For businesses in the Philippines, maintaining proper documentation is key. One of the most important documents to issue is the official receipt, which serves as proof of transactions between a seller and a buyer. This receipt is required by law and must follow a specific format set by the Bureau of Internal Revenue (BIR).

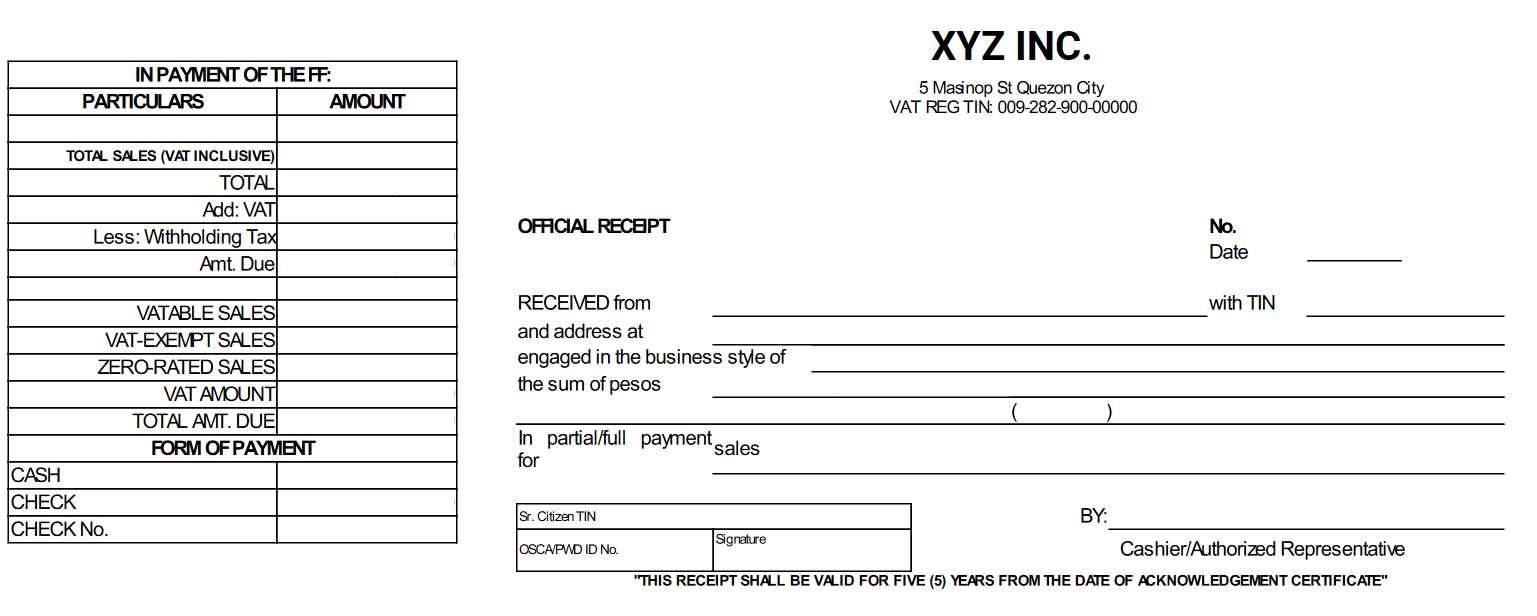

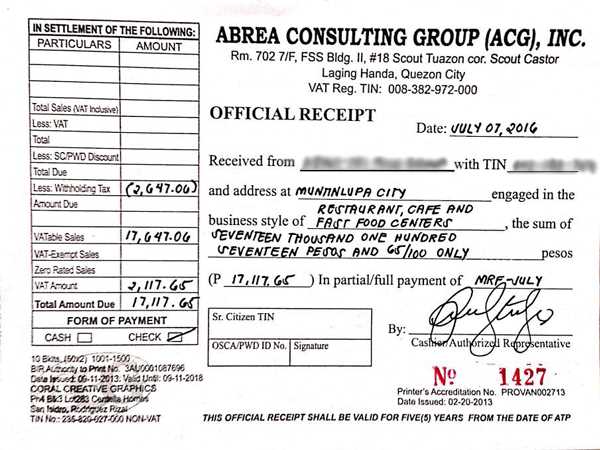

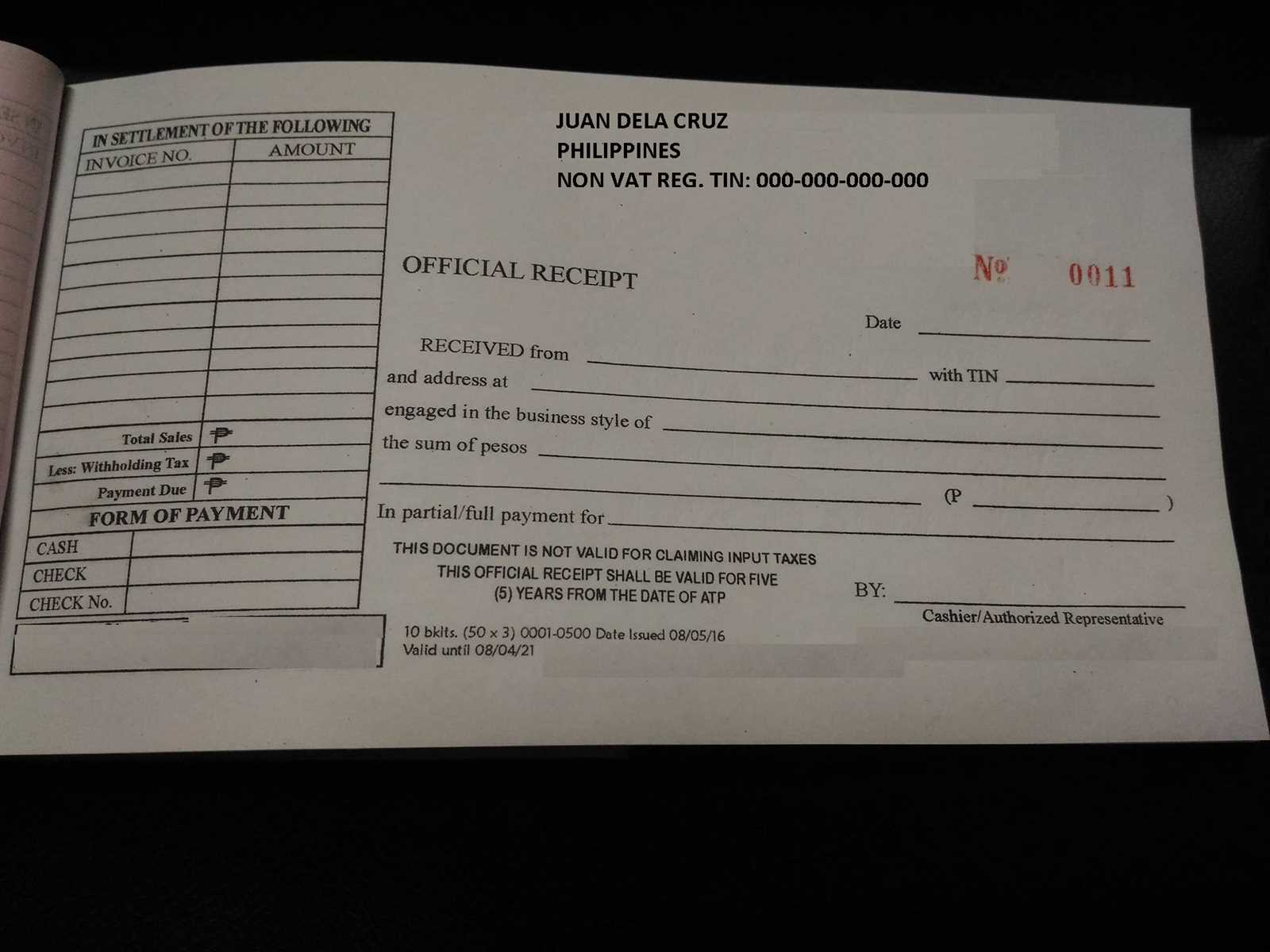

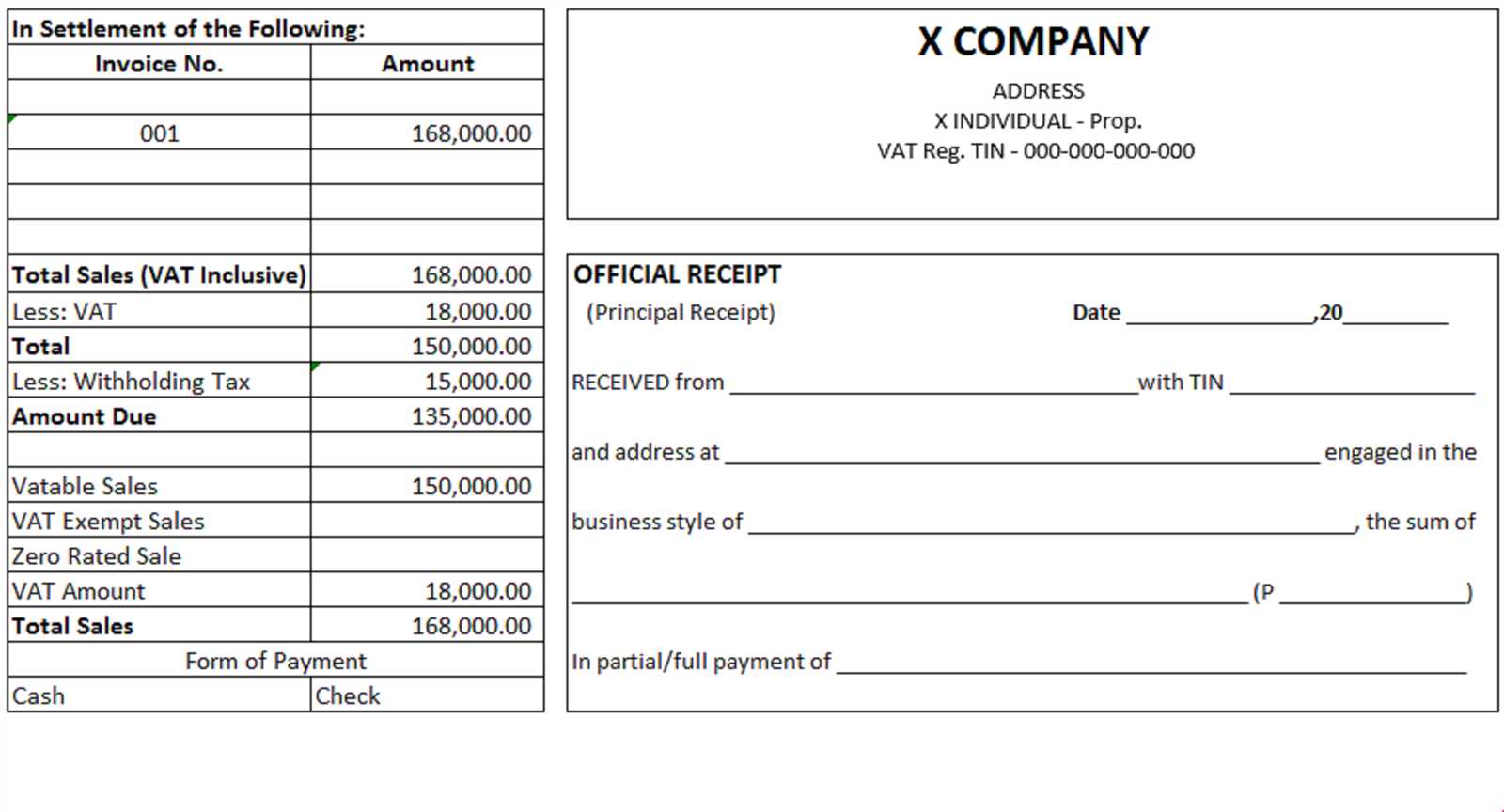

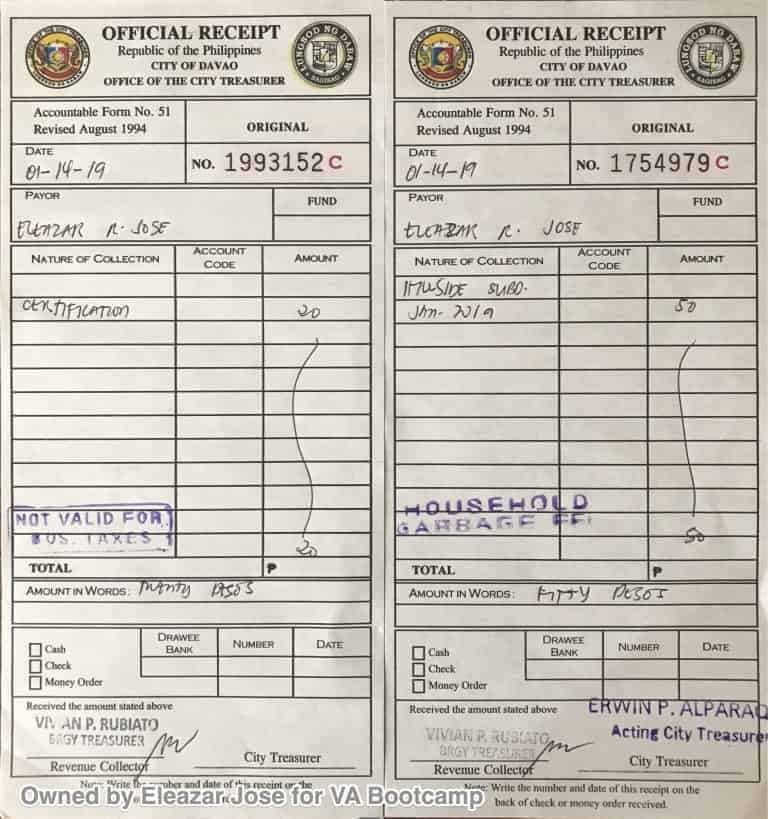

The official receipt template includes several key elements that must be correctly filled out. These include the name, address, and taxpayer identification number (TIN) of the business, the date of the transaction, a breakdown of the items or services purchased, and the amount paid. A unique receipt number should also be included to ensure traceability and prevent fraud.

When creating or printing the official receipt, ensure all details are accurate and clearly visible. The template must adhere to the standards set by the BIR and should not omit any required information. Businesses can use digital tools or templates to streamline the process, but it’s important to stay compliant with regulations to avoid penalties or fines.

Here is the revised version with reduced repetition:

