Using a notarized receipt template can simplify your transactions and provide the legal protection needed in many business and personal exchanges. A notarized receipt confirms that the information provided in the receipt has been verified by a notary public, ensuring its authenticity. This added layer of validation is particularly useful in cases involving significant sums of money, valuable property, or legal disputes.

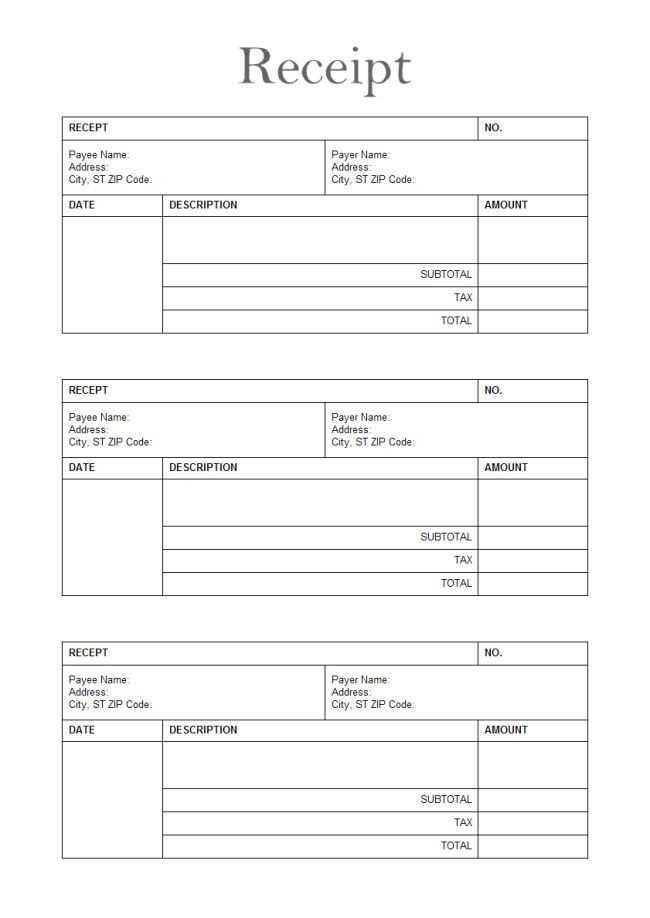

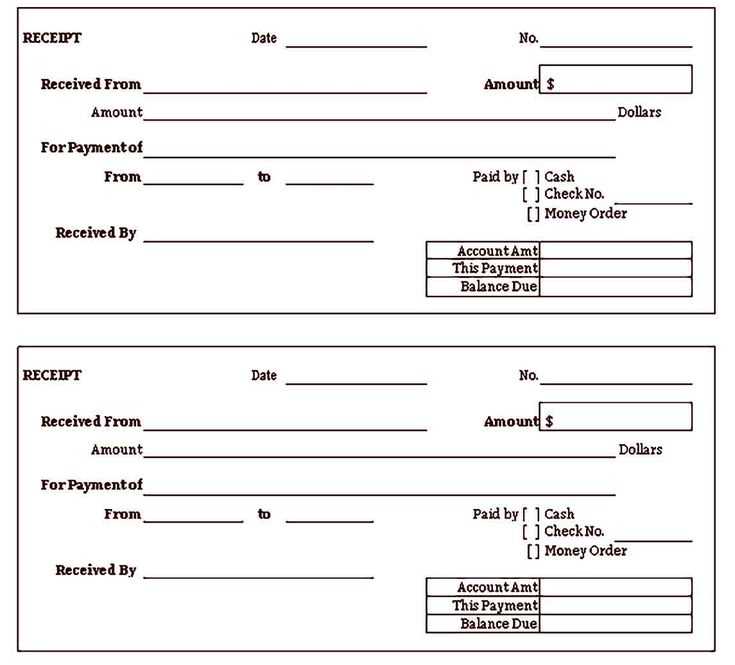

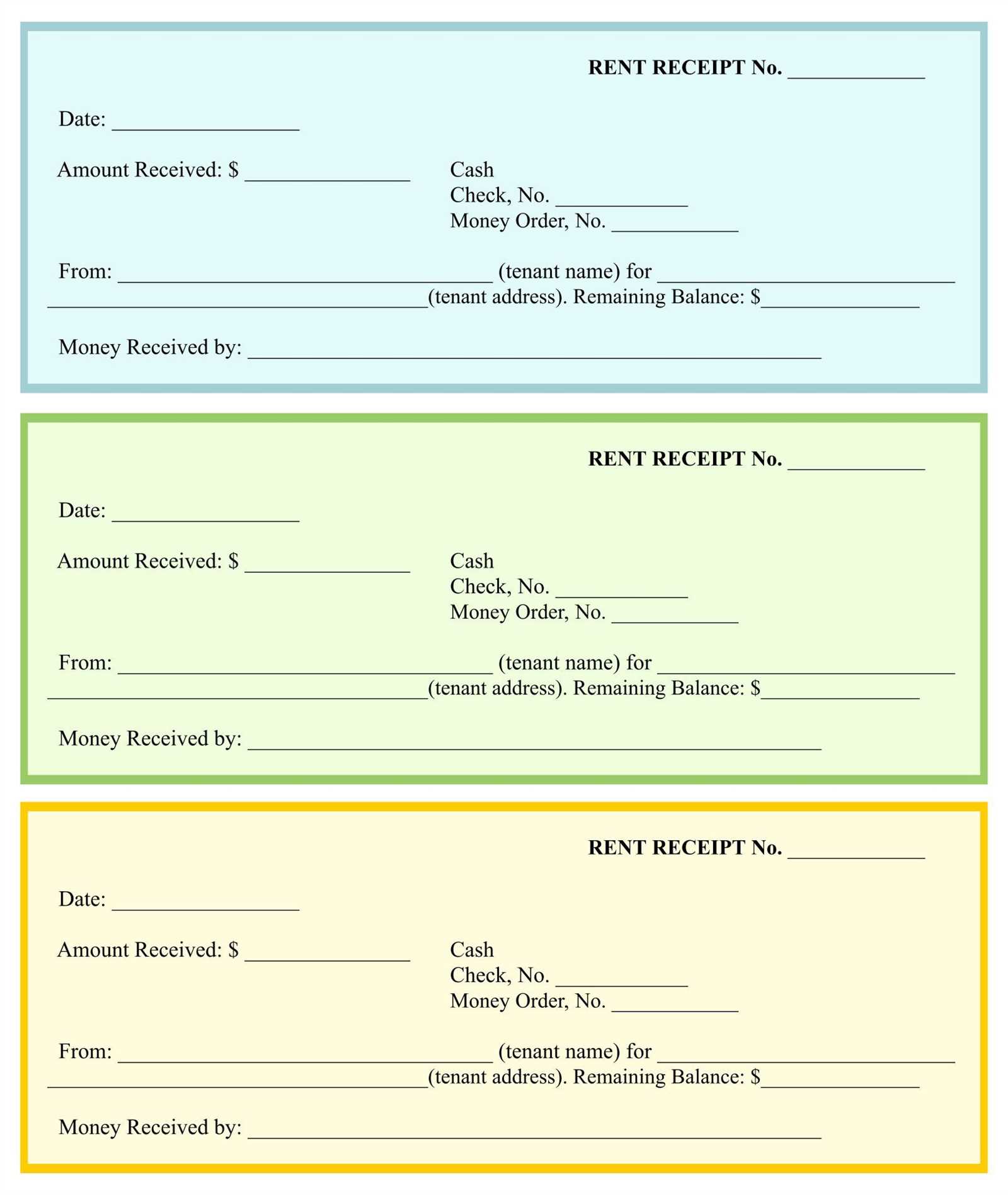

The template should clearly state the details of the transaction, including the amount, the date, and the identities of the parties involved. You can customize it to reflect the specifics of each deal while maintaining a consistent structure for ease of use. Be sure to include a section for the notary to sign, indicating their role in verifying the receipt. This ensures that the document holds legal weight if challenged in court.

To create your own notarized receipt template, ensure that it complies with local regulations and includes all the necessary elements, such as the notary’s seal, signature, and the date of notarization. This ensures that the document is valid and enforceable in legal settings.

