A proper gift receipt is essential for acknowledging donations and ensuring compliance with tax regulations. Every nonprofit should issue a clear and complete receipt that includes the donor’s name, donation amount, date, and a statement confirming whether any goods or services were provided in return. This helps donors claim tax deductions and strengthens transparency.

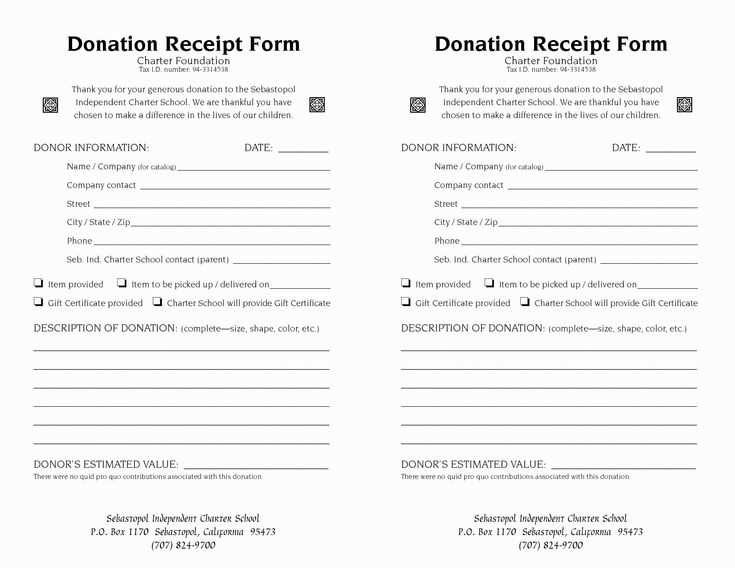

For donations above $250, the IRS requires a written acknowledgment. This must specify the contribution details and explicitly state if the donor received anything in return. If the donation was in-kind rather than monetary, include a description of the donated item but avoid assigning a dollar value.

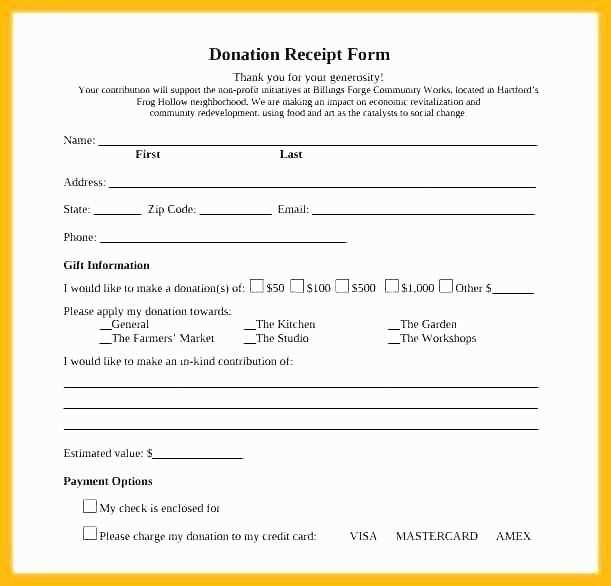

A well-structured receipt benefits both the organization and the donor. It reinforces trust, simplifies record-keeping, and ensures compliance. Below is a practical template that nonprofits can customize to fit their needs.

