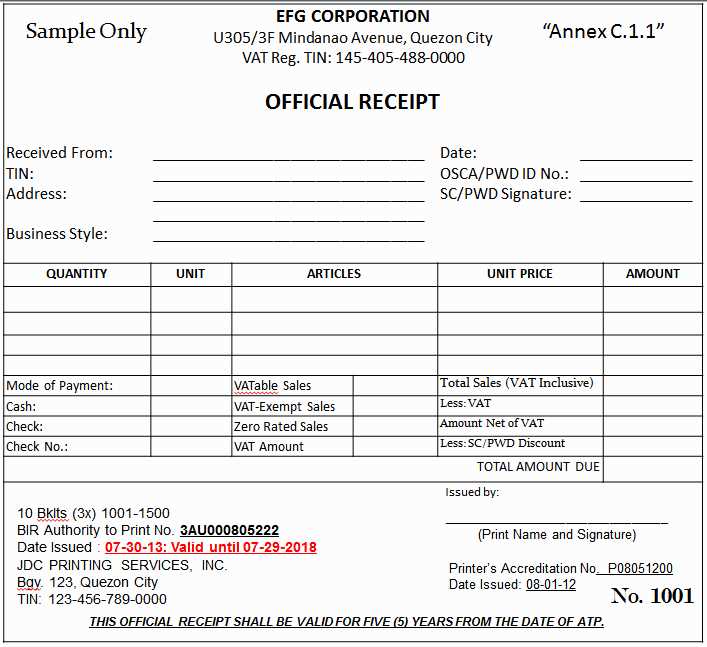

For businesses in the Philippines, providing official receipts is a requirement under the Bureau of Internal Revenue (BIR) regulations. A standard receipt template must contain specific details to ensure it complies with local laws and provides clear proof of transaction. This includes the seller’s name, Taxpayer Identification Number (TIN), and the date of the transaction.

