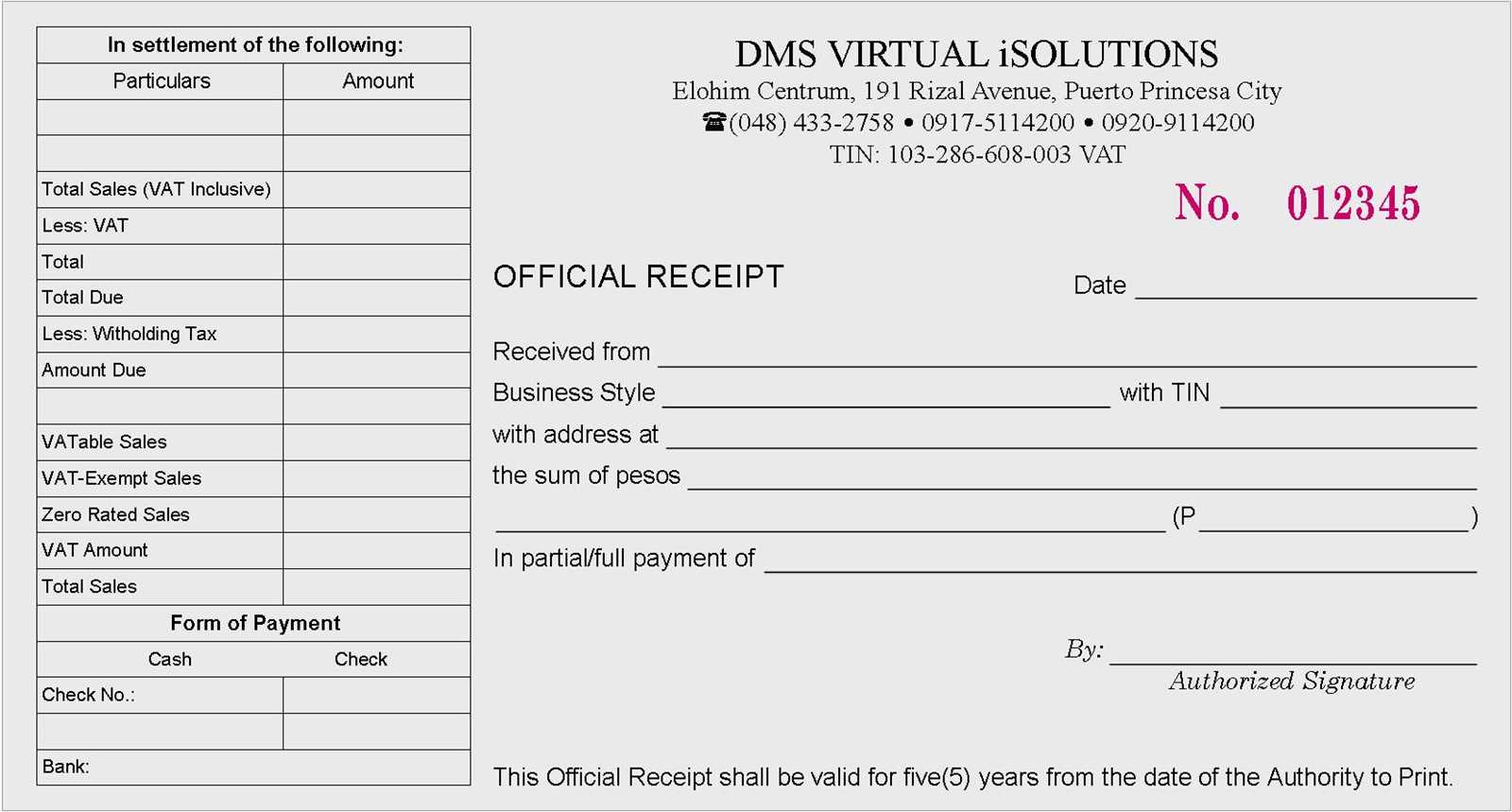

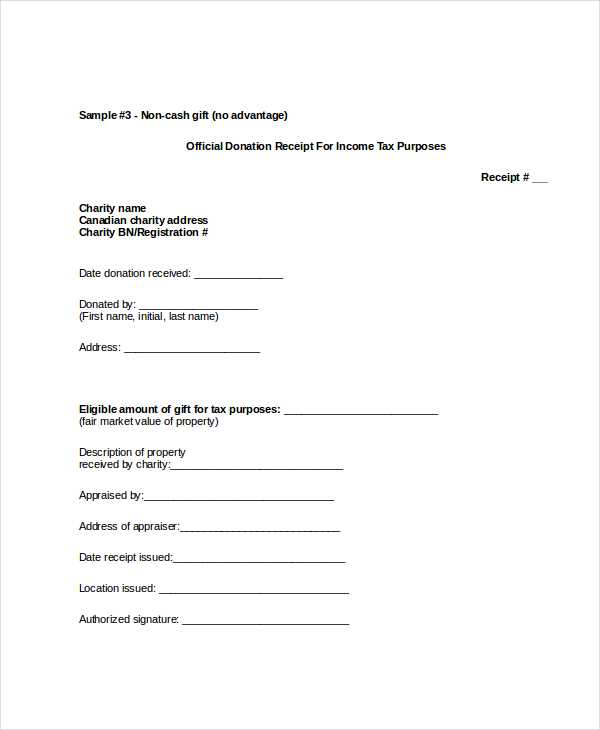

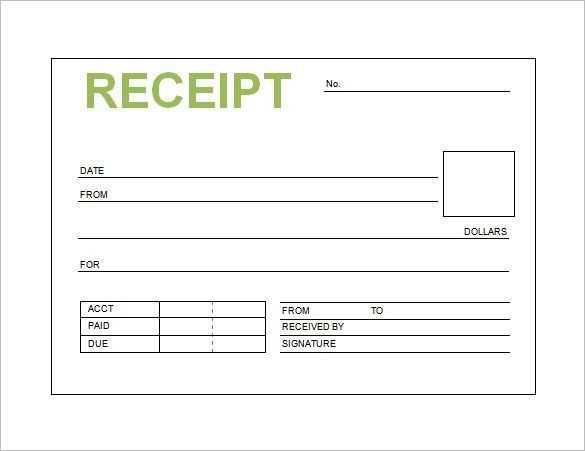

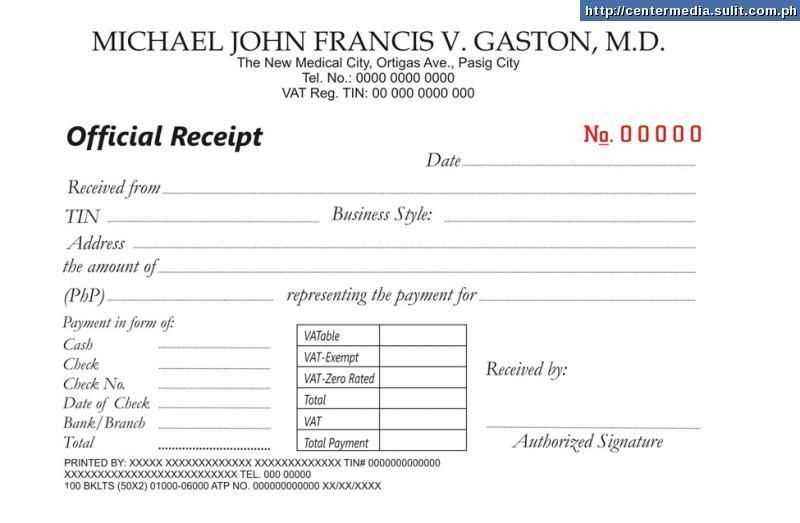

Every business transaction requires a well-structured official receipt to ensure clarity and compliance. A professionally designed receipt template should include essential details such as the date of issue, receipt number, payer and payee information, payment details, and total amount. Including a section for tax calculations and payment method enhances transparency and helps with financial tracking.

To maintain consistency, use a standardized format that aligns with accounting requirements. A receipt should clearly differentiate between subtotal, applicable taxes, and final amount paid. If applicable, add a space for company stamps or authorized signatures to validate authenticity.

Digital templates offer flexibility for customization. Choose a format that supports automated numbering and easy data entry. A well-structured receipt simplifies record-keeping and provides customers with a professional experience. Whether printed or digital, ensuring that all required elements are present prevents disputes and enhances credibility.

Here’s a version with fewer repetitions, maintaining the original meaning:

Keep the layout simple and clean. List all key elements of the transaction: the payer’s details, the receiver’s details, date, amount, and purpose. Avoid overloading with unnecessary information. Use clear labels for each section. For example, instead of repeating “receipt,” label it clearly as “Official Receipt” at the top of the document.

