For nonprofit organizations, providing a clear and accurate tax receipt is a key responsibility. A well-crafted receipt ensures both the donor and the organization comply with tax regulations, making the donation process smooth and transparent. A tax receipt should contain specific details such as the donor’s information, the amount of the donation, and a description of the donation’s purpose.

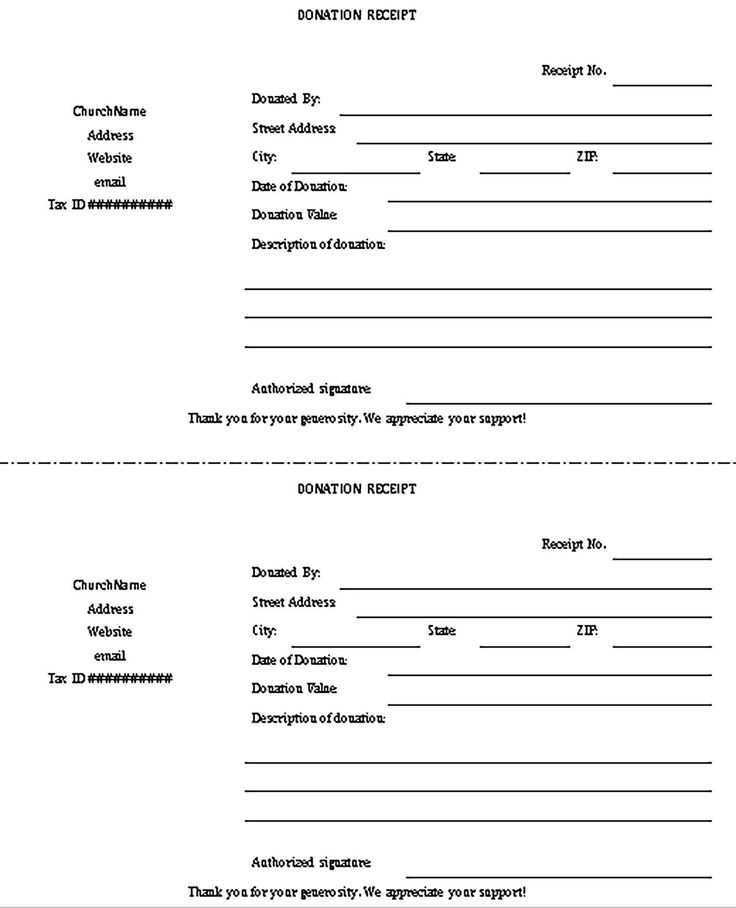

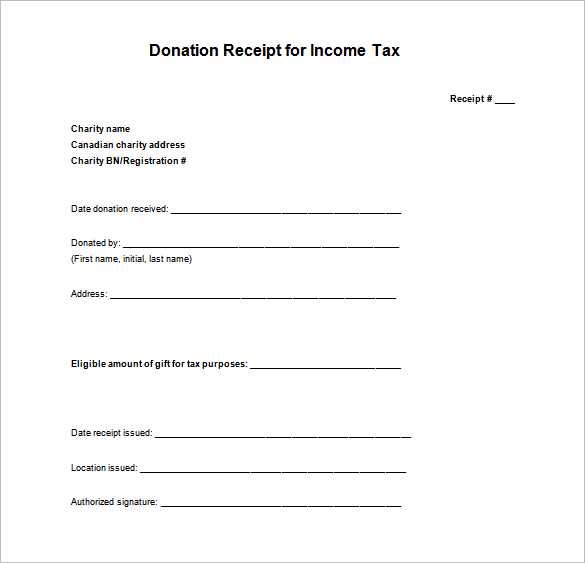

Use this template to create professional receipts for donations. Start by including the nonprofit’s name, address, and tax identification number at the top. Below, list the donor’s name, the date of the donation, and the total amount contributed. Be sure to note whether the donation is monetary or in-kind. If in-kind, include a brief description of the items received. Lastly, add a statement confirming that no goods or services were exchanged in return for the donation, which is a critical point for tax purposes.

