Use a clear and concise nonprofit receipt template to streamline your donation tracking. This document ensures that donors receive accurate records for tax purposes and helps maintain proper accounting for your organization. Include the donation date, donor details, and the total amount contributed.

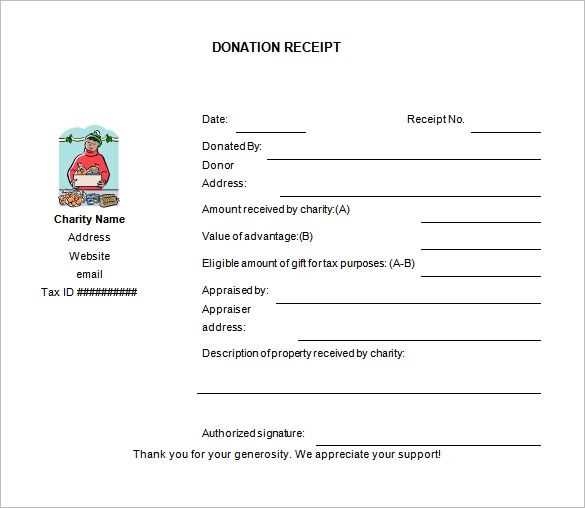

The receipt should specify whether the donation is monetary or in-kind. For in-kind gifts, list the description of the items donated along with their estimated value. If the donation is monetary, provide a breakdown of the amount received and any applicable tax-exempt status information.