Receipt Sections

Ensure that the total amount is prominently displayed. Include a breakdown of the payment if applicable, such as taxes or discounts. Use bullet points for these details to make them easy to follow.

Clarity and Legibility

Use legible fonts and proper alignment. Consistency in font size and spacing contributes to a professional appearance. The layout should guide the reader naturally through the details.

- Official Receipt Template: Key Aspects and Guidelines

Ensure your official receipt template includes the necessary elements for legal and business purposes. Start with clear identification of the issuing entity, including the company name, address, and contact details. This helps recipients easily identify the source of the transaction.

The receipt should include a unique serial number for tracking and reference. This number prevents confusion, especially in case of multiple transactions or audits. Make sure to generate sequential numbers to avoid duplication.

Next, include the transaction date and details of the items or services provided. This section should list each item, its quantity, and its price, as well as any applicable taxes or discounts. Clearly breaking down the pricing ensures transparency.

A subtotal, tax amount, and total amount should be displayed at the bottom, with clear separation to distinguish each section. This layout avoids confusion about the final payment amount.

For added clarity, provide payment method information–whether it’s cash, credit, bank transfer, or another method. This information adds a layer of transparency and tracks the payment flow.

Finally, include space for both the customer and the issuer’s signatures or any other confirming marks. This reinforces the validity of the transaction.

A receipt template must include specific details to ensure clarity and legal compliance. Here are the key components that should appear in every receipt:

- Seller’s Information: Clearly display the business name, address, and contact details. This establishes accountability and makes it easier for customers to reach out if necessary.

- Buyer’s Information: While optional in some cases, including the buyer’s name or contact information can help in personalizing receipts and in resolving disputes.

- Receipt Number: A unique identifier helps with record-keeping and ensures traceability for both the seller and buyer.

- Transaction Date: Always include the date when the transaction occurred. This is vital for tax purposes and returns.

- List of Items Purchased: Clearly outline each item or service bought, with descriptions, quantities, and individual prices. This ensures transparency.

- Total Amount: Display the total amount paid, including any applicable taxes or discounts. It provides the customer with a clear understanding of the cost.

- Payment Method: Specify how the payment was made, whether by cash, credit card, or other means. This supports both financial tracking and customer reference.

- Tax Information: Include applicable taxes or fees, along with their breakdown, to comply with tax regulations.

Each of these elements ensures a clear, complete, and legally valid record of the transaction for both parties involved.

Ensure your official receipt template complies with local laws and tax regulations. This will help avoid legal issues and penalties down the line. The following points outline key requirements you should incorporate:

- Include your business’s name, address, and tax identification number (TIN) on the receipt.

- Specify the date of the transaction and a unique receipt number for record-keeping purposes.

- Detail the goods or services sold, including the amount, quantity, and unit price.

- Calculate and display applicable sales tax. Ensure the rate and amount match the local tax laws.

- Provide the payment method (e.g., cash, credit, debit, or online transfer).

Make sure the format aligns with the rules of your local tax authority. In some jurisdictions, receipts must be printed or provided digitally, and must be accessible for auditing purposes. Review these standards periodically to stay compliant.

Designing a receipt template that fits your business needs requires considering the specific elements you require for accurate documentation. Customize the layout to highlight key information, such as business logo, customer details, and purchase breakdowns. A clean, easy-to-read structure ensures that important data is readily available for both your team and customers.

Branding: Incorporate your company’s logo, color scheme, and fonts to maintain a consistent brand identity. A personalized design builds professionalism and trust, making the receipt more than just a transaction record.

Itemization: Depending on your business type, you may need to display detailed product descriptions, unit prices, or taxes. Customize columns to include the necessary breakdowns–whether it’s quantity, discount percentage, or service charge. Tailor the receipt’s sections to clearly showcase all pertinent details in a way that benefits your industry and customer experience.

Legal Compliance: Include all legal information specific to your region or industry. Customize fields to reflect tax rates, business registration numbers, and compliance statements required for tax purposes. This ensures that receipts meet regulatory standards and protect both parties in case of disputes.

Payment Methods: Adapt the receipt to list various payment methods you accept, such as credit cards, cash, or online transactions. Adding payment details reinforces clarity and gives customers confidence in the transaction process.

Customer Information: Customize the receipt to collect necessary customer information like email addresses or loyalty program details. You can use this space to enhance customer engagement, whether through marketing efforts or follow-up services.