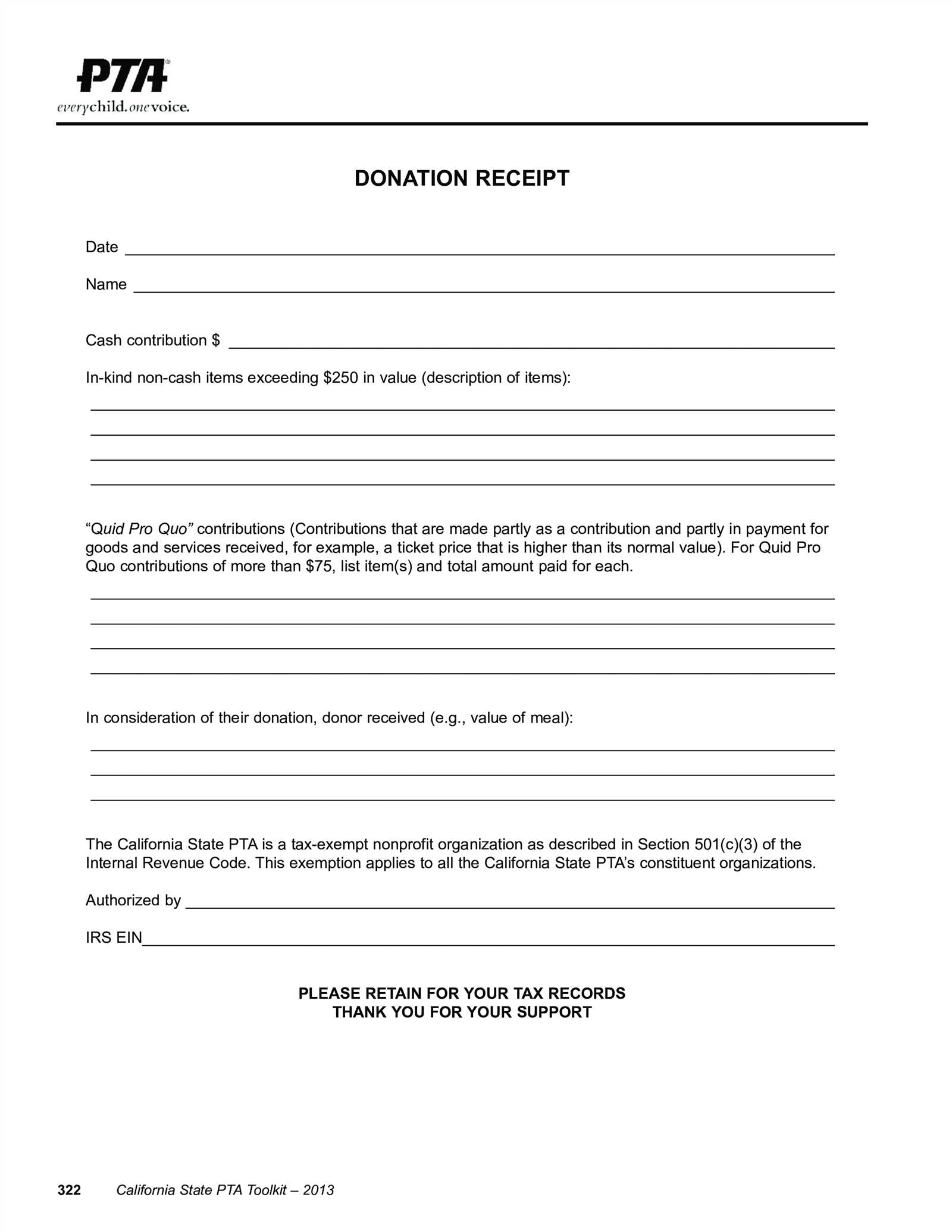

Ensure all information is accurate to avoid discrepancies. If any services were provided to the donor, include the fair market value of those services on the receipt. This will allow donors to claim their maximum eligible deduction while staying in compliance with IRS guidelines.