Here’s an updated version of the sentences, reducing the repetition:

In creating a notarized receipt, focus on clarity and accuracy. Ensure that each sentence conveys a specific, relevant piece of information. Avoid restating points unless absolutely necessary for legal clarity. For example, instead of repeating “I acknowledge receipt of payment,” you could simplify by using “Receipt acknowledged.”

Clarity in Dates and Amounts

Always state the exact date of the transaction, avoiding redundant phrases like “this day of,” which doesn’t add any new information. The amount of payment should be written both numerically and in words, ensuring there’s no room for ambiguity. Eliminate unnecessary qualifiers or repeated mentions of the same details throughout the document.

- Notarized Receipt Template Guide

A notarized receipt is a crucial document that confirms a transaction has occurred and verifies the authenticity of the transaction through the signature of a notary public. It provides legal protection for both parties involved. Below is a step-by-step guide on how to create a notarized receipt template.

Key Components of a Notarized Receipt Template

When creating a notarized receipt template, make sure to include the following sections:

| Component | Description |

|---|---|

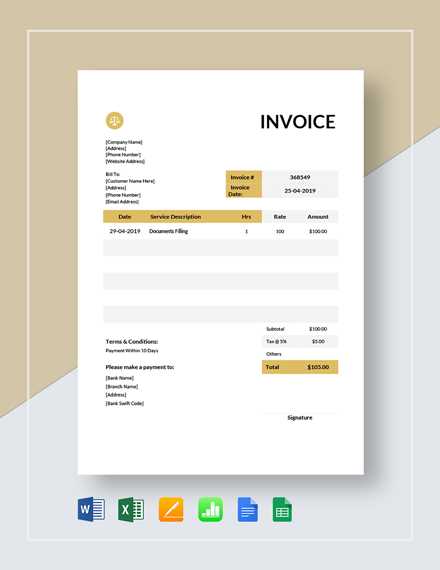

| Title | Include a clear heading like “Notarized Receipt” or “Acknowledgment of Payment.” |

| Transaction Date | Specify the exact date when the transaction took place. |

| Amount | State the total amount paid in words and figures. |

| Payee and Payer Information | Provide the full names and contact details of both parties involved in the transaction. |

| Nature of Transaction | Briefly describe the purpose of the transaction (e.g., purchase of goods or services). |

| Signature of the Parties | Both the payer and the payee should sign the document. This validates the agreement. |

| Notary Public Section | The notary’s signature and seal should be added here to verify the authenticity of the transaction. |

Tips for Creating an Effective Notarized Receipt Template

Ensure the following to create a reliable notarized receipt template:

- Use clear, unambiguous language to avoid misunderstandings.

- Ensure the amounts are written in both figures and words for clarity.

- Consult a legal professional to ensure the template meets all necessary legal standards in your jurisdiction.

To create a notarized template for your business transactions, follow these simple steps:

1. Identify the Transaction Details

Before drafting the template, list all the key details of the transaction. Include names, dates, the nature of the transaction, and the specific terms that need notarization. Make sure to specify any amounts, descriptions of services or goods, and applicable deadlines or schedules.

2. Draft a Clear and Concise Agreement

Write the agreement in simple, direct language. Avoid ambiguity and ensure that both parties understand the terms. The document should clearly outline the roles and responsibilities of each party involved. This helps to reduce disputes and facilitates the notarization process.

3. Include Notary-Specific Clauses

Incorporate a notary acknowledgment section at the end of the document. This section should contain spaces for the notary’s signature, seal, and the date the document was notarized. If the notary needs to witness the signing, include a clause indicating this requirement.

4. Provide Space for Witnesses, if Needed

If witnesses are required by law or business policy, make sure to provide space for their names, signatures, and dates. This ensures that all legal requirements are met during the notarization process.

5. Double-Check Legal Compliance

Ensure that the template complies with local regulations regarding notarization. Laws vary by jurisdiction, so it’s critical to verify that your template meets the specific legal requirements where the transaction will occur.

6. Leave Room for Amendments

In some cases, amendments may be necessary. Include a clause that allows for modifications to the agreement, specifying how and when they should be made. This flexibility ensures that the document can adapt to future changes without requiring a new notarization.