Nonprofit Gift Receipt Template: Key Considerations

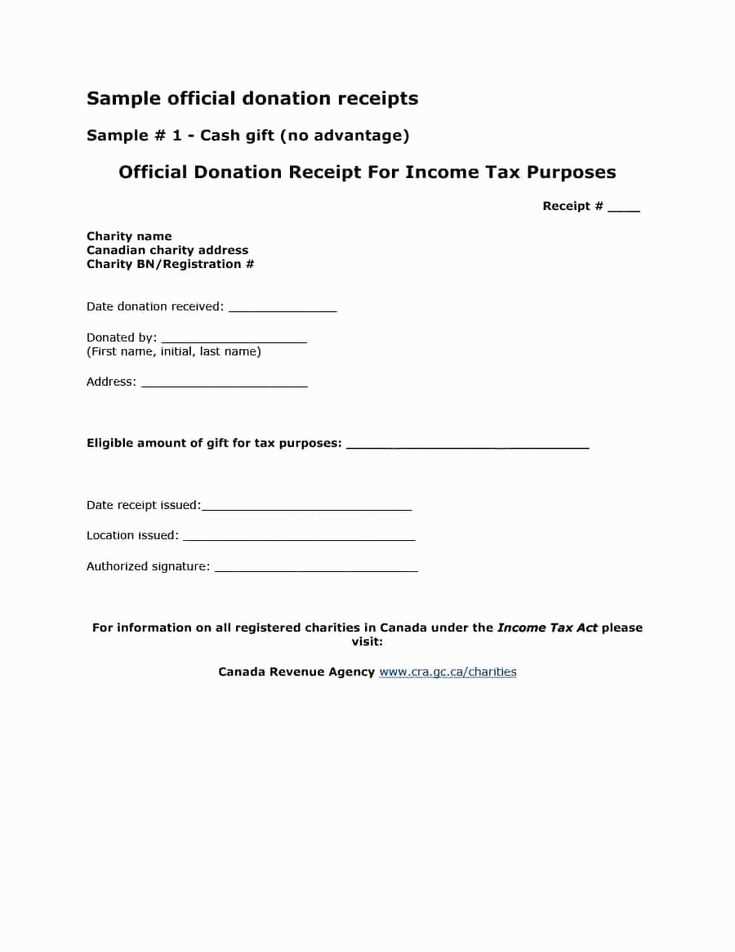

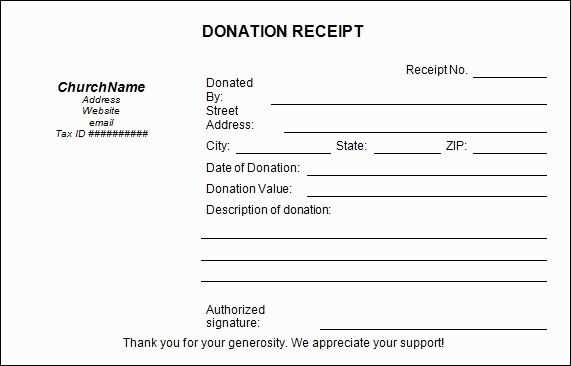

Include the organization’s full legal name and tax-exempt status. Donors need confirmation that contributions qualify for deductions.

- Donation Details: Specify the donation amount or a clear description of non-monetary gifts. For non-cash contributions, avoid assigning a value–this is the donor’s responsibility.

- Statement of No Goods or Services: If nothing was provided in return, explicitly state this. If something was given in exchange, disclose its fair market value.

- Donation Date: List the exact date the contribution was received. This helps donors align records with tax filings.

- Signature and Contact Information: While not required, a signature from an authorized representative adds credibility. Provide a contact for any donor inquiries.

Keep copies for at least three years. Digital receipts should be formatted for easy printing and recordkeeping.

Required Elements for a Valid Nonprofit Gift Receipt

A valid nonprofit gift receipt must include the organization’s legal name as registered with the IRS. Any variation or abbreviation may cause issues for donors claiming deductions.

Donor and Contribution Details

Include the donor’s full name and, if applicable, their address. Clearly state the date of the contribution and the exact amount for cash donations. For non-cash gifts, provide a description of the item but avoid assigning a value–appraisal is the donor’s responsibility.

Statement of No Goods or Services

If no benefits were provided in return, the receipt must include a statement confirming this. If the donor received something in exchange, specify its fair market value and indicate that only the excess amount qualifies as a deductible donation.

Ensure the receipt is issued by January 31 of the following year to support the donor’s tax filing. A signed or digitally verifiable receipt enhances credibility and compliance.

Formatting Guidelines for Clear and Accurate Documentation

Use a consistent font throughout the document. Choose a readable typeface like Arial or Times New Roman, and stick to one size for body text (usually 11 or 12 pt). Ensure that headings stand out, either by increasing the font size or using bold formatting.

Organize Information Logically

Arrange details in a clear, logical order. Start with the donor’s name, followed by the donation amount, the date of the donation, and any relevant additional information. Use bullet points or numbered lists for clarity where necessary.

Maintain Consistency with Dates and Amounts

Always format dates in the same style (e.g., MM/DD/YYYY or DD/MM/YYYY). Use currency symbols consistently when reporting donation amounts, and make sure to separate numbers using commas for easier reading (e.g., $1,000 instead of $1000).

Common Mistakes to Avoid When Issuing Gift Receipts

Ensure you clearly state the donation amount. Omitting this detail can lead to confusion for both the donor and the organization. Always include the full value of the contribution without any vague wording.

Don’t forget to include the organization’s tax-exempt status. Without this, the receipt may not be valid for tax purposes, leading to issues for your donors during tax season.

Avoid vague descriptions of the donation. Instead of simply stating “donation,” specify whether it was cash, property, or another type of gift. This makes the receipt more useful for record-keeping.

Keep accurate records of the donation date. Providing the wrong date or leaving it out entirely can create complications for both parties if a donor needs to verify their contribution.

Double-check the donor’s details for accuracy. Typos in the donor’s name or address could lead to misunderstandings or problems in future communications.

Do not mix personal and corporate donations in a single receipt. Separate these entries to avoid confusion and ensure each donor gets the correct documentation for tax purposes.

Finally, never fail to provide the receipt in a timely manner. Delays in issuing gift receipts can hinder your donors’ ability to claim deductions during tax season. Aim to send receipts promptly after receiving the donation.