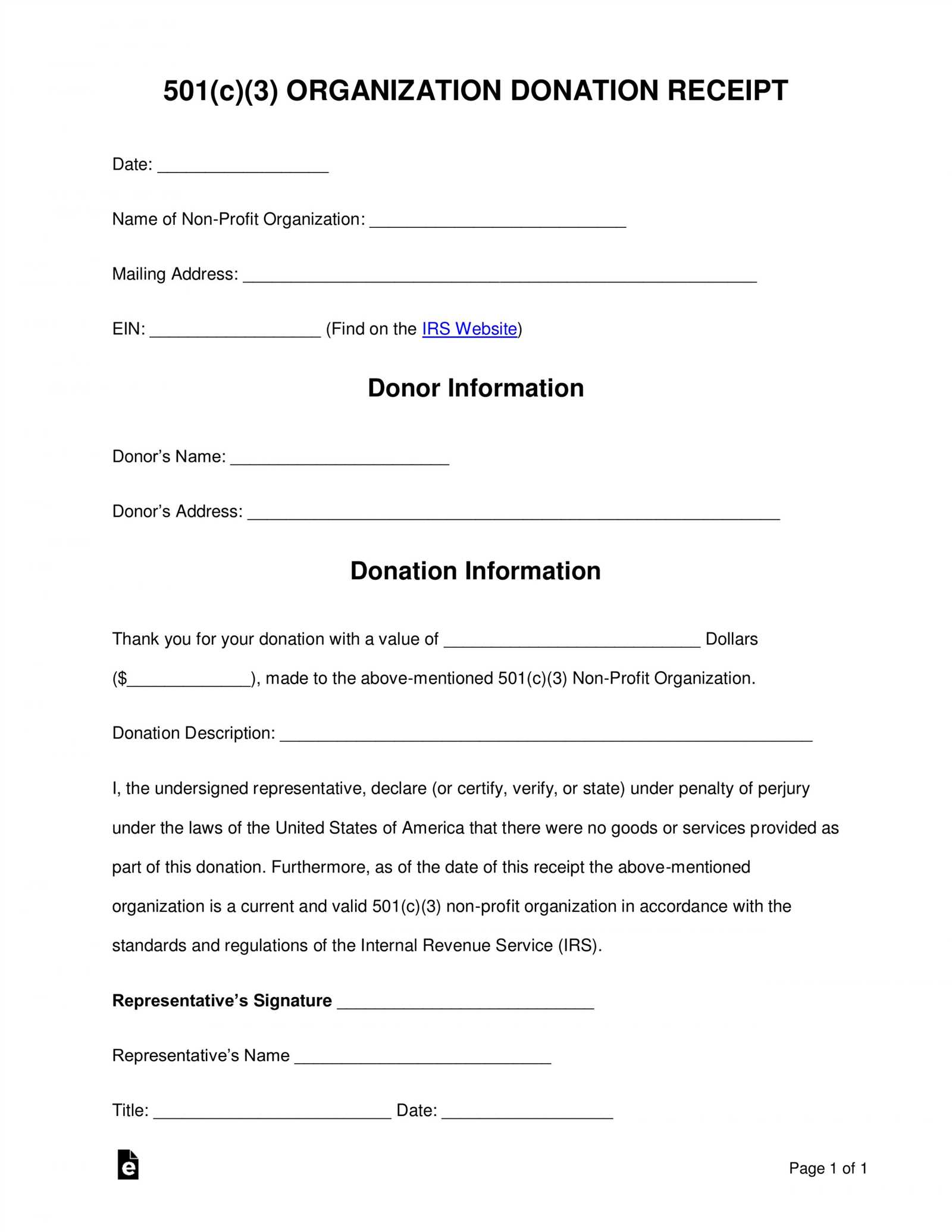

Include the organization’s name, address, and tax-exempt status. Ensure your nonprofit is registered with the IRS as a 501(c)(3) organization or other applicable status. This ensures donations are tax-deductible.

State the donation’s amount or description. If the donor contributes property or goods, provide a description of the items without assigning a value. For cash donations, list the exact amount given.

Include a statement confirming that no goods or services were exchanged for the donation, or if applicable, list the fair market value of any items received. This helps the donor claim the correct tax deduction.

Provide the donation date. This allows donors to accurately report the donation on their tax returns for the correct year.

Have the receipt signed by an authorized individual. This can be a board member, executive, or another representative of the organization with the authority to issue receipts.

Ensure the wording of the receipt is clear and concise, indicating the tax-deductible nature of the donation. Avoid any vague language that could lead to confusion or audits.

To create a valid non-profit tax-deductible receipt, include the following details:

- Organization Name and EIN: Include the full name of the organization and its Employer Identification Number (EIN) to confirm its tax-exempt status.

- Donor’s Information: Add the donor’s name and address for accurate record-keeping and tax filing purposes.

- Donation Date: Record the exact date the donation was made, which is necessary for both the donor’s and the organization’s tax purposes.

- Donation Amount or Description of Goods: Specify whether the donation is monetary or a non-cash contribution. For items, include a description and estimated value if available.

- Statement on Goods or Services: If the donor received any goods or services in exchange for the donation, list those and their estimated value. This information ensures the donor knows what portion is tax-deductible.