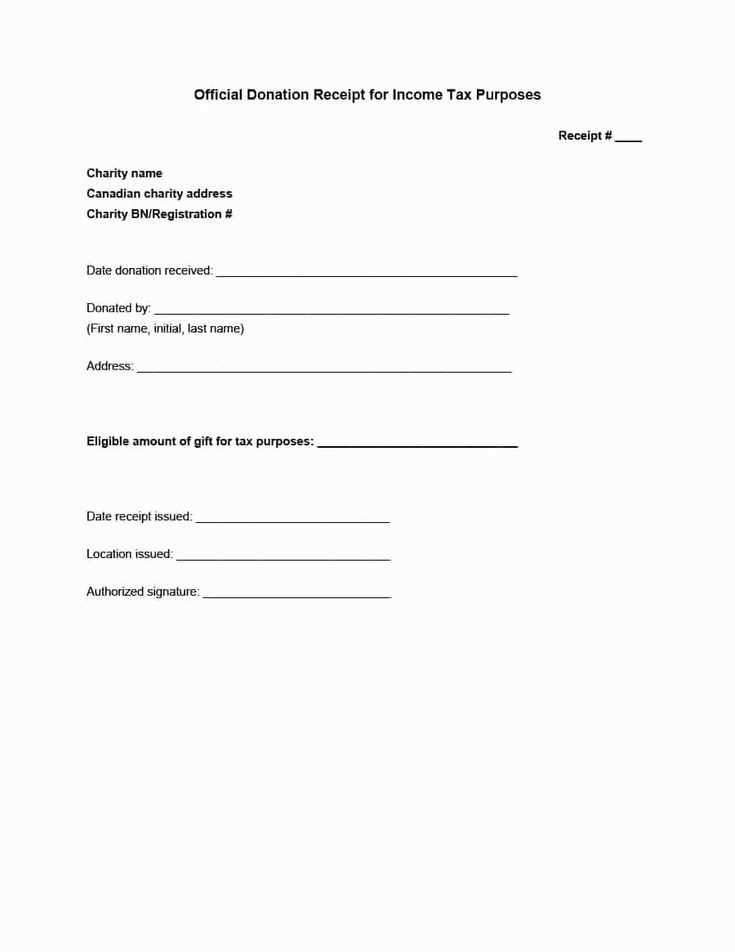

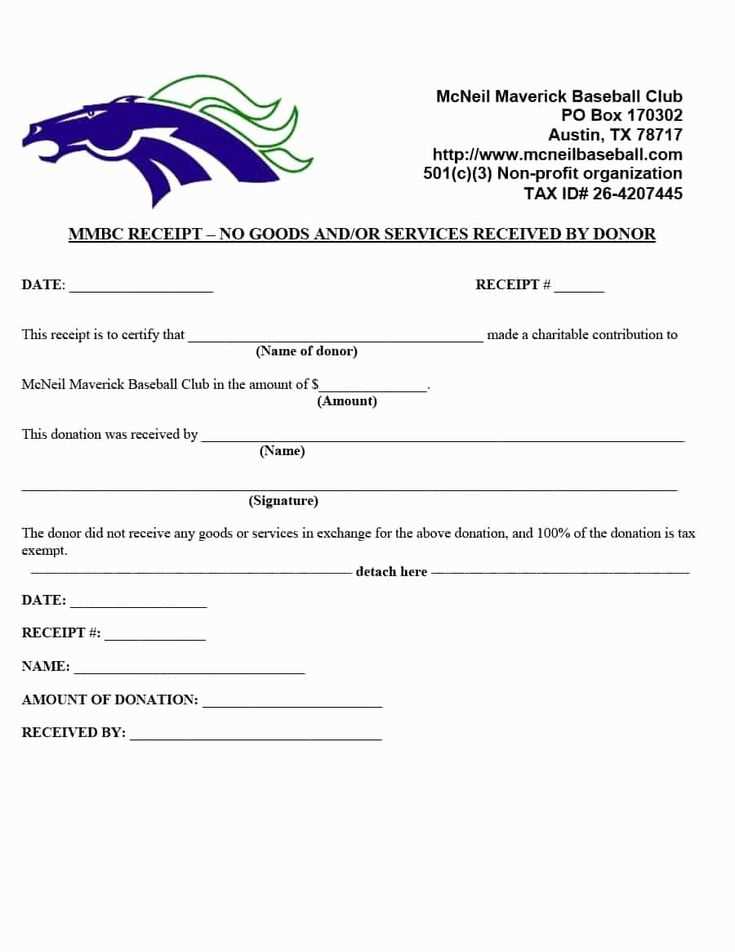

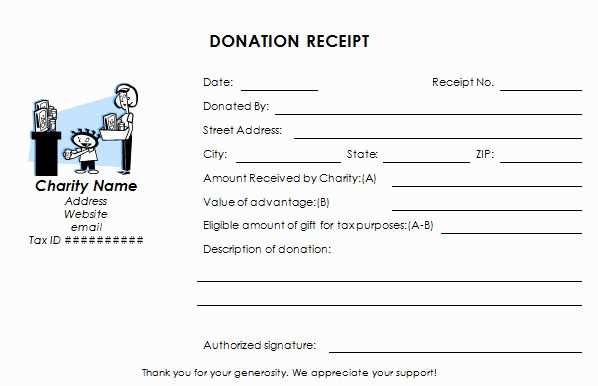

Ensure your nonprofit receipt template complies with IRS guidelines. This includes a statement indicating that no goods or services were provided in exchange for the donation, or if they were, specifying their value. Always include the organization’s name, address, and tax identification number to authenticate the receipt.

By standardizing the format of your receipts, you reduce errors and create a professional record that supports your nonprofit’s transparency and credibility. A well-designed receipt also builds trust with donors, encouraging future contributions to your cause.

Here are the corrected lines where repeated words were removed, while preserving the meaning:

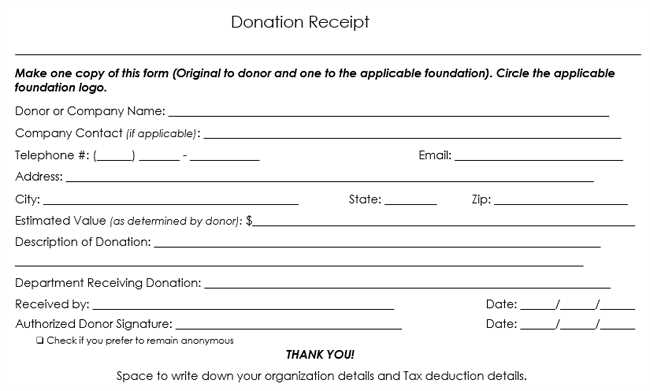

Ensure the receipt contains all required information, such as the donor’s name, date of the contribution, and donation amount. This will help maintain clarity and transparency.

The description of the donation should clearly reflect the purpose. Avoid redundant phrases like “generous donation” or “large contribution,” as they do not add value.

For tax purposes, specify whether the donation is eligible for a tax deduction. Including this detail will help the donor understand the benefits.

Always provide contact details for follow-up questions. A simple line with the email or phone number is enough.