Here’s the revised version with the repetition reduced:

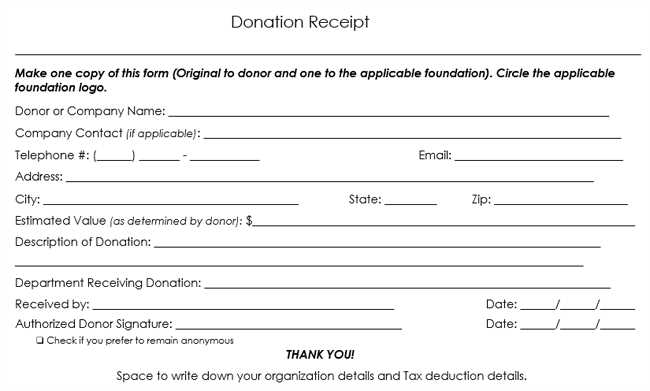

When creating a tax receipt for a non-profit organization, it’s important to ensure clarity while keeping the text concise. Begin by listing the donor’s full name, donation date, and amount. Be specific about the nature of the donation, whether it was cash or goods. Include the non-profit’s name and contact information for transparency.

Ensure you mention the tax-exempt status of the organization clearly. Avoid redundant language such as “tax-deductible” multiple times throughout the receipt. Mention only once that the donation qualifies for tax deductions, as specified by IRS guidelines.

In addition, include a brief statement confirming that no goods or services were exchanged for the donation, if applicable. This helps the donor maintain proper tax records. Finally, make sure the receipt includes the signature or electronic approval of a representative from the non-profit for authentication.

- Non-Profit Tax Receipt Template

Provide the following key elements in a non-profit tax receipt template:

1. Non-Profit Organization Details: Include the full name, address, and tax-exempt status number of the organization. This should be clearly visible at the top of the receipt.

2. Date of Donation: The specific date the donation was received should be listed. This ensures that the donation is tied to the appropriate tax year for the donor.

3. Donor Information: List the donor’s name, address, and contact details, which allows both the organization and the donor to track contributions.

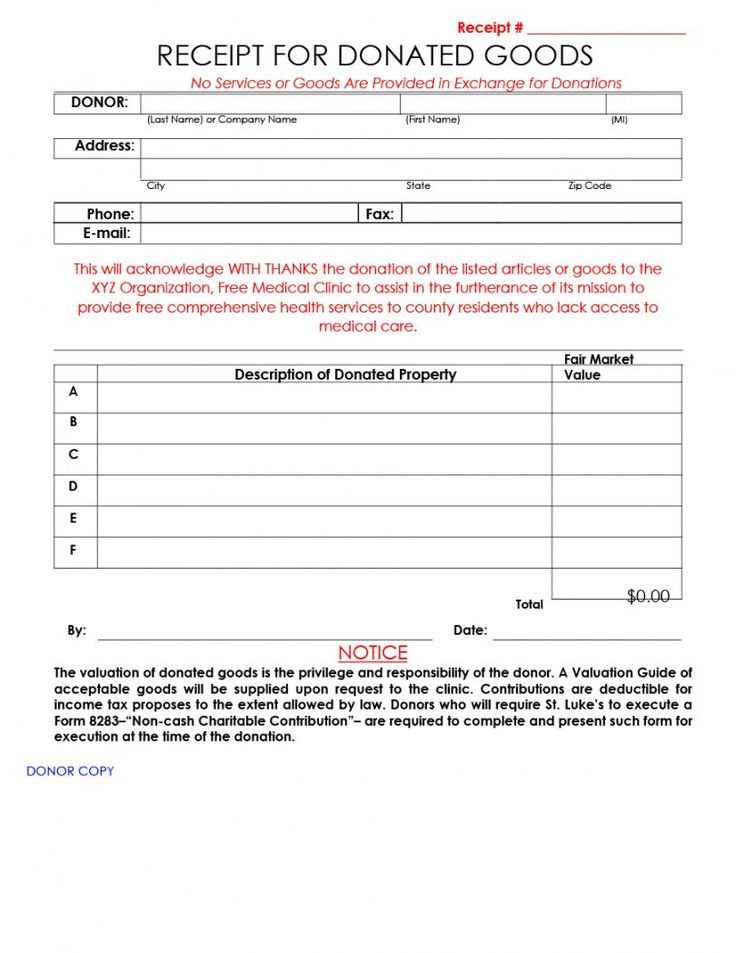

4. Description of Donation: Describe the donation made, including whether it was cash, goods, or services. For in-kind donations, specify the nature of the item(s) donated.