By following these steps, you will have a notarized template ready to be used in various business transactions. Each time you use it, just update the specific details and ensure it is notarized correctly to maintain its legal standing.

Ensure the document contains the date of signing. This establishes the moment the document becomes valid and is vital for any future legal reference.

Clearly state the identities of all involved parties. Full names, addresses, and roles must be included to prevent any confusion or legal disputes.

The notary’s certificate must be attached. This section verifies that the notary has witnessed the signatures, affirming the authenticity of the document.

The signatures of all parties must be present. These should be done in front of the notary to confirm voluntary agreement to the document’s terms.

Include the notary’s details such as name, commission number, and state of issuance. This identifies the notary’s authority and the location of the notarization.

Indicate the type of notarial act. Specify whether it is an acknowledgment, jurat, or another form of notarization. This defines the notary’s role in the process.

Ensure the document is free of alterations after notarization. If any changes are made post-signing, the notarization becomes invalid.

Keep the document clear of ambiguous language. Clear terms make the agreement easier to understand and less prone to legal challenges.

| Legal Element | Importance |

|---|---|

| Date of Signing | Establishes when the document becomes valid. |

| Identity of Parties | Prevents confusion or disputes over who is involved. |

| Notary’s Certificate | Confirms the authenticity of the signatures. |

| Signatures | Validates consent and agreement to the terms. |

| Notary’s Details | Identifies the notary and their jurisdiction. |

| Type of Notarial Act | Clarifies the notary’s role and the document’s validity. |

| Alteration-Free Document | Ensures the notarized document remains unchanged. |

| Clear Language | Reduces the risk of misinterpretation and legal challenges. |

A notary serves as a neutral third party who verifies the authenticity of a transaction and the identities of the parties involved. When it comes to receipts, a notary helps ensure that the document is genuine and that it can stand as legally binding evidence in disputes.

Here’s how a notary contributes to authenticating a receipt:

- Verification of Identity: A notary checks the identity of the parties signing the receipt to confirm that they are who they claim to be. This eliminates the risk of fraudulent signatures and enhances the receipt’s credibility.

- Witnessing the Transaction: The notary may witness the actual exchange of goods or services, ensuring that the receipt reflects a legitimate transaction. This step is crucial in protecting both the buyer and seller.

- Acknowledgment of Voluntary Signing: The notary ensures that the individuals signing the receipt are doing so willingly and without any undue pressure, which adds another layer of authenticity to the document.

- Stamping and Sealing: A notary applies a stamp or seal on the receipt as an official sign of authentication. This notary seal serves as proof that the receipt has been notarized and verified, which can be important in legal situations.

Using a notary for receipts is particularly helpful when transactions involve significant amounts of money or high-value items, where legal verification is necessary to avoid future disputes.

Include clear and readable fonts. Ensure that the text is easy to read on both small and large screens. Opt for standard fonts like Arial or Helvetica, avoiding decorative or complex styles that may confuse the customer.

Use logical organization. Start with your business name and contact details at the top, followed by transaction specifics such as the date, items purchased, amounts, and total. Place the payment method and any terms clearly at the bottom.

Incorporate branding elements. Add your company’s logo and color scheme to make the receipt align with your brand identity. This not only reinforces your company’s image but also helps customers associate the receipt with your business.

Make it mobile-friendly. Design the template to fit easily on smartphones, ensuring that important details remain visible without the need for zooming or scrolling. Use a single-column format for simplicity and legibility.

Be concise with item descriptions. Avoid overloading the receipt with unnecessary details. Instead, provide just enough information for the customer to recognize the purchase while maintaining space for other important details.

Provide a clear breakdown of taxes and fees. Display sales tax, shipping, or any other extra charges separately from the item total. This transparency helps customers understand how the final price is calculated.

Offer return and refund policies. Include a short section outlining the terms for returns or exchanges, helping customers quickly find the information if needed. Keep this section brief but informative, avoiding too much legal jargon.

Use high-quality paper or digital formats. Ensure the printed version is durable, or if providing a digital receipt, make it in a widely accepted format like PDF. This ensures that your receipt looks professional and lasts longer.

Test the template on multiple devices. Before finalizing the design, test it on different screens and printers to check for any layout issues or readability problems. A receipt that works well across various platforms ensures a better customer experience.