- Nonprofit Receipt Template

To create a nonprofit receipt template, ensure it includes all necessary information for your donors and complies with legal requirements. A clear and concise receipt boosts transparency and makes tax filing easier for your donors.

The receipt should include the following key elements:

- Organization Information: The nonprofit’s name, address, and contact details should be clearly stated at the top of the receipt.

- Donor Information: Include the donor’s name and address to ensure the donation is correctly attributed for tax purposes.

- Date of Donation: Record the exact dat

- How to Structure a Donation Receipt for Nonprofits

- State that the nonprofit is a 501(c)(3) tax-exempt organization.

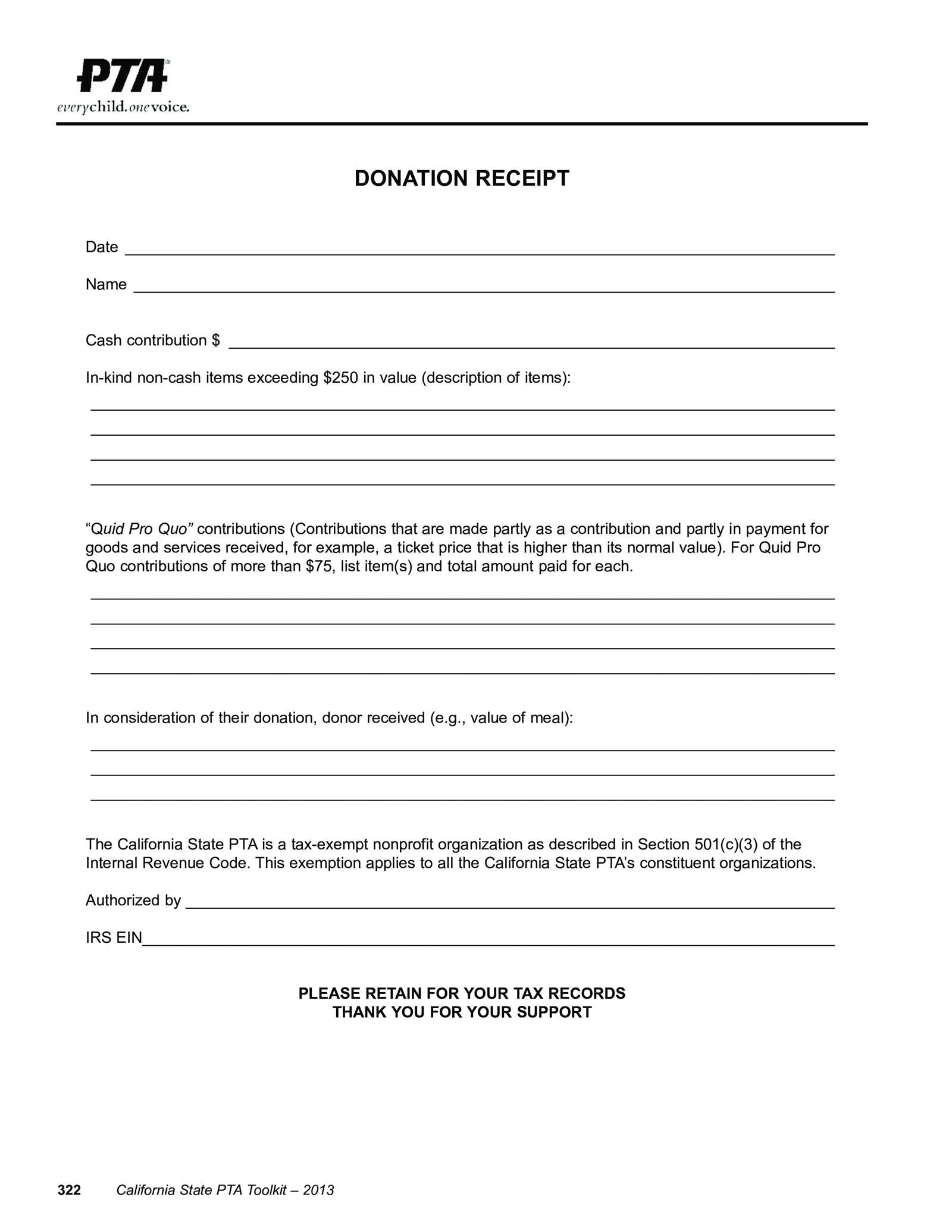

- Include a statement that no goods or services were provided in exchange for the donation, unless something was given (e.g., tickets or gifts). If goods or services were provided, describe them and give their value.