5. Value of Donation: For cash donations, the exact dollar amount should be mentioned. For goods or services, provide a good faith estimate of the fair market value.

6. Acknowledgment Statement: Include a statement confirming that no goods or services were provided in exchange for the donation (if applicable). For donations that included goods or services, provide a description and the estimated value of what was received in return.

7. IRS Language: Add a phrase like “The organization is a 501(c)(3) tax-exempt charity” for compliance. This informs the donor of the non-profit’s status and assures they are eligible for tax deductions.

8. Authorized Signature: Have a representative of the organization sign and date the receipt. This adds credibility and authenticity to the receipt.

By following these steps, you ensure a tax receipt that is clear, accurate, and legally sound for both the donor and the non-profit.

Design a clean and straightforward tax receipt template for your non-profit organization. Keep it simple but detailed to ensure both compliance and ease of understanding for donors.

Include Basic Information

Start with the organization’s name, address, and tax identification number (TIN). These are required for tax reporting. Make sure the name is clearly visible at the top to establish credibility and provide easy recognition for the donor.

Detail the Donation

Include the date of the donation, the donor’s name, and a description of the contribution. If it’s a monetary donation, list the amount. For non-cash donations, briefly describe the item or service donated and its estimated value, if possible.

Ensure you have a clear statement that no goods or services were exchanged in return for the donation, or, if applicable, mention the value of any benefits provided. This section should also include a thank-you message to express appreciation.

Lastly, add a disclaimer stating the donor should keep the receipt for their records, and remind them of any applicable tax laws they should be aware of.

To ensure that a donation tax receipt is valid, it must include specific details required by tax authorities. Here’s a breakdown of the most important information to include:

- Organization’s Name and Address – The legal name and address of the charity or non-profit must be clearly stated. This helps identify the organization responsible for issuing the receipt.

- Charity Registration Number – Include the official registration or tax ID number of the organization, which confirms its eligibility to issue tax receipts.

- Donor’s Name – The receipt should show the donor’s full name as it appears in your records. This is critical for the donor’s tax reporting.

- Date of Donation – Indicate the exact date the donation was made. This is necessary for tax purposes to ensure proper reporting for the correct year.

- Amount Donated – Clearly state the monetary value of the donation. For non-cash donations, describe the donated goods and their fair market value.

- Receipt Number – Provide a unique receipt number for record-keeping purposes. This helps maintain a clear audit trail.

- Statement of No Goods or Services Provided – If the donor received no goods or services in exchange for their donation, include a statement to this effect. This is especially important for larger donations where tax exemptions apply.

- Signature of Authorized Person – The receipt should be signed by a person authorized to issue tax receipts, typically someone within the organization who has this responsibility.

Additional Considerations

- If the donation is for a specific fund or purpose, include that detail to ensure clarity about the donation’s intended use.

- For donations over a certain threshold, such as those above $250, a more detailed breakdown may be required, including confirmation of the donor’s eligibility for tax deductions.

Include the non-profit’s legal name, address, and contact details at the top. Make sure the organization’s IRS tax-exempt number is clearly visible. This ensures donors can verify the legitimacy of the donation and its tax-deductible status.

Donation Details

Clearly list the donation amount and date, specifying whether it is cash or goods. If the donation is goods, provide a description of the items and their fair market value. For in-kind donations, include a note stating that the non-profit does not assign a value to the items, as this is the donor’s responsibility.

Non-Profit’s Acknowledgment Statement

Include a statement confirming the non-profit did not provide any goods or services in exchange for the donation, unless those were of nominal value. This is a requirement by the IRS for tax-deductible contributions. If any goods or services were provided, outline their value and describe them specifically.