Common Mistakes to Avoid When Using Notarized Documents

Notarized documents carry significant weight in legal and business transactions. To ensure their validity, avoid these common mistakes:

1. Failing to Properly Identify Signers

Make sure that all parties involved present valid identification to the notary. Inaccurate or incomplete identification could invalidate the notarization. Always verify that the names on the document match the ID presented by each signer.

2. Not Understanding the Notary’s Role

A notary’s job is not to ensure the document’s content is correct, only to verify the signer’s identity and that they are signing willingly. Never assume that a notary has reviewed the document for accuracy or legality. It’s the responsibility of the parties involved to understand the terms of the document.

3. Leaving Fields Blank

Never leave any fields blank on a notarized document. Notaries should never complete the document for you. Blank spaces can lead to confusion or fraudulent alterations. Ensure all sections are filled out before signing in the presence of a notary.

4. Using Incorrect Notary Certificates

Different documents require different notarial certificates. Using the wrong type of certificate can cause delays or invalidation of the document. Always verify the type of notarization needed (acknowledgment, jurat, etc.) for your specific document.

5. Not Following Legal Requirements

Some documents may require specific formalities, such as witnesses in addition to a notary. Verify any additional requirements before meeting with a notary. Missing such details can make the document unenforceable.

6. Attempting to Notarize a Document from a Remote Location

In most cases, the signer must be physically present with the notary. Remote notarization may be allowed in certain jurisdictions, but only under specific circumstances. Always check local laws to ensure remote notarization is an option for your situation.

7. Overlooking the Notary’s Record Keeping

Notaries often maintain a journal of their activities. Always confirm that the notary properly records the notarization, as these records can serve as proof in case of disputes or questions about the validity of the document.

8. Signing Before the Notary is Present

Sign the document only in the presence of the notary. Signing beforehand may compromise the notarization’s legality, as the notary must witness the actual signing.

- Check that all names and signatures are correct.

- Ensure there are no missing or incomplete sections.

- Confirm the type of notarization needed for your document.

By avoiding these common mistakes, you can ensure that your notarized documents hold up in legal and professional settings. Take your time and always follow proper procedures to maintain the integrity of the notarization process.

If you face a dispute over a notarized receipt, take action by first reviewing the terms stated within the document. Check for any discrepancies in the information, such as the amount, parties involved, or date. This will help identify if there has been any error or misunderstanding regarding the transaction.

Step 1: Verify the Notary’s Role and Authority

The role of the notary is to confirm the identity of the signatories and witness their signatures. If a dispute arises, verify that the notary correctly followed the legal procedure. If the notarization process was compromised in any way, the validity of the receipt could be challenged.

Step 2: Gather Supporting Evidence

Collect any other relevant documentation, such as emails, contracts, or bank statements, which could help clarify the situation. Evidence like photographs, written agreements, or recorded conversations may also support your case if the notarized receipt is being contested.

Step 3: Open Communication with the Other Party

Engage in direct communication with the other party to understand the issue. Sometimes misunderstandings can be resolved through clear, open dialogue without further escalation. Be sure to remain calm and professional in your discussions.

If the dispute persists, consider mediation or legal action. A notarized receipt holds weight in legal matters, and if it is disputed, proper legal advice may be necessary to navigate the issue efficiently.

To create a notarized receipt, ensure it includes the necessary legal elements to confirm authenticity and acknowledgment by a notary. Here are key points to follow:

- Receipt Details: List the transaction amount, date, and both parties involved. Include a brief description of the exchanged goods or services.

- Notary Information: The notary should include their full name, official seal, and notary commission number. This confirms their legal authority to validate the document.

- Signature Section: Provide a section for both the buyer and seller’s signatures. The notary will sign and affix their seal near these signatures to confirm the document’s legitimacy.

- Witnesses: Some jurisdictions may require witnesses in addition to the notary. Include a line for witness signatures if applicable.

- Jurisdiction and Notary Statement: Ensure the notary statement reflects the correct jurisdiction, and the notary’s statement clearly identifies the document’s validity under their supervision.

Make sure all fields are filled out clearly to avoid delays or legal complications. Verify the notary’s credentials and ensure the document meets local regulations before proceeding.