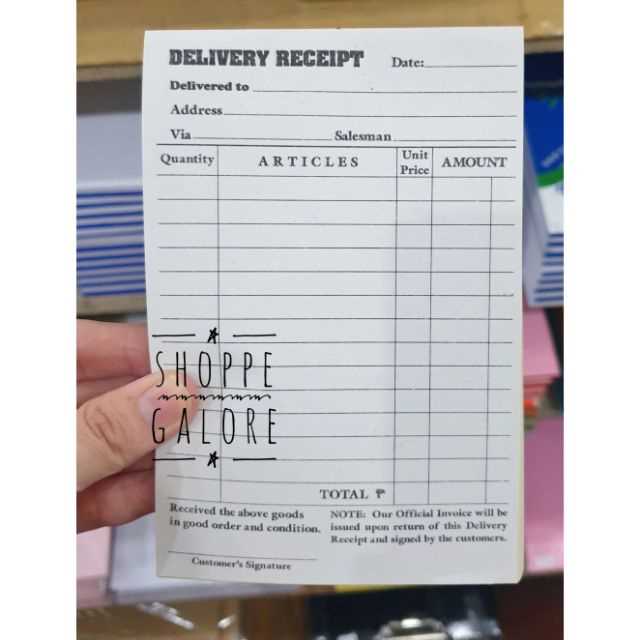

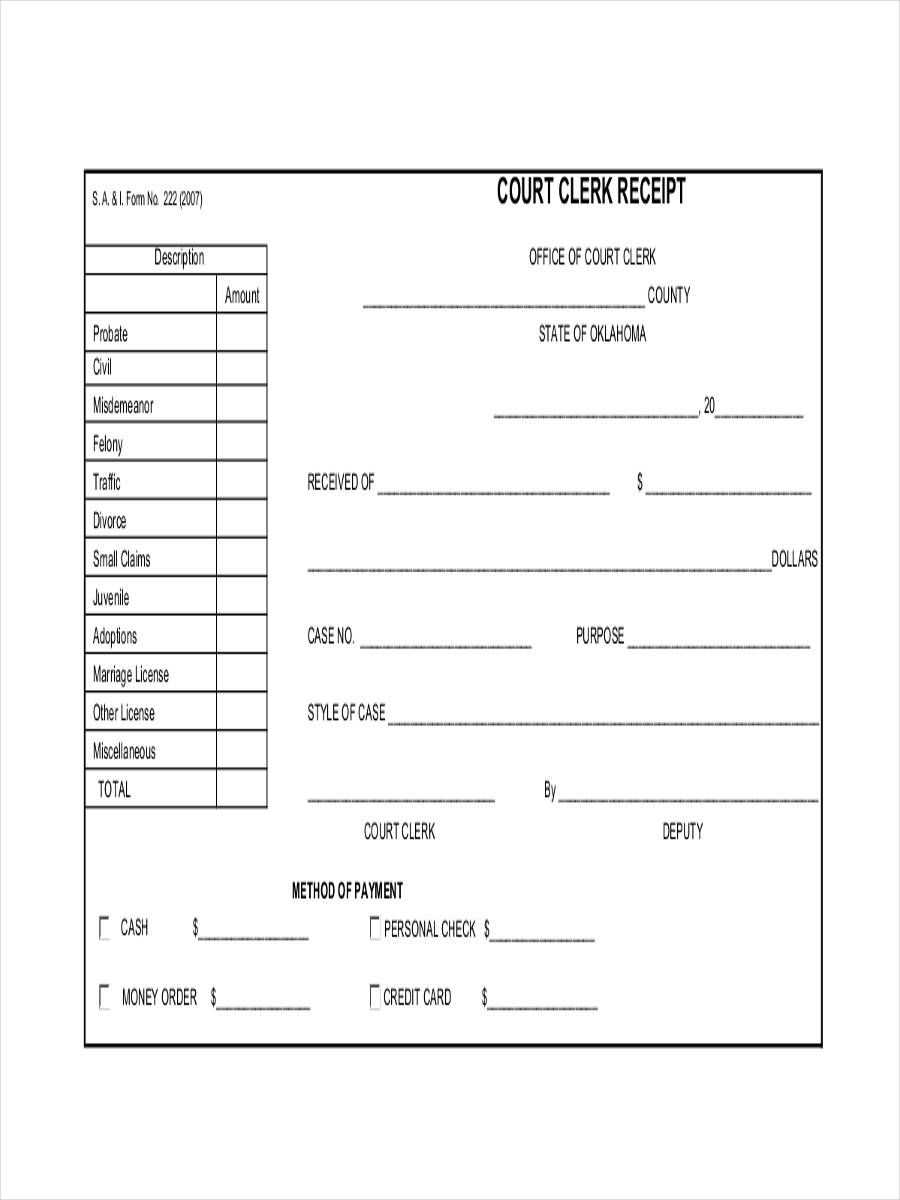

A well-structured receipt includes clear sections for the product or service description, amount, and VAT (if applicable). Each receipt should also indicate the mode of payment, whether it’s cash, credit, or other methods, ensuring transparency in every transaction. Adding these details helps both the business and the customer track financial exchanges accurately.

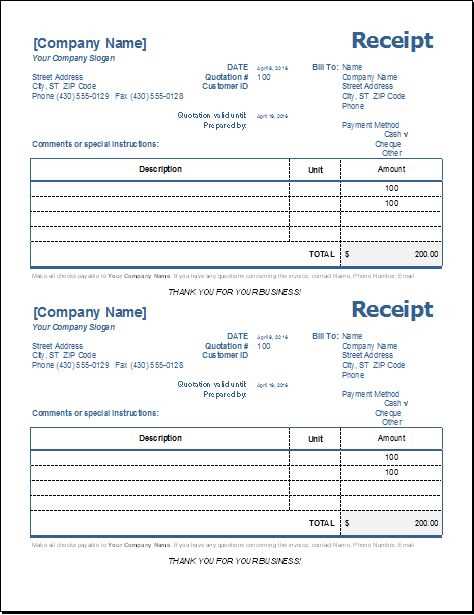

To create a professional receipt, you can use various templates available online, but always make sure they comply with BIR standards. Customizing the template to suit your business’s branding is a great way to maintain a professional image while staying compliant. Pay attention to spacing and font legibility to ensure the information is easy to read.

Here’s a refined plan based on your request: Official Receipt Template Philippines

To create a proper official receipt template in the Philippines, start by including all required details to ensure it meets local regulations. This includes business name, address, and tax identification number (TIN), which are mandatory for legal purposes.

Here are the key elements to include in an official receipt template:

- Business Information: Include the business name, registered address, and TIN. These details should be clear and easy to find.