- Receipt Number: Include a unique number for each receipt issued for tracking purposes and organization.

- Authorized Signature: Ensure that a representative from the organization signs the receipt to validate it.

By including these details, your receipt will meet IRS guidelines, ensuring it’s recognized as a valid document for tax deductions.

Ensure the donation receipt includes the donor’s full name and address. Missing or incorrect details can invalidate the deduction. Verify all information before issuing the receipt.

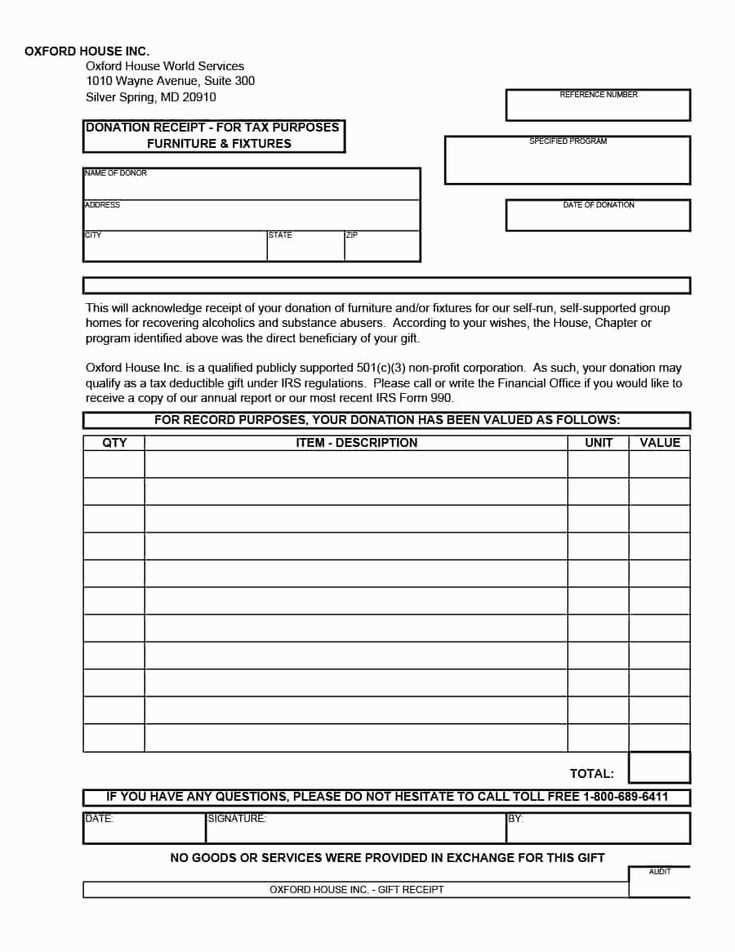

1. Failing to Include a Clear Description of the Donation

Provide a detailed description of the donated item or service. A vague description may cause confusion with tax authorities. List the type and condition of items, including any market value if relevant.

2. Ignoring the Fair Market Value of Goods Donated

For non-cash donations, accurately state the fair market value (FMV). If the value is uncertain, consider seeking a professional appraisal. Not disclosing FMV can lead to the denial of tax deductions.

Double-check that the receipt explicitly states whether the donation was in cash or in-kind. This distinction is key for both tax purposes and legal compliance.

3. Missing the Official Tax-Exempt Status Statement

Receipts should clearly state that your organization is tax-exempt under the relevant tax code section. This statement assures the donor their contribution is tax-deductible.

4. Incorrect Dates or Lack of Date

Ensure the receipt includes the exact date of the donation. A receipt without a date is incomplete and will not hold up if audited.

5. Failing to Acknowledge Non-Deductible Benefits

If the donor received something in return, like goods or services, note the value of those benefits. Deductible amounts should exclude these values. This transparency is crucial for correct deductions.

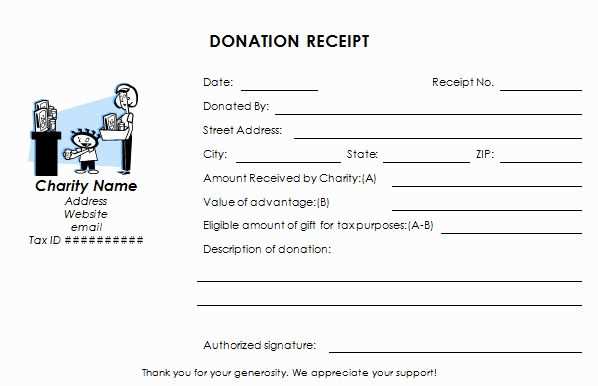

Key Elements of a Non-Profit Tax Deductible Receipt

Ensure your non-profit’s tax-deductible receipts meet IRS requirements. Include the non-profit’s name, address, and tax-exempt status. The donation amount should be clearly stated, along with a description of any goods or services provided in exchange for the contribution, if applicable.

Receipt Date and Donor Information

Always specify the date of the donation and include the donor’s name. If the donor is an organization, list the organization’s name and address. Avoid ambiguity to make the receipt verifiable and acceptable for tax purposes.

Clear Language for Donors

Use simple language. Clearly mention that no goods or services were provided, or if they were, specify their value. The IRS requires this to validate the tax-exempt status of the receipt for donors’ tax filing purposes.