Finally, the receipt should be signed by an authorized representative of the non-profit, with their title and contact information provided, so donors can reach out if they have any questions or need further verification.

Incorrectly listing the donation amount is a frequent mistake. Always double-check the total before finalizing the receipt. A common error is omitting the correct monetary value, which can lead to confusion and disputes later.

Incorrect Date Formatting

Make sure the donation date is clear and correct. Errors such as using an inaccurate date or failing to use a standard date format can cause issues for both the donor and your records.

Missing or Incorrect Donor Information

Ensure that the donor’s name and contact details are clearly stated. Typos or missing information can result in lost receipts or confusion. It’s also important to verify that the donor’s name matches the information you have on file.

Omitting the charity’s tax-exempt status is another common mistake. Always include your organization’s official tax-exempt number to avoid issues with the IRS and ensure the donation is properly recognized.

Finally, neglecting to include a brief description of the donation can lead to misunderstandings. Be specific about what was donated (cash, goods, services) to provide transparency and avoid problems when the donor files their tax return.

Different donor types may require specific adjustments to your tax receipt template to ensure it meets their needs and expectations. Tailor your receipts to reflect the nature of the donation and the donor’s relationship with your organization. Here’s how you can customize receipts for various donor types:

| Donor Type | Customizations |

|---|---|

| Individual Donors | For individual donors, include their full name, address, and specific donation amount. Highlight the date of the donation and note if it was a one-time or recurring contribution. Ensure to provide clear instructions for tax filing purposes. |

| Corporate Donors | Corporate donors require additional details like their company name, EIN (Employer Identification Number), and the donation’s business purpose. Specify if the donation is a sponsorship or a charitable gift, as this impacts their tax deductions. |

| Anonymous Donors | For anonymous donations, ensure that the receipt maintains privacy while still confirming the donation amount and date. You may consider noting the donation as anonymous without disclosing personal information. |

| In-Kind Donors | In-kind donations require a description of the donated items or services and an approximate value. Since these types of donations are non-cash, it’s crucial to include a statement explaining that the organization does not provide appraisals of in-kind donations. |

Each donor type may require specific wording and documentation to comply with tax regulations. Adapt your receipts to reflect these differences while maintaining accuracy and transparency.

Send tax receipts to donors within 24-48 hours after receiving a donation. This ensures donors have the documentation they need for tax purposes in a timely manner.

Email Distribution

Email is a quick and cost-effective way to distribute tax receipts. Here are the key steps:

- Use personalized subject lines to grab attention, such as “Your Donation Receipt from [Organization Name].”

- Attach the receipt as a PDF file, ensuring it includes necessary details like the donor’s name, donation amount, and organization tax ID number.

- Include a brief, friendly message thanking the donor and confirming the tax-deductible nature of their contribution.

- Make sure to use an email address that the donor recognizes and is likely to trust.

Postal Distribution

For donors who prefer physical receipts or for those making significant donations, postal distribution is appropriate. Follow these guidelines:

- Print the receipt on high-quality paper, ensuring that the organization’s logo, contact details, and tax ID are clearly visible.

- Mail receipts within 1-2 weeks of donation. Include a personalized thank-you letter with each receipt.

- Consider using a tracked mailing service for larger donations to ensure the receipt is received securely.

By distributing receipts promptly and professionally, you demonstrate gratitude while making the donation process smooth for your supporters.

Include all necessary details on your non-profit tax receipt to ensure clarity and compliance with tax laws. Start with the non-profit’s full name and address at the top, followed by the donor’s name and contact information. Clearly list the date of the donation and the total amount contributed. If the donation includes goods or services, specify their fair market value. Also, note whether the donation is tax-deductible under current tax laws, providing any applicable disclaimers. Finally, include a statement confirming no goods or services were exchanged for the donation, if that’s the case.

To simplify, use clear labels for each section, ensuring easy readability. Provide room for the signature of an authorized representative at the bottom to validate the receipt. Always maintain consistency in formatting to keep the receipt professional and uniform. If you use templates, make sure they are tailored to fit the specifics of your organization’s operations and tax requirements.