- Key Legal Requirements for Donation Receipts in Nonprofits

- Customizing Your Receipt Template for Various Donation Types in Nonprofits

Begin with clear identification of the nonprofit organization and the donor’s details. Include the organization’s name, address, and tax ID number. The donor’s name and contact information must also be accurate, ensuring they match the information on file.

Include Donation Details

Clearly state the amount donated, the date of the donation, and the method of payment (e.g., cash, check, or credit card). If the donation is in-kind, provide a description of the items received and their estimated value.

Confirm Tax-Exempt Status

Ensure all information is accurate and up to date for record-keeping and tax purposes. Keep receipts organized and accessible for both the nonprofit and the donor.

Nonprofits must comply with specific legal guidelines when issuing donation receipts. First, ensure that receipts include a statement that the organization is a tax-exempt entity under section 501(c)(3) of the IRS code. This ensures donors can claim tax deductions for their contributions.

The receipt should clearly list the donor’s name and address, along with the date and amount of the donation. If the donation is non-cash, describe the item(s) donated, or provide an estimate of the value when necessary.

For donations of $250 or more, it’s required to include a written acknowledgment from the nonprofit. This statement must affirm that no goods or services were exchanged for the contribution, or it must describe what the donor received in exchange for their gift and its fair market value.

| Required Information | Details |

|---|---|

| Donor Information | Full name and address of the donor. |

| Donation Date | Exact date the donation was made. |

| Donation Amount | Exact amount or description of the donated property. |

| Non-cash Donation Description | Detailed description of non-cash items or estimated value if applicable. |

| Value of Goods/Services | If applicable, describe any goods or services provided in exchange for the donation. |

For donations under $250, a receipt is not mandatory, but it’s recommended to provide one to ensure donors have the necessary documentation for their records. Keeping track of all donations and issuing timely receipts will prevent issues during tax filings for both the nonprofit and the donor.

Tailoring your receipt template for different donation types ensures clarity and accuracy, which helps both your nonprofit and the donors. A personalized approach fosters trust and simplifies tax deduction processes for contributors. Here’s how to customize receipts for various donation scenarios:

Monetary Donations

For cash or check donations, include the date of receipt, donor’s full name, and the amount donated. Add a statement confirming that no goods or services were provided in exchange for the donation, as required for tax purposes. Clearly state that the donation is tax-deductible.

In-Kind Donations

In-kind donations require a detailed description of the donated items. Specify the number of items and their condition if applicable. Mention that the nonprofit does not assign a value to the donated goods, but the donor can estimate the value for tax purposes.

Recurring Donations

For monthly or quarterly donations, provide a summary of the donor’s total contributions over the year. Clearly outline the frequency and amount of each donation, along with the total amount donated to date. This helps donors track their giving and simplifies year-end tax reporting.

Event-Based Donations

When donors give during fundraising events, clarify if the contribution was made for a ticket purchase or as a direct donation. For ticket-based donations, explain the non-deductible portion (if any) and the amount eligible for tax deduction.

Customizing each donation receipt to reflect the type of gift will ensure your nonprofit stays transparent, helps donors with their tax filings, and maintains a good relationship with supporters.

Ensure each nonprofit receipt includes these key components to stay compliant with regulations:

- Nonprofit Organization Name: Clearly state the name of your organization at the top of the receipt.

- Date of Donation: Include the exact date the donation was made. This helps both the donor and your organization keep track of transactions.

- Donor Information: Include the name and address of the donor. This makes it easier to verify the donation and issue proper tax receipts.

- Amount Donated: Specify the amount of money donated. For in-kind donations, provide an estimated value of the items contributed.

- Description of Donation: Describe the nature of the donation. If it’s a monetary donation, mention the amount. For goods, list the items donated and their estimated value.

- Tax-exempt Status: Include a statement confirming that your organization is a tax-exempt entity (e.g., 501(c)(3) organization) to ensure the donor can claim their donation on taxes.

- Nonprofit’s EIN (Employer Identification Number): This number helps the IRS verify your nonprofit’s status and is a critical detail for the donor’s records.

- Signature of Authorized Person: An authorized representative from your nonprofit should sign the receipt to validate the donation.

These details guarantee that your nonprofit receipts are legally sound and transparent, ensuring donors can easily claim their tax deductions.