All these features can be seamlessly integrated into your official receipt template, ensuring it serves not only as a proof of transaction but as a reflection of your business operations and customer relations. Tailoring your receipt to your specific needs is key to ensuring it supports both your workflow and your brand image.

Digital vs. Printed Templates: Pros and Cons

Choosing between digital and printed receipt templates depends on your specific needs and business environment. Below is a detailed breakdown of the advantages and drawbacks of each option.

| Aspect | Digital Templates | Printed Templates |

|---|---|---|

| Cost | Lower long-term costs due to no printing or paper expenses. | Higher initial and ongoing costs for paper, ink, and printer maintenance. |

| Convenience | Access and share easily via email or online platforms. Can be stored digitally. | Physical receipt may be necessary for some customers or situations, like returns. |

| Storage | Easy to store and search through digital files. | Requires physical space for storing paper receipts. |

| Environmental Impact | More eco-friendly with no paper waste. | Less eco-friendly due to paper and ink consumption. |

| Professionalism | Often seen as more modern and streamlined. May look impersonal if not customized well. | Can provide a more personal, tactile touch, often appreciated in face-to-face transactions. |

In choosing, evaluate your workflow and customer preferences. Digital templates offer convenience and sustainability, while printed ones might be more suitable for businesses that prioritize physical documentation or customer preferences for paper receipts.

Avoid cluttered layouts that make it hard for users to focus on key information. Clean, minimalist designs with clear visual hierarchy guide the viewer’s attention efficiently.

- Overloading with Text: Keep your content concise and to the point. Too much text can overwhelm users and detract from the main message. Break it into smaller sections, using bullet points where possible.

- Poor Font Choices: Select legible fonts that align with your brand identity. Avoid using more than two or three fonts in a design to maintain consistency and readability.

- Ignoring Mobile Compatibility: Ensure your design adapts well to various screen sizes. A design that looks great on a desktop but poorly on mobile can alienate a large portion of your audience.

- Neglecting White Space: White space helps the design breathe and improves readability. Don’t overcrowd elements; leave enough space around text, images, and icons to create a balanced layout.

- Inconsistent Branding: Stick to your brand colors, fonts, and logo usage. Inconsistency can confuse users and dilute your brand identity.

- Ignoring User Experience (UX): Always think from the user’s perspective. An intuitive, user-friendly design leads to higher engagement and satisfaction. Test with real users to identify pain points.

By focusing on simplicity, consistency, and usability, you’ll ensure your design is both functional and aesthetically pleasing. Avoiding these common pitfalls helps create a more polished and professional end product.

Zoho Invoice offers a straightforward solution for creating receipts. It allows customization with company logos and details, making it ideal for businesses. You can generate receipts directly from invoices, streamlining the process.

QuickBooks is another strong contender, providing an easy-to-use interface for generating receipts and tracking payments. It integrates with accounting features, so you can instantly create receipts and manage your finances in one place.

For a more user-friendly option, Wave is free and perfect for small businesses. It gives you templates that can be easily customized and exported, making it simple to create receipts without any extra hassle.

If you prefer something more versatile, Microsoft Word offers receipt templates that you can edit and adapt to your needs. It’s a solid option if you need full control over the design and don’t want to rely on cloud-based solutions.

For small businesses and freelancers, FreshBooks is a great choice. It allows you to create professional-looking receipts, track payments, and handle invoicing. The customization options cater to various industries, so you can tailor receipts to suit your needs.

| Software | Key Features | Best For |

|---|---|---|

| Zoho Invoice | Customizable templates, easy integration with accounting tools | Small to medium businesses |

| QuickBooks | Receipt generation, payment tracking, and accounting features | Business owners who need full accounting functionality |

| Wave | Free receipt creation, customizable templates | Small businesses or freelancers |

| Microsoft Word | Complete design control, customizable templates | Businesses needing full customization |

| FreshBooks | Professional receipt creation, payment tracking, and invoicing | Freelancers and small businesses |

Use clear and concise bullet points to outline details in your official receipt. Ensure each item listed is accompanied by accurate descriptions and amounts. Avoid cluttering the document with unnecessary details. Stick to the most relevant information: the date of purchase, itemized list of products or services, amounts, and applicable taxes.

Start with the title of your receipt and proceed to outline the transaction in an orderly list. Group related items to make it easier for the recipient to read. Keep formatting consistent, using bold for headings and simple lines or spaces between sections to create a clean layout.

Use a final line to summarize the total amount due or paid. Double-check for accuracy before sending, as mistakes can create confusion and erode trust.