- Receipt Number: Assign a unique number to each receipt for tracking and record-keeping purposes. Ensure the number is sequential.

- Date of Transaction: Include the date the transaction was made. This is critical for documentation and tax purposes.

- Customer Information: While not always required, including the name and contact details of the customer adds transparency to the transaction.

- Items or Services Provided: List the items or services sold, including their description and individual prices. This ensures clarity for both parties.

- Total Amount: Clearly display the total amount paid. Break this down if applicable, showing taxes or discounts separately.

- VAT (Value-Added Tax): If your business is VAT-registered, show the amount of VAT separately. Ensure the percentage is clearly stated.

- Payment Method: Indicate how the customer paid (e.g., cash, card, online transfer).

It’s also essential to choose a simple, easy-to-read format for your official receipt. This ensures that both the business and the customer can access the information without confusion. For businesses operating online, consider a digital template that can be filled out electronically. However, for physical receipts, ensure the print quality is clear and legible.

Lastly, always store copies of official receipts for record-keeping and tax purposes. This is a legal requirement for businesses in the Philippines to maintain proper documentation of sales and services.

How to Create a Legally Compliant Receipt

To ensure a receipt is legally compliant in the Philippines, include the following details: the complete name and address of the business, the Taxpayer Identification Number (TIN), and the date of the transaction. These details help verify the legitimacy of the transaction for both the buyer and the seller.

Include a clear description of the products or services provided, along with the quantity and price. Each line item should have a corresponding total amount to avoid confusion during audits or inquiries.

The total amount due must be clearly stated, including the applicable VAT or sales tax. For tax-exempt transactions, specify the exemption and the relevant legal basis. Make sure to print the VAT-inclusive price and the tax breakdown for transparency.

Ensure that the receipt has a unique serial number, which is crucial for tracking and verification. This number helps in linking the transaction to the business’s financial records, ensuring proper accounting and tax reporting.

Finally, make sure that the receipt is signed by an authorized representative of the business. This adds authenticity and accountability to the document.

Key Elements to Include in a Receipt Template

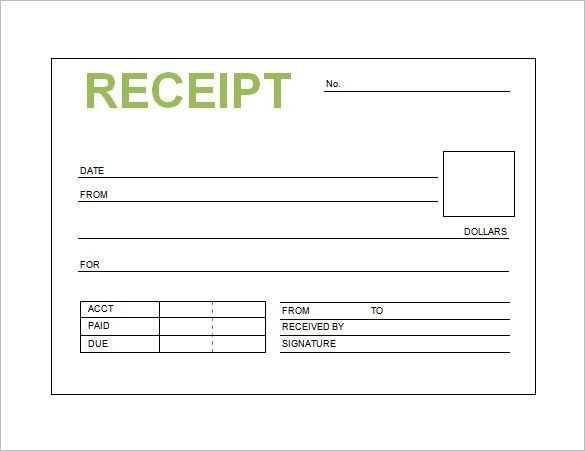

Clearly label the document as a “Receipt” at the top. This helps users immediately identify its purpose.

Business Information

Include the name, address, and contact details of the business issuing the receipt. Make sure this information is easily readable and correctly spelled.

Transaction Details

List the date of the transaction and the items or services purchased. Include a brief description, quantity, and price for each item. Clearly state the total amount paid and specify the payment method (e.g., cash, credit card).

For taxes, clearly show the tax rate applied and the amount. This ensures transparency for the customer regarding tax calculations.

Unique Identifier

Provide a unique receipt number for reference. This helps track transactions for both the customer and the business.

Common Mistakes to Avoid When Issuing Receipts

Ensure the date on the receipt is accurate. Mistakes in recording the transaction date can lead to confusion, especially for tax purposes or refund claims. Double-check the date before printing or sending the receipt.

Incorrect Amounts

Always verify the total amount and break it down correctly. A common mistake is rounding off the total or omitting taxes. This creates discrepancies in records and can lead to disputes with customers or authorities.

Missing Information

All necessary details must be included. This includes the business name, contact details, transaction number, and itemized list of products or services. Omitting these details could result in a receipt being deemed invalid in certain cases.

Another key point is ensuring the receipt is issued only after the transaction is finalized. Issuing receipts prematurely can create confusion regarding payments or incomplete orders.

Finally, remember to store and manage receipts securely, especially digital ones. This ensures both you and the customer can reference them later without issues.