To create a streamlined and clear official receipt for the Republic of the Philippines, ensure you include key elements such as the issuer’s name, address, Tax Identification Number (TIN), and the date of the transaction. Specify the transaction details clearly, including the amount, the purpose of the payment, and any relevant reference numbers. This prevents ambiguity and enhances the document’s professionalism.

Key Sections to Include

Each receipt should have a clear breakdown of services or products provided. Make sure the total amount is clearly separated from taxes, discounts, and additional charges. Double-check that the payment method is noted accurately, whether it’s cash, check, or bank transfer.

Formatting Tips

Keep the layout clean with distinct sections. Use bold headings for crucial details like the issuer’s name, TIN, and the total amount. Ensure the font is easy to read and aligns with the standard format typically used for official receipts in the country.

By following these guidelines, the receipt will remain professional and clear without redundancy, reducing potential errors or misunderstandings.

Official Receipt Template of the Republic of the Philippines

Understanding the Legal Requirements for Receipts

How to Customize the Template for Your Business

Key Elements Required on a Receipt in the Philippines

Step-by-Step Guide to Completing an Official Receipt

Common Mistakes to Avoid When Issuing Receipts

How to Ensure Compliance with Tax Regulations Using Receipts

Make sure your official receipt template aligns with the Philippines’ tax laws to avoid penalties. The Bureau of Internal Revenue (BIR) sets specific guidelines for receipts used in business transactions. A compliant template should include the correct elements such as BIR-registered number, date, and clear breakdown of goods or services. For customization, ensure your business name, address, and contact details are displayed clearly. Be cautious about not omitting any required details, like the VAT registration number if applicable.

To customize the template, include your business logo and ensure the receipt format reflects your branding. However, do not remove key sections like the BIR’s serial number or tax details. These components ensure that the receipt is legitimate and can be verified by the authorities. Use software that automatically generates sequential numbers to track each transaction and stay organized.

A complete receipt should have the following elements: the name of the business, its address, TIN (Tax Identification Number), BIR accreditation number, detailed item descriptions, the amount paid, and the payment method. These elements confirm the transaction and provide both the buyer and seller with records for future reference.

Follow this simple process when issuing an official receipt: First, enter the customer’s details, then list the purchased items and their corresponding prices. After calculating the total amount, indicate the taxes (VAT or non-VAT). Finish by including the date and the serial number. Always ensure the receipt is signed, either manually or digitally, to maintain its validity.

Watch out for common mistakes such as leaving out the BIR-registered number, using a wrong serial number, or not issuing receipts for small transactions. These errors could lead to audits or fines. Double-check each receipt to confirm that all fields are filled in correctly and the serial numbers are properly sequential.

To stay compliant with tax regulations, regularly audit your receipts to ensure they meet BIR standards. Keep records of all transactions, as these documents are crucial during tax filing. Make sure the format you use allows easy tracking of your sales and taxes paid. Stay informed about any changes to BIR rules regarding receipt issuance to keep your business in line with current tax requirements.